North Carolina Non-Disclosure Agreement for Merger or Acquisition

Description

How to fill out Non-Disclosure Agreement For Merger Or Acquisition?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a variety of legal paperwork templates that you can download or print.

Using the site, you can access thousands of forms for business and individual purposes, categorized by types, states, or keywords. You can find the latest versions of forms such as the North Carolina Non-Disclosure Agreement for Merger or Acquisition in just minutes.

If you are already a member, Log In and download the North Carolina Non-Disclosure Agreement for Merger or Acquisition from the US Legal Forms library. The Acquire button will be visible on every form you view. You can access all previously downloaded forms from the My documents tab in your account.

Process the payment. Use your credit card or PayPal account to complete the transaction.

Select the format and download the form to your device. Make modifications. Complete, edit, print, and sign the downloaded North Carolina Non-Disclosure Agreement for Merger or Acquisition. Each document you save in your account has no expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you need. Access the North Carolina Non-Disclosure Agreement for Merger or Acquisition with US Legal Forms, one of the most extensive collections of legal documentation themes. Utilize numerous professional and state-specific templates that meet your business or personal needs.

- If this is your first time using US Legal Forms, here are some simple steps to get you started.

- Ensure you have chosen the correct form for your specific area/region.

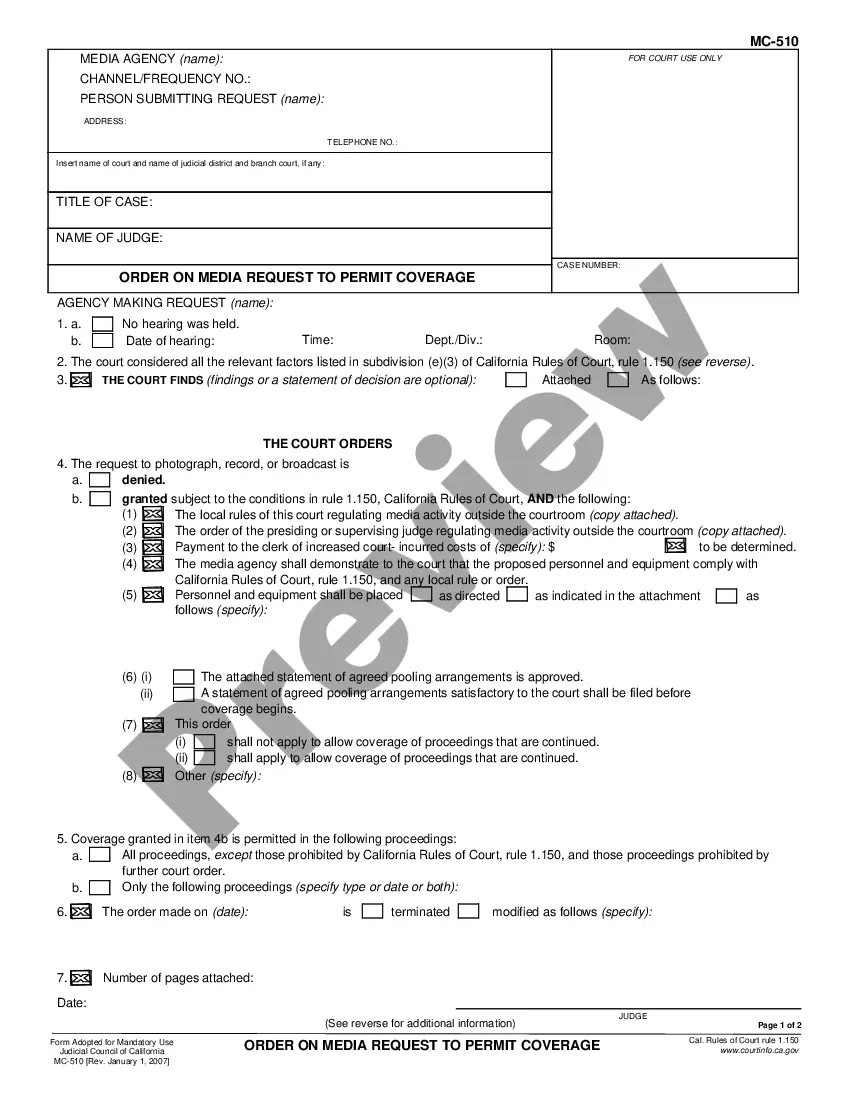

- Click on the Review button to inspect the content of the form.

- Check the form description to verify that you have selected the correct version.

- If the form does not fit your requirements, use the Lookup box at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your selection by clicking on the Acquire now button.

- Choose the pricing plan you prefer and provide your details to register for an account.

Form popularity

FAQ

Filling out a North Carolina Non-Disclosure Agreement for Merger or Acquisition involves several straightforward steps. Start by identifying the parties involved, including their full legal names and addresses. Next, clearly outline the confidential information to be protected, ensuring specificity to avoid ambiguity. Finally, review the agreement for accuracy, sign it, and keep a copy for your records; this process secures your sensitive information effectively.

To create a North Carolina Non-Disclosure Agreement for Merger or Acquisition, start by outlining the parties involved. Clearly define the confidential information to protect, specify the purpose of the agreement, and establish the duration of confidentiality. You can simplify this process by using a trusted platform like UsLegalForms, which offers templates specifically designed for various legal needs, including mergers and acquisitions. Utilizing such resources ensures you create a thorough and legally sound agreement that meets your specific requirements.

The primary purpose of the NDA in acquisition is to protect sensitive information during negotiations between the parties involved. This legal document establishes a framework for confidentiality, ensuring that trade secrets, financials, and other proprietary data are not disclosed to unauthorized individuals. Utilizing a North Carolina Non-Disclosure Agreement for Merger or Acquisition allows businesses to engage in discussions freely, knowing their information is secure.

NDAs are generally enforceable in North Carolina, provided they meet specific legal requirements. The agreement must clearly define what information is confidential and the obligations of both parties. By utilizing a well-crafted North Carolina Non-Disclosure Agreement for Merger or Acquisition, businesses can enhance the enforceability of their NDA and protect their sensitive information.

An NDA in M&A is a formal contract that establishes confidentiality between parties who are exploring a merger or acquisition. This legal document is designed to protect sensitive information shared during negotiations, ensuring that proprietary data remains secure. By implementing a North Carolina Non-Disclosure Agreement for Merger or Acquisition, businesses can create a safe environment for discussions, enabling both sides to explore opportunities without fear of information leaks.

There are several exceptions to a non-disclosure agreement, including cases where the information becomes public through no fault of the receiving party or is received from another source legally. In some cases, the legal obligation to disclose information may also override the NDA, such as during court proceedings. Understanding these exceptions is important to ensure you are protected when using a North Carolina Non-Disclosure Agreement for Merger or Acquisition.

You may not need an NDA when you are dealing with publicly available information or if the parties involved have an existing relationship built on trust. Additionally, if the information is not sensitive or crucial to the negotiation process, an NDA might not be necessary. However, it is always advisable to assess the situation carefully and consider the benefits of using a North Carolina Non-Disclosure Agreement for Merger or Acquisition, even in less sensitive scenarios.

The confidentiality clause in M&A is a specific component of the North Carolina Non-Disclosure Agreement for Merger or Acquisition. This clause explicitly defines what information is considered confidential and stipulates the responsibilities of both parties regarding the handling of this information. It helps prevent unauthorized disclosure and ensures that proprietary information remains secure, thus facilitating open discussions during the merger or acquisition.

The NDA for merger acquisition is a legal document that safeguards confidential information shared between parties considering a merger or acquisition. This agreement ensures that sensitive business details, such as financial data and proprietary strategies, are only accessible to authorized individuals. By using a North Carolina Non-Disclosure Agreement for Merger or Acquisition, businesses can protect their interests and maintain a competitive edge throughout the negotiation process.

The North Carolina Non-Disclosure Agreement for Merger or Acquisition is a critical step in the M&A process. First, the parties involved must draft and sign the NDA, which outlines the confidential information shared during negotiations. After signing, both sides can freely exchange sensitive data while ensuring it remains protected. This process fosters trust and transparency, allowing both parties to evaluate the potential merger or acquisition thoroughly.