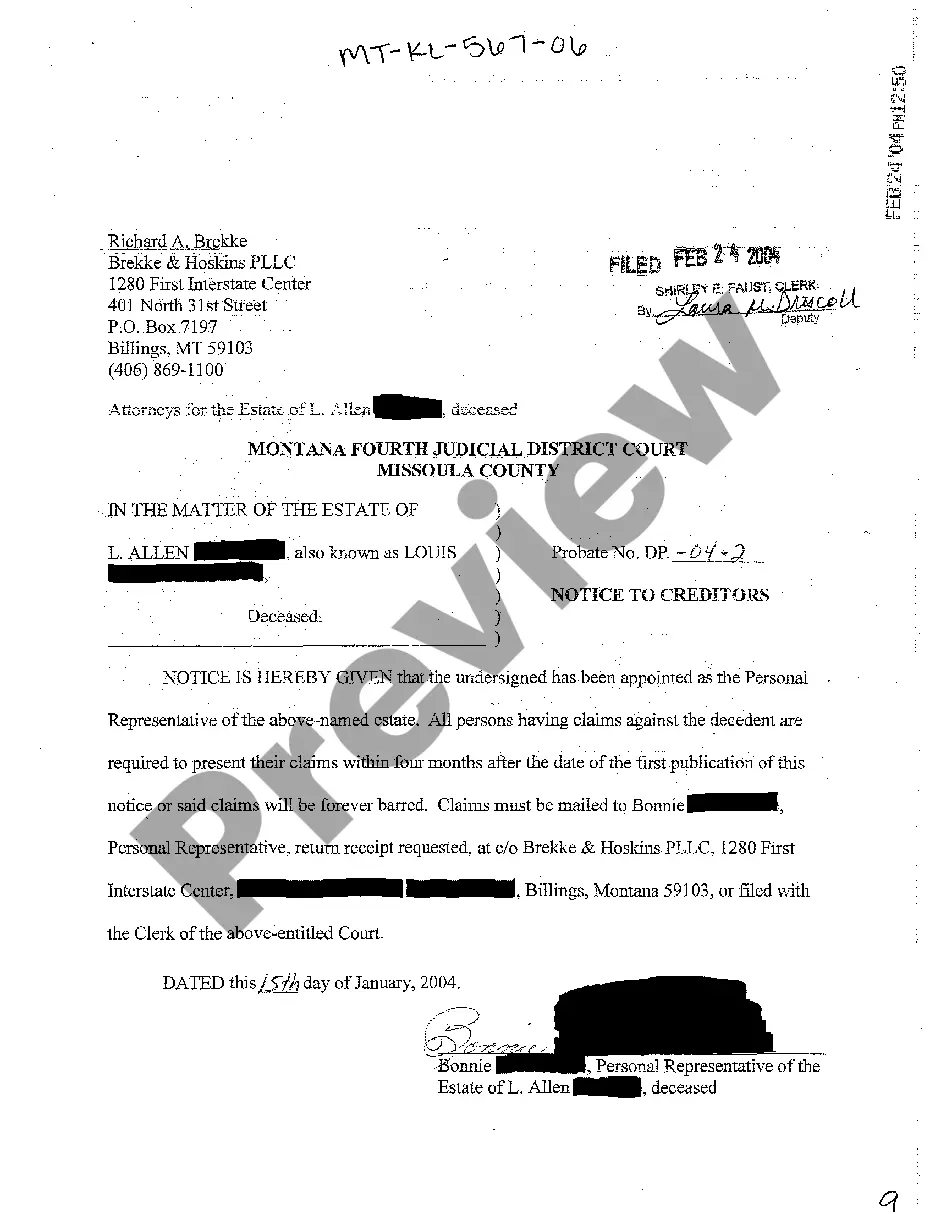

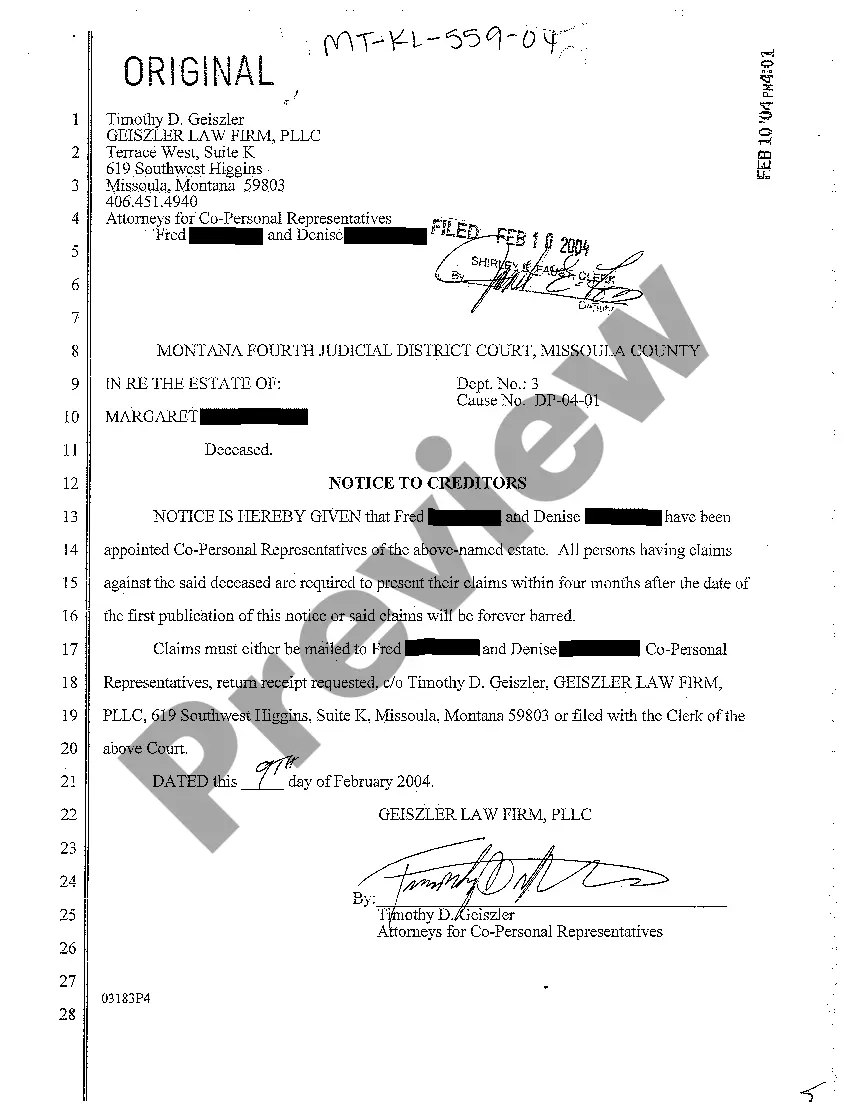

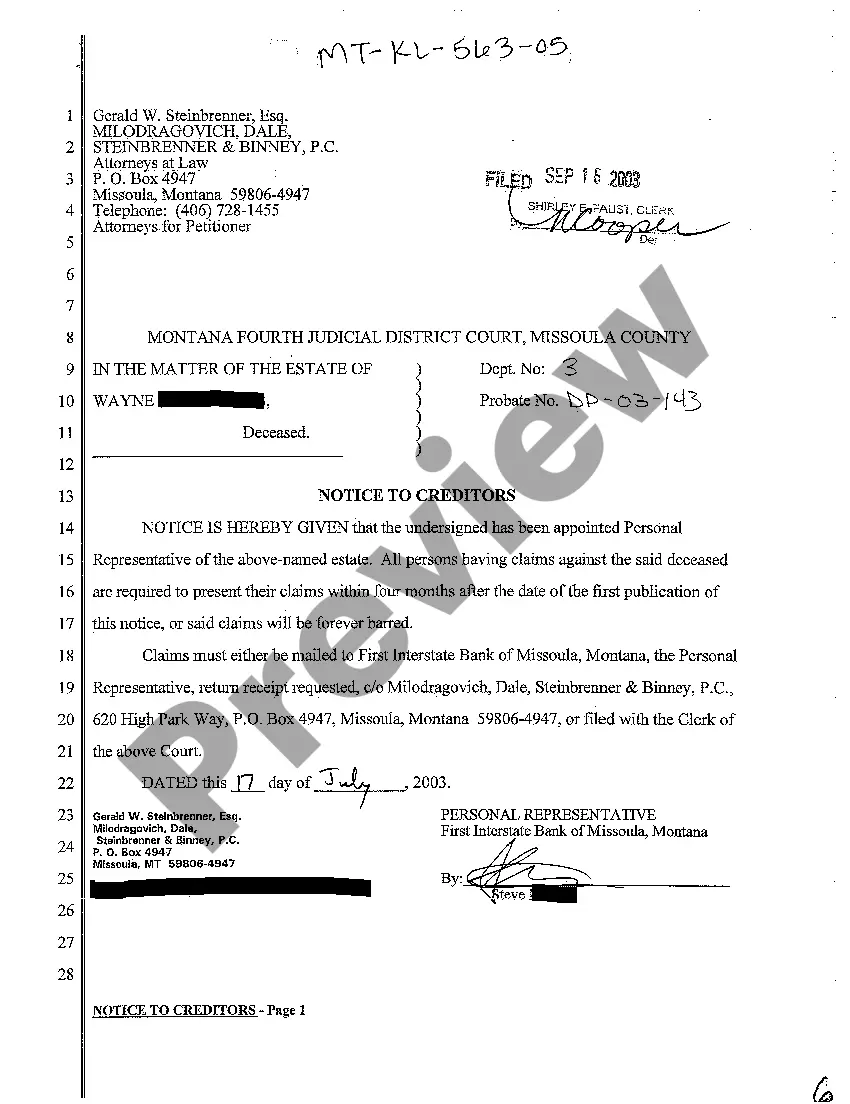

Montana Notice to Creditors

Description

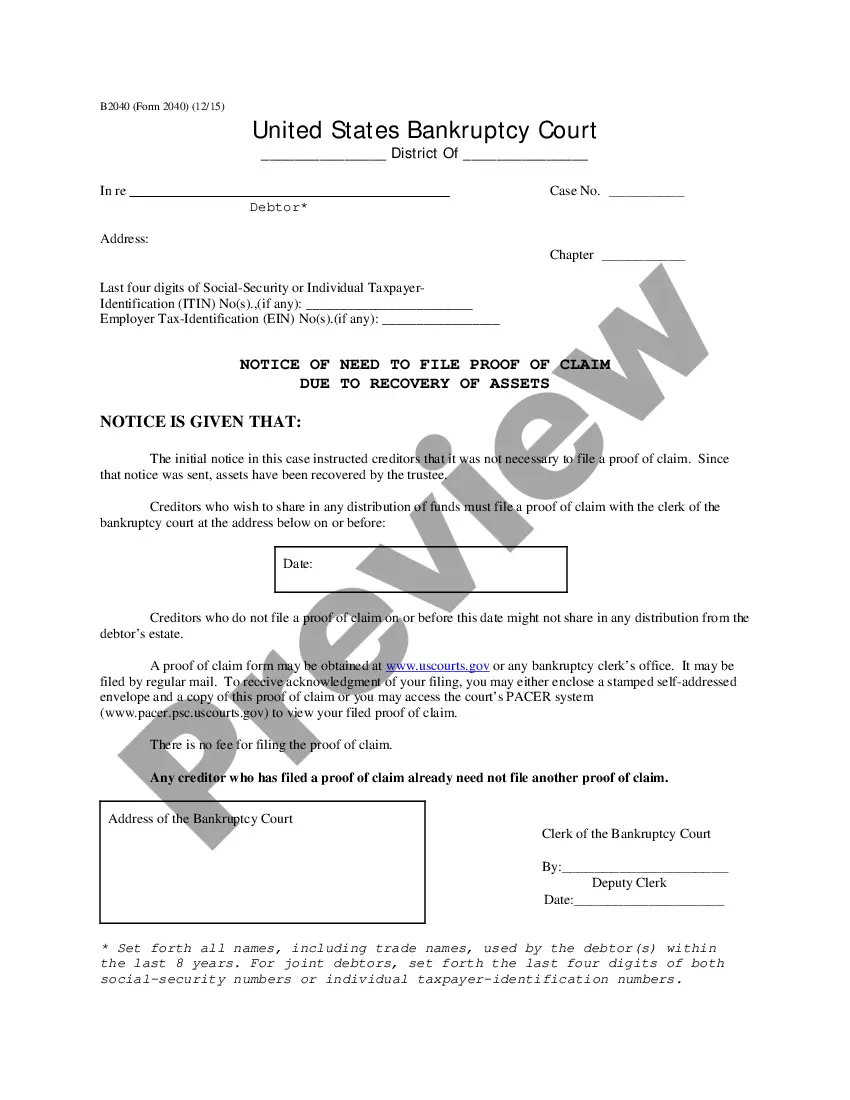

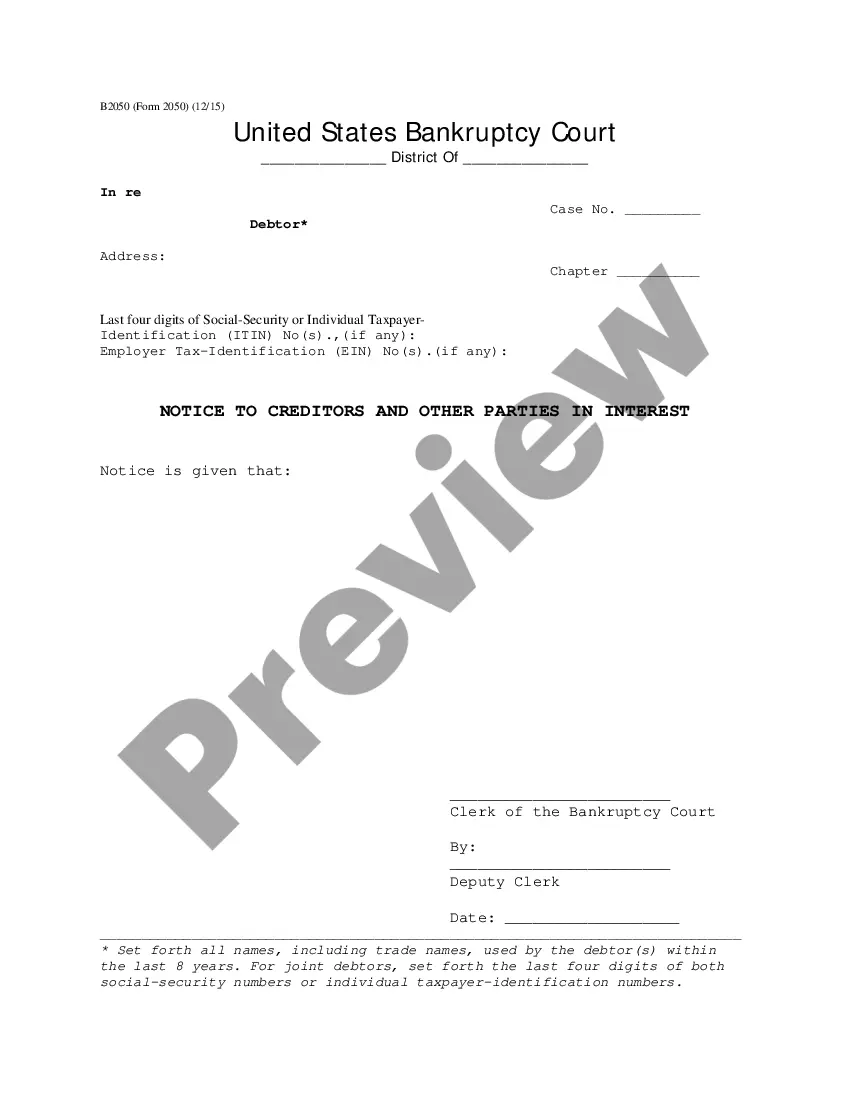

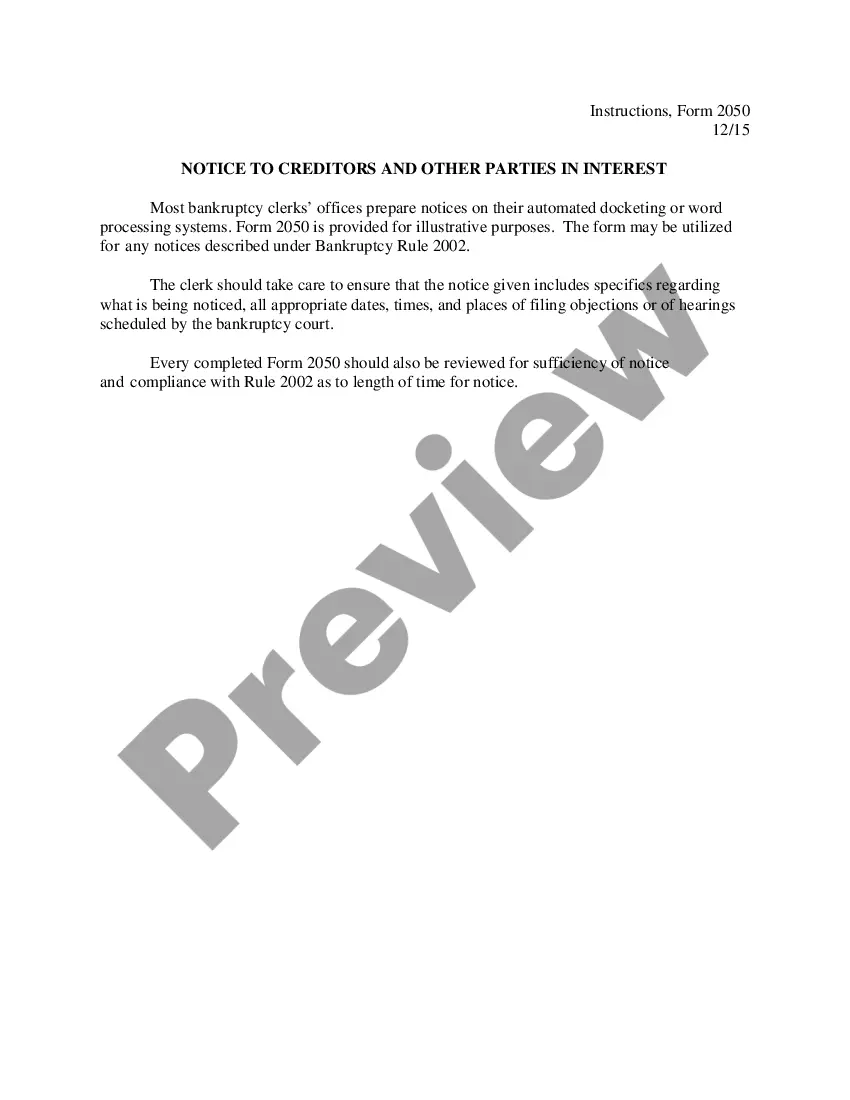

How to fill out Montana Notice To Creditors?

Get a printable Montana Notice to Creditors in just several clicks from the most comprehensive catalogue of legal e-documents. Find, download and print out professionally drafted and certified samples on the US Legal Forms website. US Legal Forms is the #1 supplier of affordable legal and tax templates for US citizens and residents online since 1997.

Customers who have already a subscription, need to log in directly into their US Legal Forms account, get the Montana Notice to Creditors and find it stored in the My Forms tab. Customers who don’t have a subscription must follow the steps listed below:

- Ensure your template meets your state’s requirements.

- If available, look through form’s description to learn more.

- If available, preview the shape to view more content.

- When you’re sure the form fits your needs, click on Buy Now.

- Create a personal account.

- Select a plan.

- through PayPal or credit card.

- Download the template in Word or PDF format.

When you’ve downloaded your Montana Notice to Creditors, you may fill it out in any online editor or print it out and complete it manually. Use US Legal Forms to get access to 85,000 professionally-drafted, state-specific documents.

Form popularity

FAQ

How to Notify Creditors of Death. Once your debts have been established, your surviving family members or the executor of your estate will need to notify your creditors of your death. They can do this by sending a copy of your death certificate to each creditor.

If you are unmarried and die without a valid will and last testament in Montana, then your entire estate goes to any surviving children in equal shares, or grandchildren if you don't have any surviving children. If you die intestate unmarried and with no children, then by law, your parents inherit your entire estate.

A notice to creditors is a public statement noting the death of an individual in order to alert potential creditors to the situation. Still published in local newspapers, the notice is filed by the estate's executor and meant to facilitate the probate proceedings.

Under Montana statute, where as estate is valued at less than $50,000, an interested party may, thirty (30) days after the death of the decedent, issue a small estate affidavit to to demand payment on any debts owed to the decedent.

In Montana, you can make a living trust to avoid probate for virtually any asset you ownreal estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).