Montana Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption

Description

How to fill out Certification Of No Information Reporting On Sale Or Exchange Of Principal Residence - Tax Exemption?

Selecting the optimal legal document template can be challenging. Certainly, there are many templates accessible online, but how can you locate the legal form you require.

Utilize the US Legal Forms website. The service offers thousands of templates, inclusive of the Montana Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption, suitable for both business and personal needs.

All the forms are reviewed by professionals and comply with state and federal regulations.

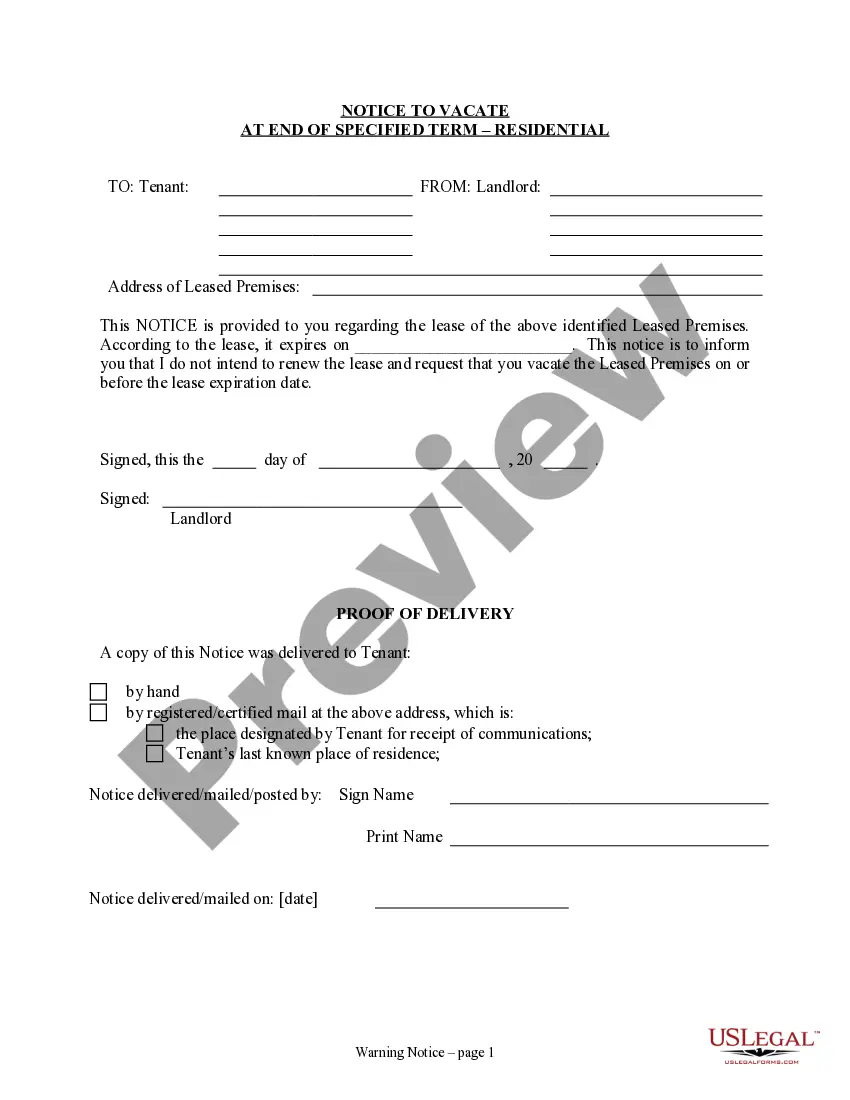

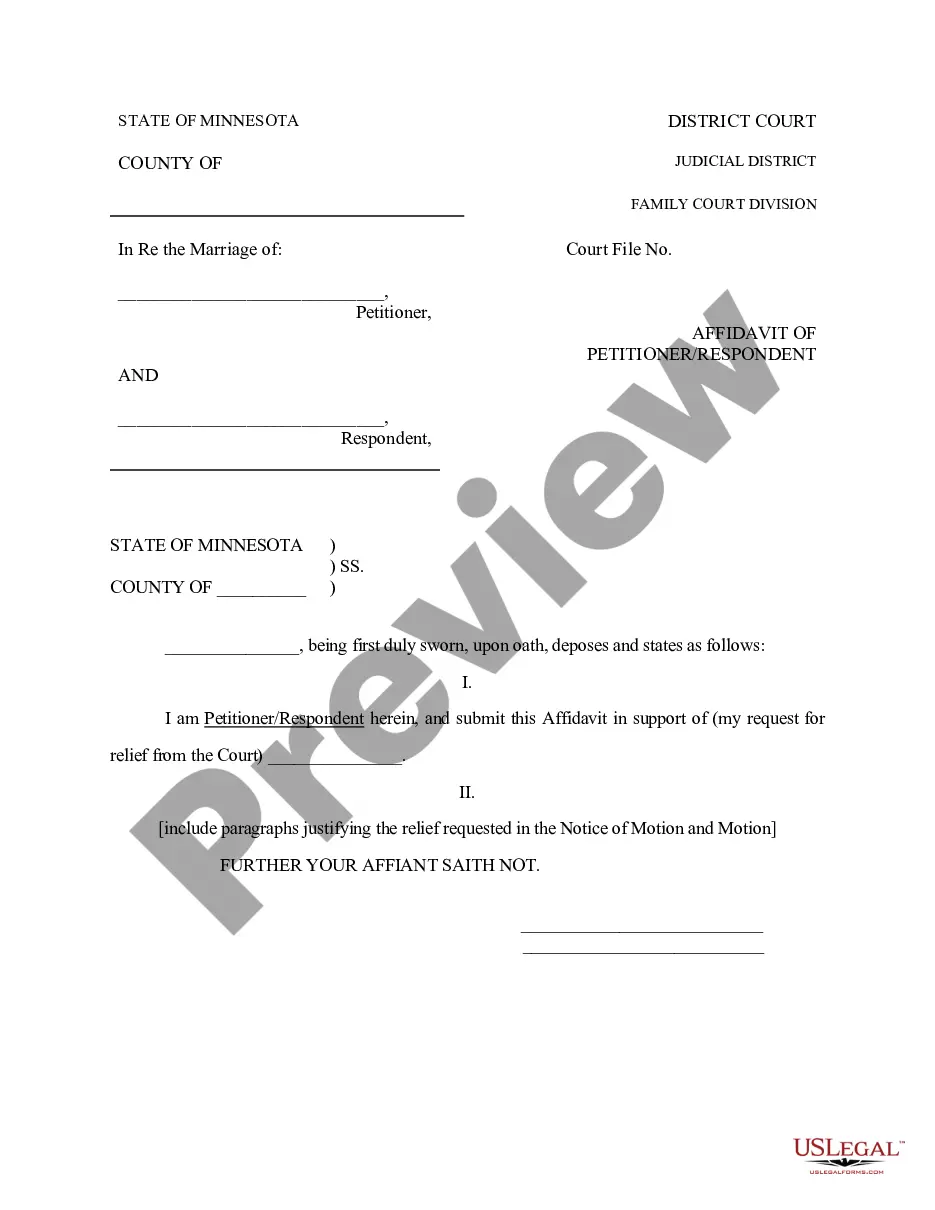

If the form does not fulfill your criteria, use the Search field to find the appropriate form. Once you are confident that the form is correct, click on the Purchase now button to obtain the form. Select your desired pricing plan and input the necessary information. Create your account and pay for the order using your PayPal account or credit card. Choose the file format and download the legal document template to your device. Ultimately, complete, modify, and print out and sign the received Montana Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption. US Legal Forms is the largest repository of legal forms through which you can access numerous document templates. Take advantage of the service to download professionally crafted paperwork that complies with state requirements.

- If you are already registered, Log In to your account and click the Download button to acquire the Montana Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption.

- Utilize your account to search for the legal documents you have previously purchased.

- Navigate to the My documents tab in your account and retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple guidelines you should follow.

- First, ensure you have selected the correct form for your area.

- You may examine the form using the Preview button and review the form details to confirm this is suitable for you.

Form popularity

FAQ

To avoid capital gains on the sale of your primary residence, ensure you meet both the ownership and residency criteria. This usually means having owned and lived in the home for a cumulative two years within the last five years. Utilizing the Montana Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption can further streamline the process. This solution helps you maximize your savings and minimize your tax burden.

Another sparsely populated state, Montana does not have a state sales tax. However, local municipalities that attract tourists such as Big Sky have the right to implement local sales taxes. Property taxes are on the heavier end of the scale, and income tax is near the average rate of all 50 states.

When you sell your home, federal tax law requires lenders or real estate agents to file a Form 1099-S, Proceeds from Real Estate Transactions, with the IRS and send you a copy if you do not meet IRS requirements for excluding the taxable gain from the sale on your income tax return.

Only five states don't impose any sales tax: Alaska, Delaware, Montana, New Hampshire, and Oregon.

States without an income tax often make up for the lack of these revenues by raising a variety of other taxes, including property taxes, sales taxes, and fuel taxes. These can add up so that you're paying more in overall taxation than you might have in a state that does tax your income at a reasonable rate.

The Internal Revenue Service requires owners of real estate to report their capital gains. In some cases when you sell real estate for a capital gain, you'll receive IRS Form 1099-S. This form itself is sent to property sellers by real estate settlement agents, brokers or lenders involved in real estate transactions.

Montana's economy is dominated by the primary sectoragriculture, forestry, mining, and energy productionand by services. About one-third of the state's workforce is employed in the service sector. The outdoor recreation industry has become important, and some high-technology industries have come to the state.

If you receive an informational income-reporting document such as Form 1099-S, Proceeds From Real Estate Transactions, you must report the sale of the home even if the gain from the sale is excludable. Additionally, you must report the sale of the home if you can't exclude all of your capital gain from income.

The Internal Revenue Service requires owners of real estate to report their capital gains. In some cases when you sell real estate for a capital gain, you'll receive IRS Form 1099-S. This form itself is sent to property sellers by real estate settlement agents, brokers or lenders involved in real estate transactions.

The state of Montana has no sales tax at the state or local levels. It is one of five states in the U.S. that does not charge a state sales tax.