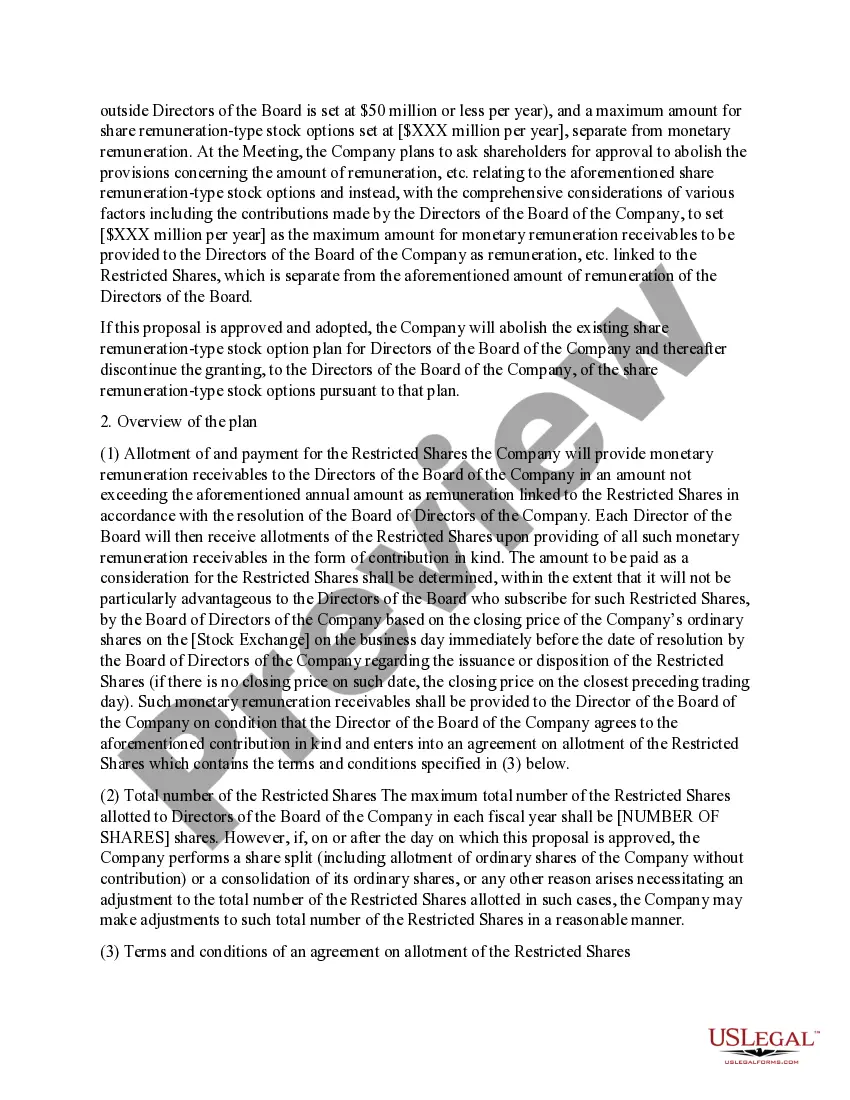

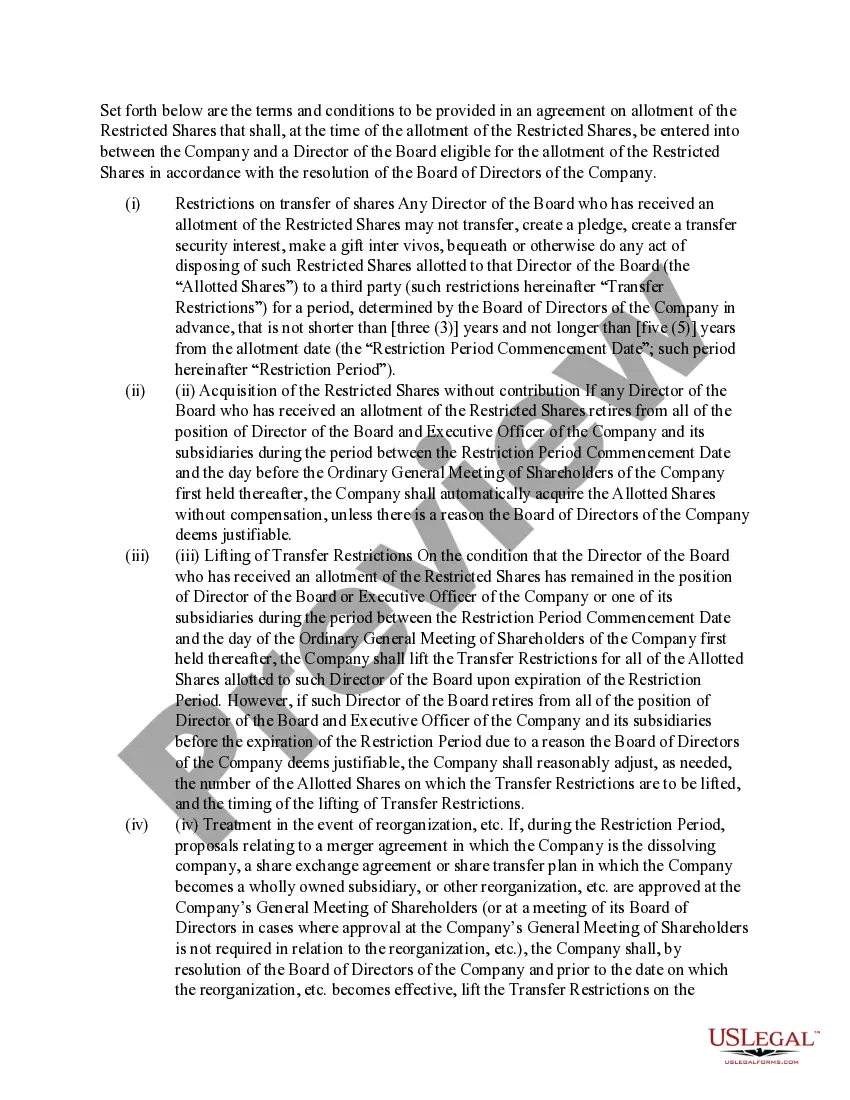

Montana Notice Regarding Introduction of Restricted Share-Based Remuneration Plan

Description

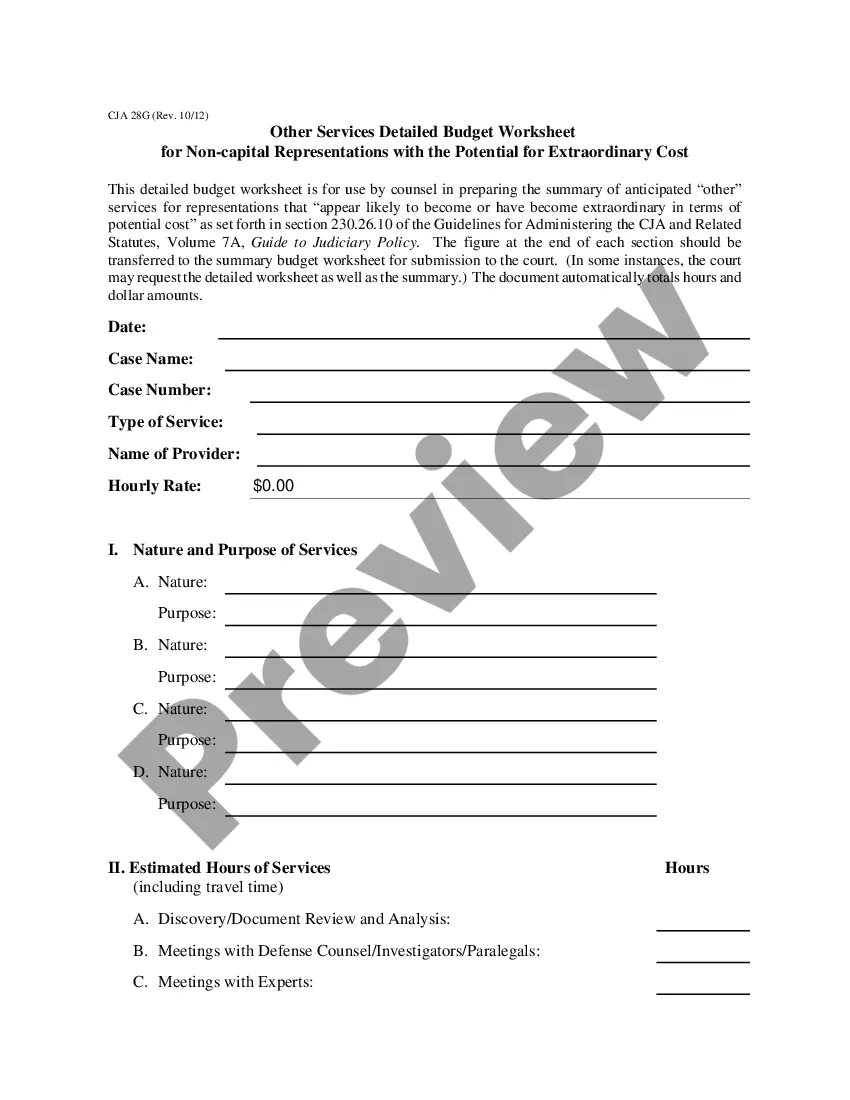

How to fill out Notice Regarding Introduction Of Restricted Share-Based Remuneration Plan?

If you need to total, down load, or produce lawful record templates, use US Legal Forms, the greatest assortment of lawful types, which can be found online. Utilize the site`s basic and handy lookup to find the documents you want. Numerous templates for enterprise and specific uses are sorted by classes and says, or search phrases. Use US Legal Forms to find the Montana Notice Regarding Introduction of Restricted Share-Based Remuneration Plan in just a couple of click throughs.

If you are previously a US Legal Forms consumer, log in to the bank account and click on the Down load switch to obtain the Montana Notice Regarding Introduction of Restricted Share-Based Remuneration Plan. You may also gain access to types you formerly delivered electronically within the My Forms tab of your respective bank account.

If you are using US Legal Forms the first time, refer to the instructions under:

- Step 1. Ensure you have selected the shape for your proper city/land.

- Step 2. Take advantage of the Preview choice to check out the form`s articles. Don`t neglect to read the explanation.

- Step 3. If you are unsatisfied together with the develop, take advantage of the Lookup industry towards the top of the display screen to get other versions of the lawful develop web template.

- Step 4. When you have discovered the shape you want, click the Get now switch. Opt for the prices program you like and include your qualifications to register to have an bank account.

- Step 5. Approach the transaction. You should use your bank card or PayPal bank account to complete the transaction.

- Step 6. Choose the format of the lawful develop and down load it in your device.

- Step 7. Comprehensive, edit and produce or sign the Montana Notice Regarding Introduction of Restricted Share-Based Remuneration Plan.

Each lawful record web template you purchase is your own property eternally. You have acces to every single develop you delivered electronically in your acccount. Click the My Forms portion and pick a develop to produce or down load once again.

Compete and down load, and produce the Montana Notice Regarding Introduction of Restricted Share-Based Remuneration Plan with US Legal Forms. There are many professional and status-particular types you can use to your enterprise or specific requires.

Form popularity

FAQ

Refer to the NPI claims instructions on the Provider Information website to determine the reason your claims are denying, then correct and resubmit them within the 365-day timely filing limit.

Exempt Employments The most common employments that are exempt are: Sole proprietors, working members of a partnership, working members of a limited liability partnership and working members of a member-managed limited liability.

Visit the Montana Healthcare Programs Provider Information website to access your provider type page. Choose Resources by Provider Type in the left-hand menu.