Montana Pledge of Shares of Stock

Description

How to fill out Pledge Of Shares Of Stock?

Have you ever been in a situation where you require documents for potentially business or personal reasons virtually every time.

There are numerous legal document templates available online, but finding trustworthy ones isn't easy.

US Legal Forms offers a wide array of document templates, including the Montana Pledge of Shares of Stock, which can be drafted to comply with state and federal regulations.

Once you find the correct form, click Acquire now.

Select the pricing plan you prefer, enter the required information to create your account, and pay for the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Montana Pledge of Shares of Stock template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it corresponds to the correct city/area.

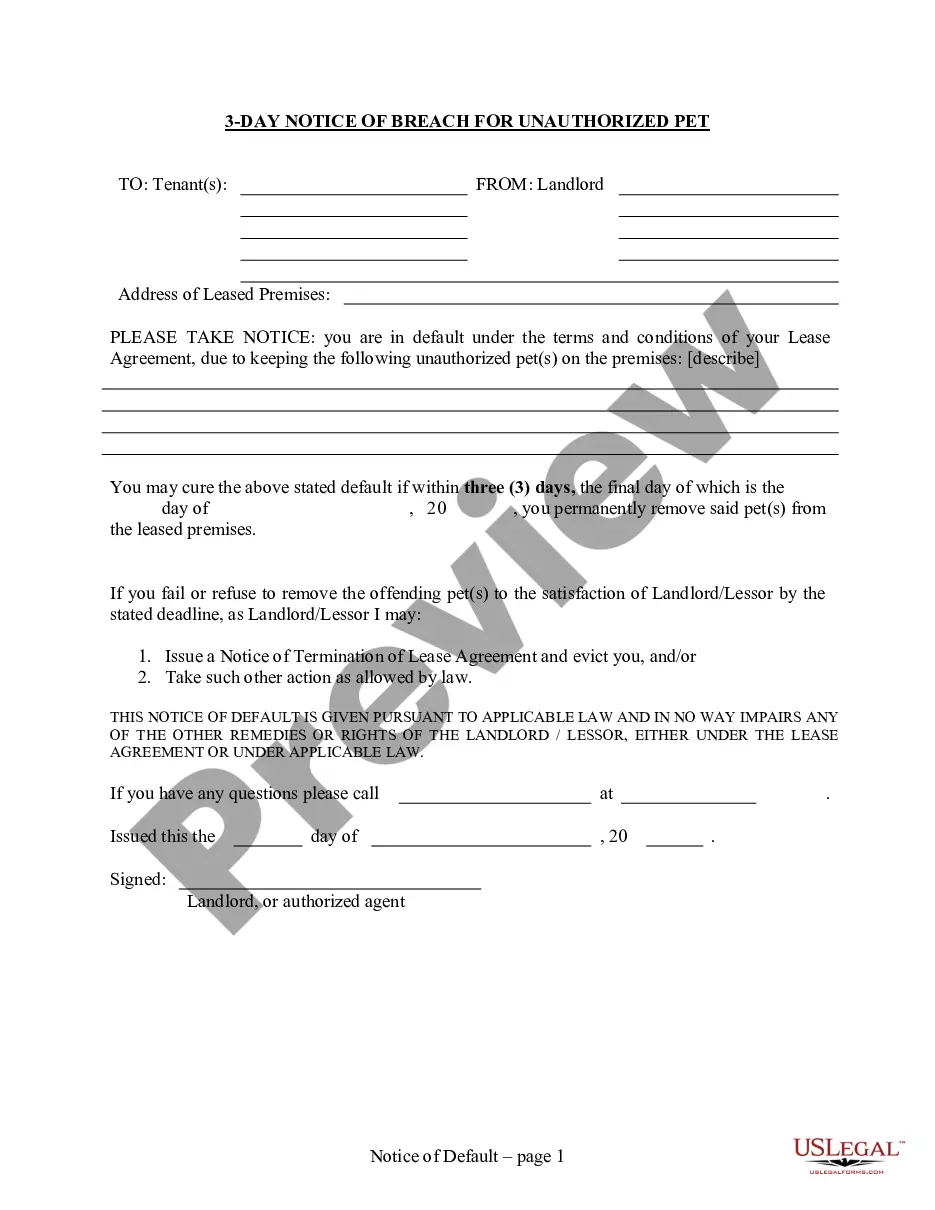

- Utilize the Preview button to review the document.

- Check the details to confirm that you have selected the right form.

- If the form isn’t what you are looking for, use the Search field to find the form that matches your needs and preferences.

Form popularity

FAQ

If you choose not to pledge your shares, you may miss out on potential financing opportunities. Pledging your stock can give you access to loans or credit, which can be crucial for business growth. Without a Montana Pledge of Shares of Stock, your assets may remain untapped, limiting your financial flexibility.

Pledging shares can be both good and bad, depending on your financial situation and objectives. The Montana Pledge of Shares of Stock offers liquidity and access to funds while you retain ownership. However, if your financial circumstances change, you risk losing your shares. It is important to weigh the advantages against the risks and seek guidance from financial professionals.

To invoke a pledge of shares, you need to follow the specific procedures outlined in your stock pledge agreement. This typically involves notifying the lender of your intention to enforce the pledge. If you're facing challenges or need help, US Legal Forms can provide useful templates and resources to guide you through the process. Always ensure to communicate effectively with your lender to maintain a clear understanding.

The process of pledging shares generally involves completing a Montana Pledge of Shares of Stock agreement, which outlines the obligations and terms. You will need to submit relevant documents to secure the pledge with the appropriate financial institution. Once completed, you'll receive confirmation to ensure the pledge is official.

Not pledging your MTF shares allows you to retain full ownership and flexibility without any commitments. However, you may miss out on potential financing options that could come with a share pledge. It's important to evaluate how the Montana Pledge of Shares of Stock could support your investment strategy.

The duration for which you can keep shares pledged may vary based on the Montana Pledge of Shares of Stock agreement you enter into. Many agreements allow you to keep shares pledged until the underlying obligation is fulfilled. To understand the exact terms, reviewing your specific contract is crucial.

Enforcing a share pledge typically involves following the stipulations outlined in your Montana Pledge of Shares of Stock agreement. If the pledger defaults on obligations, the secured party can take legal steps to recover the pledged shares. It's advisable to consult a legal professional for guidance on this process to ensure compliance and protect your interests.

If you choose not to pledge your shares in Angel One, you might miss out on potential benefits such as lower interest rates and leverage options. However, your shares remain entirely yours without any commitments. It's essential to weigh the potential benefits of the Montana Pledge of Shares of Stock against your financial goals.

To initiate a share pledge under the Montana Pledge of Shares of Stock, you typically need a completed pledge agreement, share certificates, and possibly other related documents. These documents validate the pledge and secure your agreement with the lender. Check with your financial institution and legal advisor for the exact requirements, ensuring you have all necessary paperwork ready.

The rules for pledging shares under the Montana Pledge of Shares of Stock require proper documentation and compliance with state regulations. Generally, you'll need to submit a pledge agreement detailing the terms and conditions of the pledge. Make sure to understand the implications, such as potential rights of the lender or limitations on trading these shares.