Montana Certificate of Trust - Indebtedness

Description

How to fill out Certificate Of Trust - Indebtedness?

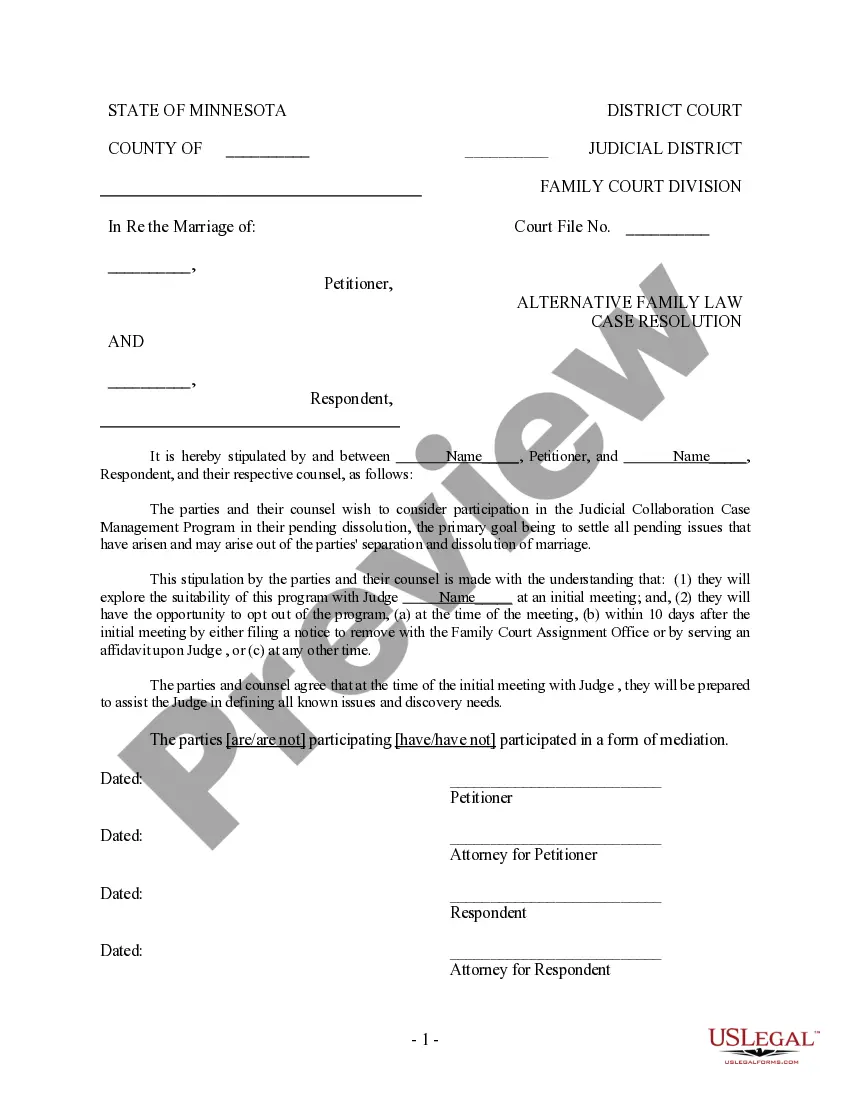

It is possible to invest time online searching for the lawful file web template that suits the state and federal needs you will need. US Legal Forms offers a large number of lawful varieties that happen to be analyzed by experts. You can easily acquire or printing the Montana Certificate of Trust for Property from my services.

If you already have a US Legal Forms accounts, you may log in and then click the Down load switch. After that, you may complete, edit, printing, or signal the Montana Certificate of Trust for Property. Each lawful file web template you get is your own for a long time. To acquire one more version of the acquired develop, proceed to the My Forms tab and then click the corresponding switch.

If you work with the US Legal Forms site the very first time, keep to the basic instructions listed below:

- First, make sure that you have chosen the right file web template to the county/area of your liking. Read the develop explanation to ensure you have selected the proper develop. If readily available, utilize the Preview switch to appear from the file web template also.

- If you want to get one more variation from the develop, utilize the Look for discipline to get the web template that fits your needs and needs.

- When you have found the web template you want, click Purchase now to proceed.

- Pick the costs prepare you want, type in your accreditations, and register for your account on US Legal Forms.

- Total the financial transaction. You can utilize your charge card or PayPal accounts to pay for the lawful develop.

- Pick the file format from the file and acquire it for your product.

- Make changes for your file if needed. It is possible to complete, edit and signal and printing Montana Certificate of Trust for Property.

Down load and printing a large number of file web templates making use of the US Legal Forms Internet site, which offers the most important assortment of lawful varieties. Use specialist and state-particular web templates to take on your small business or person needs.

Form popularity

FAQ

There isn't a clear cut rule on how much money you need to set up a trust, but if you have $100,000 or more and own real estate, you might benefit from a trust.

How to Create a Living Trust in Montana Select an individual or joint trust. ... Take inventory of your property to determine what to store in your trust. Select a trustee to manage your trust. ... Create a trust document by hiring a lawyer or using a computer program. Sign the document in front of a notary public.

A living trust in Montana is a legal document created by the trustor. The trustor sets up the trust and places his assets in the ownership of the trust. When you create a living trust, (also called an inter vivos trust) you must select a trustee.

The cost of setting up a trust in Montana varies depending on the complexity of the trust and the attorney's fees. A basic Revocable Living Trust generally ranges from $1,000 to $3,000. More complex trusts can cost several thousand dollars more.

Oshins as of 2021. South Dakota. South Dakota is the top-ranked state for trust decanting, as its statute allows for the most flexibility in trust decanting provisions. ... Nevada. The Silver State is almost tied for first place with South Dakota as the top-ranked state for trust decanting. ... Delaware. ... Tennessee.

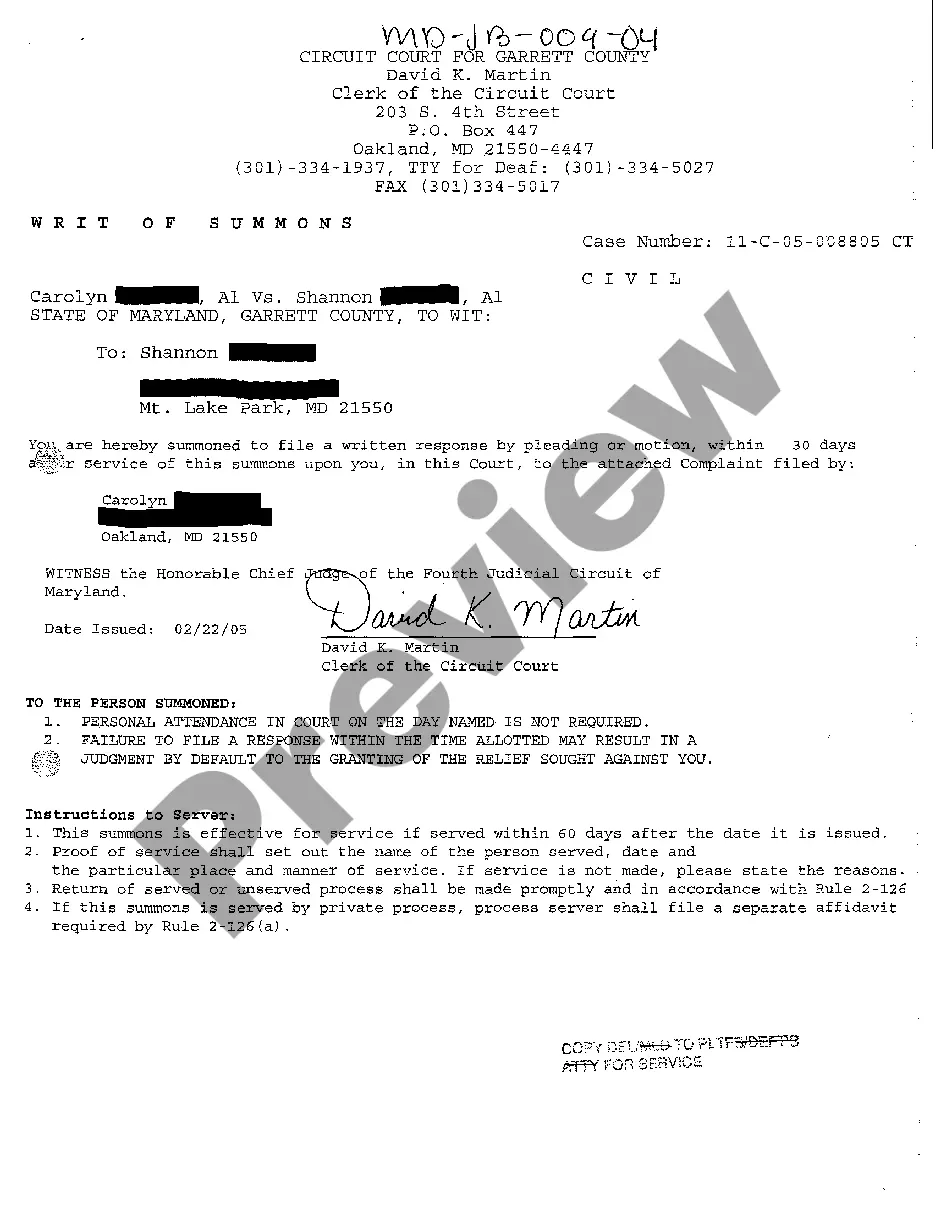

A Trust Certification gives a Trustee the ability to provide anyone who needs it (think: financial institutions or other third parties) important information about the Trust - like the date it was formed, the legal/formal name of the Trust, who the Trustee is (or Trustees are) and other information institutions may ...

The trust agreement is the parent document that details anything and everything regarding the trust, including its agreements. Meanwhile, the certificate of trust is used in tandem to keep nonessential information confidential.