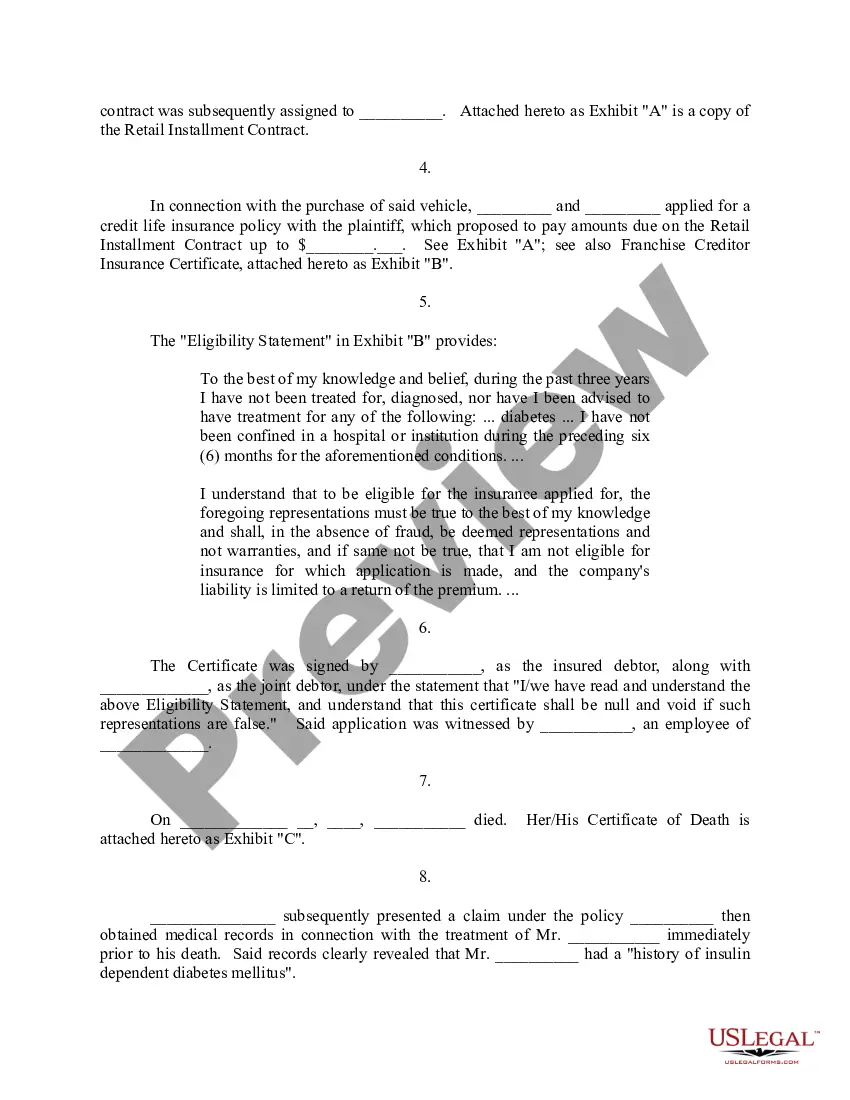

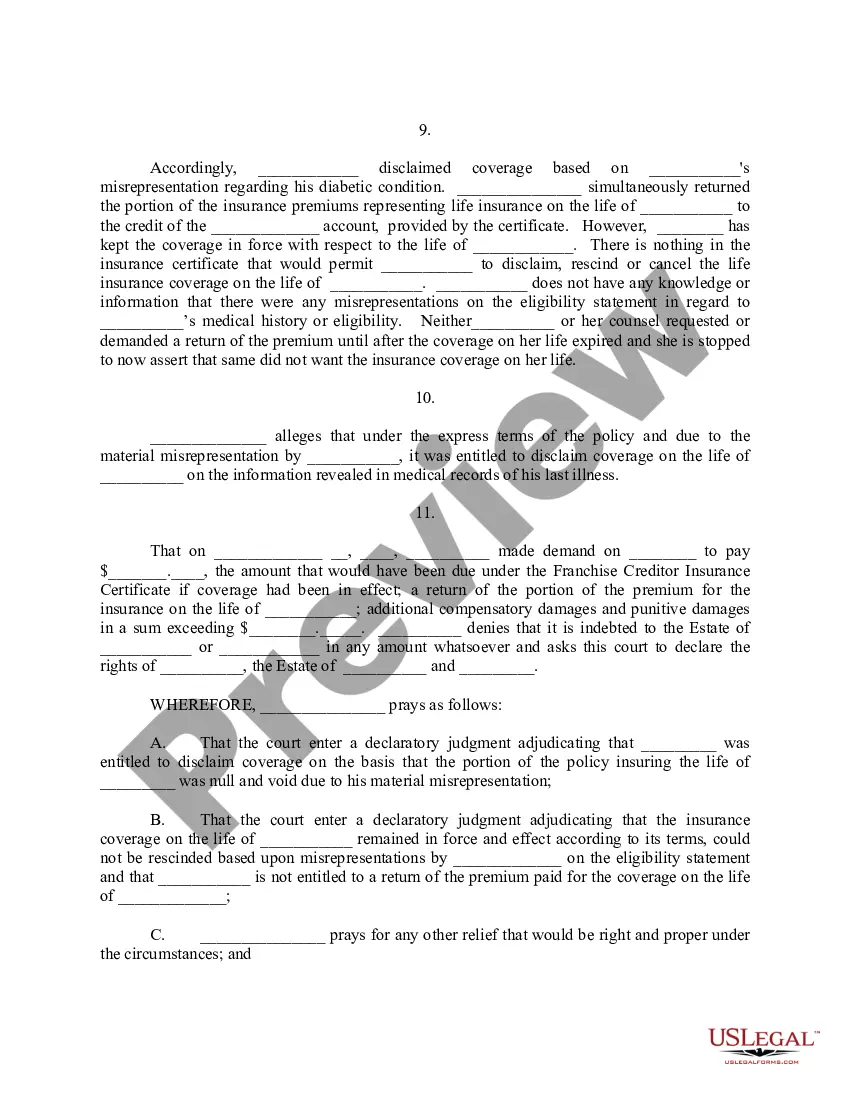

This form is a Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage. Adapt to your specific circumstances. Don't reinvent the wheel, save time and money.

North Carolina Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage

Description

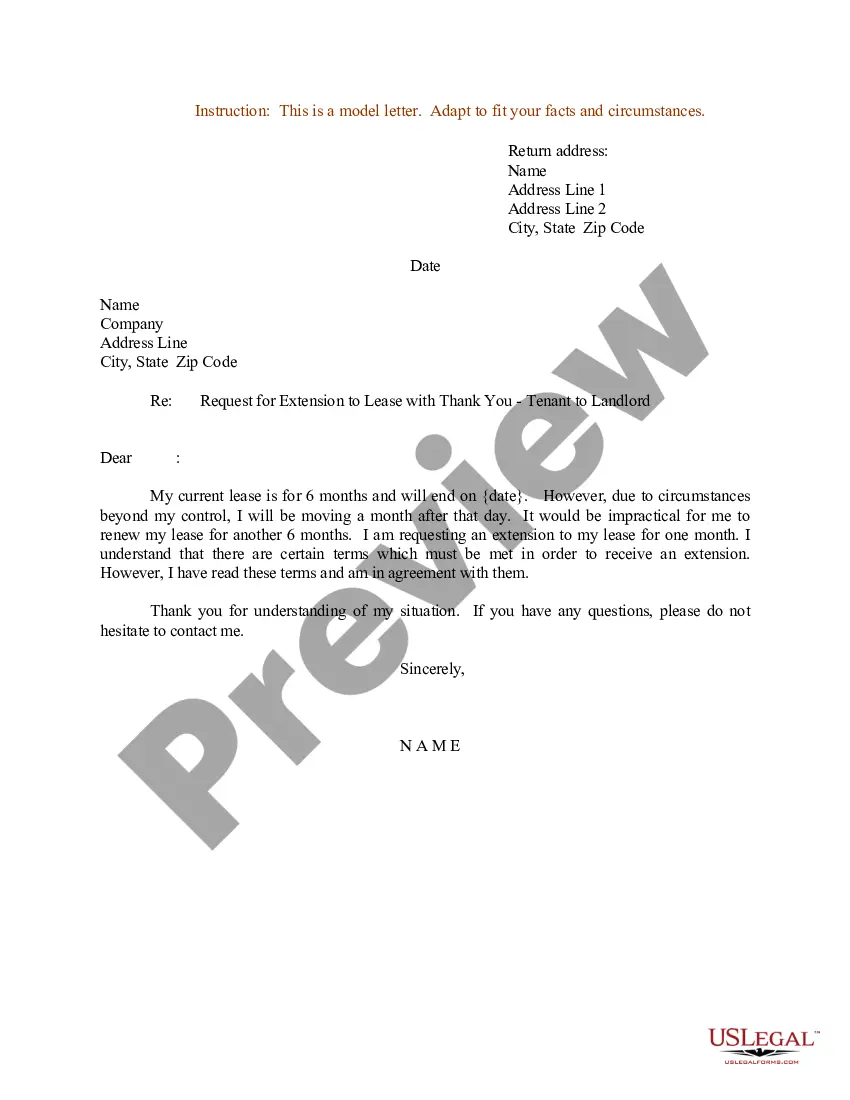

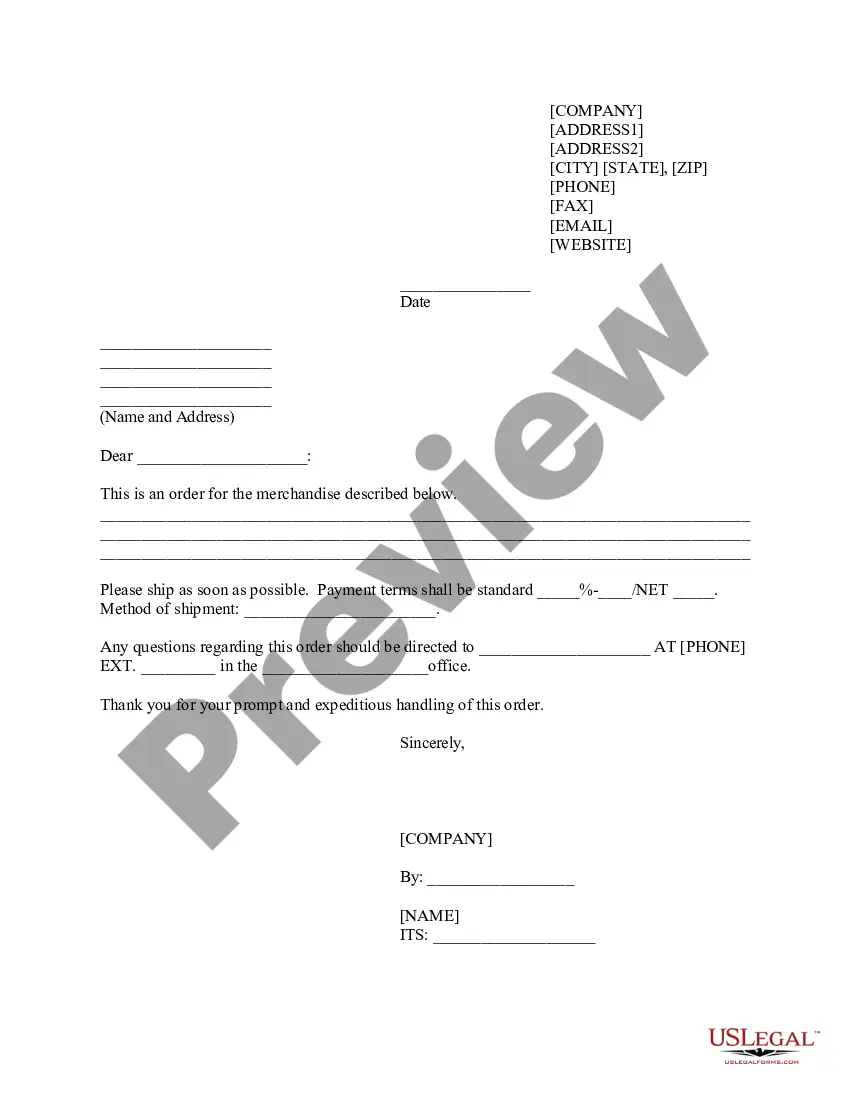

How to fill out Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage?

You can spend several hours online searching for the proper document template that meets the state and federal requirements you need. US Legal Forms offers a wide range of legal templates that are reviewed by experts.

You can easily download or print the North Carolina Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage from our service. If you have a US Legal Forms account, you can Log In and click the Obtain button. After that, you may complete, modify, print, or sign the North Carolina Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage.

Every legal document template you purchase is yours to keep indefinitely. To get another copy of any purchased form, go to the My documents tab and click the corresponding button. If you are using the US Legal Forms website for the first time, follow the simple instructions below: First, ensure you have selected the correct document template for the state/city of your choice. Review the form description to confirm you have chosen the right form. If available, use the Preview button to view the document template as well.

Avoid altering or removing any HTML tags. Only synonymize plain text outside of the HTML tags.

- If you want to find another version of the form, use the Search field to locate the template that suits your needs and requirements.

- Once you have found the template you need, click Buy now to proceed.

- Select the pricing option you prefer, enter your details, and create your account on US Legal Forms.

- Complete the transaction. You can use your Visa or Mastercard or PayPal account to pay for the legal form.

- Choose the format of the document and download it to your device.

- Make changes to your document if necessary. You can complete, modify, sign, and print the North Carolina Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage.

- Access and print numerous document templates using the US Legal Forms website, which offers the largest selection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

Form popularity

FAQ

However, in South Carolina there is a law (38-77-250) that says the at fault party's insurance carrier must tell you the insurance policy limits if certain criteria are met.

Also known as your coverage amount, your insurance limit is the maximum amount your insurer may pay out for a claim, as stated in your policy. Most insurance policies, including home and auto insurance, have different types of coverages with separate coverage limits.

§ 58-60-20. Such file shall contain one copy of each authorized form for a period of three years following the date of its last authorized use.

In addition to liability based on those North Carolina statutes, North Carolina courts have held that an insurance company is responsible for bad faith wrongdoing when it refuses to pay policy benefits after receiving and recognizing a valid claim or otherwise acts solely in its own interest, provided, that there must ...

North Carolina Motor Vehicle Law requires that Automobile Liability coverage be continuously maintained. The minimum coverage requirements are $30,000 Bodily Injury for each person, $60,000 total Bodily Injury for all persons in an accident and $25,000 for Property Damage.

An insurer must disclose the coverage and limits of an insurance policy within 30 days after the information is requested in writing by a claimant.

Knowing insurance policy limits can be a huge advantage when dealing with a case against a negligent driver and their insurance company. However, in North Carolina, insurance companies are not required to reveal how much insurance the at-fault driver has or what their policy limits are.