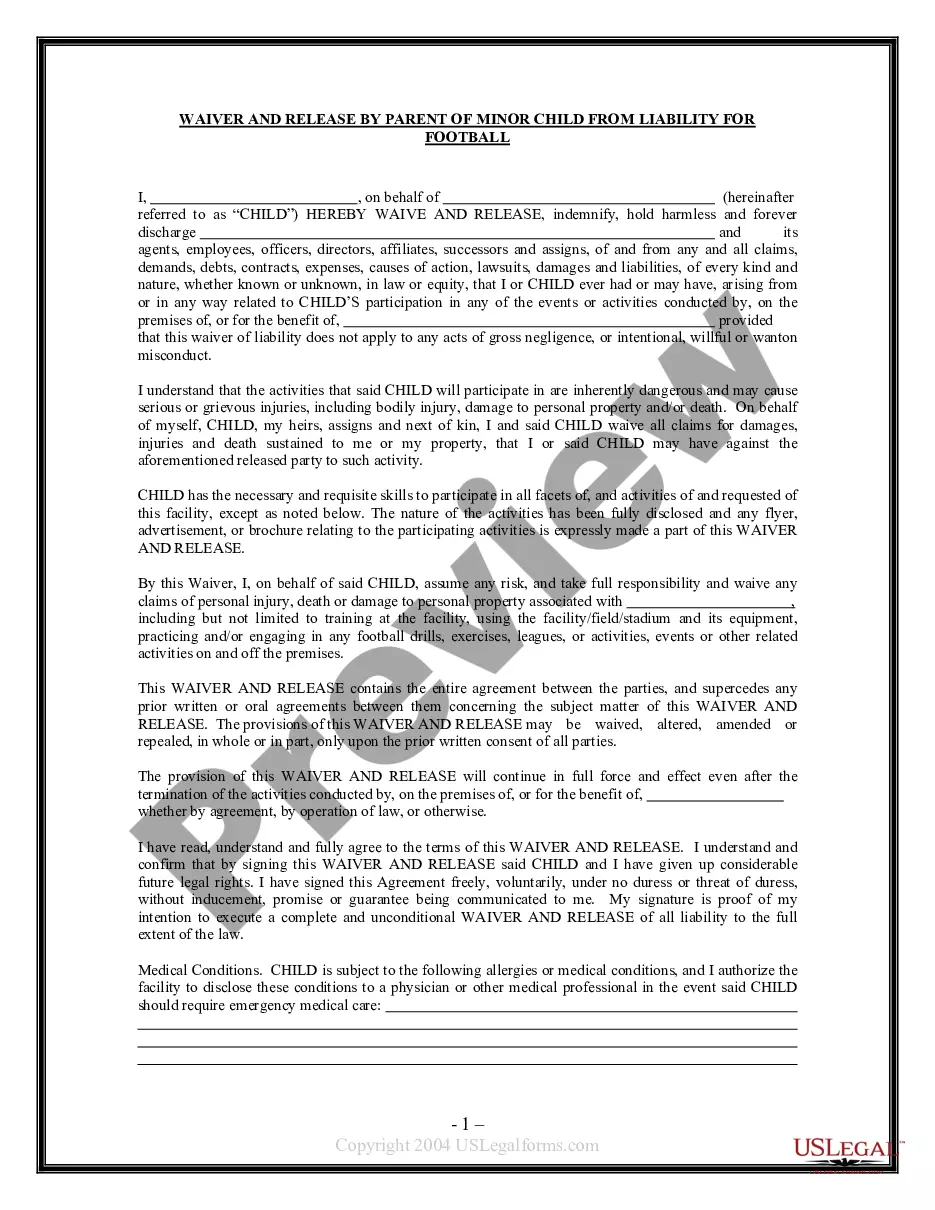

In the absence of a provision in a trust instrument giving the trustee power to terminate the trust, a trustee generally has no control over the continuance of the trust. In this form, the trustee had been given the authority to terminate the trust. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Montana Termination of Trust By Trustee and Acknowledgment of Receipt of Trust Funds By Beneficiary

Description

How to fill out Termination Of Trust By Trustee And Acknowledgment Of Receipt Of Trust Funds By Beneficiary?

Selecting the appropriate legal documents template can be challenging. It goes without saying that there are countless formats available online, but how can you locate the legal form you require? Utilize the US Legal Forms website. The service provides thousands of templates, including the Montana Termination of Trust By Trustee and Acknowledgment of Receipt of Trust Funds By Beneficiary, which can be utilized for both business and personal purposes.

All forms are reviewed by professionals and conform to federal and state standards. If you are already registered, Log In to your account and hit the Download button to obtain the Montana Termination of Trust By Trustee and Acknowledgment of Receipt of Trust Funds By Beneficiary. Use your account to access the legal forms you may have previously purchased. Navigate to the My documents tab in your account and retrieve another copy of the documents you need.

If you are a new user of US Legal Forms, here are some simple guidelines you should adhere to: First, ensure that you have chosen the correct form for your area/county. You can review the form using the Preview button and go through the form details to confirm it is suitable for you. If the form does not satisfy your requirements, use the Search section to find the correct form. Once you are convinced the form is accurate, click the Get now button to obtain the form.

US Legal Forms is the largest repository of legal forms where you can find a variety of document templates. Take advantage of the service to download properly crafted documents that comply with state regulations.

- Select the pricing plan you prefer and input the necessary details.

- Create your account and pay for the order using your PayPal account or credit card.

- Choose the file format and download the legal document template to your device.

- Complete, modify, print, and sign the received Montana Termination of Trust By Trustee and Acknowledgment of Receipt of Trust Funds By Beneficiary.

Form popularity

FAQ

A trust Acknowledgement refers to a formal agreement where beneficiaries confirm they have received their share of assets from the trust. This step is crucial during the Montana Termination of Trust By Trustee, as it protects both the trustee and beneficiaries from future claims. Including this acknowledgment ensures clarity and finality in the distribution process. Use our resources to easily generate the necessary documents for your trust acknowledgment.

Removing a trust isn't always straightforward, as it generally requires the consent of all beneficiaries, especially in Montana. The process involves the Montana Termination of Trust By Trustee, where the trustee must prepare legal documents for termination. Additionally, it's important that the beneficiaries acknowledge receipt of trust funds to ensure everything is settled. Our platform offers necessary forms and guidance to assist you in this process.

To close your trust, you must follow specific legal protocols, starting with the Montana Termination of Trust By Trustee. This entails notifying the beneficiaries and ensuring they receive their respective funds. Once all distributions are complete, and the beneficiaries acknowledge receipt of trust funds, the trust can officially close. Our services provide templates and resources to simplify this process for you.

Deactivating a trust involves several steps, primarily focused on complying with your state's laws regarding trust termination. In Montana, the process includes the Montana Termination of Trust By Trustee, where the trustee files necessary documents indicating the trust's closure. It is essential to ensure all beneficiaries acknowledge receipt of trust funds to avoid future disputes. Consider using our platform to guide you through the process easily.

To dissolve a trust in Montana, you need to adhere to the guidelines detailed in the trust agreement. This process usually involves distributing assets, notifying beneficiaries, and completing any required legal documentation. Utilizing resources like uslegalforms can help you efficiently navigate the complexities of Montana Termination of Trust By Trustee and Acknowledgment of Receipt of Trust Funds By Beneficiary.

A trustee steps down by formally resigning from their role, which often requires notifying beneficiaries and possibly seeking court approval. The trustee should follow the procedures established in the trust document to ensure a smooth transition. Familiarizing yourself with the Montana Termination of Trust By Trustee and Acknowledgment of Receipt of Trust Funds By Beneficiary can clarify the necessary steps.

To release funds from a trust, the trustee generally needs to follow the trust provisions that outline distribution conditions. This may include obtaining consent from beneficiaries or certifying certain obligations have been met. Proper execution of the Montana Termination of Trust By Trustee and Acknowledgment of Receipt of Trust Funds By Beneficiary is essential to ensure compliance with legal standards.

When a trust is terminated, its assets are distributed to the beneficiaries according to the terms specified in the trust document. The trustee must clear any debts before final distribution. The process of Montana Termination of Trust By Trustee and Acknowledgment of Receipt of Trust Funds By Beneficiary ensures all actions are legally documented and binding.

Removing a beneficiary from a trust usually requires a clear legal basis as defined in the trust agreement. The trustee must follow a legal process, which may involve court intervention if beneficiaries contest the change. Understanding the implications of Montana Termination of Trust By Trustee and Acknowledgment of Receipt of Trust Funds By Beneficiary can help navigate these complexities.

A trustee can terminate a trust by following the directives set forth in the trust document. This often involves notifying beneficiaries, settling debts, and distributing the remaining assets. It's essential to consult legal guidelines regarding Montana Termination of Trust By Trustee and Acknowledgment of Receipt of Trust Funds By Beneficiary to ensure compliance.