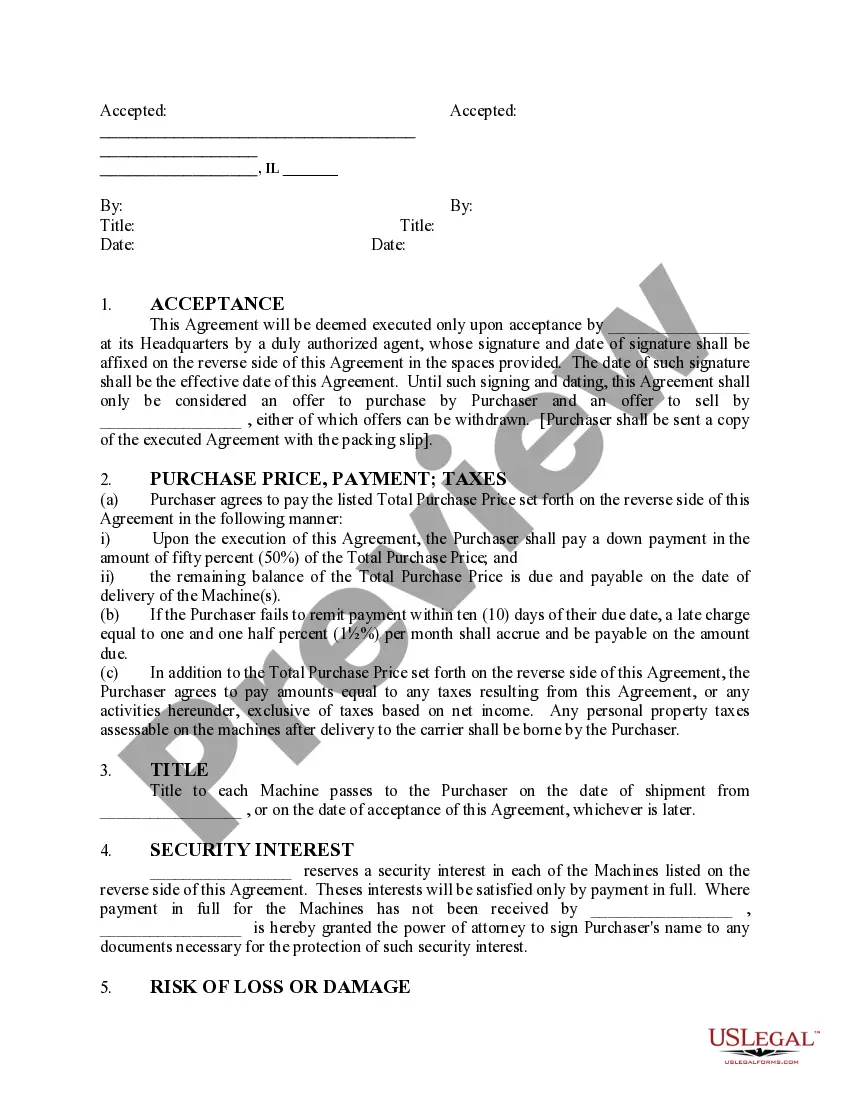

Mississippi Agreement for Sales of Data Processing Equipment

Description

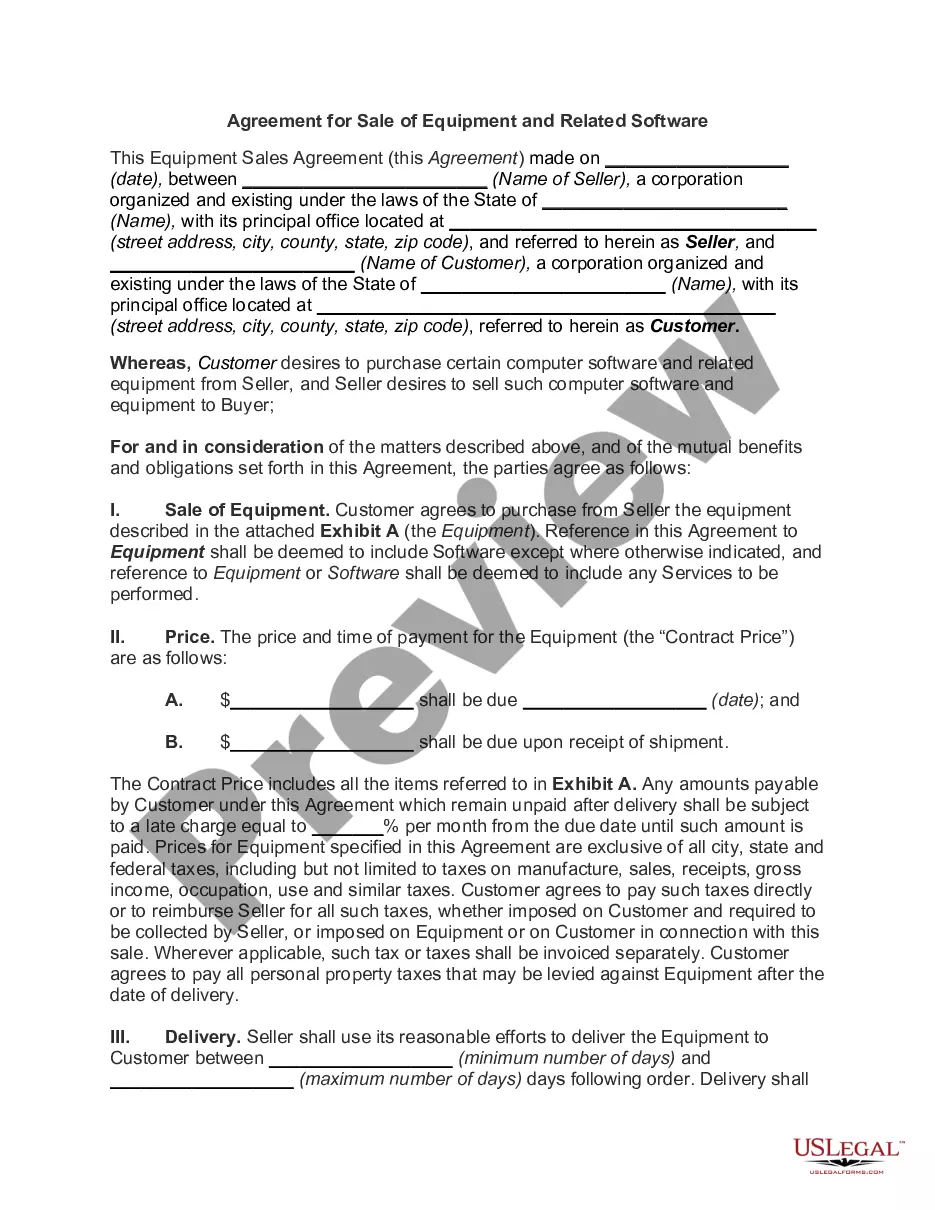

How to fill out Agreement For Sales Of Data Processing Equipment?

If you wish to complete, obtain, or create legal document templates, utilize US Legal Forms, the premier collection of legal documents available online.

Take advantage of the website's simple and straightforward search to find the forms you require. A wide range of templates for business and personal purposes are categorized by types and titles, or keywords.

Use US Legal Forms to locate the Mississippi Agreement for Sale of Data Processing Equipment with just a few clicks of the mouse.

Every legal document format you purchase is your property permanently. You will have access to every form you downloaded in your account. Click on the My documents section and choose a form to print or download again.

Stay competitive and acquire, and print the Mississippi Agreement for Sale of Data Processing Equipment with US Legal Forms. There are millions of professional and state-specific forms available for your business or personal needs.

- When you are already a US Legal Forms user, Log In to your account and click on the Download option to access the Mississippi Agreement for Sale of Data Processing Equipment.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the guidelines below.

- Step 1. Ensure you have selected the form for the correct state/country.

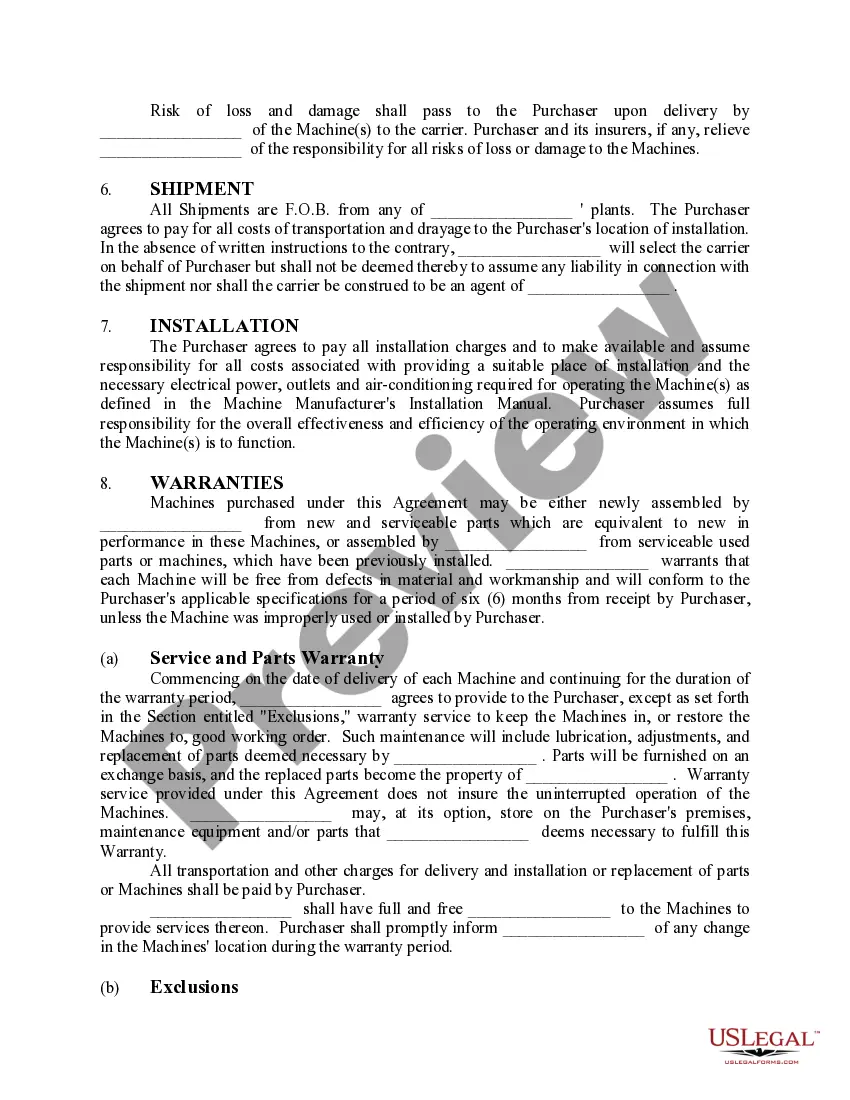

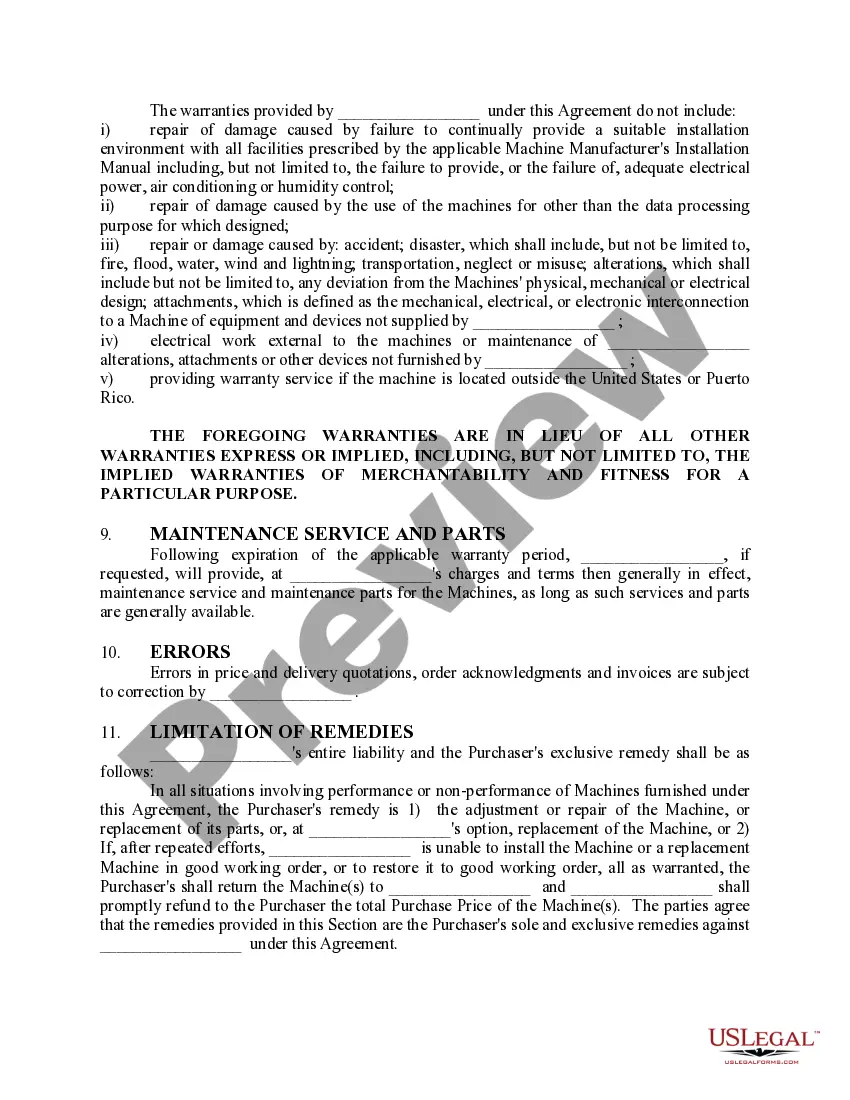

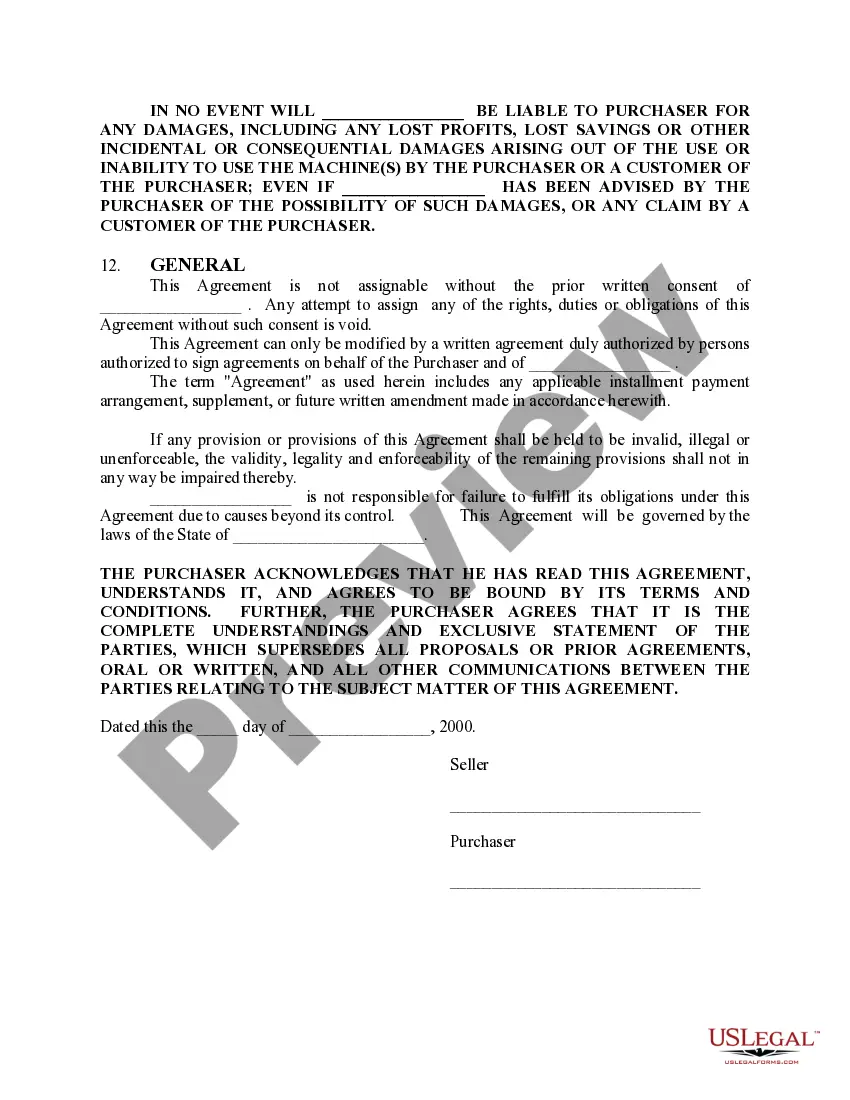

- Step 2. Use the Preview option to review the form's details. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other variations of the legal document template.

- Step 4. Once you have found the form you need, click the Buy now option. Choose the pricing plan you prefer and enter your information to register for an account.

- Step 5. Process the transaction. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Select the format of the legal document and download it to your device.

- Step 7. Complete, modify, and print or sign the Mississippi Agreement for Sale of Data Processing Equipment.

Form popularity

FAQ

Common mistakes in bills of sale often stem from missing key details or including vague descriptions of the equipment. Failing to list contact information for both parties or not mentioning warranties can create confusion later. Another frequent error is not understanding state requirements, which can lead to legal issues. Using resources like UsLegalForms can help you avoid these mistakes and create a solid Mississippi Agreement for Sales of Data Processing Equipment.

A bill of sale is not always a legal requirement in Mississippi; however, it's highly recommended for documenting transactions involving data processing equipment. This document helps protect both the seller and the buyer by establishing clear terms of the sale. If you plan to register the item or if there are significant values involved, having a bill of sale is crucial. Utilizing a Mississippi Agreement for Sales of Data Processing Equipment can streamline this process.

Several factors can void a bill of sale in Mississippi. If either party misrepresents the equipment or if there is a failure to disclose significant defects, the agreement may become invalid. Additionally, if one party was coerced into signing the bill or if the document lacks essential information, it may not hold up in court. To avoid these situations, ensure you have a clear Mississippi Agreement for Sales of Data Processing Equipment that both parties understand and agree upon.

In Mississippi, a verbal contract can be binding, but it is often difficult to enforce. This is especially relevant when dealing with significant transactions, such as a Mississippi Agreement for Sales of Data Processing Equipment. To avoid confusion, having a written agreement is advisable. Written agreements provide clear terms and proof of the arrangement, which helps avoid disputes.

The Mississippi Consumer Data Privacy Act is a significant piece of legislation aimed at safeguarding consumer data within the state. It mandates that businesses implement privacy practices that protect personal data from misuse. For parties engaged in the Mississippi Agreement for Sales of Data Processing Equipment, understanding this act is vital for maintaining compliance and ensuring the integrity of consumer transactions. Utilizing platforms like UsLegalForms can help navigate these legal requirements effectively.

The consumer privacy act in Mississippi is designed to provide residents with more control over their personal information. It outlines the requirements for businesses to disclose their data practices and allows consumers to opt-out of certain data sales. This act is particularly relevant to the Mississippi Agreement for Sales of Data Processing Equipment, as it addresses how personal data related to these transactions should be managed. Being informed about this act can empower you in your dealings.

The consumer privacy act establishes guidelines that protect individuals' personal data. It aims to enhance transparency about how businesses collect, use, and share personal information. For those involved in the Mississippi Agreement for Sales of Data Processing Equipment, this act ensures that consumer data remains secure and used appropriately. Knowing your rights under this act is important for making informed decisions regarding data handling.

In Mississippi, you can enter into a legally binding contract for personal property at the age of 18. This age marks the legal threshold where individuals gain the capacity to form contracts, including those related to the Mississippi Agreement for Sales of Data Processing Equipment. If you're under 18, you may need a guardian to help you finalize such agreements. Understanding this age limit is crucial for any transactions involving data processing equipment.

Yes, an LLC can operate without an operating agreement, but this scenario can lead to uncertainty. Without this document, state laws will govern the business, which may not align with your intentions. Thus, having an operating agreement is a proactive step to define roles and avoid disputes. Using the Mississippi Agreement for Sales of Data Processing Equipment can be essential in clearly outlining the terms of transactions related to your business.

The requirement for an operating agreement varies by state, with some states like Delaware, California, and New York strongly recommending it. While not all states mandate it, having an agreement can simplify governance and avoid legal issues. As you explore operating agreements, think about how the Mississippi Agreement for Sales of Data Processing Equipment can play a role in your business dealings and contracts.