This is a financing agreement addendum to the software/services master agreement order form. It includes terms on interest and prepayments.

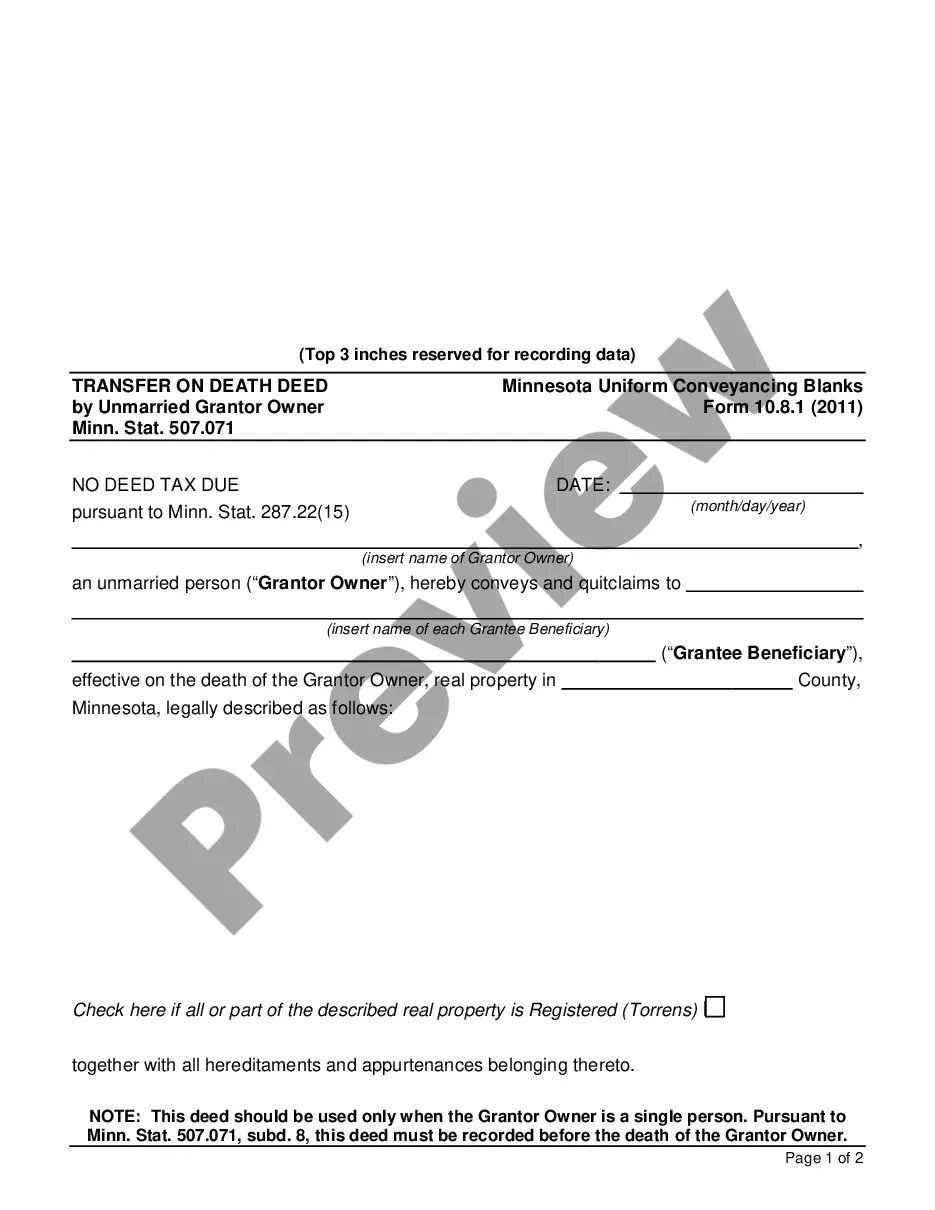

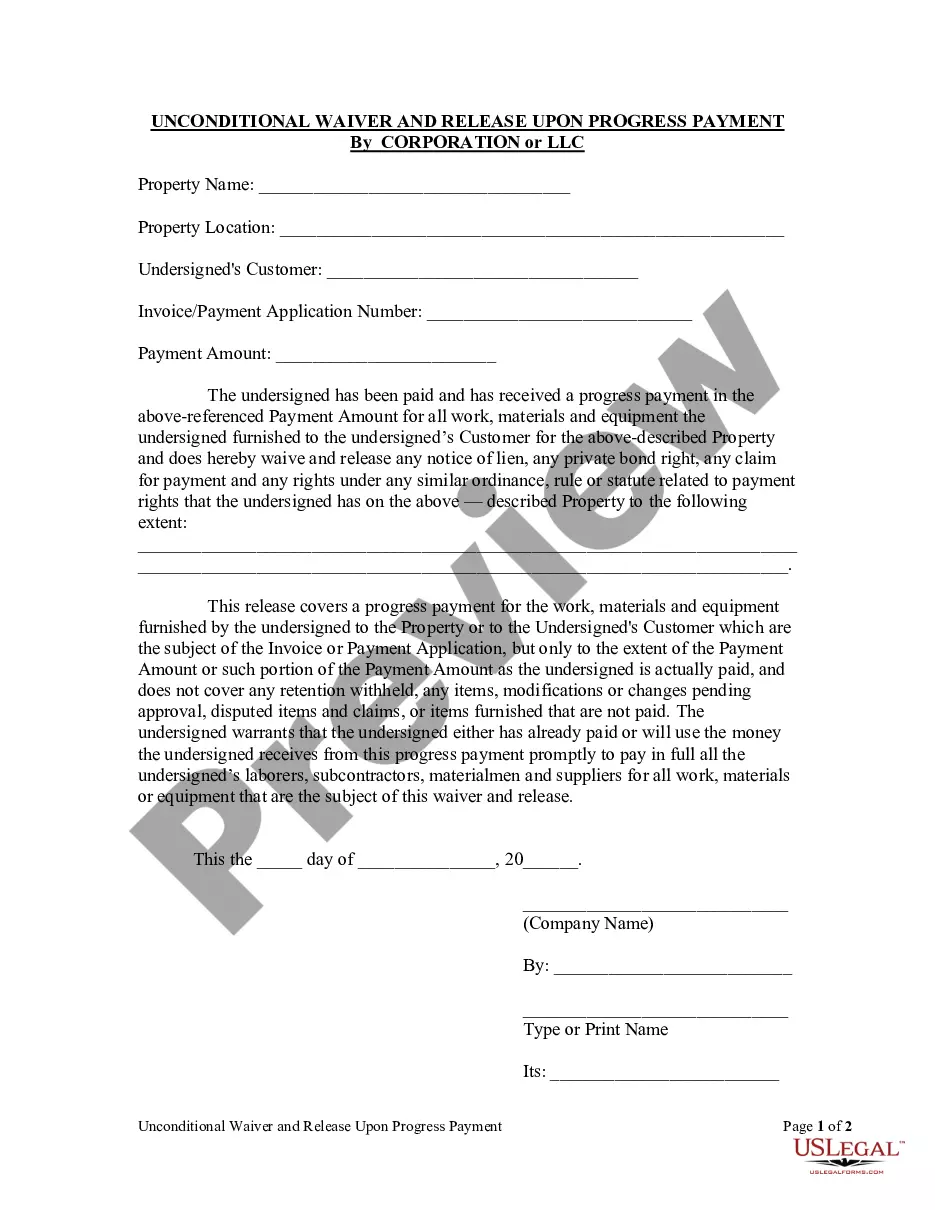

Mississippi Financing

Description

How to fill out Financing?

US Legal Forms - one of several largest libraries of legitimate kinds in the United States - provides a wide array of legitimate papers themes it is possible to acquire or printing. While using site, you may get a large number of kinds for enterprise and specific uses, sorted by types, suggests, or keywords and phrases.You can get the most recent types of kinds just like the Mississippi Financing in seconds.

If you currently have a registration, log in and acquire Mississippi Financing from your US Legal Forms collection. The Acquire key will appear on every single develop you see. You have access to all in the past delivered electronically kinds in the My Forms tab of your own bank account.

If you want to use US Legal Forms the first time, listed here are simple instructions to get you began:

- Ensure you have selected the best develop for the metropolis/region. Select the Review key to analyze the form`s articles. Browse the develop explanation to actually have selected the appropriate develop.

- In case the develop does not suit your specifications, make use of the Look for industry towards the top of the monitor to get the one which does.

- In case you are happy with the form, confirm your decision by clicking on the Buy now key. Then, select the costs prepare you want and give your references to register for an bank account.

- Procedure the transaction. Make use of your credit card or PayPal bank account to accomplish the transaction.

- Choose the formatting and acquire the form on the system.

- Make alterations. Complete, revise and printing and indication the delivered electronically Mississippi Financing.

Every format you included in your bank account lacks an expiry particular date and it is the one you have forever. So, in order to acquire or printing an additional duplicate, just proceed to the My Forms section and click on the develop you need.

Gain access to the Mississippi Financing with US Legal Forms, the most substantial collection of legitimate papers themes. Use a large number of professional and status-specific themes that fulfill your small business or specific demands and specifications.

Form popularity

FAQ

MESG awards up to $2,500 per academic year, but awards may not exceed tuition and required fees.

MTAG awards up to $500 per academic year for freshmen and sophomores and $1,000 per academic year for juniors and seniors.

The Mississippi Department of Banking and Consumer Finance's (DBCF) mission is to regulate, supervise, and safeguard financial institutions chartered and licensed in Mississippi.

The state offers three undergraduate grant programs: HELP, which awards full tuition for students with financial need; MTAG, which awards $500 per year to freshmen and sophomores and $1,000 per year to juniors and seniors; and.

The HELP Grant pays full tuition at public Mississippi colleges and universities (or the equivalent at a private Mississippi college or university). For more information visit the Mississippi Office of Student Financial Aid.

.DBCF.MS.GOV A Credit Availability loan is a binding contract to borrow money that is intended for short-term use and is not generally based on your credit report. This loan may be paid-off at any time. Paying off a loan early may result in paying less fees.

Be within one year of high school graduation (current college freshman). Score a minimum of 20 on the National ACT before enrolling as a first-time college student. Graduate high school with a minimum 2.5 cumulative GPA and have a minimum 2.5 cumulative college GPA. Complete a specific high school curriculum.

Federal Supplemental Educational Opportunity Grant (FSEOG) Mississippi Tuition Assistance Grant (MTAG) Mississippi Eminent Scholars Grant (MESG)