A debt collector may not use unfair or unconscionable means to collect a debt. This includes causing a person to incur charges for communications by concealing the true propose of the communication.

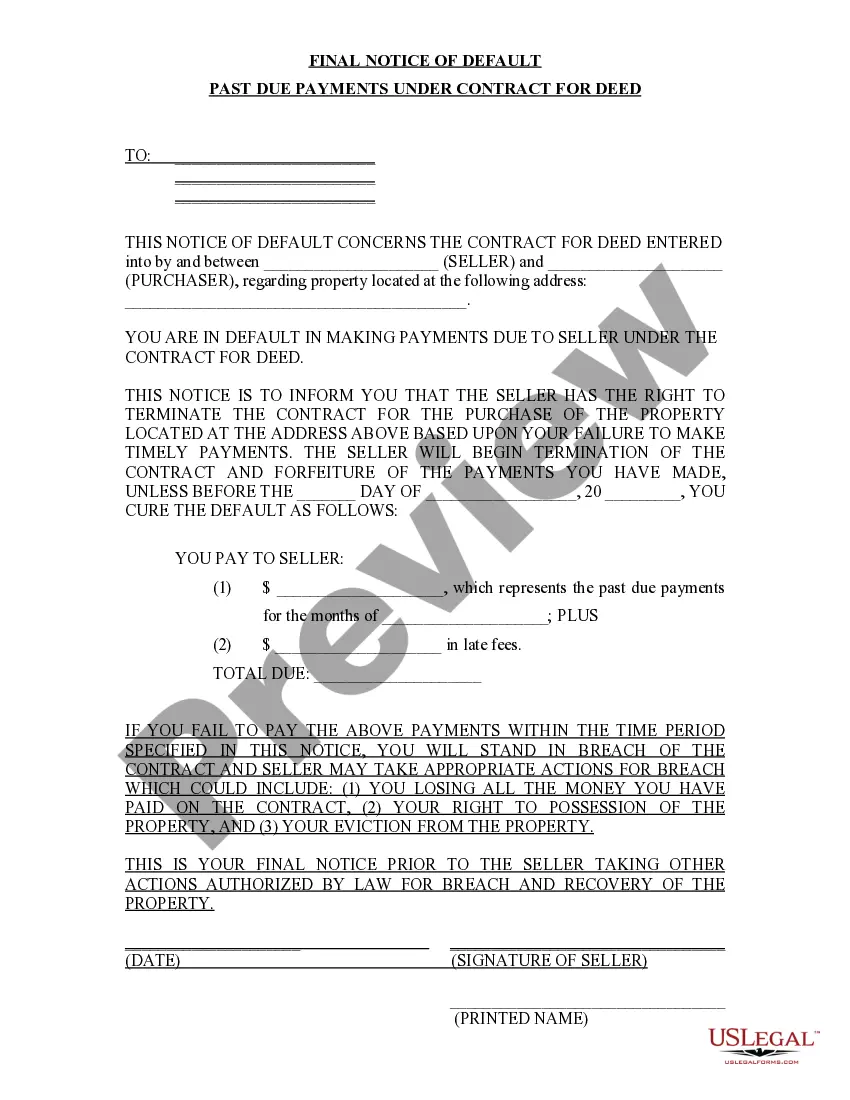

Montana Notice to Debt Collector - Causing a Consumer to Incur Charges for Communications by Concealing the Purpose of the Communication

Description

How to fill out Notice To Debt Collector - Causing A Consumer To Incur Charges For Communications By Concealing The Purpose Of The Communication?

Are you currently in a role that requires documents for both business or individual uses almost every day.

There are many legal document templates available online, but finding ones you can trust is not easy.

US Legal Forms offers thousands of form templates, such as the Montana Notice to Debt Collector - Causing a Consumer to Incur Charges for Communications by Concealing the Purpose of the Communication, which are designed to meet federal and state regulations.

Choose a suitable format and download your copy.

Access all the document templates you have purchased in the My documents section. You can retrieve another copy of the Montana Notice to Debt Collector - Causing a Consumer to Incur Charges for Communications by Concealing the Purpose of the Communication at any time, if necessary. Click the desired form to download or print the document template. Use US Legal Forms, the most extensive collection of legal templates, to save time and avoid errors. The service provides professionally crafted legal document templates that can be utilized for various purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Montana Notice to Debt Collector - Causing a Consumer to Incur Charges for Communications by Concealing the Purpose of the Communication template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the template you need and ensure it is for the correct city/state.

- Utilize the Preview option to review the document.

- Read the details to confirm that you have selected the correct template.

- If the form is not what you are looking for, use the Search field to find the document that fits your needs and specifications.

- Once you locate the appropriate form, click Purchase now.

- Select the pricing plan you prefer, complete the necessary information to create your account, and pay for the order using your PayPal or credit card.

Form popularity

FAQ

When a creditor sells a past due debt to a collection agency, the collection agency becomes the owner of debt. They may add additional interest and fees to the balance as part of their collection efforts, so the collection amount may be greater than the original amount that was written off by your creditor.

What debt collectors can doask for payment.offer to settle or make a payment plan.ask why you haven't met an agreed payment plan.review a payment plan after an agreed period.advise what will happen if you don't pay.repossess goods you owe money on, as long as they've been through the correct process.

You should complain to the bank, building society or credit card company first, using their complaints procedure. If this does not sort out the problem, you can complain to the Financial Ombudsman Service, telling them that a debt collector or creditor has broken the terms of the Standards of Lending Practice.

If a creditor takes too long to take action to recover a debt it becomes 'statute barred', meaning it can no longer be recovered through court action. In practical terms, this effectively means the debt is written off, even though technically it still exists.

If, for example, you have a collection or multiple collections appearing on your credit reports and those debts do not belong to you, you can dispute them and have them removed. However, if they are a result of missed payments on accounts you own, disputing them will not change your credit file. Here's what to know.

A debt collector may not collect any interest or fee not authorized by the agreement or by law. The interest rate or fees charged on your debt may be increased if your original loan or credit agreement permits it and no law prohibits the increase, or if state law expressly permits the interest or fee.

Interest is added to almost all debts, and extra charges are added to many debts if you don't pay on time. Interest can be charged at the same amount or it may be 'variable' and change over time.

They can only add amounts which are allowed in the contract you signed with the original creditor. If the debt is still owned by the original creditor they may continue adding interest and charges while the collection agency is contacting you.

Debt collectors have no special legal powers. You may feel under pressure to pay more than you can afford, but don't feel threatened. Find out more about the difference between debt collectors and bailiffs. Debt collectors may work for your creditor, or they may work for a separate debt collection agency.

Debt collection agencies are not bailiffs; They have no extra-legal authority. Debt collectors are either acting on behalf of your creditor or working for a company that has taken on the debt. They don't have any special legal powers and can't do anything different than the original creditor.