Montana Employee Benefit Plan Document Checklist

Description

How to fill out Employee Benefit Plan Document Checklist?

Have you ever been in a situation where you require documentation for both corporate or specific functions almost daily.

There are numerous legal document templates accessible online, but finding reliable versions can be challenging.

US Legal Forms offers thousands of template forms, such as the Montana Employee Benefit Plan Document Checklist, crafted to comply with state and federal standards.

When you find the appropriate form, click on Get now.

Select the pricing plan you want, enter the necessary information to create your account, and complete the payment using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After logging in, you can download the Montana Employee Benefit Plan Document Checklist template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Locate the form you need and verify that it is for the correct region/state.

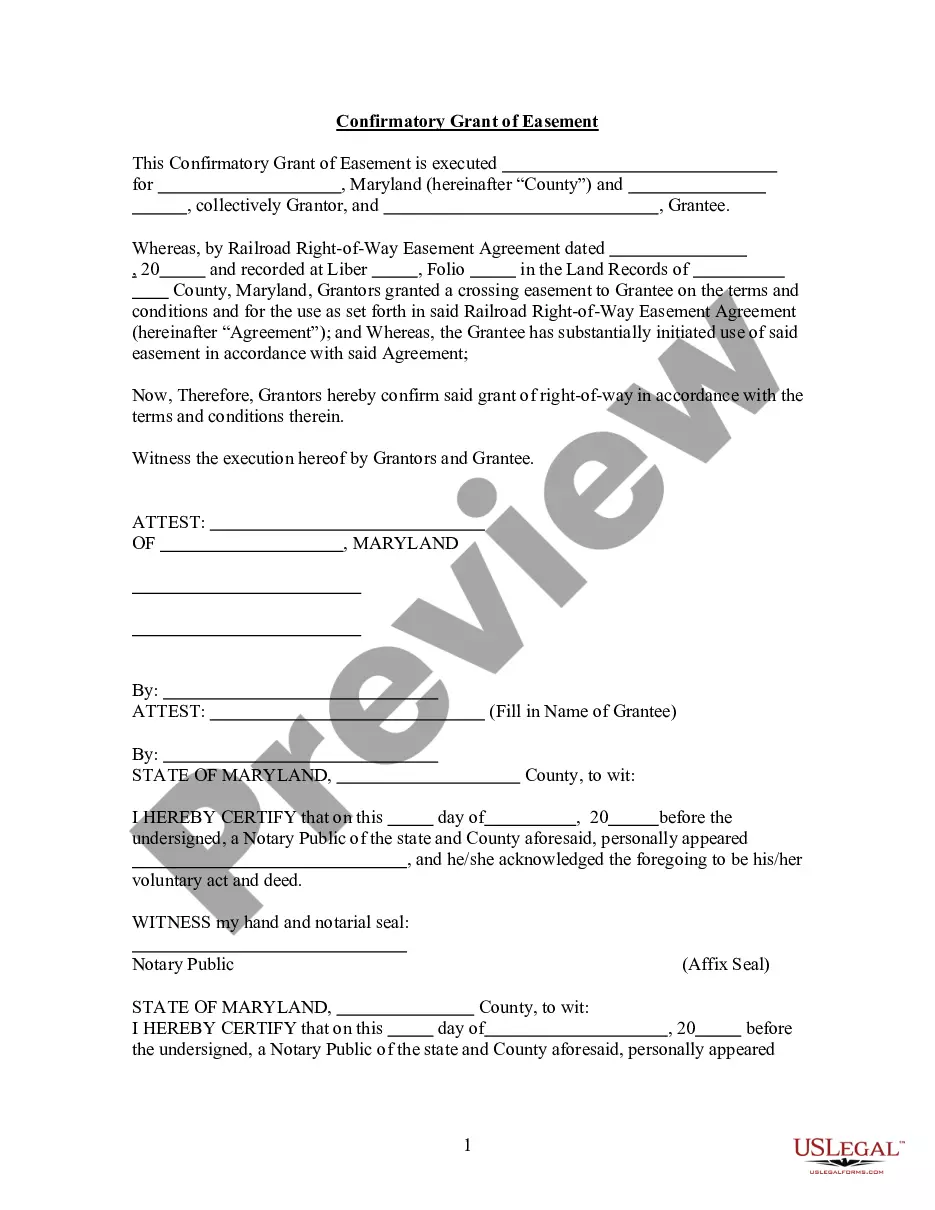

- Use the Review button to preview the document.

- Check the information to confirm that you have chosen the right form.

- If the form is not what you are looking for, utilize the Search field to find a form that fits your needs.

Form popularity

FAQ

ERISA requires plans to provide participants with plan information including important information about plan features and funding; sets minimum standards for participation, vesting, benefit accrual and funding; provides fiduciary responsibilities for those who manage and control plan assets; requires plans to

Traditionally, most benefits used to fall under one of the four major types of employee benefits, namely: medical insurance, life insurance, retirement plans, and disability insurance.

ERISA requires a formal written plan document, a summary plan description (SPD), and a summary of benefits & coverage (SBC). Each of these requirements is discussed in more detail below. A formal plan document is required for every ERISA plan.

Mandatory Benefits a Company Must Legally Provide Full-time Employees. Vacation, health insurance, long-term disability coverage, tuition reimbursement, and retirement savings plans are just a few of the many benefits employers may offer employees.

Legally required benefits. The grouping includes Social Security, Medicare, federal and state unemployment insurance, and workers' compensation.

Employers can customize an employee benefits package to the needs and desires of its employees, but there are several standard offerings that should be included.Health Insurance.Paid Time Off (PTO)Short-Term Disability Insurance.Long-Term Disability Insurance.Dental Insurance.Vision Insurance.Life Insurance.More items...?

Legally Required Benefits: Those Benefits which are required by law, which must be provided by the employer to their employees are called legally required benefits. Social Security Benefit, Workmen compensation insurance, health insurance, medical leave, maternity leave etc. are some legally required benefits.

It includes salaries, wages and social security contribution (i.e. health insurance), paid leaves, profit sharing and bonus and non-monetary benefits like car, free medical facilities, free or subsidized goods, free or subsidized lunch, etc.

Depending on the company, these benefits may include health insurance (required to be offered by larger companies), dental insurance, vision care, life insurance, legal insurance, paid vacation leave, personal leave, sick leave, child care, fitness, retirement benefits and planning services, college debt relief, pet

The SPD must include many specified items, such as plan-identifying and eligibility information, a description of plan benefits and circumstances causing loss or denial of benefits, benefit claim procedures, and a statement of participants' ERISA rights.