Montana Termination of Granter Retained Annuity Trust in Favor of Existing Life Insurance Trust is a legal process that involves terminating a Granter Retained Annuity Trust in the state of Montana and transferring its assets to an existing Life Insurance Trust. This strategic estate planning technique allows individuals to efficiently manage their assets for the benefit of their beneficiaries while minimizing tax obligations. Keywords: Montana Termination, Granter Retained Annuity Trust, Existing Life Insurance Trust, estate planning, assets, beneficiaries, tax obligations. There might be different types or variations of the Montana Termination of Granter Retained Annuity Trust in Favor of Existing Life Insurance Trust, including: 1. Irrevocable Life Insurance Trust (IIT) Conversion: This type of termination involves converting a Granter Retained Annuity Trust into an Irrevocable Life Insurance Trust. By terminating the annuity trust and transferring the assets to the IIT, individuals can efficiently provide financial security for their loved ones upon their passing while potentially reducing estate taxes. 2. Charitable Remainder Annuity Trust (CAT) Conversion: In this variation, individuals terminate their Granter Retained Annuity Trust in favor of an Existing Life Insurance Trust with a charitable remainder. This allows individuals to support charitable causes while transferring assets to the Life Insurance Trust for the benefit of their beneficiaries. 3. Generation-Skipping Transfer (GST) Tax Planning: Some individuals may opt for termination and transfer strategies that include Generation-Skipping Transfer planning. By utilizing a GST tax-exempt Existing Life Insurance Trust, individuals can effectively transfer assets to multiple generations, skipping estate taxes on certain wealth transfers. 4. Special Needs Trust (SET) Integration: In cases where a beneficiary has special needs or disabilities, individuals may choose to terminate the Granter Retained Annuity Trust and transfer assets to an Existing Life Insurance Trust dedicated to providing ongoing financial support and protection for the beneficiary's specific needs. By understanding the various types of Montana Termination of Granter Retained Annuity Trust in Favor of Existing Life Insurance Trust, individuals can work with estate planning professionals to determine the most appropriate strategy for their unique circumstances, ensuring the efficient transfer of assets and maximizing the benefits for their beneficiaries, while minimizing potential tax implications. It is recommended to consult with an attorney or financial advisor specializing in estate planning and tax laws to navigate the complexities of this process effectively.

Montana Termination of Grantor Retained Annuity Trust in Favor of Existing Life Insurance Trust

Description

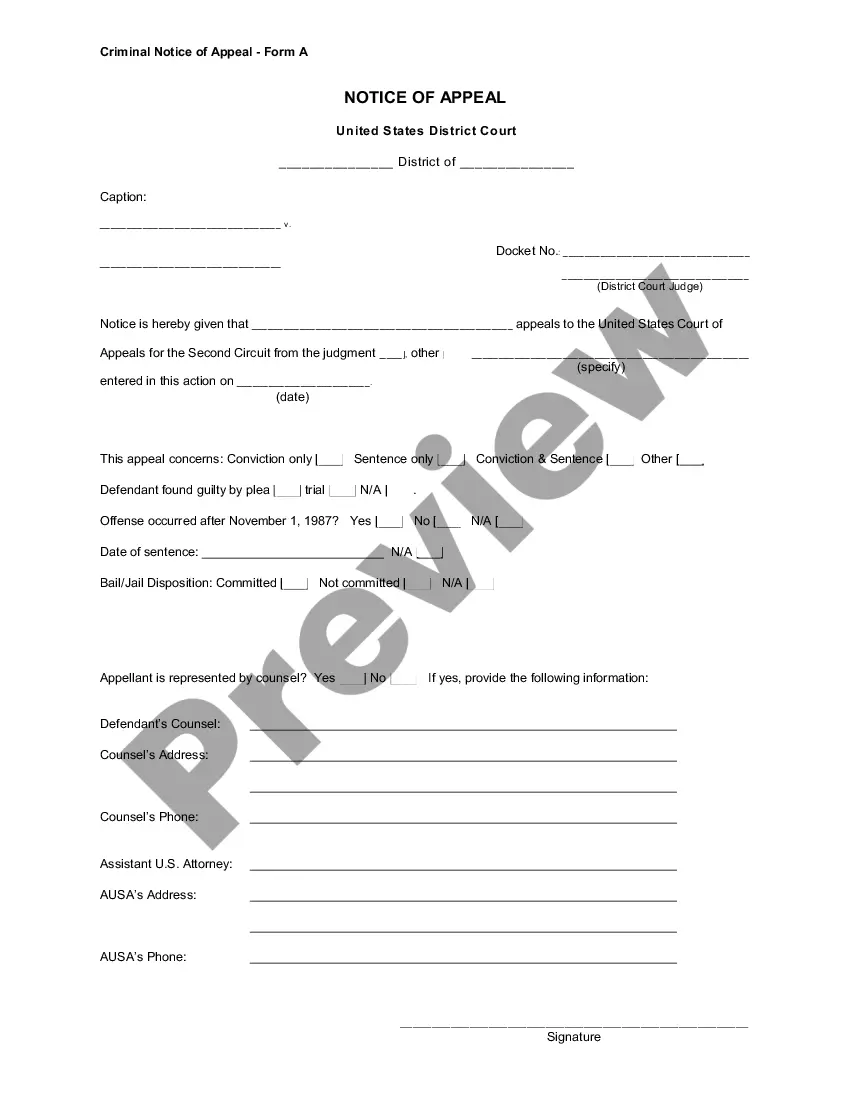

How to fill out Montana Termination Of Grantor Retained Annuity Trust In Favor Of Existing Life Insurance Trust?

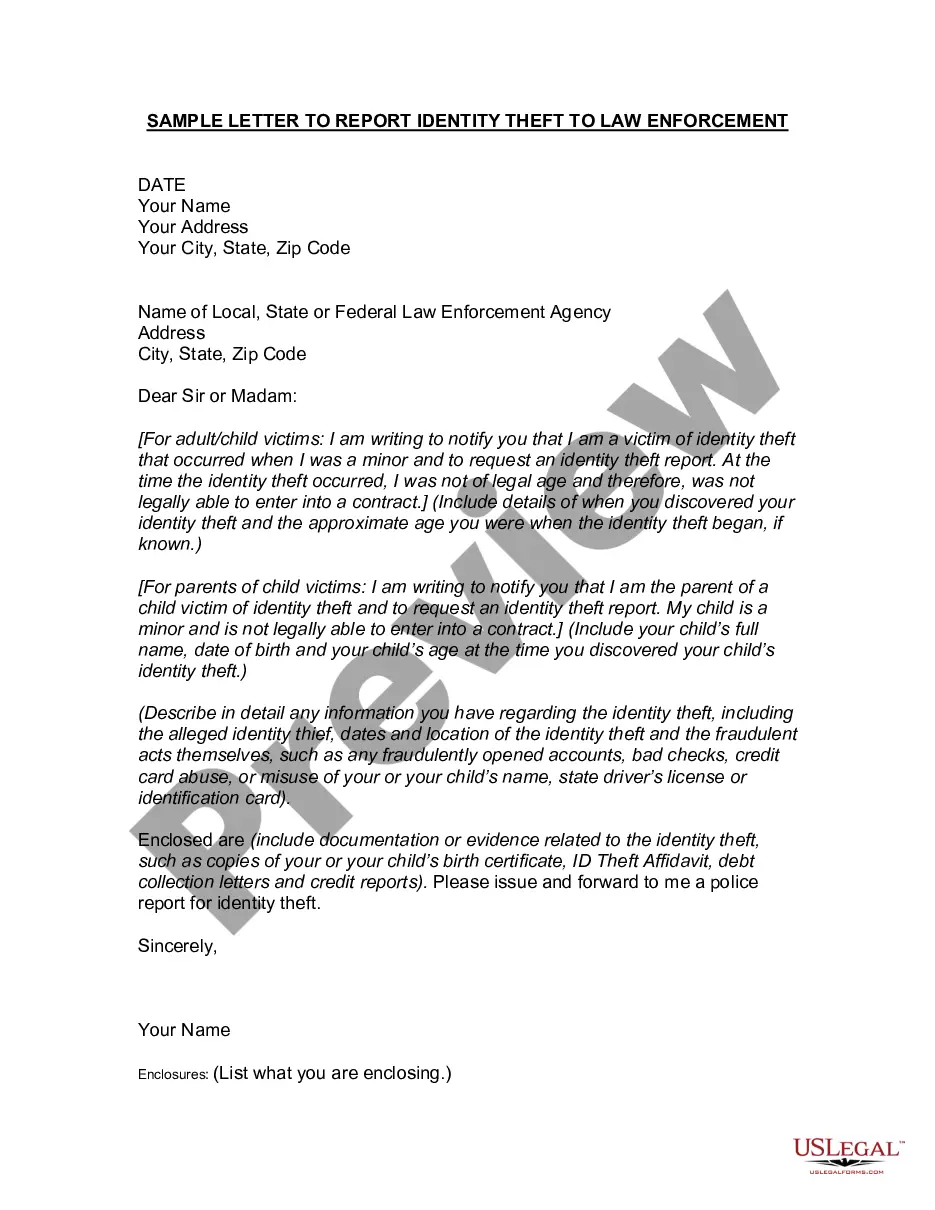

Are you currently inside a position the place you will need paperwork for possibly company or specific reasons virtually every day time? There are a variety of authorized file templates accessible on the Internet, but locating versions you can trust is not simple. US Legal Forms provides a large number of type templates, just like the Montana Termination of Grantor Retained Annuity Trust in Favor of Existing Life Insurance Trust, which are created to satisfy state and federal specifications.

When you are already familiar with US Legal Forms site and possess a free account, just log in. Afterward, you may down load the Montana Termination of Grantor Retained Annuity Trust in Favor of Existing Life Insurance Trust web template.

If you do not offer an accounts and want to begin to use US Legal Forms, adopt these measures:

- Find the type you require and make sure it is for that proper area/region.

- Take advantage of the Review key to examine the shape.

- Browse the description to actually have chosen the right type.

- In case the type is not what you are seeking, take advantage of the Look for industry to discover the type that fits your needs and specifications.

- Once you obtain the proper type, click on Get now.

- Select the rates strategy you desire, submit the desired details to produce your money, and purchase the order utilizing your PayPal or charge card.

- Decide on a hassle-free document file format and down load your copy.

Discover all the file templates you might have bought in the My Forms food list. You can get a additional copy of Montana Termination of Grantor Retained Annuity Trust in Favor of Existing Life Insurance Trust at any time, if possible. Just select the essential type to down load or printing the file web template.

Use US Legal Forms, the most extensive variety of authorized types, in order to save time as well as stay away from blunders. The assistance provides expertly manufactured authorized file templates which can be used for a range of reasons. Produce a free account on US Legal Forms and begin creating your lifestyle a little easier.

Form popularity

FAQ

One easy way to terminate a life insurance trust, the grantor to stops making the premium payments, known as gifts, to the trust. If the grantor stops making payments to the trust, then the policy will lapse. This causes the purpose of the trust to be eliminated.

Thus, the trustee cannot terminate the GRAT before expiration of the term of the grantor's qualified interest by distributing to the grantor and the remainder beneficiaries the actuarial value of their term and remainder interests, respectively.

The grantor is the person who creates a trust, and the beneficiaries are the persons identified in the trust to receive the assets. The assets in the trust are supplied by the grantor. The associated property and funds are transitioned into the ownership of the trust.

Unlike many estate planning techniques, the client has significant access to GRAT assets and can substitute assets, change beneficiaries, and otherwise modify the GRAT to suit his or her changing needs. Accordingly, the GRAT is one of the most powerful wealth-shifting tools available for high net worth families.

To implement this strategy, you zero out the grantor retained annuity trust by accepting combined payments that are equal to the entire value of the trust, including the anticipated appreciation. In theory, there would be nothing left for the beneficiary if the trust is really zeroed out.

Is an irrevocable life insurance trust (ILIT) a grantor trust? A13. Usually, yes. Most ILITs are grantor trusts since these trust instruments typically provide that income may be applied toward the payment of premiums on policies insuring the grantor's life (or the grantor's spouse's life).

The annuity amount is paid to the grantor during the term of the GRAT, and any property remaining in the trust at the end of the GRAT term passes to the beneficiaries with no further gift tax consequences.

A grantor trust is a trust in which the individual who creates the trust is the owner of the assets and property for income and estate tax purposes. Grantor trust rules are the rules that apply to different types of trusts. Grantor trusts can be either revocable or irrevocable trusts.

In other words, if the grantor (or a non-adverse party) has the power to revoke any part of a trust and reclaim the trust assets, then the grantor will be taxed on the trust income.

GRATs may provide payments for a term of years or for the life of the Grantor.