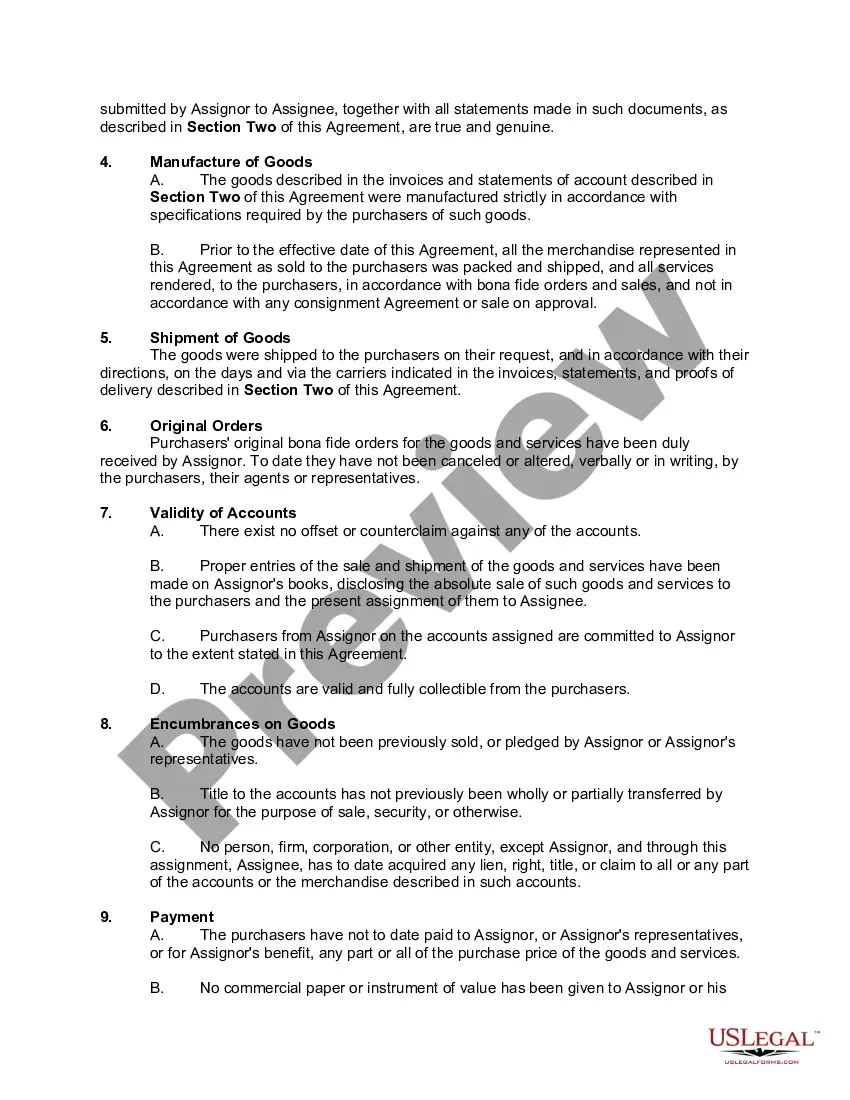

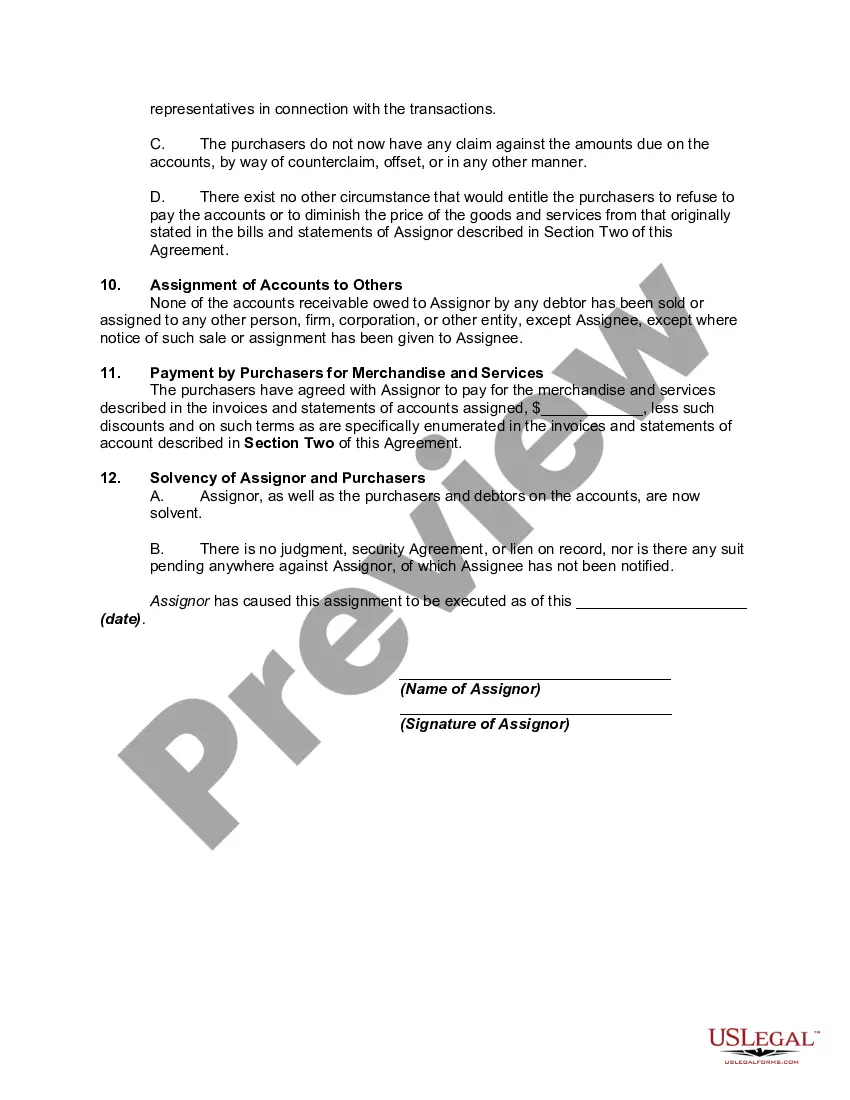

Montana Assignment of Accounts Receivable

Description

How to fill out Assignment Of Accounts Receivable?

Selecting the appropriate legal document format can be quite challenging.

Of course, there is a range of templates accessible online, but how can you find the legal document you require.

Utilize the US Legal Forms website.

If you are a new user of US Legal Forms, here are simple steps you should follow: First, ensure that you have chosen the correct form for your area.

Choose the file format and download the legal document format to your device.

Complete, edit, print, and sign the obtained Montana Assignment of Accounts Receivable.

US Legal Forms is the largest collection of legal forms where you can discover various document formats.

Utilize the service to obtain professionally crafted documents that adhere to state regulations.

- The platform offers numerous templates, including the Montana Assignment of Accounts Receivable, which you can use for both business and personal purposes.

- All forms are reviewed by experts and comply with federal and state regulations.

- If you already have an account, Log In to your account and click the Download button to access the Montana Assignment of Accounts Receivable.

- Use your account to review the legal forms you have accessed previously.

- Visit the My documents section of your account to obtain another copy of the document you need.

- You can browse the form using the Review button and examine the form description to verify it is suitable for your needs.

- If the form does not meet your requirements, use the Search field to locate the right form.

- Once you are confident the form is appropriate, click the Buy now button to acquire the form.

- Select the pricing plan you prefer and enter the required information.

- Create your account and pay for the order using your PayPal account or credit card.

Form popularity

FAQ

A notice of assignment of receivables is a formal notification to your customers that payments should be directed to the assignee rather than to your business. This document helps clarify the change in payment directives and secures your rights under the Montana Assignment of Accounts Receivable framework. Properly executing this notice ensures a smooth transition for both you and your clients.

An accounts receivable assignment grants a lender the right to collect on your invoices while you retain ownership of those receivables. On the other hand, factoring means selling your receivables to a third party, thus severing your direct link in the collection process. Knowing these distinctions is essential when negotiating terms and understanding your obligations under Montana Assignment of Accounts Receivable.

To assign accounts receivable, begin by identifying the receivables you wish to transfer. Once selected, notify your customers of the assignment, which officially transfers their payment obligations to a third party. Businesses often utilize platforms like USLegalForms to simplify this process by providing legal documentation and templates. This method is particularly beneficial for those engaged in Montana Assignment of Accounts Receivable, facilitating smooth transactions and compliance with legal requirements.

The general journal entry for accounts receivable consists of debiting the accounts receivable account and crediting the sales revenue account. This entry reflects the sale of goods or services on credit, indicating that the company will receive payment in due time. For businesses exploring Montana Assignment of Accounts Receivable, maintaining clear journal entries is crucial for ensuring accurate financial tracking.

To establish an account receivable, the typical journal entry involves debiting the accounts receivable account and crediting the sales or service revenue account. This entry records the revenue generated from sales made on credit, signifying that the business expects to receive payment in the future. For those handling Montana Assignment of Accounts Receivable, understanding this foundational entry is vital for managing finances effectively.

The adjusting journal entry for accounts receivable involves updating the records to reflect any changes in the amount owed by customers. Typically, this includes recognizing any accrued interest or discounts. It's essential to maintain accurate records, as this process is crucial for effective financial management. For businesses engaged in Montana Assignment of Accounts Receivable, precise adjustments help maintain clarity in financial reporting.

The consent to assignment of receivables is a declaration that allows a business to transfer its right to receive payment from its customers to a third party. Under the Montana Assignment of Accounts Receivable, this consent ensures that the debtor acknowledges the transfer, thus providing legal protection for both the assignor and the assignee. It helps maintain clarity in the transaction by confirming that the assigned accounts will be honored. Utilizing platforms like US Legal Forms can simplify the process of drafting these consents, ensuring you meet all legal requirements.