Mississippi Subordination Agreement (Deed of Trust to Storage Agreement)

Description

How to fill out Subordination Agreement (Deed Of Trust To Storage Agreement)?

Are you currently in the situation the place you will need documents for possibly enterprise or specific purposes virtually every day? There are a variety of legal file web templates available on the Internet, but finding types you can rely isn`t simple. US Legal Forms delivers a huge number of kind web templates, just like the Mississippi Subordination Agreement (Deed of Trust to Storage Agreement), that happen to be created in order to meet state and federal requirements.

Should you be presently familiar with US Legal Forms website and also have an account, basically log in. Following that, you can acquire the Mississippi Subordination Agreement (Deed of Trust to Storage Agreement) web template.

If you do not provide an account and need to start using US Legal Forms, follow these steps:

- Discover the kind you will need and ensure it is for your proper town/region.

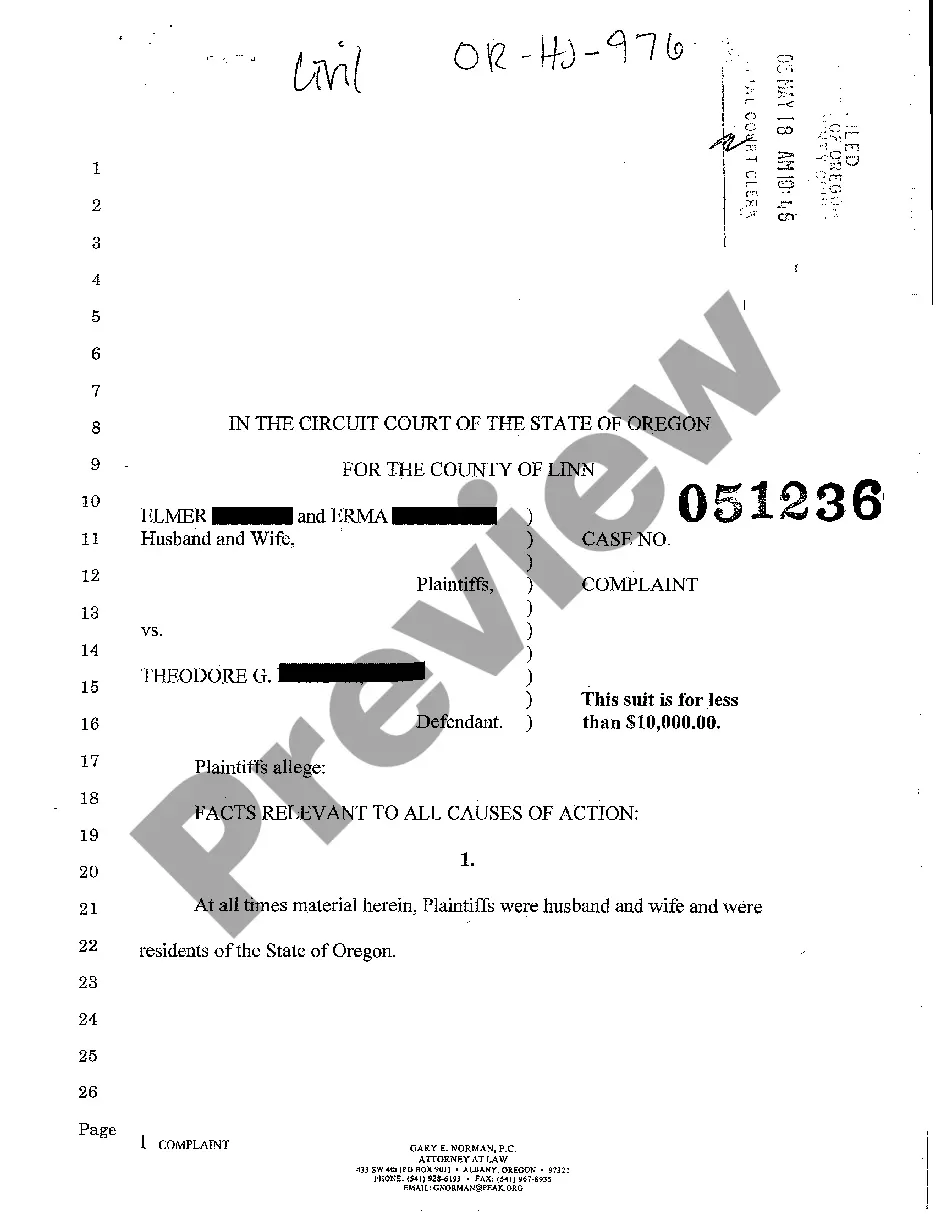

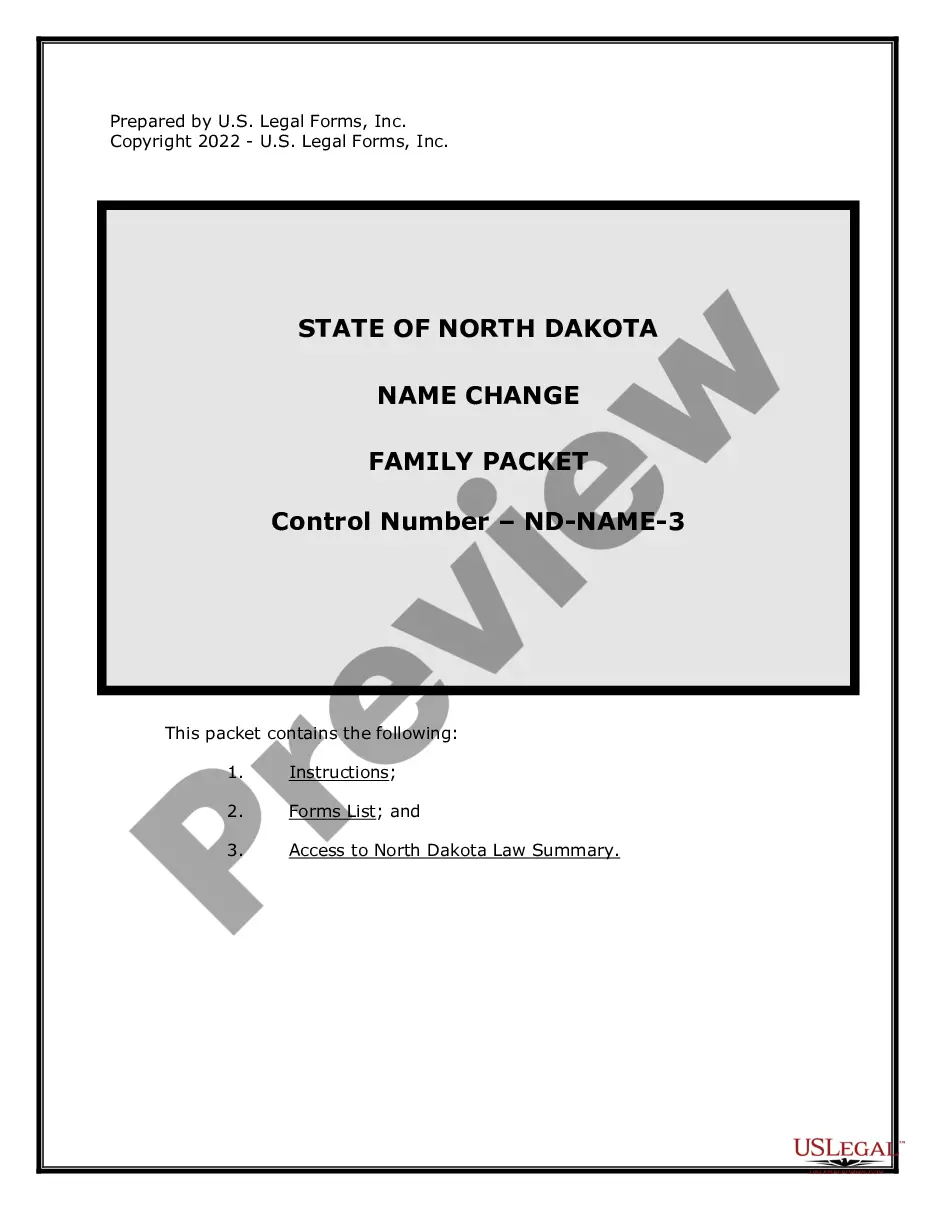

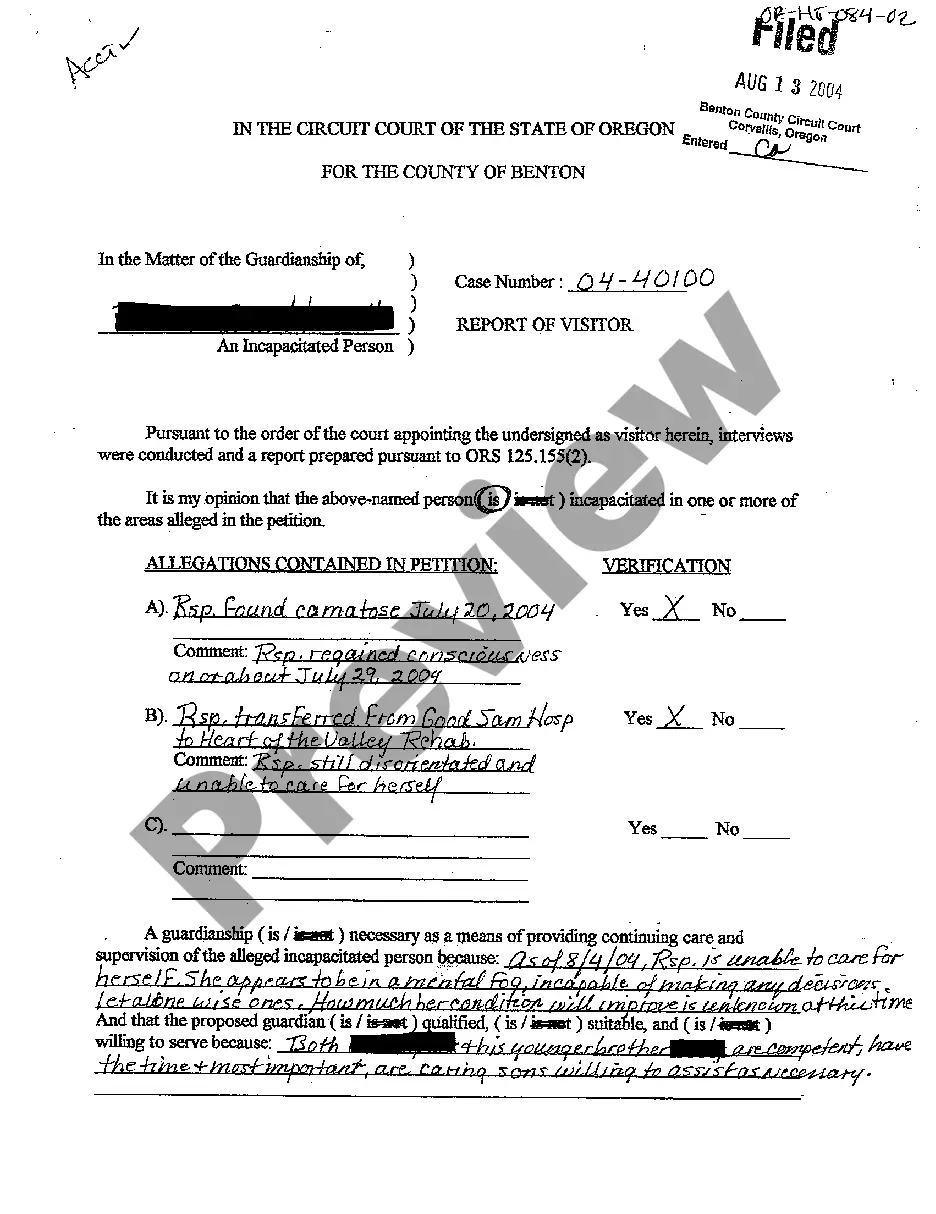

- Utilize the Preview switch to review the form.

- Browse the information to ensure that you have chosen the right kind.

- In the event the kind isn`t what you are seeking, use the Lookup discipline to find the kind that suits you and requirements.

- If you find the proper kind, click on Get now.

- Select the pricing strategy you would like, submit the required information to produce your bank account, and buy your order with your PayPal or bank card.

- Pick a practical file format and acquire your version.

Locate every one of the file web templates you might have purchased in the My Forms menus. You can get a more version of Mississippi Subordination Agreement (Deed of Trust to Storage Agreement) anytime, if required. Just select the required kind to acquire or print out the file web template.

Use US Legal Forms, one of the most considerable variety of legal types, to save some time and prevent faults. The assistance delivers skillfully produced legal file web templates that can be used for a range of purposes. Make an account on US Legal Forms and commence making your way of life a little easier.

Form popularity

FAQ

Subordination agreements ensure that a primary lender will be paid in the event the borrower takes on more debt. As with most legal documents, subordination agreements need to be notarized in order to be official in the eyes of the law.

For instance, usually a trust deed incorporating a subordination agreement will state that the lien of the trust deed will, on recordation, automatically be junior to the lien of another trust deed, or it will state that the new loan and deed of trust will, without any other or further instrument of subordination, ...

This Lease and any Option granted hereby shall be subject and subordinate to any ground lease, mortgage, deed of trust, or other hypothecation or security device (collectively, ?Security Device?), now or hereafter placed upon the Premises, to any and all advances made on the security thereof, and to all renewals, ...

Example of a Subordination Agreement A standard subordination agreement covers property owners that take a second mortgage against a property. One loan becomes the subordinated debt, and the other becomes (or remains) the senior debt. Senior debt has higher claim priority than junior debt.

A subordination clause is a clause in an agreement that states that the current claim on any debts will take priority over any other claims formed in other agreements made in the future.

Let's illustrate a subordinate clause in a sentence: 'I played out until it went dark. ' The phrase 'until it went dark' is the subordinate clause because it requires additional information in order to make sense.

The creditor usually will require the debtor to sign a subordination agreement which ensures they get paid before other creditors, ensuring they are not taking on high risks.