Montana Construction Loan Agreement

Description

A Loan Agreement is a document between a borrower and lender that details the loan repayment schedule.

The Loan Agreement protects the lender by enforcing the borrower's pledge to repay the loan; payment via regular payments or lump sums. The borrower may also find the loan contract useful because it records the details of the loan for their records and helps keep track of payments.

Loan agreements generally include information about:

* The location.

* The loan amount.

* Interest and late fees.

* Repayment method.

* Collateral and insurance."

How to fill out Construction Loan Agreement?

You are able to invest several hours online looking for the legitimate document web template that meets the state and federal needs you need. US Legal Forms gives thousands of legitimate forms that happen to be evaluated by specialists. It is possible to down load or produce the Montana Construction Loan Agreement from my service.

If you already have a US Legal Forms account, you can log in and then click the Down load switch. Next, you can complete, edit, produce, or indicator the Montana Construction Loan Agreement. Every legitimate document web template you purchase is the one you have eternally. To acquire one more version of any acquired kind, visit the My Forms tab and then click the related switch.

If you work with the US Legal Forms website the very first time, adhere to the easy recommendations below:

- Very first, ensure that you have selected the correct document web template for your county/metropolis of your liking. Read the kind information to ensure you have picked out the correct kind. If accessible, utilize the Review switch to search through the document web template too.

- In order to get one more version from the kind, utilize the Look for industry to find the web template that meets your requirements and needs.

- After you have found the web template you want, click Get now to move forward.

- Select the costs program you want, type in your qualifications, and sign up for an account on US Legal Forms.

- Total the financial transaction. You may use your charge card or PayPal account to purchase the legitimate kind.

- Select the file format from the document and down load it in your product.

- Make alterations in your document if possible. You are able to complete, edit and indicator and produce Montana Construction Loan Agreement.

Down load and produce thousands of document web templates using the US Legal Forms Internet site, that provides the largest selection of legitimate forms. Use professional and condition-specific web templates to handle your organization or personal requirements.

Form popularity

FAQ

Construction-to-permanent financing is a type of loan which allows you to build or renovate your home. When the construction process concludes, this loan rolls over into a traditional mortgage without you having to go through another closing. You'll only have to pay for one set of closing costs.

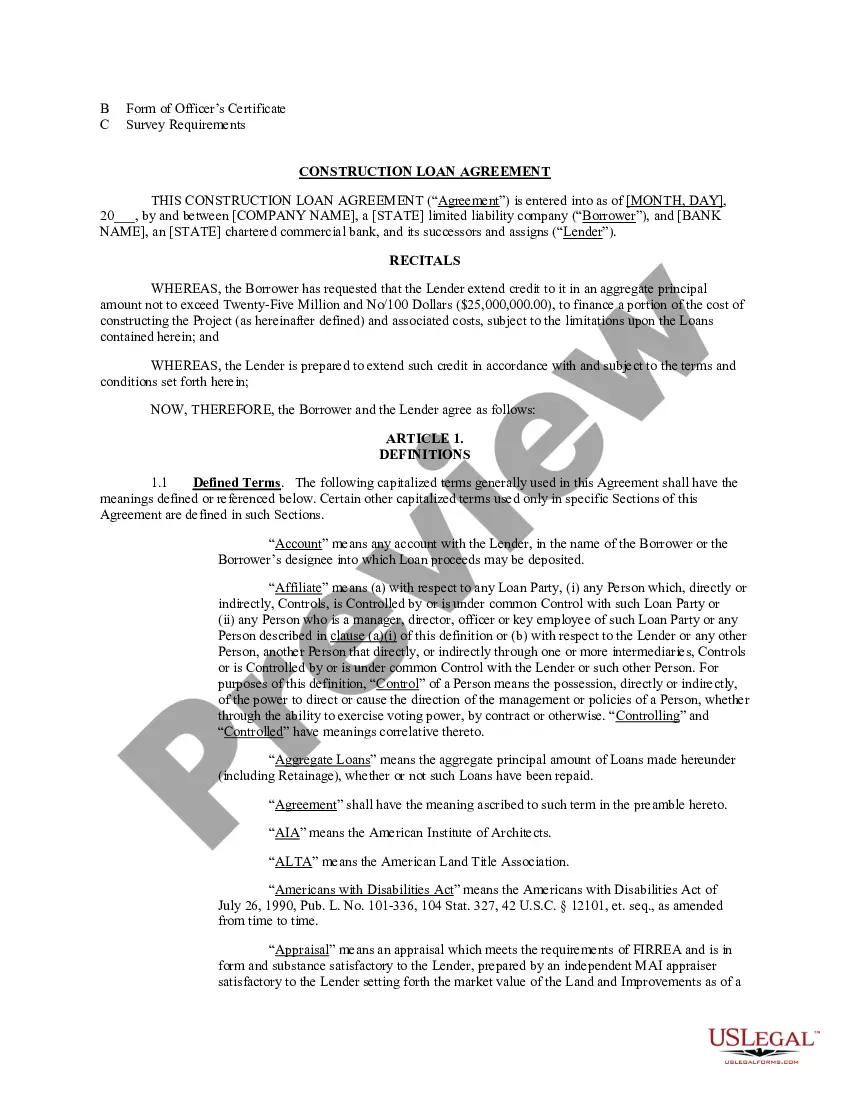

Include key terms of the loan, such as the lender and borrower's contact information, the reason for the loan, what is being loaned, the interest rate, the repayment plan, what would happen if the borrower can't make the payments, and more. The amount of the loan, also known as the principal amount.

What to include in your loan agreement? The amount of the loan, also known as the principal amount. The date of the creation of the loan agreement. The name, address, and contact information of the borrower. The name, address, and contact information of the lender.

What a personal loan agreement should include Legal names and address of both parties. Names and address of the loan cosigner (if applicable). Amount to be borrowed. Date the loan is to be provided. Repayment date. Interest rate to be charged (if applicable). Annual percentage rate (if applicable).

However, the do-it-yourself approach is perfectly acceptable and just as legally enforceable. Once you have both agreed on the terms, you may want to have the personal loan contract notarized or ask a third party to act as a witness during the signing.

The purpose for which funds may be used. Loan funding mechanics, and applicable interest. Repayment obligations. Representations, warranties and undertakings.

A loan agreement should be structured to include information about the borrower and the lender, the loan amount, and repayment terms, including interest charges and a timeline for repaying the loan. It should also spell out penalties for late payments or default and should be clear about expectations between parties.

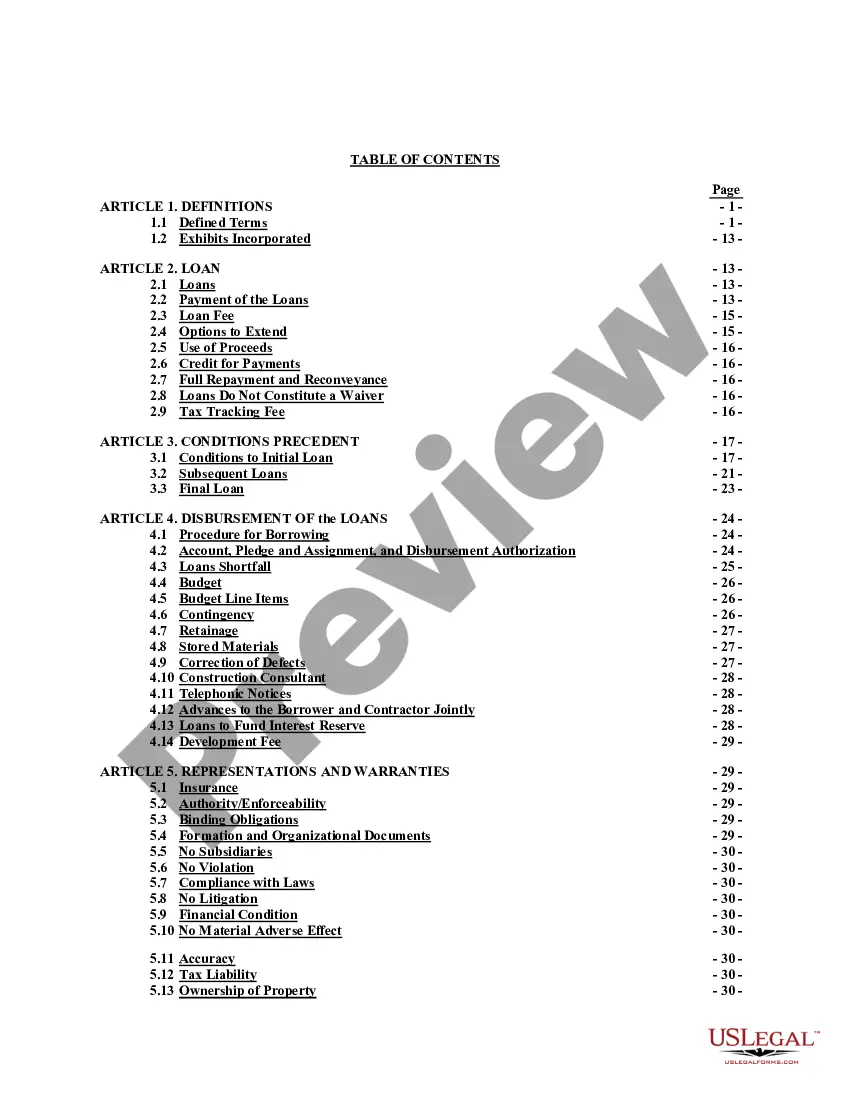

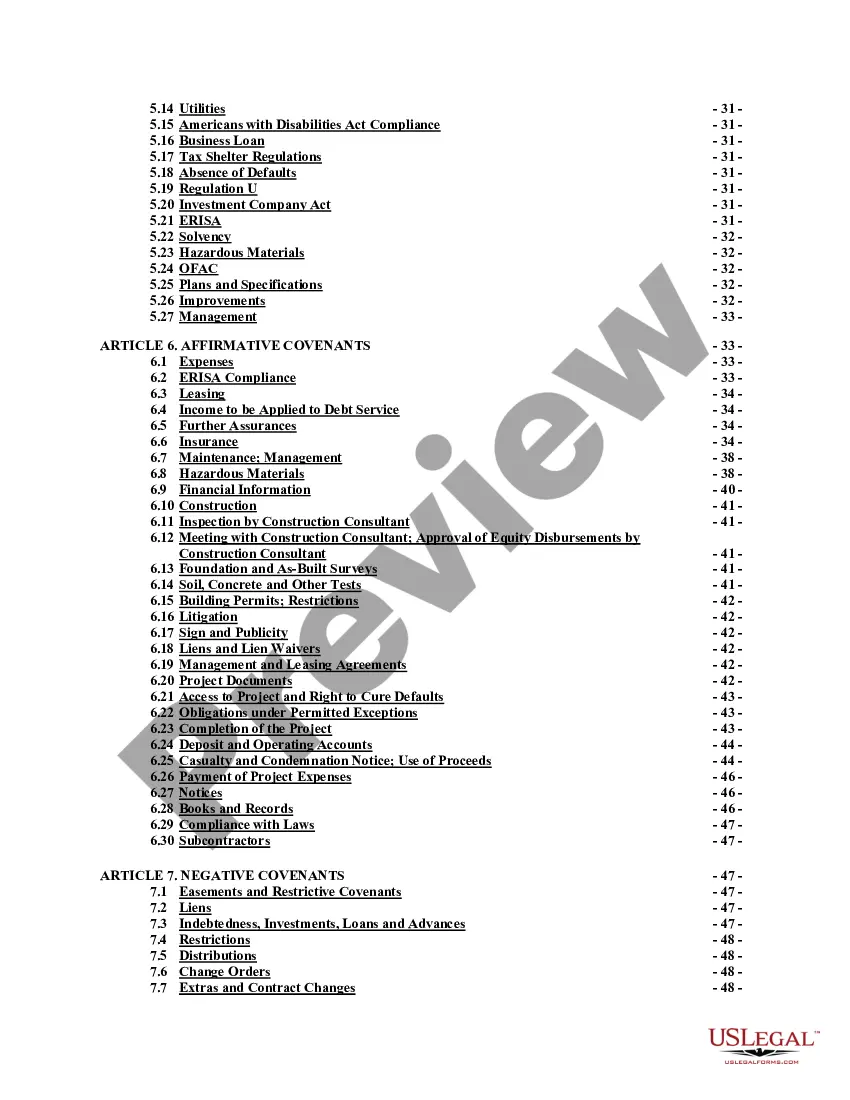

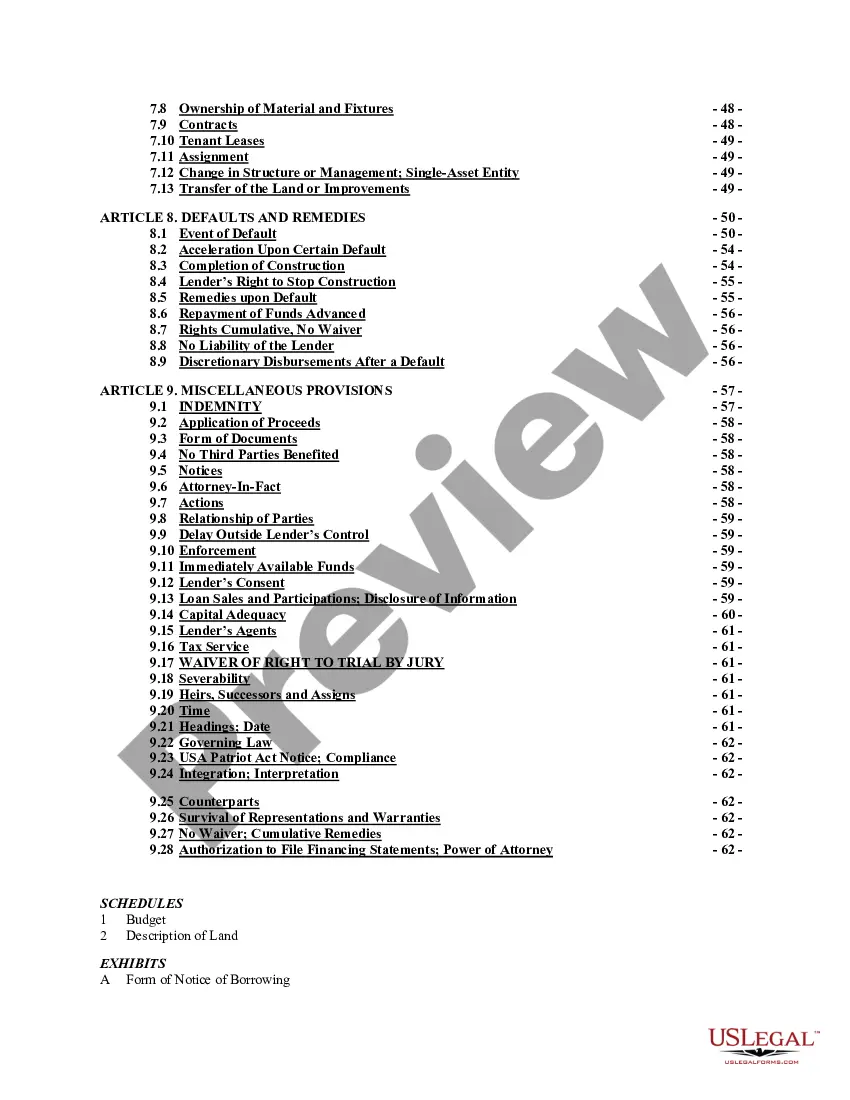

A construction loan agreement is a legally binding contract between the lender and the borrower, detailing the promises and commitments both parties have to uphold through successful project completion.