An artisan, also called a craftsman, is a skilled manual worker who uses tools and machinery in a particular craft. A bill of sale is a document that transfers ownership of personal property from the seller to the buyer. The phrase as is used in a bill of sale as the form demonstrates is a phrase used in warranty law to disclaim the seller's liability for faults in the item sold. The buyer accepts the item in the present condition, whether the faults are apparent or not.

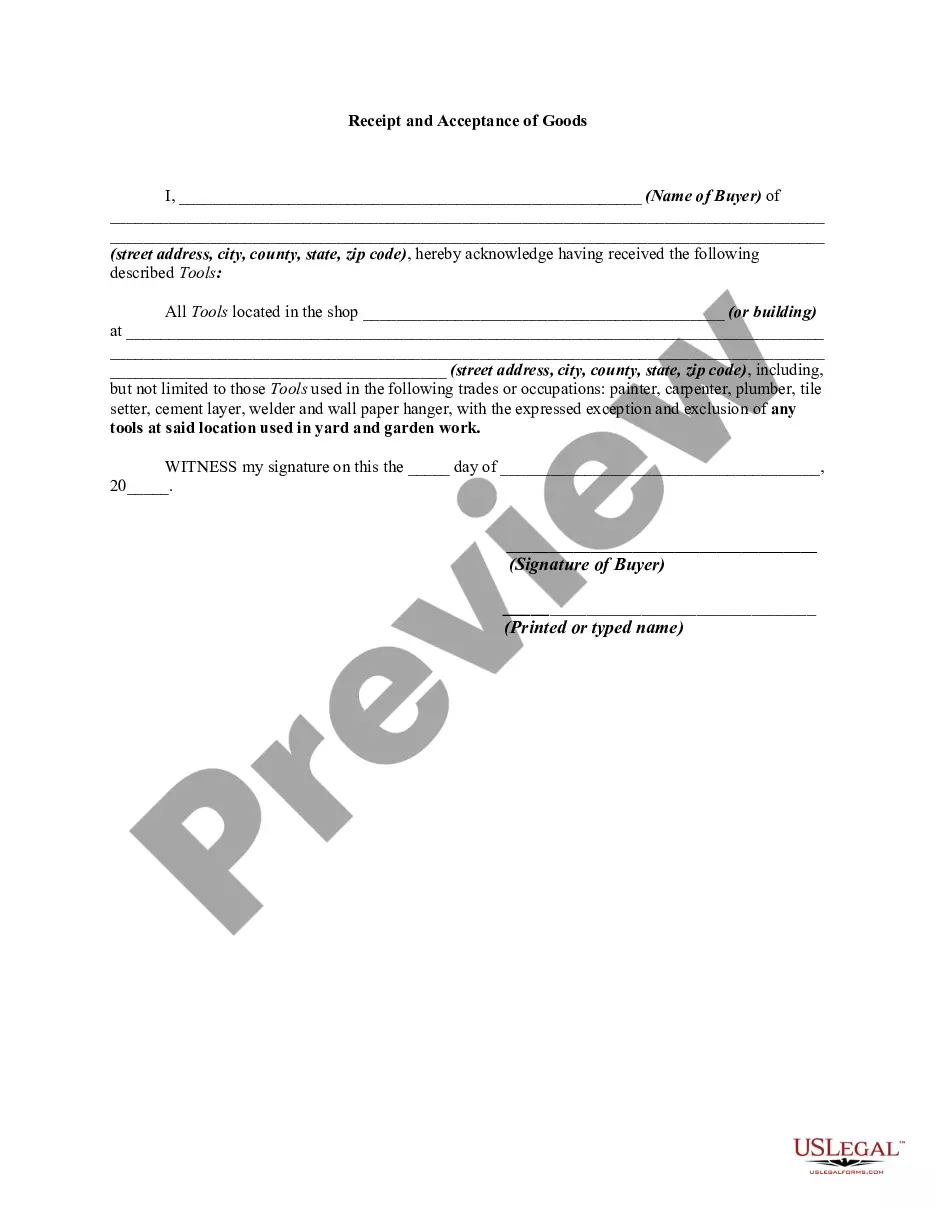

North Carolina Bill of Sale of Artisan's Tools Located in a Building Along With Other Tools

Description

How to fill out Bill Of Sale Of Artisan's Tools Located In A Building Along With Other Tools?

You can spend hours online searching for the legal document template that meets the state and federal requirements you desire.

US Legal Forms offers thousands of legal forms that have been reviewed by professionals.

You can effortlessly download or print the North Carolina Bill of Sale for Artisan's Tools Located in a Building Along With Other Tools from your services.

If available, use the Preview option to browse through the document template as well.

- If you already have a US Legal Forms account, you can Log In and click on the Download option.

- Then, you can fill out, edit, print, or sign the North Carolina Bill of Sale for Artisan's Tools Located in a Building Along With Other Tools.

- Each legal document template you purchase is yours indefinitely.

- To obtain another copy of the purchased form, go to the My documents tab and click on the corresponding option.

- If this is your first time using the US Legal Forms website, follow the simple instructions provided below.

- First, ensure that you have chosen the correct document template for the state/city of your choice.

- Check the form description to confirm you have selected the appropriate form.

Form popularity

FAQ

In general, clothing, groceries, medicines and medical devices and industrial equipment are sales tax exempt in many states (but don't assume they'll be exempt in all states. Every state is different when it comes to sales tax!)

During the annual Sales Tax Holiday, a variety of purchases are exempt from the state's 6% Sales Tax and any applicable local taxes. Tax-free items range from clothing, accessories, and shoes to school supplies, backpacks, and computers.

Goods that are subject to sales tax in North Carolina include physical property, like furniture, home appliances, and motor vehicles. Prescription Medicine, groceries, and gasoline are all tax-exempt. Some services in North Carolina are subject to sales tax.

Machinery and Equipment, Sales and Use Tax ExemptionMill machinery, a term that generally includes manufacturing machinery, is exempt from sales and use tax. For a list of items that are classified as mill machinery, please see the North Carolina Department of Revenue's Sales and Use Tax Technical guides..

Sales of bottled drinking water that contain natural or artificial sweeteners are subject to the general 4.75% State, applicable local (2.00% or 2.25%), and applicable transit (0.50%) rates of sales and use tax.

The Machinery Act (General Statute 105, Subchapter II) provides the framework for the listing, assessing, and appraising of both real and personal property in North Carolina. Under G. S. 105-286, all counties are required to conduct a reappraisal at least every eight (8) years.

In North Carolina, grocery items are not subject to the state's statewide sales tax, but are subject to a uniform 2% local tax. Candy, however, is generally taxed at the full combined sales tax rate.

Goods that are subject to sales tax in North Carolina include physical property, like furniture, home appliances, and motor vehicles. Prescription Medicine, groceries, and gasoline are all tax-exempt.

Mill (generally manufacturing) machinery, including parts or accessories as well as specialized equipment for loading or processing, is exempt from sales and use tax.

Tangible personal property includes, but is not limited to, machinery, equipment, furniture, fixtures, drawings, signs, purchased software which is treated as a capital asset, reference libraries, etc. All items must be listed at 100% cost including installation, sales tax, freight and any associated costs.