North Carolina Sample Letter for Promissory Note and Stock Pledge Agreement

Description

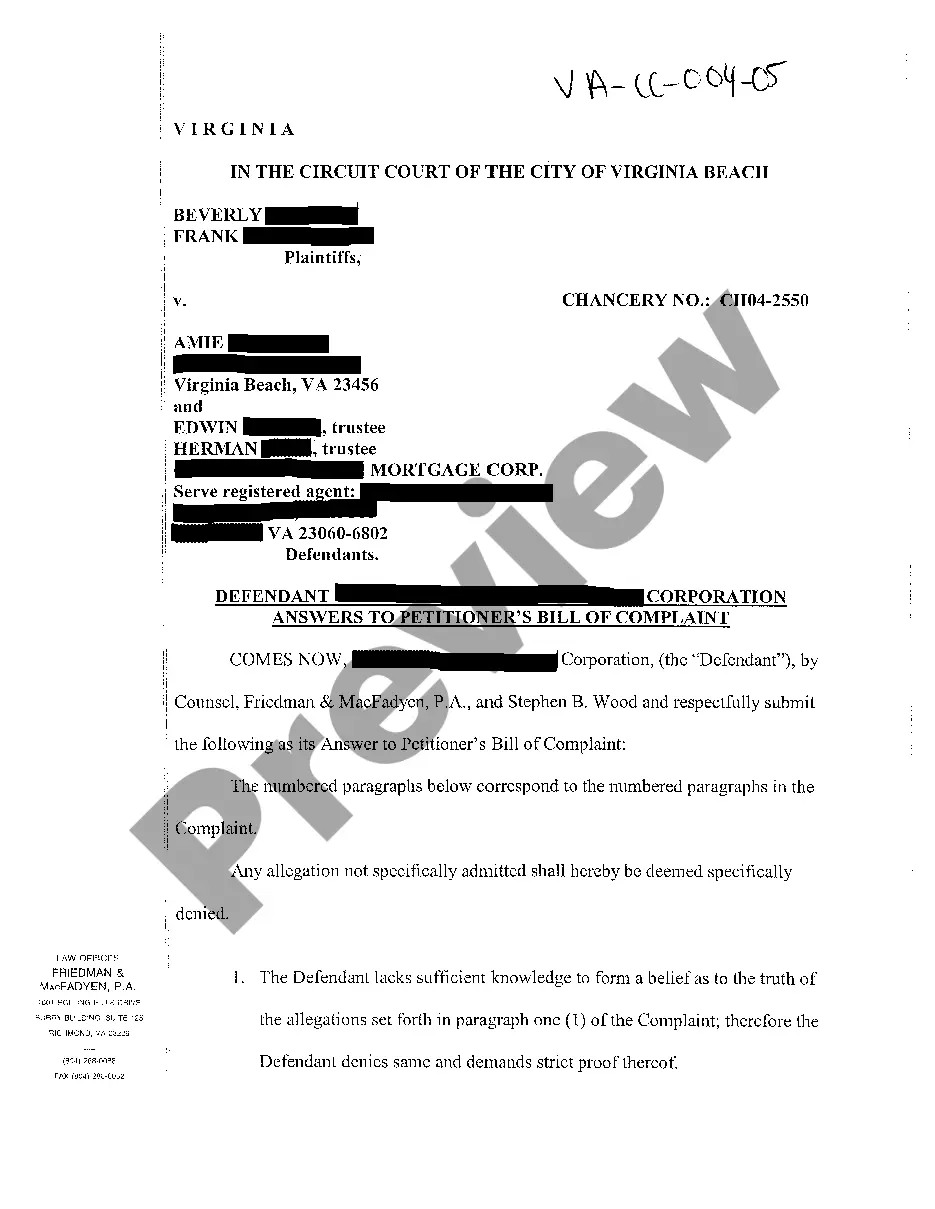

How to fill out Sample Letter For Promissory Note And Stock Pledge Agreement?

US Legal Forms - one of the largest collections of authentic documents in the United States - provides an extensive selection of legitimate form templates that you can download or print. By utilizing the website, you can access thousands of forms for business and personal use, organized by categories, states, or keywords.

You can obtain the latest versions of forms such as the North Carolina Sample Letter for Promissory Note and Stock Pledge Agreement within moments. If you already have a subscription, Log In and retrieve the North Carolina Sample Letter for Promissory Note and Stock Pledge Agreement from the US Legal Forms repository. The Download option will appear on every form you view. You can access all previously downloaded forms in the My documents tab of your account.

If you are using US Legal Forms for the first time, here are simple instructions to get started: Ensure you have selected the correct form for your city/state. Click the Preview option to review the form's details. Read the form description to confirm you have chosen the right one. If the form does not meet your requirements, use the Search box at the top of the screen to find one that does. If you are satisfied with the form, confirm your selection by clicking the Get now button. Then, select your preferred pricing plan and provide your information to register for an account. Process the payment. Use your credit card or PayPal account to complete the transaction. Choose the format and download the form onto your device. Make adjustments. Complete, modify, print, and sign the downloaded North Carolina Sample Letter for Promissory Note and Stock Pledge Agreement. Each template you add to your account has no expiration date and is yours permanently. So, if you wish to download or print another copy, simply go to the My documents section and click on the form you need.

- Access the North Carolina Sample Letter for Promissory Note and Stock Pledge Agreement with US Legal Forms, one of the most extensive libraries of legitimate document templates.

- Utilize thousands of professional and state-specific templates that fulfill your business or personal needs and requirements.

Form popularity

FAQ

In simple words, a pledge is a promise to repay a loan, and collateral is what you lose if you don't keep your promise. For example, I can take a loan from a friend, pledge to return it within 30 days, and offer my bike as collateral. As long as I return the loan within 30 days, the bike is safe.

A pledge of shares agreement or Pledge And Security Agreement is an agreement between a lender and a borrower where the borrower agrees to contribute their membership interest in the borrowing entity, such as an LLC to the lender in the event of default.

If the company's cash flow is healthy enough to keep up the collateral value, pledged shares may not harm. But, if the cash flow is poor and promoters cannot maintain collateral value, the pledged shares may prove disastrous for the company's financial conditions.

Pledging of shares is a financial arrangement in which the promoters of a company pledge their shares as collateral to secure a loan or meet their financial requirements. Pledge in the stock market means taking a loan against its securities. This arrangement is typical for companies where investors hold many shares.

Collateral is an asset of value that a borrower pledges as a guarantee that a loan will be repaid. Collateral is a tangible or intangible asset pledged to secure a loan. If the borrower stops repaying the loan, the lender can seize and sell the collateral to get their funds back.

Pledging of shares involves the transfer of ownership of shares from the shareholder to the lender, as collateral security for a loan. The bank or financial institution holds the shares until you fully repay the loan.

A pledge and security agreement is a legal document that outlines an arrangement in which one party (the pledgor) unconditionally transfers the title to a specific property or asset to another person or entity (the pledgee), who accepts it for safekeeping, usually in return for some form of compensation.

An agreement typically used to create a security interest in equity interests (including capital stock, LLC interests, and partnership interests) and promissory notes.