An independent contractor is a person or business who performs services for another person pursuant to an agreement and who is not subject to the other's control, or right to control, the manner and means of performing the services. The exact nature of

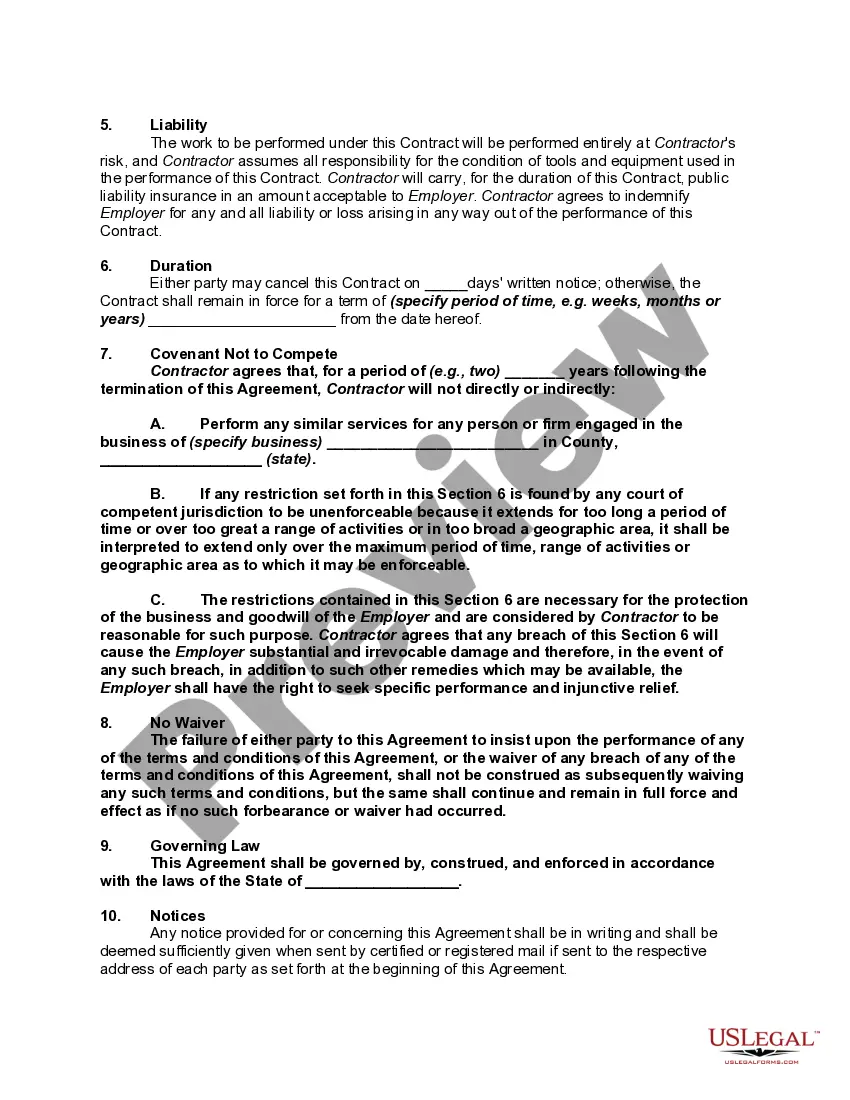

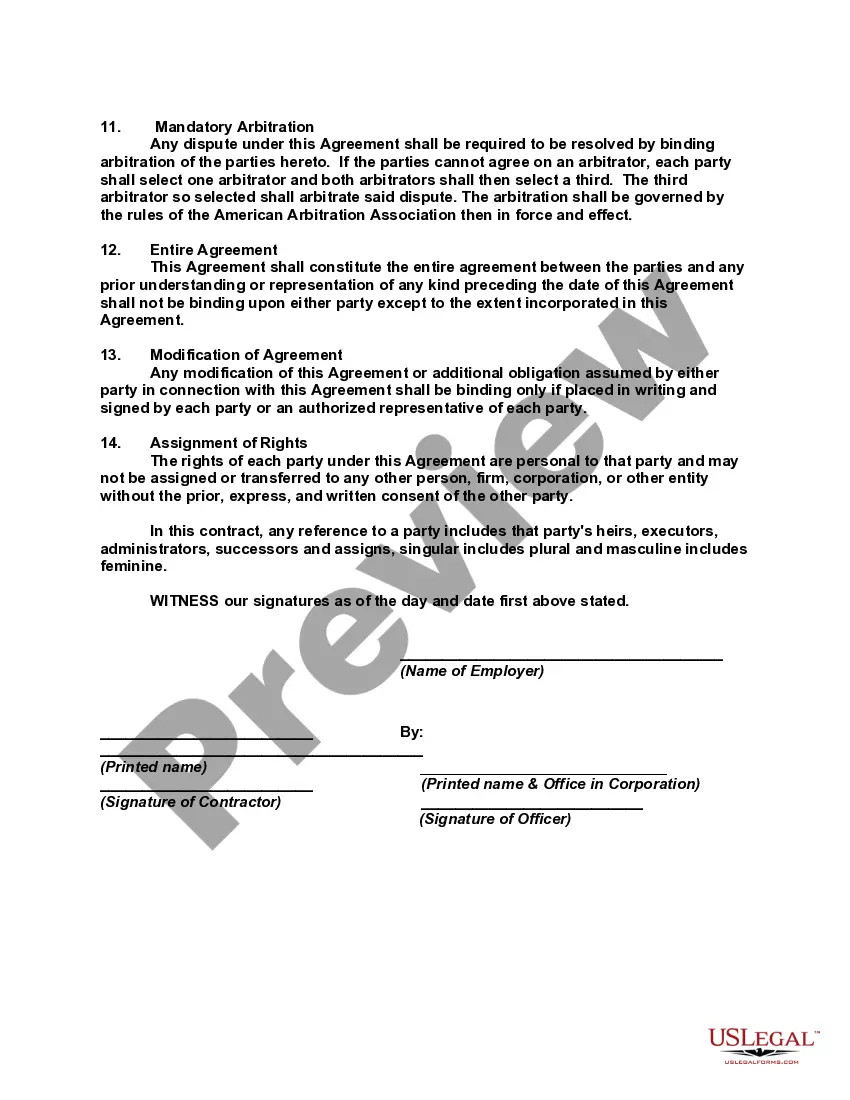

Montana Contract with Self-Employed Independent Contractor with Covenant Not to Compete

Description

How to fill out Contract With Self-Employed Independent Contractor With Covenant Not To Compete?

Locating the appropriate legal document format can be quite a challenge.

It goes without saying that there are numerous templates accessible online, but how will you find the legal form you require.

Utilize the US Legal Forms website.

If you are a new user of US Legal Forms, here are simple guidelines to follow: First, ensure you have selected the correct form for your locality/state. You can browse the document using the Preview feature and review the document description to confirm this is indeed suitable for you. If the form does not fulfill your requirements, use the Search box to find the appropriate form. When you are confident that the form is correct, click the Get now button to obtain the document. Select the pricing plan you desire and enter the necessary information. Create your account and complete your purchase with your PayPal account or credit card. Choose the file format and download the legal document format to your device. Complete, modify, print, and sign the acquired Montana Contract with Self-Employed Independent Contractor with Covenant Not to Compete. US Legal Forms is the largest repository of legal forms where you can find a plethora of document templates. Utilize the service to acquire professionally crafted documents that conform to state requirements.

- The service offers a vast selection of templates, including the Montana Contract with Self-Employed Independent Contractor with Covenant Not to Compete, which can be utilized for both business and personal purposes.

- All of the forms are reviewed by experts and comply with state and federal regulations.

- If you are already registered, sign in to your account and click on the Download button to obtain the Montana Contract with Self-Employed Independent Contractor with Covenant Not to Compete.

- Utilize your account to search through the legal forms you have previously purchased.

- Proceed to the My documents section of your account and retrieve an additional copy of the documents you need.

Form popularity

FAQ

Non-compete clauses can hold up in court, but their enforceability largely depends on compliance with state laws and the reasonableness of the terms. Courts generally assess whether the clause protects valid business interests without being overly restrictive to the contractor. As you navigate the complexities of a Montana Contract with Self-Employed Independent Contractor with Covenant Not to Compete, consider using US Legal Forms to draft a legally sound agreement that stands a better chance in court.

Yes, non-compete clauses can be enforceable in Montana, but they come with specific restrictions. The agreement must reasonably protect legitimate business interests and must not impose undue hardship on the independent contractor. Furthermore, they typically cannot last longer than two years. If you're drafting a Montana Contract with Self-Employed Independent Contractor with Covenant Not to Compete, ensure that you formulate it with legal guidelines in mind.

Non-compete clauses are not enforceable in several states, including California, North Dakota, and Oklahoma. These states prioritize a worker's freedom to pursue employment and career opportunities. Additionally, other states may have strict limitations on the use of non-compete agreements. When considering a Montana Contract with Self-Employed Independent Contractor with Covenant Not to Compete, it's essential to understand the regulations specific to your state to avoid invalid agreements.

The IRS defines self-employed individuals as those who carry on a trade or business as a sole proprietor, independent contractor, or a member of a partnership. This status impacts tax obligations and eligibility for certain deductions. When creating a Montana Contract with Self-Employed Independent Contractor with Covenant Not to Compete, it is advisable to consider tax implications as part of your broader business plan.

Yes, obtaining a business license is often required for independent contractors in Montana, depending on your specific profession and location. Different jurisdictions may have varying requirements, so it's essential to check local regulations. A well-structured Montana Contract with Self-Employed Independent Contractor with Covenant Not to Compete can complement your licensing efforts by providing legal clarity.

A self contractor, much like an independent contractor, operates their own business. However, the term 'self contractor' generally emphasizes ownership of the business aspect, while 'independent contractor' focuses more on the contract work provided. By utilizing a Montana Contract with Self-Employed Independent Contractor with Covenant Not to Compete, you can establish a clear distinction for your operations.

employed general contractor manages construction projects, coordinating with subcontractors and ensuring projects stay on schedule. They are responsible for hiring workers, obtaining permits, and ensuring compliance with regulations. Including a Montana Contract with SelfEmployed Independent Contractor with Covenant Not to Compete can clarify roles and expectations for everyone involved.

To establish yourself as an independent contractor in Montana, you need to create a clear business structure and obtain necessary permits or licenses. This often includes registering your business name and securing a business license if needed. Additionally, using a Montana Contract with Self-Employed Independent Contractor with Covenant Not to Compete can help you define your work parameters and protect your business.

Yes, a self-employed individual is often considered an independent contractor. This means they run their own business and offer services directly to clients, rather than being under someone else's employment. When you're a self-employed independent contractor, you can benefit from flexibility while using a Montana Contract with Self-Employed Independent Contractor with Covenant Not to Compete to protect your interests.

In Montana, an independent contractor works on a contract basis, exercising control over how they complete their tasks. In contrast, an employee operates under the direction of their employer and typically receives benefits, such as health insurance. Understanding this distinction is crucial, especially when drafting a Montana Contract with Self-Employed Independent Contractor with Covenant Not to Compete.