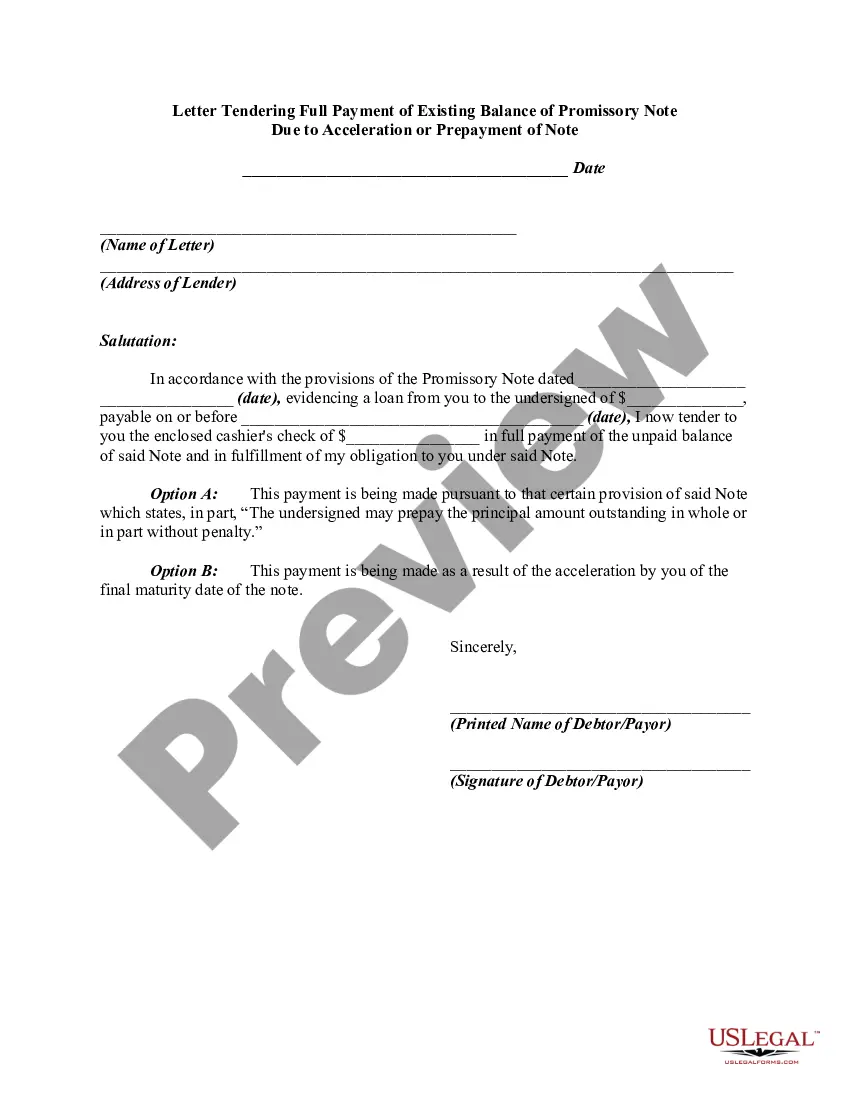

A sample of an acceleration clause in a promissory note would be: "the failure to pay any installment when due shall mature the entire indebtedness at the option of the holder of this Note." A sample of a prepayment clause in a promissory note would be: "the undersigned may prepay the principal amount outstanding in whole or in part without penalty."

North Carolina Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment of Note

Description

How to fill out Letter Tendering Full Payment Of Existing Balance Of Promissory Note Due To Acceleration Or Prepayment Of Note?

You can dedicate hours online searching for the legal document template that fulfills the federal and state requirements you need.

US Legal Forms provides a vast array of legal forms that are reviewed by experts.

It is easy to download or print the North Carolina Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment of Note from my service.

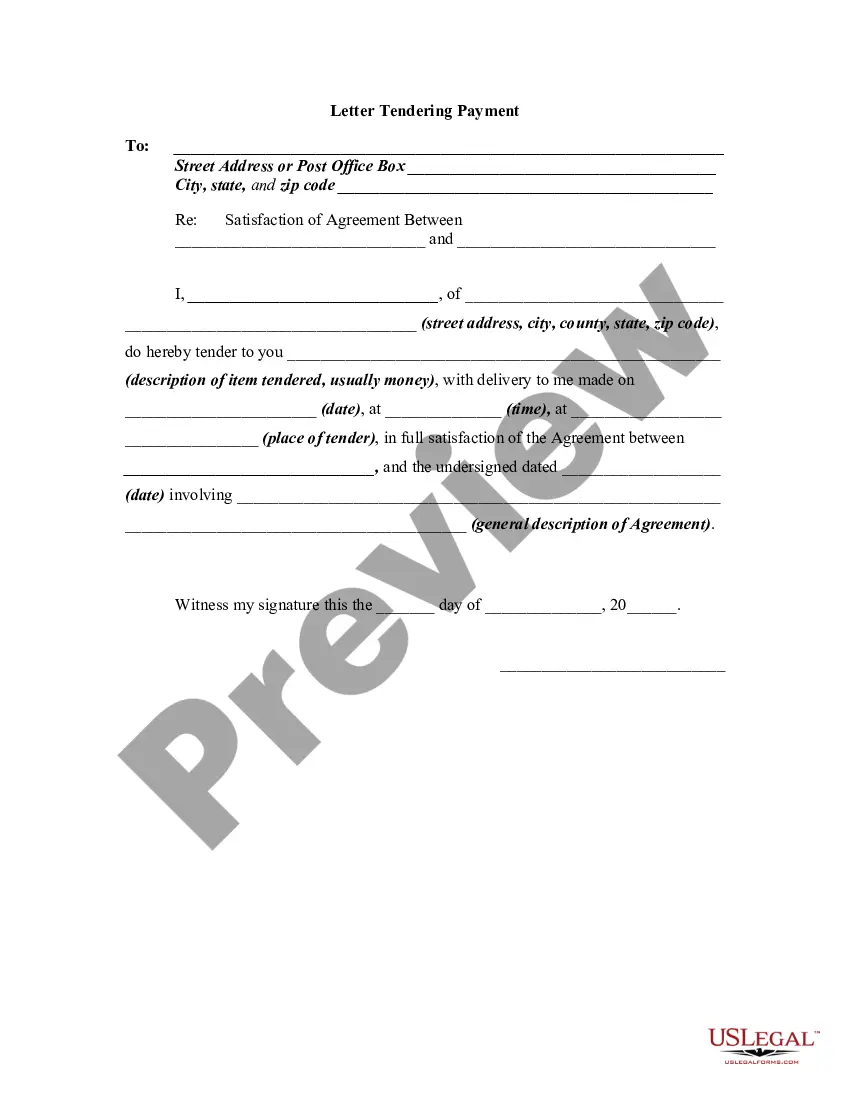

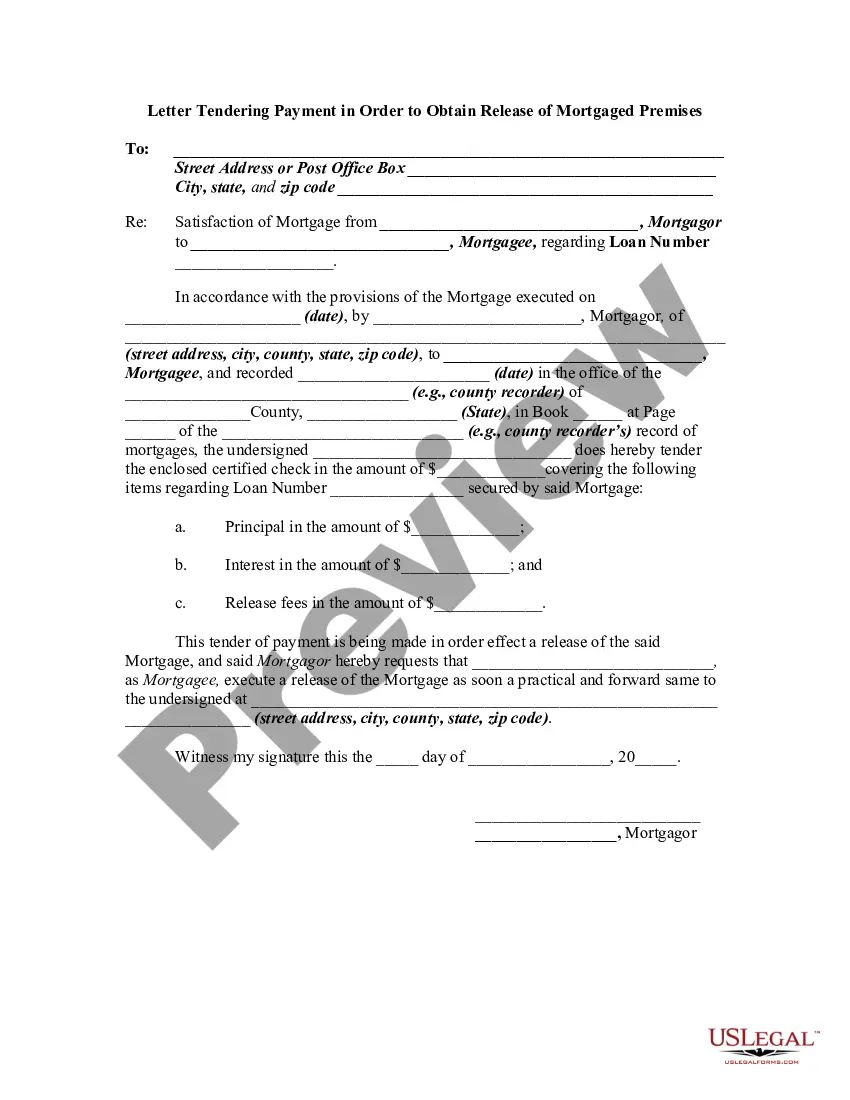

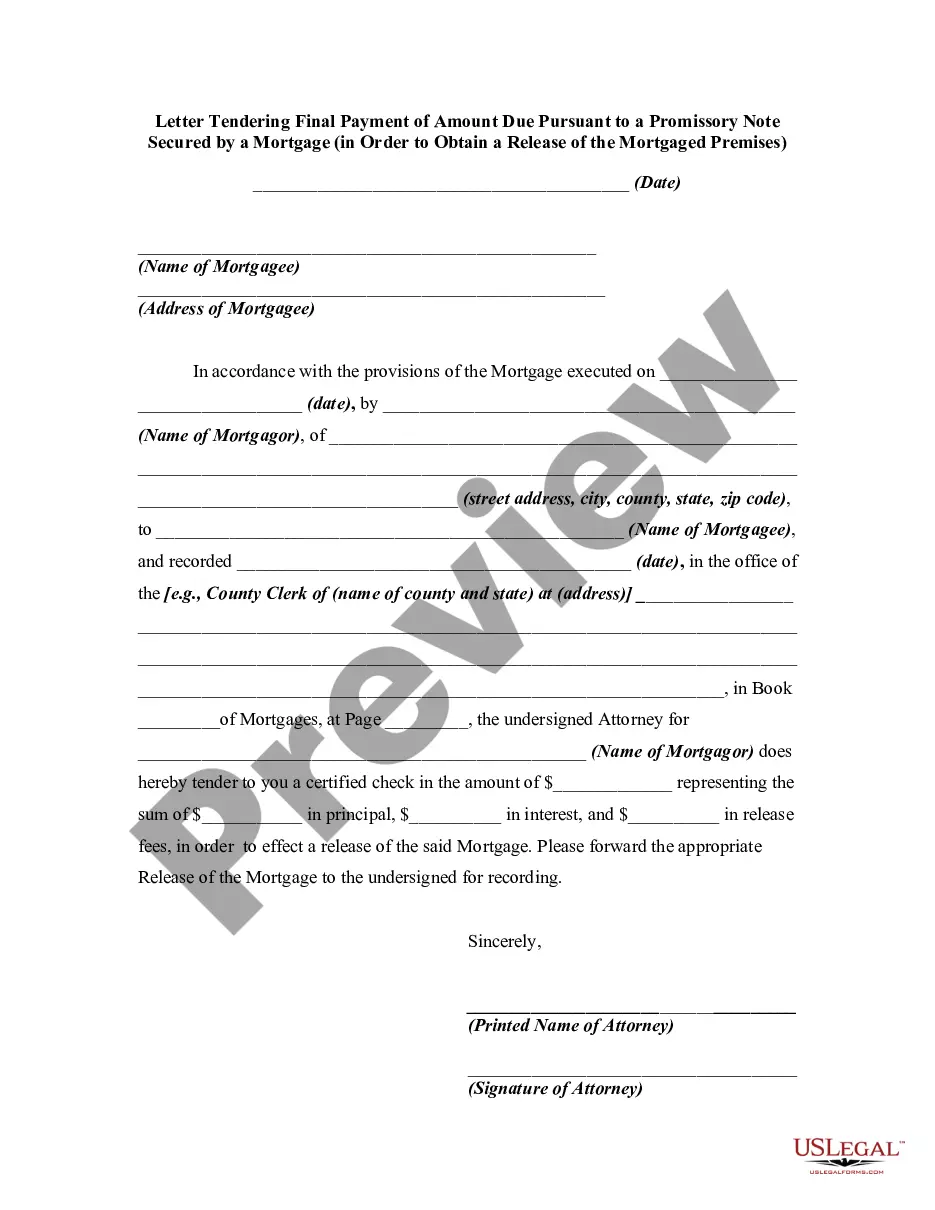

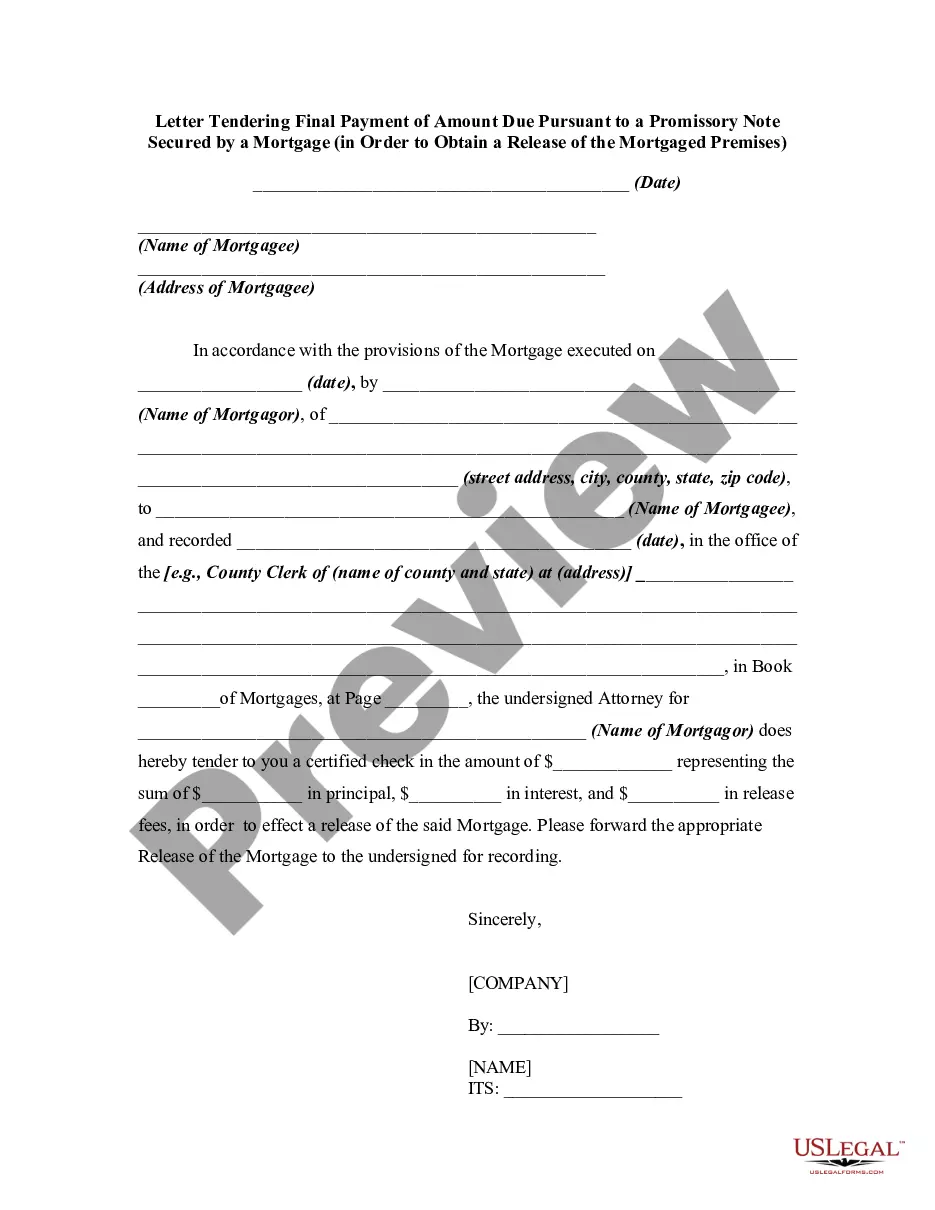

If available, make use of the Preview button to browse through the document template as well.

- If you already have an account with US Legal Forms, you can Log In and click the Acquire button.

- Afterward, you can complete, modify, print, or sign the North Carolina Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment of Note.

- Every legal document template you purchase is yours permanently.

- To obtain another copy of any acquired form, go to the My documents tab and click the appropriate button.

- If this is your first time using the US Legal Forms site, follow these simple instructions below.

- First, ensure that you have selected the correct document template for your state/region of choice.

- Review the form description to confirm that you have chosen the right form.

Form popularity

FAQ

Yes, a handwritten promissory note can be legal if it meets certain criteria. The terms must be clear and unambiguous, making it evident how much is owed and under what conditions. Nonetheless, you should ensure that all necessary legal standards are met, especially in North Carolina, where rules apply to the Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment of Note.

Generally, a promissory note is not classified as legal tender. Legal tender refers to currency recognized by law for payment of debts. However, a promissory note can serve as evidence of a debt between the parties involved. For situations requiring a formal acknowledgment of debt, consider using the North Carolina Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment of Note.

Yes, you can certainly write your own promissory note. However, it is important to follow the legal requirements for your state, including North Carolina's rules surrounding promissory notes. A well-drafted note can help avoid potential conflicts down the line. If you need guidance, consider using US Legal Forms to access templates tailored for North Carolina Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment of Note.

An example of a promissory note could be a document where John borrows $10,000 from Sarah, promising to repay it in three years at a 5% interest rate. The note includes the total amount owed, the payment schedule, and details about actions that may occur if repayment terms are not met, such as a North Carolina Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment of Note. This example highlights key components to establish both parties' obligations clearly.

When writing a promissory note for payment, begin with the title and clearly state it is a promissory note. Specify the principal amount, interest rate, and due dates in simple terms. Include the possibility of repayment options such as a North Carolina Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment of Note, ensuring that the responsibilities of both parties are clear and unambiguous.

To record a promissory note payment, maintain a clear record of each transaction in a payment ledger. Include the date, payment amount, remaining balance, and a brief description of the note. This is crucial for tracking payments leading up to the final settlement, especially when it involves a North Carolina Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment of Note. Regularly update your records to reflect current financial standing.

To write a simple promissory note, start by clearly stating the borrower's name and the amount borrowed. Include terms such as the interest rate, maturity date, and payment schedule. Use straightforward language to outline what happens if the note is not repaid, including any actions like a North Carolina Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment of Note. Ensure both parties sign and date the document for authenticity.

A demand letter for payment serves as a formal communication that requests payment for a debt or obligation. It outlines the specifics of the debt, including the North Carolina Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment of Note. The purpose is not only to prompt payment but also to establish a timeline for resolution before considering legal action.

A demand letter signifies a formal request for payment or action, and it often serves as a precursor to legal actions. Receiving a demand letter, especially one related to the North Carolina Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment of Note, usually indicates that the sender is serious about resolving the issue. Ignoring a demand letter can lead to further consequences, including potential legal action.

In North Carolina, a promissory note is typically valid for three to six years, depending on its terms and the actions taken by the parties involved. This validity period starts from the due date of the note. If you are dealing with a North Carolina Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment of Note, it’s essential to be aware of these timelines to protect your interests.