Montana Self-Employed Independent Contractor Consideration For Hire Form

Description

How to fill out Self-Employed Independent Contractor Consideration For Hire Form?

If you wish to finalize, obtain, or create legal document templates, utilize US Legal Forms, the most extensive collection of legal forms available online.

Employ the site's straightforward and convenient search feature to find the documents you need.

A range of templates for business and personal use are categorized by groups and states, or keywords. Use US Legal Forms to find the Montana Self-Employed Independent Contractor Consideration For Hire Form with just a few clicks.

Each legal document template you acquire is yours indefinitely. You have access to every form you saved in your account. Navigate to the My documents section and select a form to print or download again.

Complete and download, and print the Montana Self-Employed Independent Contractor Consideration For Hire Form with US Legal Forms. There are numerous professional and state-specific forms you can use for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click on the Download button to obtain the Montana Self-Employed Independent Contractor Consideration For Hire Form.

- You can also access forms you have previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Review option to examine the form's details. Be sure to read the description.

- Step 3. If you are not content with the form, utilize the Search box at the top of the screen to find alternative versions of the legal form format.

- Step 4. Once you have identified the form you need, click on the Get now button. Choose the pricing plan you prefer and enter your credentials to register for an account.

- Step 5. Process the transaction. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Fill out, modify, and print or sign the Montana Self-Employed Independent Contractor Consideration For Hire Form.

Form popularity

FAQ

Yes, you can hire yourself as an independent contractor for your LLC, but it's essential to follow specific guidelines. Ensure you complete the necessary documentation, including the Montana Self-Employed Independent Contractor Consideration For Hire Form, to maintain compliance. This approach allows for effective tax management while receiving compensation for your services.

Legal requirements for independent contractors include proper tax reporting and documentation. In Montana, filling out the Montana Self-Employed Independent Contractor Consideration For Hire Form is essential for compliance. Additionally, contractors must adhere to the stipulations outlined in their contracts and follow state regulations.

Independent contractors typically fill out the W-9 form to report their tax information. In Montana, completing the Montana Self-Employed Independent Contractor Consideration For Hire Form is also necessary. These forms provide essential documentation that outlines the working relationship and financial arrangements.

To obtain your Independent Contractor Exemption Certificate (ICEC) in Montana, you should submit an application through the Montana Department of Labor and Industry. The Montana Self-Employed Independent Contractor Consideration For Hire Form may also play a role in your application process. Ensuring you have proper documentation helps protect your status as an independent contractor.

The 1099 form reports payments made to independent contractors, while the W-9 form provides the necessary tax information for the 1099. Deciding between them isn't applicable, as both serve different purposes. In your hiring process, use the W-9 to gather details, which will then help you complete the 1099 at year-end.

Independent contractors must typically complete a W-9 form for tax purposes. In Montana, they should also familiarize themselves with the Montana Self-Employed Independent Contractor Consideration For Hire Form. These forms help clarify the relationship between the contractor and the hiring party, addressing issues like taxes and reporting.

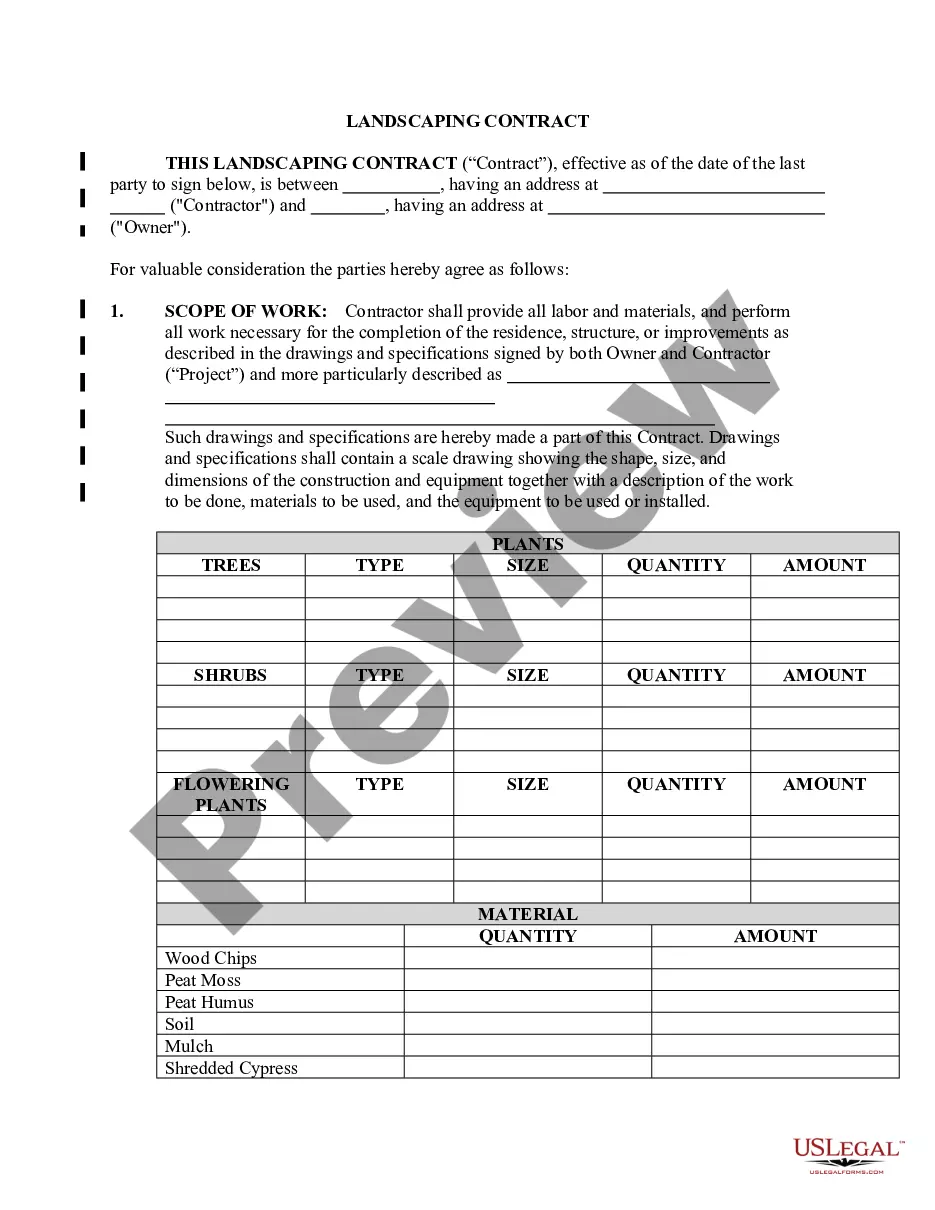

To hire an independent contractor in Montana, you will need to complete the Montana Self-Employed Independent Contractor Consideration For Hire Form. Additionally, you may require a W-9 form to collect the contractor's tax information. Proper paperwork ensures compliance with tax regulations and helps establish a clear work agreement.

To register as an independent contractor in Montana, you first need to obtain a business license and, if necessary, register your business with the Secretary of State. Additionally, you should fill out the Montana Self-Employed Independent Contractor Consideration For Hire Form to formalize your status. This document helps clarify your relationship with clients and ensures compliance with state regulations. Lastly, remember to track your income and expenses to streamline tax reporting.

To hire independent contractors as a sole proprietor, you start by clearly defining the project requirements and selecting candidates who best match those needs. You will then need to prepare a written agreement, often referred to as the Montana Self-Employed Independent Contractor Consideration For Hire Form, to outline the terms of the arrangement. This not only sets expectations but also protects your interests. Lastly, ensure you properly classify the workers as independent contractors for tax purposes.

Filling out a declaration of independent contractor status form involves detailing your relationship with the hiring business. You should include information about the nature of your services, payment conditions, and your independent status. The Montana Self-Employed Independent Contractor Consideration For Hire Form serves as an effective way to consolidate this information, making it easier for both parties to understand their rights and responsibilities.