Montana Sample Letter for Corrections to Credit Report

Description

How to fill out Sample Letter For Corrections To Credit Report?

If you require thorough, download, or printing legal document templates, utilize US Legal Forms, the most extensive collection of legal documents available online.

Take advantage of the site’s straightforward and convenient search feature to obtain the forms you need.

Various templates for business and individual purposes are organized by categories and topics, or keywords.

Every legal document template you purchase is yours indefinitely. You will have access to every form you downloaded in your account.

Click on the My documents section and select a form to print or download again. Complete and download, and print the Montana Sample Letter for Corrections to Credit Report with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- Utilize US Legal Forms to acquire the Montana Sample Letter for Corrections to Credit Report with just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and click the Obtain button to access the Montana Sample Letter for Corrections to Credit Report.

- You can also view forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, refer to the following steps.

- Step 1. Ensure you have selected the correct form for your state/land.

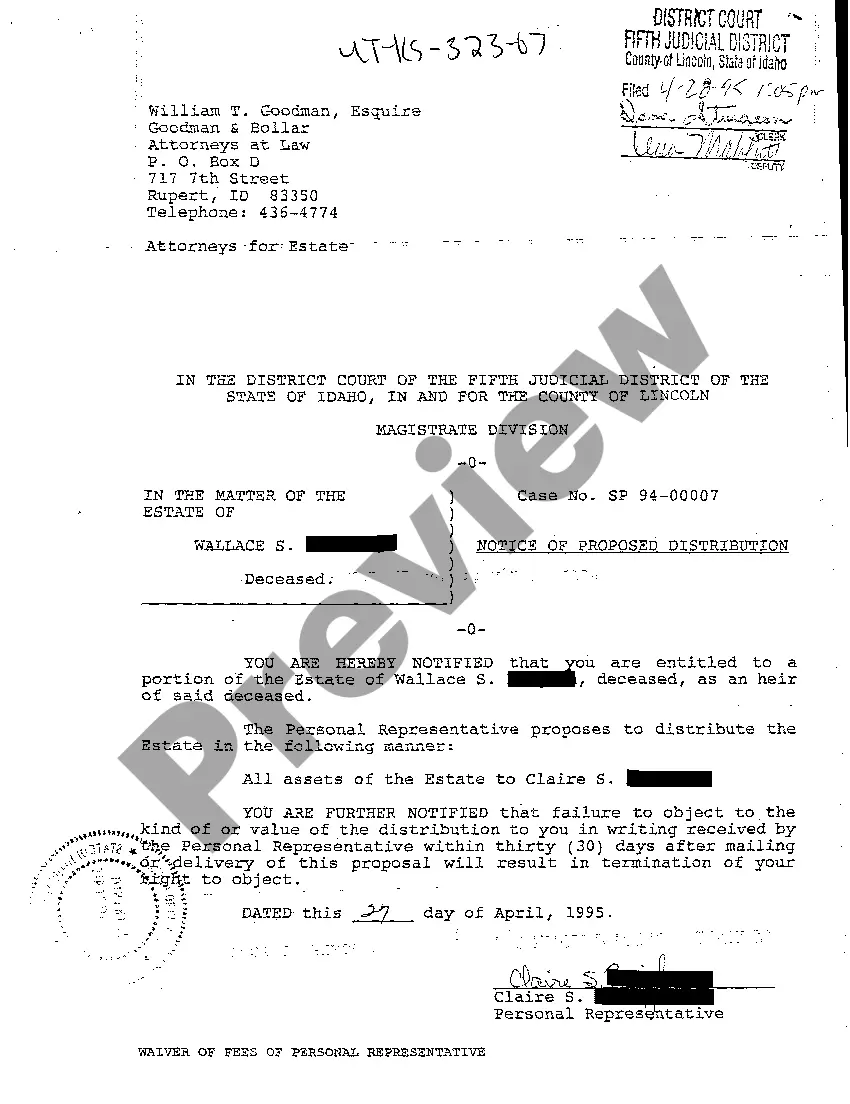

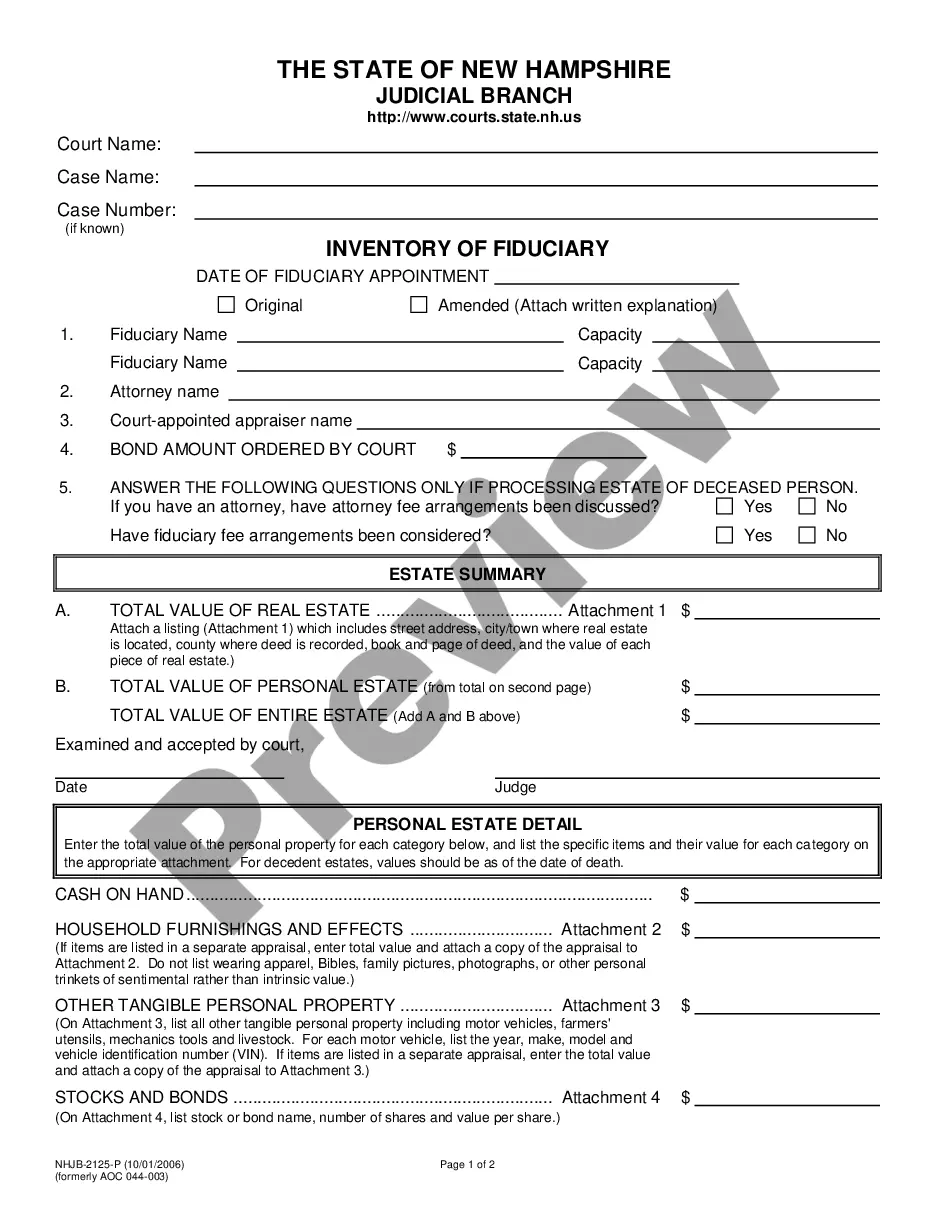

- Step 2. Use the Preview option to review the form’s details. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have found the form you need, click on the Acquire now button. Choose the payment plan you prefer and enter your details to create an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to process the payment.

- Step 6. Choose the format of the legal document and download it to your system.

- Step 7. Fill out, edit, and print or sign the Montana Sample Letter for Corrections to Credit Report.

Form popularity

FAQ

Writing a letter to dispute an item on your credit report is a straightforward process. Begin with your personal information and the details of the disputed entry. Utilize a Montana Sample Letter for Corrections to Credit Report to format your letter effectively, ensuring you include specific details about the error and request an investigation. Send the letter to the credit bureau and keep a copy for your records to track your dispute.

To make corrections to your credit report, start by obtaining a copy of your credit report from the major credit bureaus. Review the report carefully to identify the inaccuracies. Once you find errors, use a Montana Sample Letter for Corrections to Credit Report to formally dispute the inaccuracies in writing. Be sure to include any supporting documents, a clear explanation of the error, and your contact information.

When disputing an item on your credit report, clearly state which entry you believe is incorrect and why. Include any evidence that supports your claim, such as receipts or legal documents. Utilizing the Montana Sample Letter for Corrections to Credit Report can help you outline your dispute in a clear and concise manner. Remember, the more organized your request, the better your chances of a successful resolution.

To write a good credit dispute letter, start by clearly stating the inaccuracies in your credit report. Provide personal identification information, account details, and any supporting documentation. Make sure to incorporate the Montana Sample Letter for Corrections to Credit Report as a guide. This will help ensure your letter is structured correctly and effectively communicates your concerns.

To add a notice of correction to your credit report, you need to contact the credit bureau and request the addition. A Montana Sample Letter for Corrections to Credit Report can serve as a useful guide for this process, ensuring you provide all required information. Make sure to explain why you are requesting the notice and include relevant documentation. This notice can help explain circumstances around any discrepancies in your report.

Making corrections on a credit report requires you to file a dispute with the credit reporting agency. Use a Montana Sample Letter for Corrections to Credit Report to effectively convey the changes you need. Include your personal details and any evidence to support your claim to facilitate the correction process. After submission, follow up to ensure that the corrections are made.

To make corrections to your credit report, first identify the errors. Contact the credit bureau and submit a dispute with the necessary details, using a Montana Sample Letter for Corrections to Credit Report as a template. Ensure you include any supporting documents to clarify the mistake. The credit bureau will then investigate your claim and make the necessary adjustments.

When writing a letter to dispute a credit report, clearly state the inaccuracies and provide your personal information for identification. Use a Montana Sample Letter for Corrections to Credit Report for guidance on structure and content. Attach any relevant documentation that supports your case to increase your chances of a successful dispute. Make sure to keep a copy of the letter for your records.

A 623 letter is a formal notice sent to a creditor that points out inaccuracies in your credit report. It references Section 623 of the Fair Credit Reporting Act, which requires creditors to investigate disputes. You can use a Montana Sample Letter for Corrections to Credit Report to help you format this letter correctly. This letter serves as a direct way to communicate with the creditor about the errors.

To make changes to your credit report, start by identifying the inaccuracies. Then, write to the credit bureau explaining the error and request a correction using a Montana Sample Letter for Corrections to Credit Report. Provide documentation to support your claim for a smoother process. Regularly check your credit report to ensure that the changes are made accurately.