This form is an example of a contract to donate a horse to a rescue or other organization. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Montana Equine or Horse Donation Contract

Description

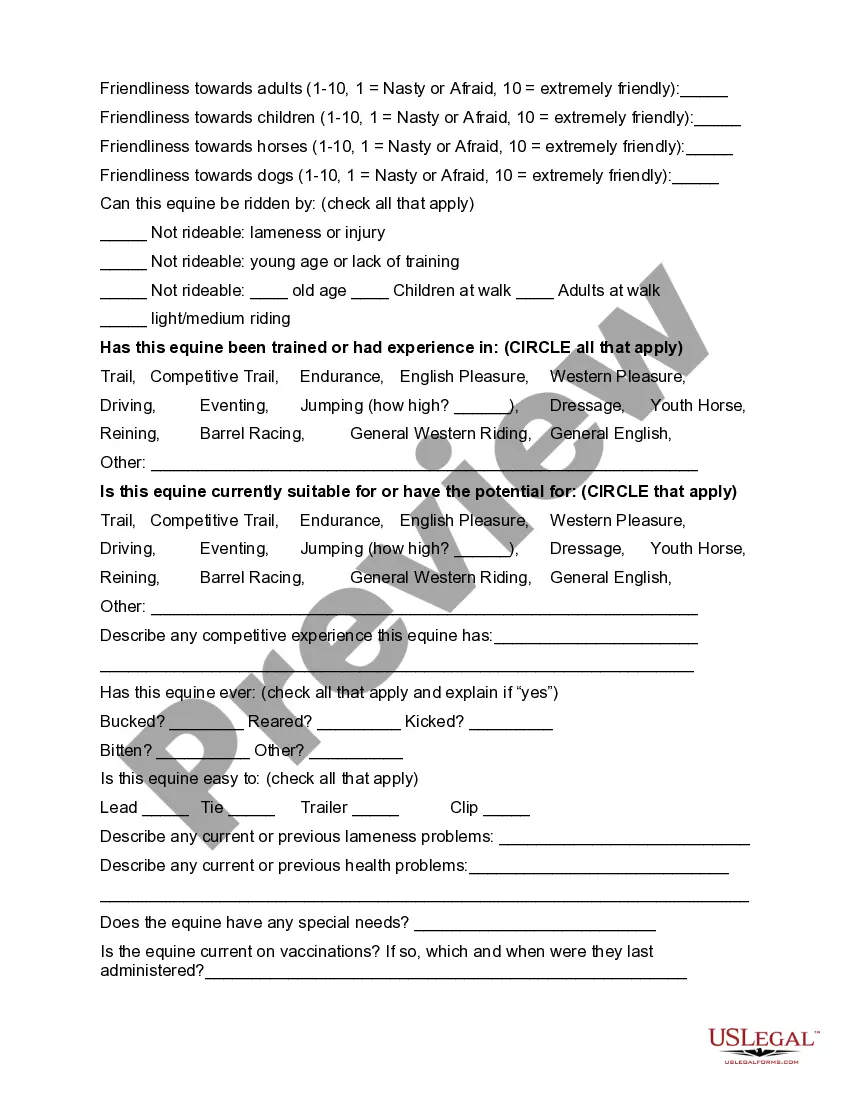

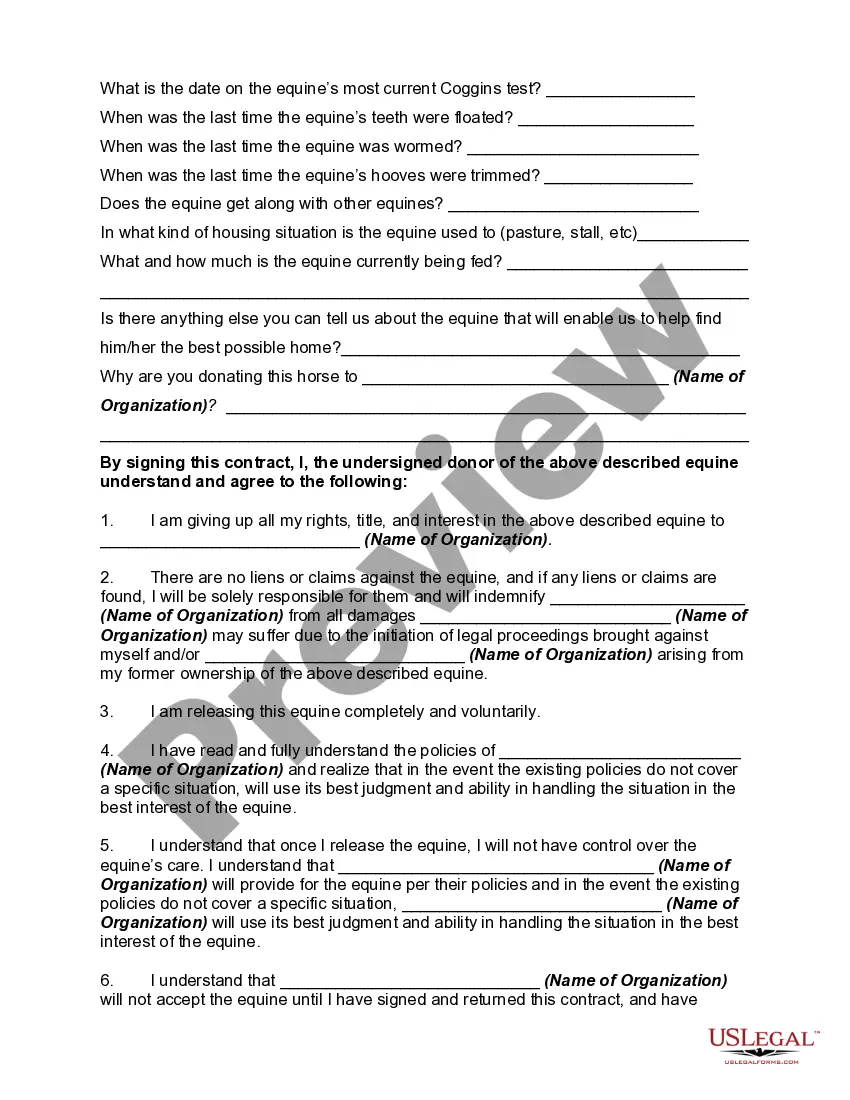

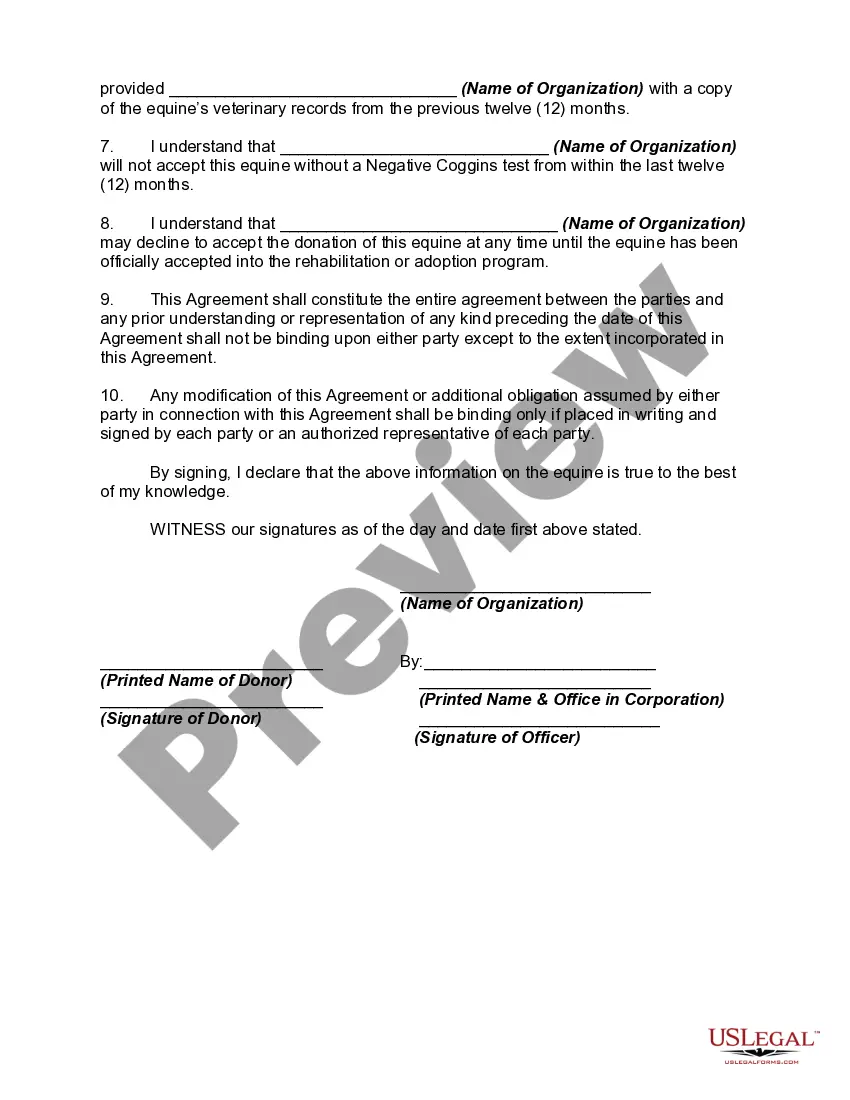

How to fill out Equine Or Horse Donation Contract?

You can allocate effort online looking for the sanctioned document template that fulfills the federal and state requirements you require.

US Legal Forms offers a vast selection of legal forms that have been evaluated by experts.

You can obtain or generate the Montana Equine or Horse Donation Agreement through their service.

If you seek to find another version of the form, use the Search section to discover the template that meets your needs and requirements.

- If you already possess a US Legal Forms account, you may Log In and select the Download option.

- Subsequently, you can complete, modify, print, or sign the Montana Equine or Horse Donation Agreement.

- Every legal document template you purchase is yours permanently.

- To request another copy of the purchased form, visit the My documents tab and select the appropriate option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions provided below.

- First, ensure you have chosen the correct document template for your region/city of preference. Review the form details to confirm you have selected the appropriate form.

- If available, utilize the Review option to examine the document template as well.

Form popularity

FAQ

Yes, you can donate a horse to charity, and it can be a rewarding experience for both you and the organization. Using a Montana Equine or Horse Donation Contract simplifies the process, ensuring that all legal aspects are covered. This contract provides clear terms about the donation, protecting your interests and the charity’s needs. By donating a horse, you can support a cause you care about while potentially receiving tax benefits.

Sponsoring a horse means providing financial support to cover various costs related to their care, such as feeding and veterinary services. By entering into a Montana Equine or Horse Donation Contract, you can ensure that your sponsored horse receives the necessary treatment and attention. Additionally, it allows you to form a connection with the animal and truly make a difference in its life. This experience can bring joy and fulfillment as you take part in their journey.

For tax purposes, a horse is categorized as personal property. The IRS recognizes horses as assets, which can impact your tax liabilities and deductions. Utilizing a Montana Equine or Horse Donation Contract can streamline understanding this classification and how it may affect your tax filings.

You may indeed qualify for a tax write-off when donating a horse, depending on its value and the accepting charity's status. Proper documentation is crucial for claiming the deduction. A Montana Equine or Horse Donation Contract not only assists in this documentation but also clarifies the details of the transaction.

Donating to a horse rescue can often provide a tax write-off if the rescue qualifies as a registered nonprofit. Many horse rescues actively work to provide care and rehabilitation for horses in need. To secure your deduction, consider using a Montana Equine or Horse Donation Contract, which will help document the donation appropriately for tax purposes.

Yes, you can donate a horse to many reputable charities. These organizations often seek horses for therapeutic riding programs, rescue initiatives, or general support of equine welfare. By using a Montana Equine or Horse Donation Contract, you can formalize your donation and ensure that it aligns with the charity’s mission.

Giving away a horse involves several steps, including selecting the right recipient and ensuring that the horse is healthy and ready for a new home. You can explore local equine charities or rescues that focus on rehoming horses. A Montana Equine or Horse Donation Contract can facilitate the transfer of ownership and protect both parties involved.

The amount you need to donate to qualify for a tax write-off varies based on the value of the horse and the charity’s status. Generally, the more valuable the horse, the higher the potential deduction. Using a Montana Equine or Horse Donation Contract will guide you through the donation's valuation and eligibility requirements.

Yes, donating a horse can be tax-deductible if you meet specific criteria. You must ensure that the charity you donate to qualifies under IRS rules. Utilizing a Montana Equine or Horse Donation Contract can help clarify the donation process and ensure you receive the proper documentation for your deduction.