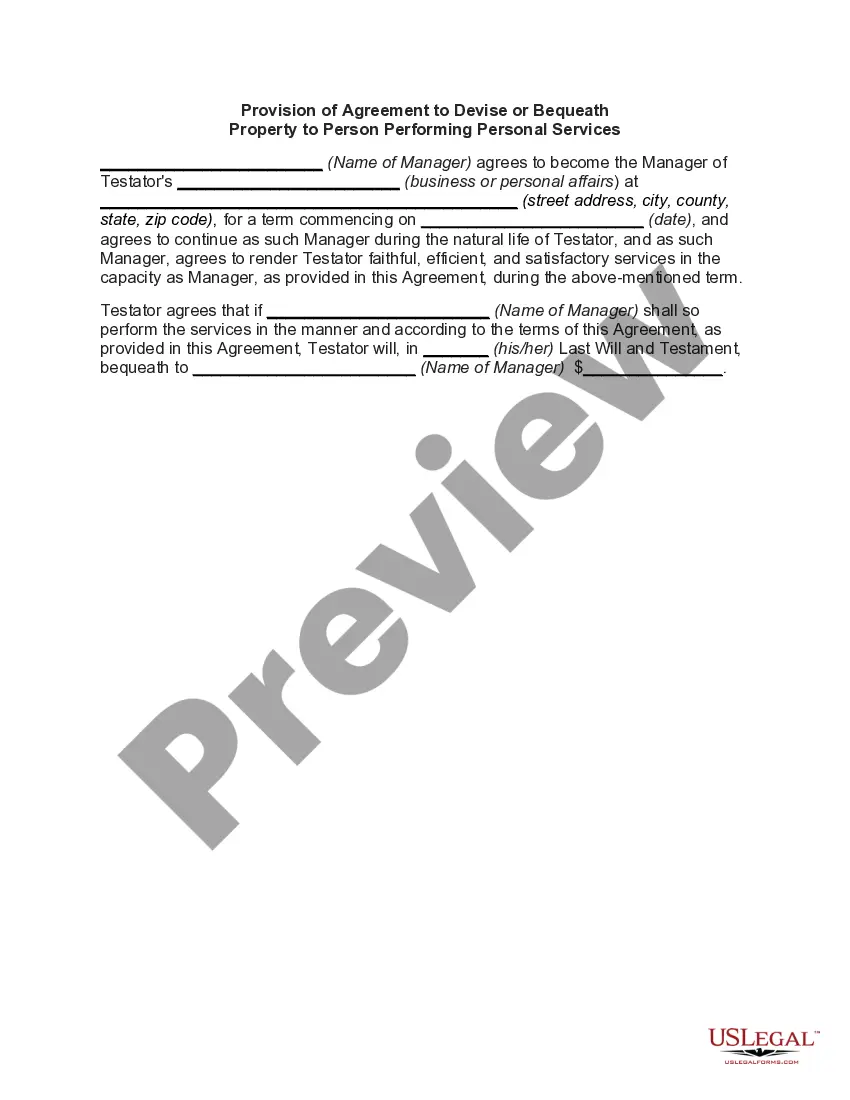

Montana Provision of Agreement to Devise or Bequeath Property to Person Performing Personal Services

Description

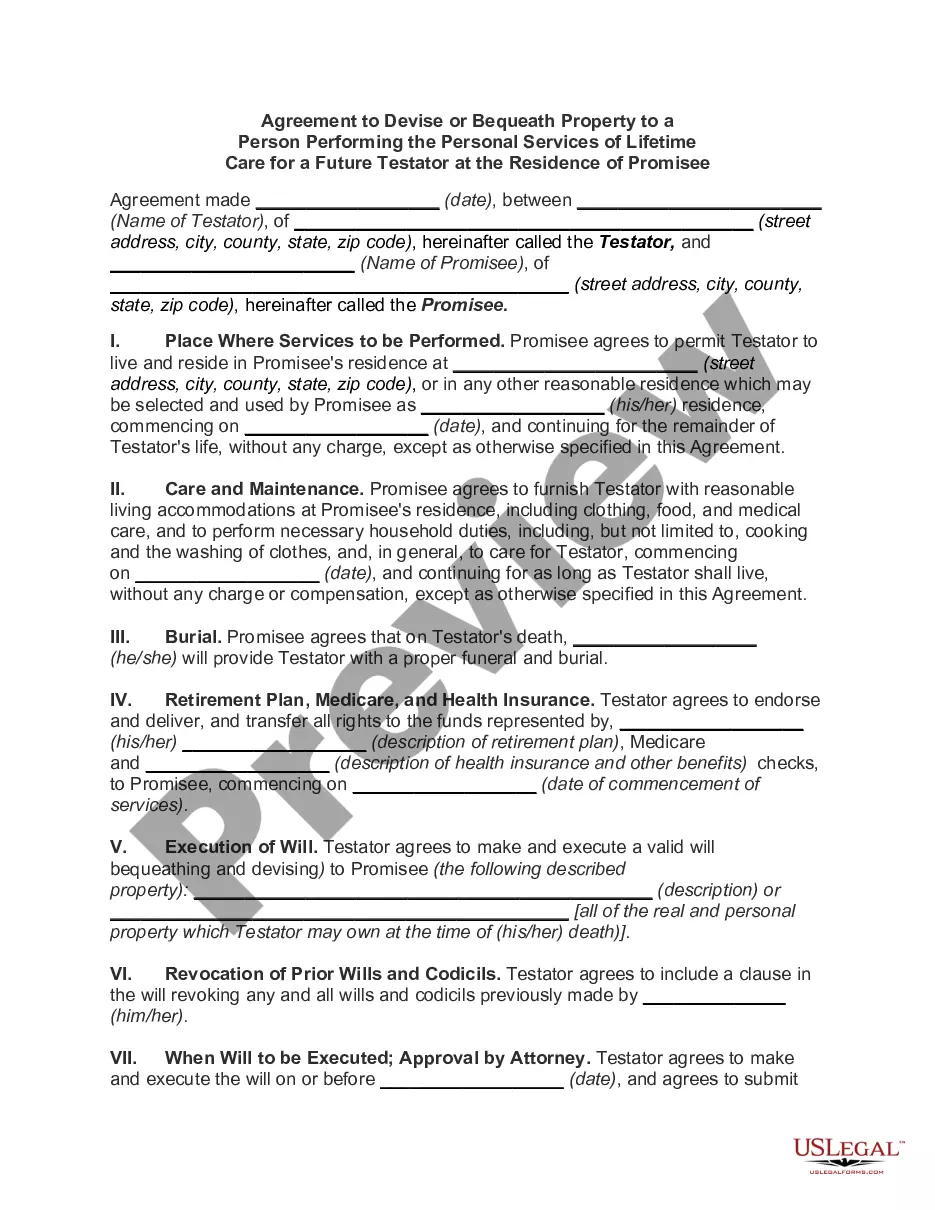

How to fill out Provision Of Agreement To Devise Or Bequeath Property To Person Performing Personal Services?

If you require thorough, obtain, or print valid document templates, utilize US Legal Forms, the most prominent collection of legal forms available online.

Employ the site’s user-friendly and convenient search to locate the documents you need.

Numerous templates for business and personal use are organized by categories and states, or keywords.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

Step 6. Choose the format of the legal form and download it to your device.

- Use US Legal Forms to find the Montana Provision of Agreement to Devise or Bequeath Property to Person Performing Personal Services with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Acquire button to get the Montana Provision of Agreement to Devise or Bequeath Property to Person Performing Personal Services.

- You can also access forms you previously downloaded from the My documents tab in your profile.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Review feature to examine the form’s details. Be sure to read the description.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have found the form you need, select the Purchase now button. Choose the payment plan you prefer and provide your information to register for an account.

Form popularity

FAQ

If an estate is valued at less than $15,000, there is no Will and the decedent was not married, in Montana, you can use summary probate procedure. Note that the state does not have an Affidavit procedure for small estates.

If you are unmarried and die without a valid will and last testament in Montana, then your entire estate goes to any surviving children in equal shares, or grandchildren if you don't have any surviving children. If you die intestate unmarried and with no children, then by law, your parents inherit your entire estate.

Do All Estates Have to Go Through Probate in Montana? Unless the estate is in a living trust, it will need to go through probate in Montana. However, it may be eligible for informal probate, which allows for the executor to handle all of the process without court intervention.

Since every estate is different, the time it takes to settle the estate may also differ. Most times, an executor would take 8 to 12 months. But depending on the size and complexity of the estate, it may take up to 2 years or more to settle the estate.

A survivorship clause in a will or trust stipulates that beneficiaries can only inherit if they live a certain number of days after the person who made the will or trust dies.

In Montana, this form of joint ownership is available: Joint tenancy. Property owned in joint tenancy automatically passes to the surviving owners when one owner dies. No probate is necessary.

A beneficiary deed is one in which an owner conveys an interest in Montana real property to a grantee beneficiary effective upon the owner's death. In other words, real property is transferred from the deceased person to the person(s) listed on the deed.

If an estate does not close within two years from the appointment of the PR, a district court judge can order the PR to appear in court to explain why the estate is not settled. The judge may order the estate closed within 30 days and declare no compensation for the attorney or PR.

THE 2019 MONTANA LEGISLATURE REPLACED. beneficiary deeds with transfer on death deeds (TODDs). As under prior law, TODDs allow owners at death to transfer their real property located in Montana to one or more beneficiaries without probate. Real property is land, including whatever is built, growing on, or affixed to it

In Montana, you can make a living trust to avoid probate for virtually any asset you ownreal estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).