Montana Corporate Guaranty - General

Description

How to fill out Corporate Guaranty - General?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a vast selection of legal template forms you can download or print.

By utilizing the website, you can discover thousands of forms for business and personal use, categorized by types, states, or keywords. You can access the most current versions of forms such as the Montana Corporate Guaranty - General in moments.

If you already hold a subscription, Log In and download the Montana Corporate Guaranty - General from the US Legal Forms library. The Download option will appear on every form you view. You can access all previously downloaded forms in the My documents tab of your account.

Complete the transaction. Use a credit card or PayPal account to finalize the payment.

Select the format and download the form to your device. Make modifications. Fill out, edit, print, and sign the downloaded Montana Corporate Guaranty - General.

Any template you add to your account has no expiration date and belongs to you forever. Therefore, if you wish to download or print another copy, simply visit the My documents section and click on the form you need.

Access the Montana Corporate Guaranty - General with US Legal Forms, the most extensive collection of legal document templates. Utilize numerous professional and state-specific templates that meet your business or personal requirements and needs.

- If you want to use US Legal Forms for the first time, follow these easy steps to get started.

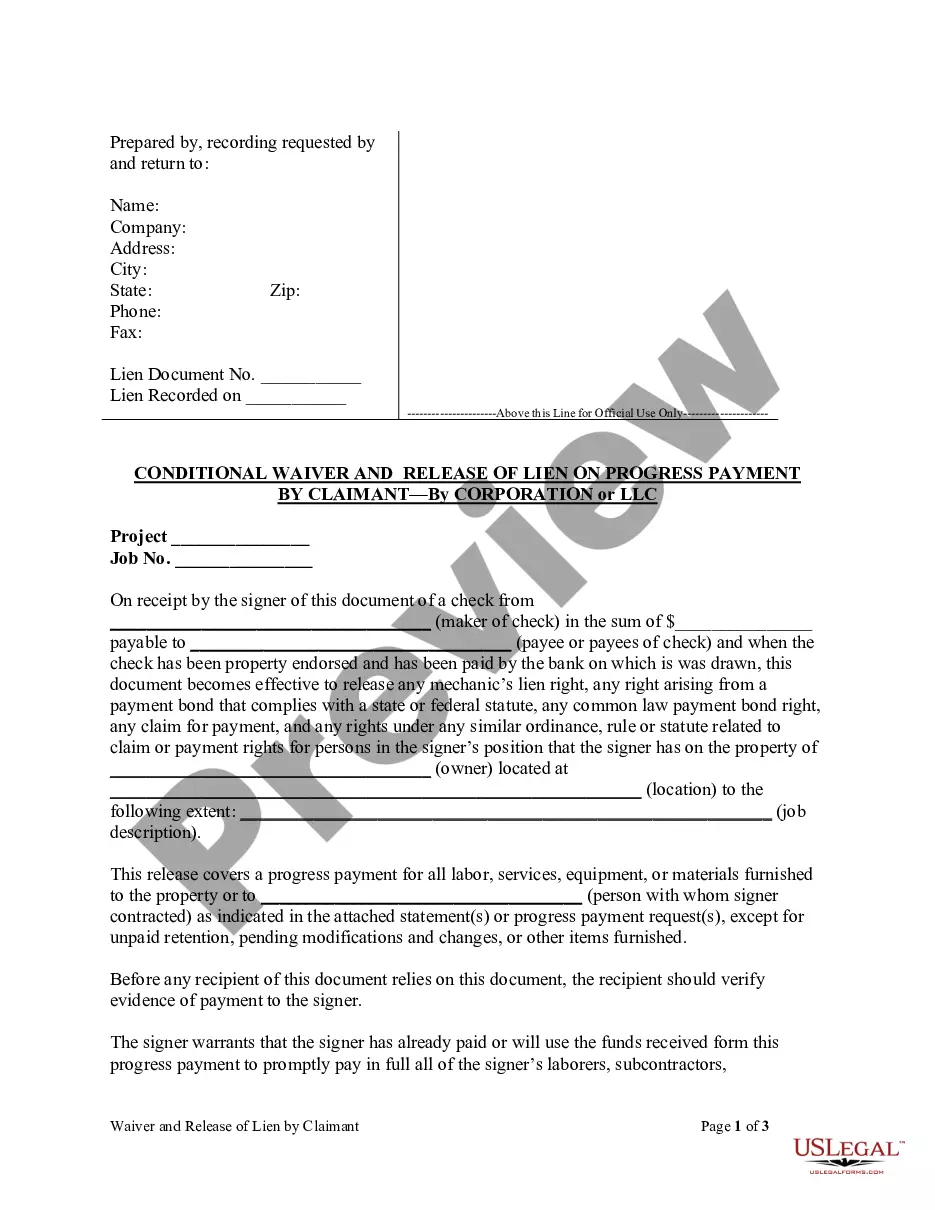

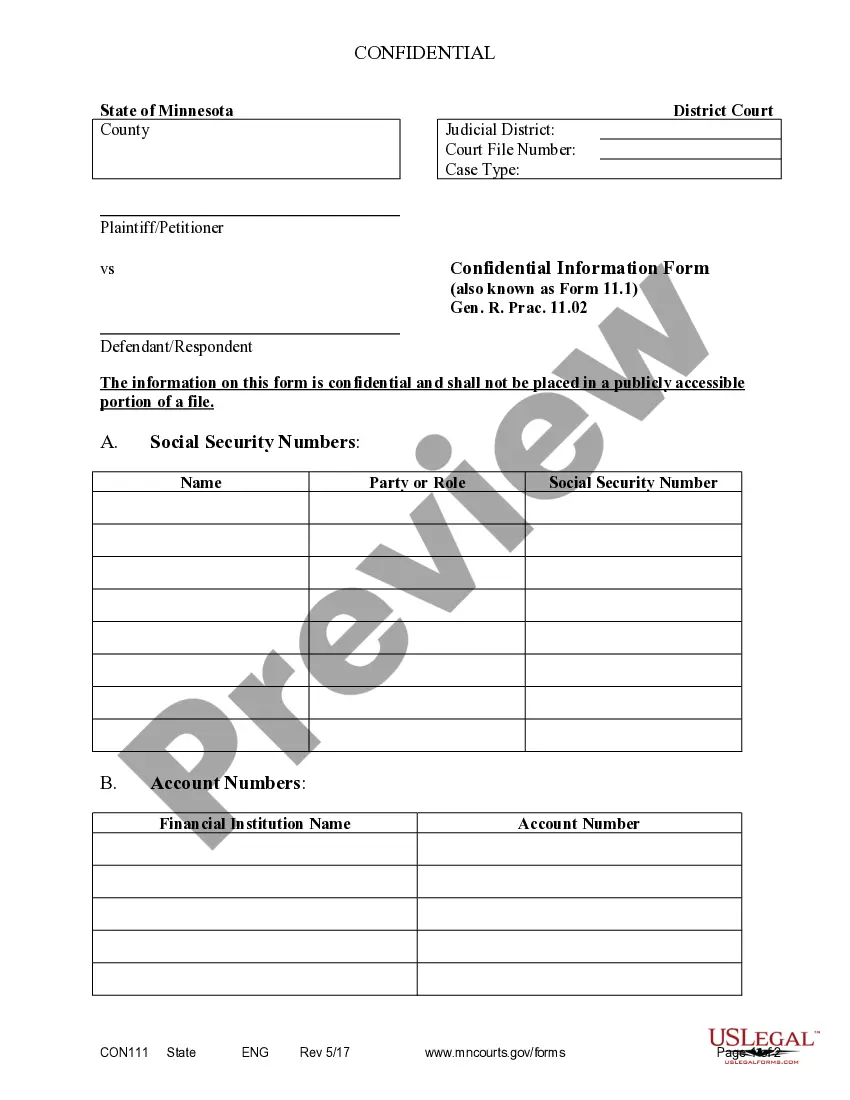

- Ensure you have selected the correct form for your region/area. Click on the Preview option to check the form's contents.

- Review the form description to confirm you have chosen the right form.

- If the form isn’t suitable for your needs, utilize the Search field at the top of the screen to find one that does fit.

- Once you are satisfied with the form, confirm your selection by clicking the Purchase now button.

- Then, select the payment plan you prefer and provide your details to register for an account.

Form popularity

FAQ

Setting up an annual report involves gathering your business's financial information and necessary documentation. Follow the guidelines provided by the Montana Secretary of State to ensure everything is complete and accurate. Staying aligned with the Montana Corporate Guaranty - General requirements is crucial for your business’s reputation. If you wish for a straightforward process, uslegalforms can provide templates and guidance for setting up your annual report efficiently.

Failing to file an annual report for your LLC can result in penalties, including potential dissolution of your business. This action directly impacts your business’s legal standing under the Montana Corporate Guaranty - General regulations. To avoid complications, stay proactive about your filing deadlines. Using uslegalforms can help you stay organized and ensure that you meet your obligations on time.

To file an annual report in Montana, access the Secretary of State’s website where you can find the necessary forms. Fill out the report accurately, and remember to include any required fees. This process is part of your obligation under the Montana Corporate Guaranty - General, ensuring your business remains in good standing. Consider uslegalforms as your ally in ensuring a smooth filing experience.

Form 2EC is a specific document used in Montana for the dissolution or withdrawal of an LLC or corporation. This form is crucial for formally ceasing your business activities and ensuring compliance with state regulations. Understanding the details of the form is essential for anyone looking to close a business under the Montana Corporate Guaranty - General framework. You can find the form on the Secretary of State’s website or through uslegalforms for convenience.

To close a business in Montana, you need to file the appropriate dissolution forms with the Secretary of State's office. Make sure to settle any outstanding debts and obligations before proceeding. This process ensures that your business is formally recognized as dissolved in compliance with the Montana Corporate Guaranty - General guidelines. For assistance, consider using the services offered by uslegalforms to simplify the documentation.

The primary difference lies in the liability and backing of the guarantee. A personal guarantee relies on an individual's financial standing, while a corporate guarantee is linked to the assets and creditworthiness of a business entity. Choosing the right form, such as a Montana Corporate Guaranty - General, can greatly impact potential risks and rewards in business agreements.

An example of a corporate guarantee could be a parent company guaranteeing the debts of its subsidiary. This ensures that lenders have the confidence to provide credit, knowing another fiscal entity backs the obligations. When creating such agreements, considering a Montana Corporate Guaranty - General can enhance credibility and financial trust.

The two types of guarantors include individual guarantors and corporate guarantors. Individual guarantors are personally liable, while corporate guarantors involve a company taking on obligations. Opting for a Montana Corporate Guaranty - General allows you to leverage corporate resources and protect individual assets, making it a strategic choice for business dealings.

A corporate guarantee is a commitment made by a corporation to assume responsibility for the debts or obligations of another entity, often used in contracts and financing. This type of agreement can provide reassurance to lenders and partners looking to invest in a business. Utilizing a Montana Corporate Guaranty - General can strengthen your business relationships and provide financial security.

The three types of guarantees are personal guarantees, corporate guarantees, and bank guarantees. A personal guarantee is backed by an individual's assets, a corporate guarantee is supported by a business, and a bank guarantee provides assurance from a financial institution. Understanding these types can help you choose the appropriate Montana Corporate Guaranty - General for your needs.