Montana Ratification of Royalty Commingling Agreement

Description

How to fill out Ratification Of Royalty Commingling Agreement?

You can spend several hours online trying to find the lawful papers web template that fits the federal and state needs you require. US Legal Forms supplies a huge number of lawful varieties that are analyzed by professionals. It is simple to down load or print the Montana Ratification of Royalty Commingling Agreement from our support.

If you currently have a US Legal Forms bank account, you may log in and then click the Download option. Afterward, you may total, edit, print, or sign the Montana Ratification of Royalty Commingling Agreement. Each lawful papers web template you buy is your own forever. To acquire one more duplicate of any purchased develop, check out the My Forms tab and then click the related option.

If you use the US Legal Forms website the very first time, stick to the basic instructions beneath:

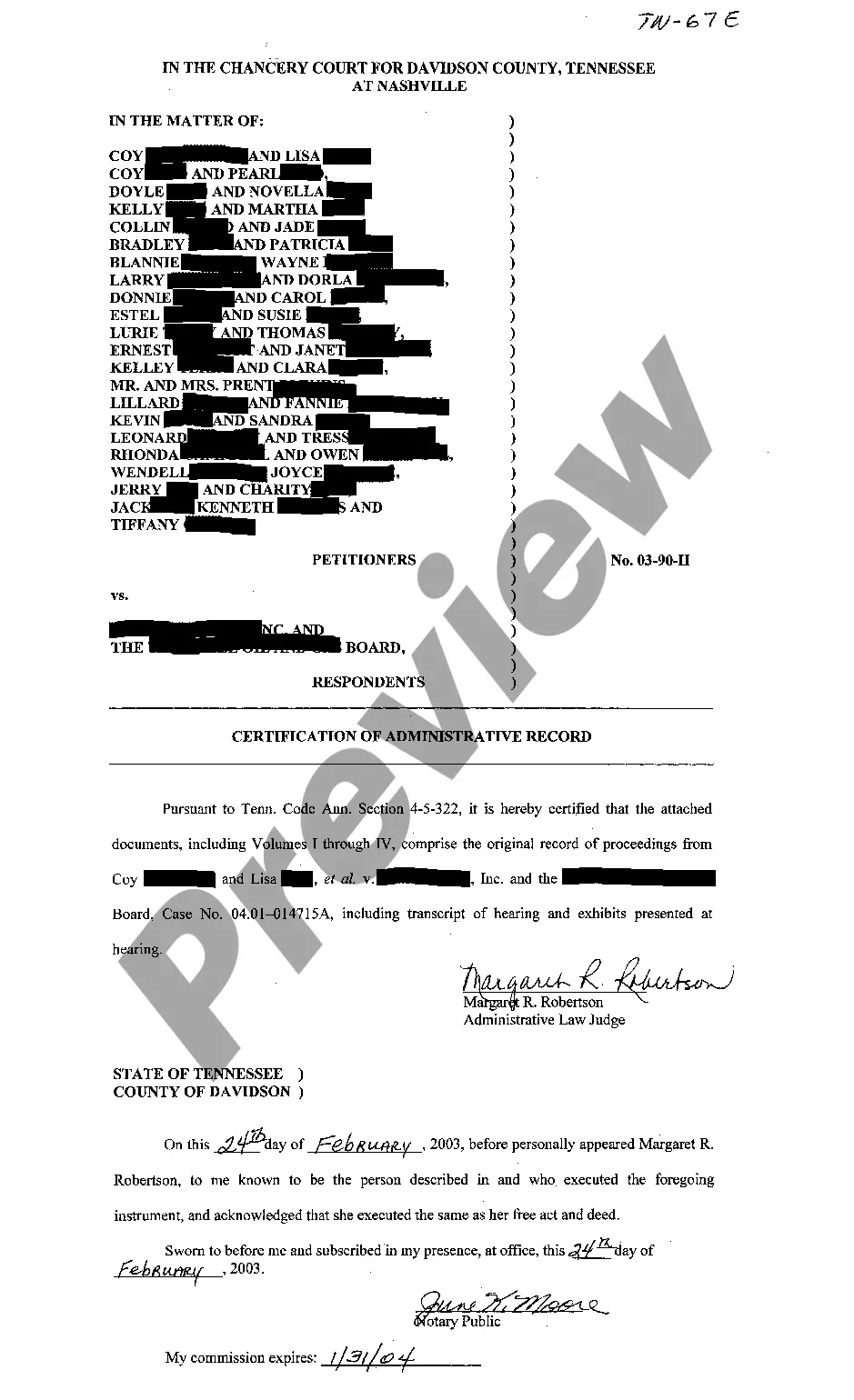

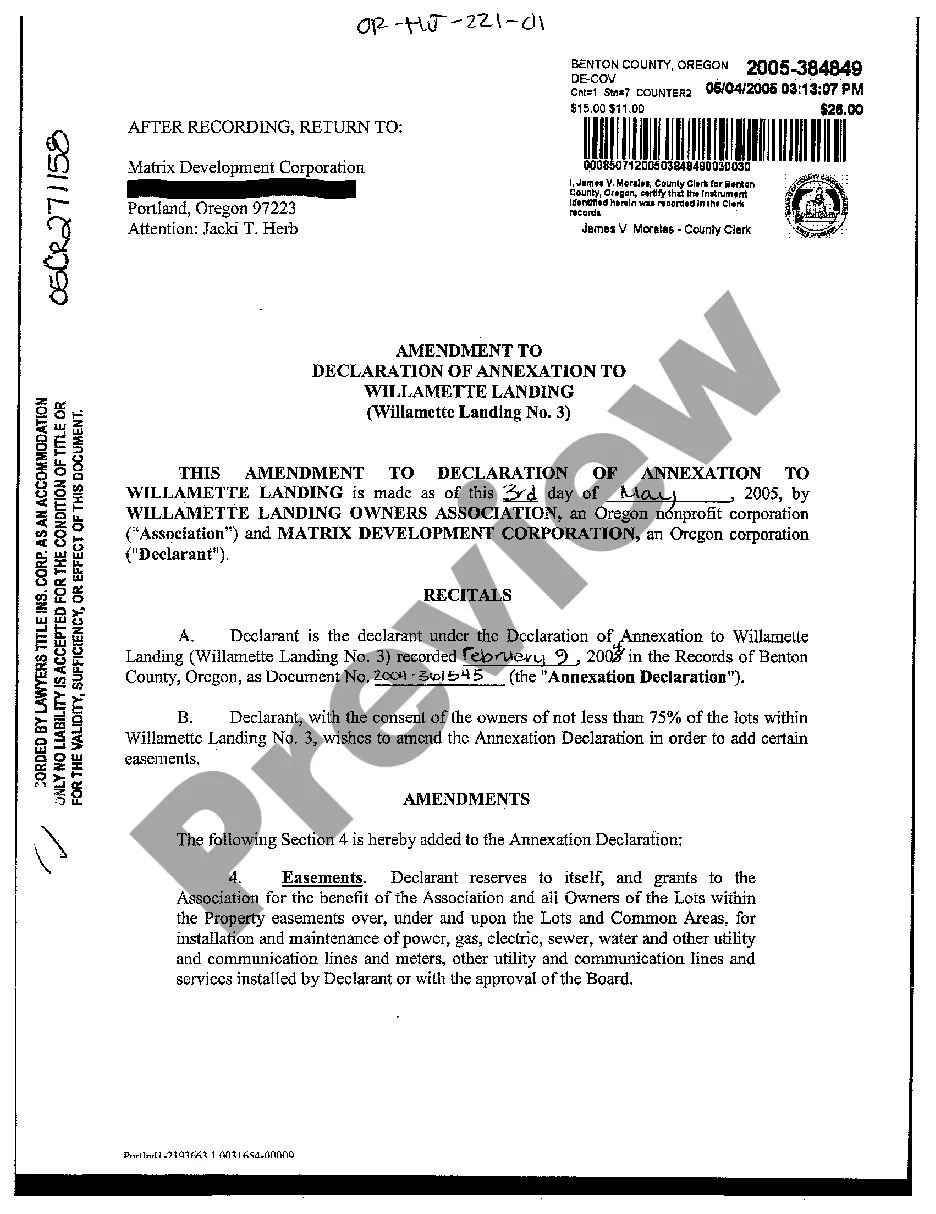

- Initially, make sure that you have chosen the correct papers web template for that region/town of your choosing. Read the develop information to make sure you have picked the appropriate develop. If accessible, utilize the Review option to look from the papers web template too.

- If you would like locate one more edition in the develop, utilize the Search field to find the web template that meets your requirements and needs.

- Upon having discovered the web template you desire, click on Purchase now to carry on.

- Find the costs prepare you desire, type your references, and register for a merchant account on US Legal Forms.

- Comprehensive the financial transaction. You may use your credit card or PayPal bank account to cover the lawful develop.

- Find the file format in the papers and down load it for your system.

- Make adjustments for your papers if possible. You can total, edit and sign and print Montana Ratification of Royalty Commingling Agreement.

Download and print a huge number of papers templates while using US Legal Forms site, that provides the largest assortment of lawful varieties. Use expert and status-specific templates to tackle your organization or personal requirements.