North Carolina Sample Letter for Settlement Check

Description

How to fill out Sample Letter For Settlement Check?

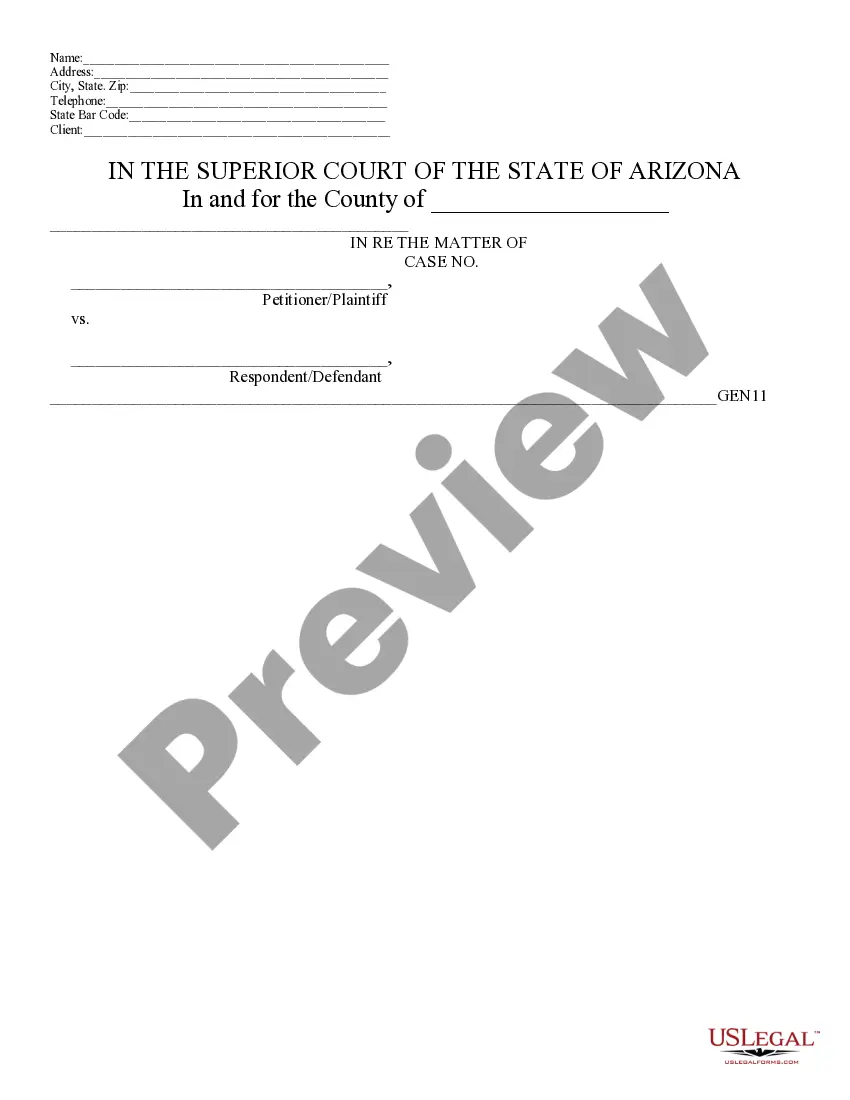

Selecting the appropriate valid document template can be a challenge. Clearly, there are numerous templates available online, but how will you find the right version you need? Utilize the US Legal Forms website. The service provides a wide array of templates, including the North Carolina Sample Letter for Settlement Check, which you can utilize for both professional and personal purposes. All of the documents are reviewed by experts and comply with federal and state regulations.

If you are already registered, Log In to your account and then click the Download button to retrieve the North Carolina Sample Letter for Settlement Check. Use your account to browse through the legal documents you have purchased previously. Navigate to the My documents tab of your account to obtain another copy of the document you require.

If you are a new user of US Legal Forms, here are simple instructions for you to follow: First, ensure you have selected the correct document for your city/region. You can preview the document using the Preview button and review the document description to confirm it is suitable for you. If the document does not meet your requirements, utilize the Search field to find the appropriate document. Once you are confident the document will work, proceed by clicking the Acquire now button to obtain the document. Choose the payment plan you prefer and enter the necessary information. Create your account and pay for the order using your PayPal account or credit card. Select the document format and download the legal document template to your device. Complete, edit, print, and sign the obtained North Carolina Sample Letter for Settlement Check.

Leverage US Legal Forms to streamline your document preparation process and ensure legal accuracy.

- US Legal Forms is the largest collection of legal documents where you can find a variety of document templates.

- Utilize the service to obtain properly crafted papers that adhere to state requirements.

- Ensure compliance with all applicable laws while using the templates.

- Easily access and manage your documents through your online account.

- Get expert-reviewed forms to ensure they meet legal standards.

- Find templates tailored for specific needs including business and personal use.

Form popularity

FAQ

A good sentence for settlement could be, 'This settlement represents a fair resolution of the dispute, ensuring both parties can move forward amicably.' This sentence conveys a sense of closure and mutual agreement. If you’re looking for more examples, a North Carolina Sample Letter for Settlement Check can offer various phrases that effectively express the intent of your settlement.

Writing a settlement check involves including essential details such as the payee's name, the amount, and a clear note indicating that it is for settlement purposes. Be sure to sign the check and keep a record of the transaction for your records. For further guidance, a North Carolina Sample Letter for Settlement Check can provide insights on how to accompany your check with a letter that explains its purpose.

When writing a letter for a full and final settlement, clearly identify the parties involved and explain the context of the claim. Detail the reasons for your request and the amount you propose, while remaining polite and professional. Utilizing a North Carolina Sample Letter for Settlement Check can help you structure your letter effectively, ensuring you address all necessary elements.

To write a strong settlement letter, start by clearly stating your purpose, including the details of the case and the amount you seek. Use a respectful tone, and provide a brief overview of the facts that support your position. For a more effective approach, consider using a North Carolina Sample Letter for Settlement Check to guide your format and language, ensuring you cover all essential points.

Writing a simple settlement agreement involves outlining the parties involved, the terms of the settlement, and any necessary conditions. Keep the language straightforward and ensure all parties understand their obligations. A North Carolina Sample Letter for Settlement Check can serve as a helpful reference to simplify this process and ensure clarity.

To create a settlement letter, begin by gathering all pertinent information about your case and the desired settlement. Organize your thoughts and structure the letter logically, ensuring it is clear and concise. You can find helpful resources, like a North Carolina Sample Letter for Settlement Check, to aid in crafting an effective letter.

When writing a lawsuit settlement letter, it is important to summarize the case, articulate your position, and propose a settlement amount. Be sure to maintain a professional tone and avoid emotional language. Referencing a North Carolina Sample Letter for Settlement Check can guide you in developing a strong and persuasive letter.

Start a settlement letter with a clear and concise introduction that states the purpose of your correspondence. Include the date and any relevant case information to provide context. A North Carolina Sample Letter for Settlement Check can offer a solid template to help you structure your opening effectively.

To write a letter for a settlement amount, start by stating the purpose of the letter and providing context about the case. Clearly indicate the amount you are proposing and justify it with relevant details. Using a North Carolina Sample Letter for Settlement Check can streamline this process and ensure you include all important elements.

An example of a settlement offer letter typically outlines the details of the case, the basis for the settlement, and the proposed amount. It should clearly express the intention to resolve the matter amicably. Utilizing a North Carolina Sample Letter for Settlement Check can help you create a compelling offer that addresses all necessary components.