North Carolina Corporate Resolution for Sole Owner

Description

How to fill out Corporate Resolution For Sole Owner?

It is feasible to spend time online attempting to locate the legal document template that meets the federal and state criteria you need.

US Legal Forms offers thousands of legal documents that are reviewed by experts.

You can effortlessly obtain or generate the North Carolina Corporate Resolution for Sole Owner from my service.

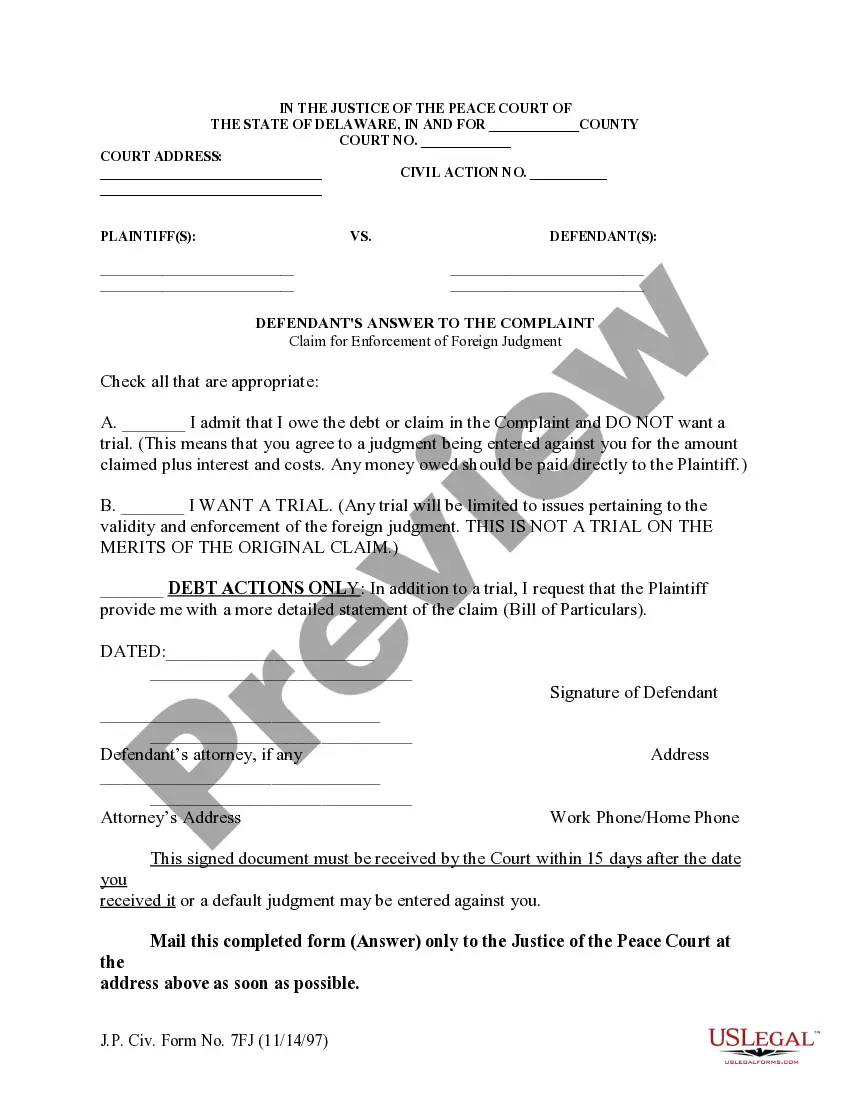

If available, utilize the Preview option to browse through the document template as well.

- If you currently possess a US Legal Forms account, you can Log In and select the Obtain option.

- Next, you can fill out, edit, create, or sign the North Carolina Corporate Resolution for Sole Owner.

- Each legal document template you acquire is yours permanently.

- To obtain another copy of any downloaded form, navigate to the My documents section and click the appropriate option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions provided below.

- First, ensure that you have chosen the correct document template for the area/town of your choice.

- Review the form description to confirm that you have selected the proper form.

Form popularity

FAQ

Any LLC member can propose a resolution, but all members must vote on it. Typically a majority of the members is needed to pass the resolution, but each LLC may have different voting rights. Some LLCs give a different value to each member's vote based on their percentage of interest in the company.

How To Write a Corporate Resolution Step by StepStep 1: Write the Company's Name.Step 2: Include Further Legal Identification.Step 3: Include Location, Date and Time.Step 4: List the Board Resolutions.Step 5: Sign and Date the Document.

Corporate resolutions are required whenever the board of directors makes a major decision. The resolution acts as a written record of the decision and is stored with other business documents. These board resolutions are binding on the company.

The resolutions are used to determine which corporate officers are legally able to sign contracts, make transfers or assignments, sell or lease real estate, and make other important decisions that bind the corporation.

Primarily a board resolution is needed to keep a record of two things: To record decisions concerning company affairs (except for shares) made in the board of directors meeting. This is also known as a board resolution. To record decisions concerning company equity made by shareholders of the corporation.

Resolution in Writing of Sole DirectorSole directors usually record their decisions as resolutions in writing. This template resolution can be used by sole directors to record decisions and so keep a written record of company business.

A corporate resolution is the legal document that provides the rules and framework as to how the board can act under various circumstances. Corporate resolutions provide a paper trail of the decisions made by the board and the executive management team.

Examples of Actions that Need Corporate ResolutionsApproval of new board members and officers.Acceptance of the corporate bylaws.Creation of a corporate bank account.Designating which board members and officers can access the bank account.Documentation of a shareholder decision.Approval of hiring or firing employees.More items...

Special resolutions - also known as 'extraordinary resolutions' - are needed for more important decisions or those decisions affecting the constitution of a company. These require at least 75% of the shareholders or directors to agree - and in some situations as much as 95%.