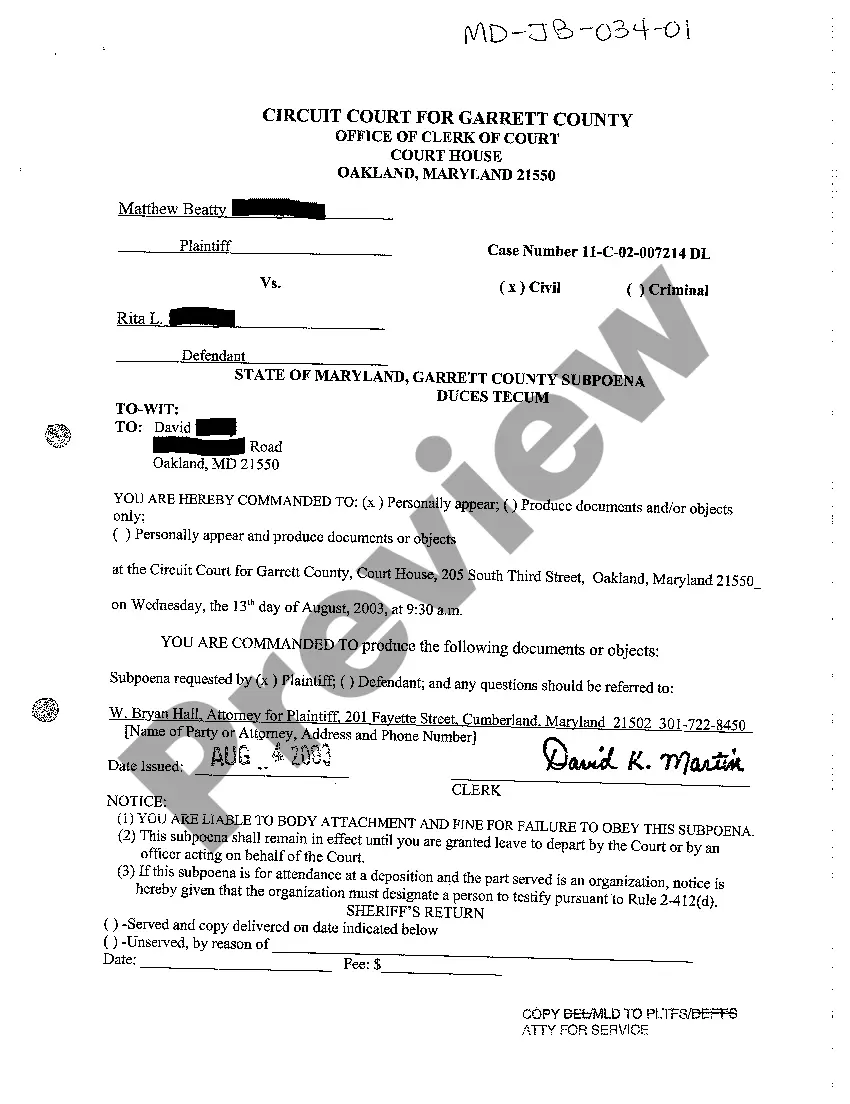

Montana Sample Letter for Proposed Final Judgment

Description

How to fill out Sample Letter For Proposed Final Judgment?

Are you currently in a situation where you require documentation for both business or personal reasons on a daily basis? There are numerous legal document templates accessible online, but locating ones you can rely on is challenging. US Legal Forms provides a vast collection of form templates, including the Montana Sample Letter for Proposed Final Judgment, which are designed to comply with federal and state regulations.

If you are already familiar with the US Legal Forms website and possess an account, simply Log In. Afterward, you can download the Montana Sample Letter for Proposed Final Judgment template.

If you do not have an account and wish to start using US Legal Forms, follow these instructions: Find the document you need and ensure it is for the correct city/county. Utilize the Preview button to review the form. Read the description to confirm you have selected the right document. If the form does not meet your expectations, use the Search feature to find the template that suits your requirements. Once you locate the appropriate form, click on Purchase now. Choose the pricing plan you prefer, fill in the necessary information to create your account, and pay for your order using your PayPal or credit card. Select a convenient document format and download your copy. Access all the document templates you have purchased in the My documents section. You can retrieve an additional copy of the Montana Sample Letter for Proposed Final Judgment at any time, if needed. Simply click the desired form to download or print the template.

By using US Legal Forms, you can access a wide range of templates tailored to meet your specific legal needs.

Start your journey towards easier document management today.

- Use US Legal Forms, the most extensive collection of legal documents, to save time and avoid mistakes.

- The service offers professionally crafted legal document templates that can be utilized for various purposes.

- Create your account on US Legal Forms and start simplifying your life.

- Ensure you choose the correct document for your specific needs.

- Take advantage of the preview feature to assess the form before finalizing your purchase.

- Explore the 'My documents' section to manage all your legal documents efficiently.

- Utilize secure payment methods for safe transactions.

Form popularity

FAQ

How long does a judgment lien last in Montana? A judgment lien in Montana will remain attached to the debtor's property (even if the property changes hands) for ten years.

How long does a judgment lien last in Montana? A judgment lien in Montana will remain attached to the debtor's property (even if the property changes hands) for ten years.

The policy of Colorado law is to subject all the property of a judgment debtor not specifically exempt to the payment of his debts. All goods, lands, and real estate of every person against whom any judgment is obtained in any court for any debt or damages are liable to be sold.

The judgment may be executed against a savings or checking account, personal property (not a necessity of life), wages, vehicles, or any other assets of the judgment debtor. Praecipe - The winning party may ask the sheriff or a process server to serve papers on the other party.

Writ of Execution: After being awarded a Judgment, you may file a written request for a Writ of Execution. A Writ can be used to garnish wages or execute against a checking or savings account. A Writ can only be served by the Sheriff's Office or a licensed levying officer.

If the court rules in their favor, the creditor can file a judgment lien against you, which means that the court has permitted them to forcefully collect that debt from you. This allows them to take possession of your real estate holdings, personal property, or business.

Montana follows federal wage garnishment laws. The maximum garnishment amount that judgment creditors can take from a single paycheck is the lesser of the following: 25% of your disposable earnings for that workweek, or. The amount that your disposable earnings exceed 30 times the federal minimum hourly wage.

The local attorney must file a notice of appearance in the case in which you seek to appear. This notice of appearance informs the court that you are making an application to the Montana Bar to appear pro hac vice. The Montana court rule requires local counsel to be at least minimally involved in the case.