Mississippi Visiting Professor Agreement - Self-Employed Independent Contractor

Description

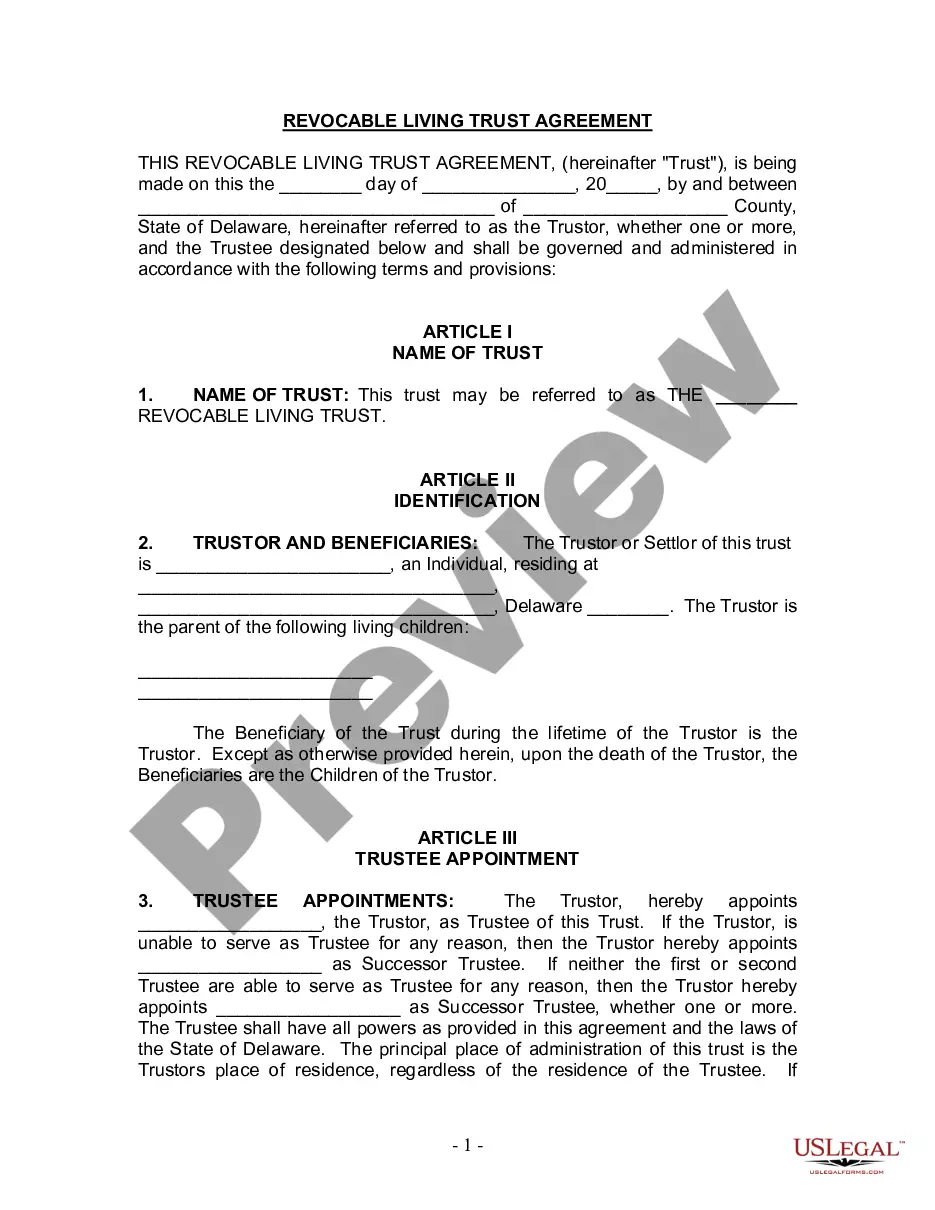

How to fill out Visiting Professor Agreement - Self-Employed Independent Contractor?

It is feasible to spend hours online searching for the legal document template that satisfies the state and federal requirements you seek.

US Legal Forms provides a vast array of legal forms that are reviewed by professionals.

You can conveniently download or print the Mississippi Visiting Professor Agreement - Self-Employed Independent Contractor from our services.

If available, use the Preview button to review the document template as well. To find an additional version of the form, use the Search field to locate the template that meets your requirements and specifications. After you have found the template you want, click on Get now to proceed. Select the pricing plan you prefer, enter your details, and register for a free account on US Legal Forms. Complete the transaction. You can use your credit card or PayPal account to purchase the legal form. Choose the format of the document and download it to your device. Make modifications to your document if necessary. You can complete, edit, sign, and print the Mississippi Visiting Professor Agreement - Self-Employed Independent Contractor. Obtain and print a wide range of document templates using the US Legal Forms website, which offers the largest selection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you already have a US Legal Forms account, you can Log In and click on the Obtain button.

- Then, you can complete, modify, print, or sign the Mississippi Visiting Professor Agreement - Self-Employed Independent Contractor.

- Each legal document template you purchase is yours indefinitely.

- To obtain an additional copy of any purchased form, go to the My documents tab and click on the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the location/city of your choice.

- Review the form description to confirm you have selected the appropriate form.

Form popularity

FAQ

Often, adjunct professors operate as independent contractors, especially under a Mississippi Visiting Professor Agreement - Self-Employed Independent Contractor. They typically teach on a part-time basis without a long-term employment commitment. This arrangement provides both the professor and the institution with the ability to adjust teaching assignments as needed, fostering a dynamic educational environment. Therefore, if you are an adjunct professor, it’s important to understand your status as an independent contractor.

Yes, an independent contractor is classified as self-employed. This means they work for themselves and are not tied to a single employer. In the context of a Mississippi Visiting Professor Agreement - Self-Employed Independent Contractor, this classification allows for greater flexibility in how they manage their work and finances. Understanding this distinction is essential for both the contractor and the educational institution.

Creating an independent contractor agreement involves several straightforward steps. First, outline the scope of work, terms of payment, and duration of the project. Next, ensure you include clauses that highlight the independent contractor's status, as well as any necessary confidentiality or non-compete agreements. Using a Mississippi Visiting Professor Agreement - Self-Employed Independent Contractor template from US Legal Forms can simplify this process, providing you with legal protection while saving you time and effort.

Yes, adjunct faculty can often be classified as independent contractors depending on their specific agreements. This classification allows them the flexibility to teach courses while maintaining other professional engagements. If you’re an adjunct using a Mississippi Visiting Professor Agreement - Self-Employed Independent Contractor, recognizing this status can be beneficial for your professional planning.

The independent contractor law in Mississippi defines criteria determining who qualifies as an independent contractor. This classification impacts tax responsibilities, benefits, and legal rights. For those under a Mississippi Visiting Professor Agreement - Self-Employed Independent Contractor, understanding these regulations ensures you navigate your work situation confidently.

In recent updates, laws effective July 1, 2025, address the classification of workers and create more protections for independent contractors. This includes adjustments to tax obligations and benefits that may apply to your work situation. As someone involved in a Mississippi Visiting Professor Agreement - Self-Employed Independent Contractor, it is crucial to be aware of these changes to remain compliant.

The new federal rule focuses on clarifying what defines an independent contractor versus an employee. This distinction impacts benefits and protections workers are entitled to. For professionals engaging in activities under the Mississippi Visiting Professor Agreement - Self-Employed Independent Contractor, staying abreast of these rules can enhance your work status understanding.

Filling out an independent contractor agreement involves several steps including defining the scope of work, payment terms, and duration of the contract. This ensures both parties have a clear understanding and agreement on the expectations. Resources like uslegalforms can assist you in creating a comprehensive Mississippi Visiting Professor Agreement - Self-Employed Independent Contractor to minimize misunderstandings.

As an independent contractor in Mississippi, you have rights that include payment for services provided and the ability to determine your work schedule. Additionally, your agreement, like the Mississippi Visiting Professor Agreement - Self-Employed Independent Contractor, should outline your specific terms and responsibilities. Understanding these rights empowers you to maintain control over your work and remuneration.

The new contractor law in Mississippi clarifies the criteria for classifying workers as independent contractors. Knowing these specifics helps many professionals, particularly those in agreements like the Mississippi Visiting Professor Agreement - Self-Employed Independent Contractor, understand their status. Staying updated on these regulations can protect your rights and ensure you operate legally.