Mississippi Data Entry Employment Contract - Self-Employed Independent Contractor

Description

How to fill out Data Entry Employment Contract - Self-Employed Independent Contractor?

Are you currently in the location where you need documentation for occasional organizational or specific purposes almost every day.

There are numerous legal document templates accessible online, but finding ones you can rely on isn't simple.

US Legal Forms offers thousands of template formats, including the Mississippi Data Entry Employment Contract - Self-Employed Independent Contractor, which are designed to meet state and federal requirements.

Choose the payment method you prefer, provide the necessary information to create your account, and complete the transaction using your PayPal or credit card.

Select a suitable file format and download your copy.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Mississippi Data Entry Employment Contract - Self-Employed Independent Contractor template.

- If you do not possess an account and wish to start using US Legal Forms, follow these steps.

- Locate the template you need and confirm it is for the correct jurisdiction/area.

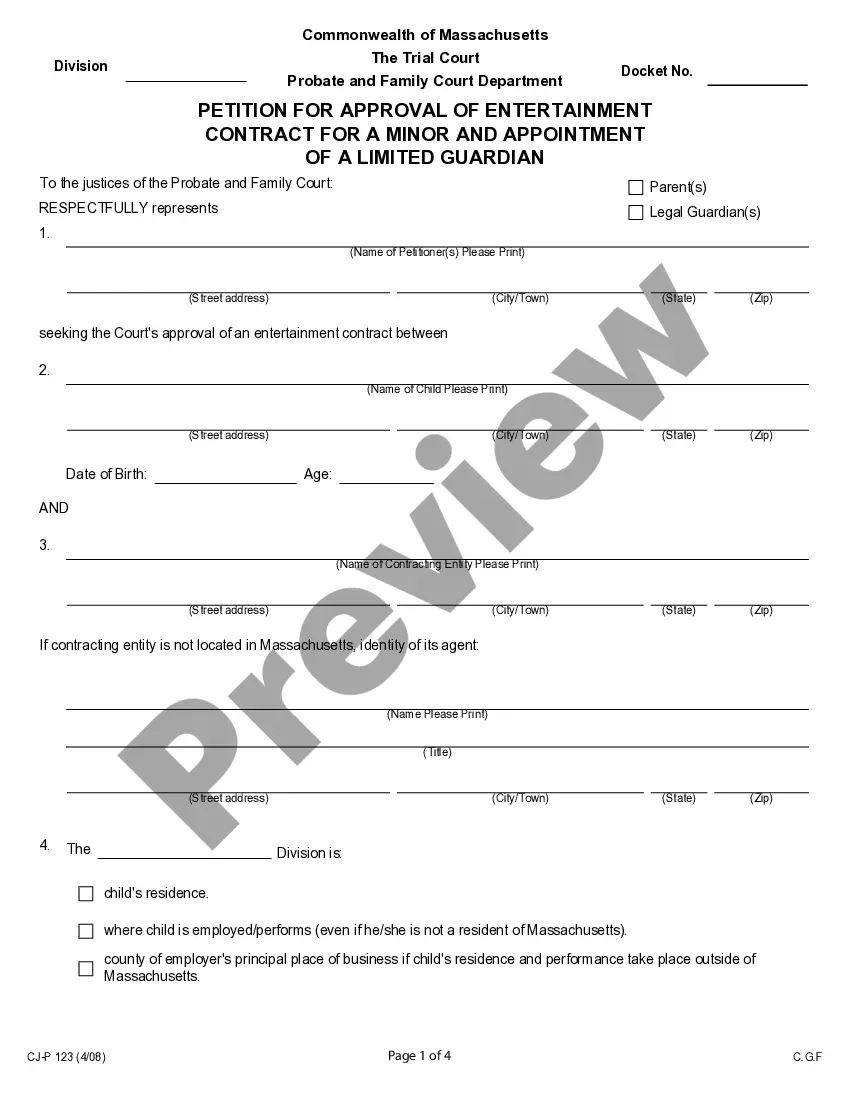

- Use the Preview button to examine the template.

- Read the description to ensure you have selected the right template.

- If the template isn't what you're looking for, utilize the Search field to find the template that fits your needs and requirements.

- Once you find the correct template, click Purchase now.

Form popularity

FAQ

Absolutely, as a self-employed individual, having a contract is not only possible but advisable. A contract ensures that both you and your clients have a clear understanding of the scope of work, payment terms, and deadlines. This formal agreement helps foster trust and accountability in your professional relationships. To solidify agreements, consider using a Mississippi Data Entry Employment Contract - Self-Employed Independent Contractor.

Yes, having a contract as an independent contractor is essential for outlining the terms of your work. This document provides legal protection and clarifies expectations between you and your clients. A well-crafted contract can prevent misunderstandings and safeguard your rights as a worker. You can utilize a Mississippi Data Entry Employment Contract - Self-Employed Independent Contractor to formalize your agreements.

Both terms describe similar work arrangements, but using 'self-employed' emphasizes your overall business ownership. On the other hand, 'independent contractor' specifies a contractual relationship with clients. Depending on your situation, you may choose one term over the other, but both indicate autonomy in your work. Consider implementing a Mississippi Data Entry Employment Contract - Self-Employed Independent Contractor to define your role more clearly.

New rules for self-employed individuals often focus on tax obligations, benefits, and reporting requirements. It's important to stay informed about these changes to ensure compliance and make the most of available tax deductions. Consulting with a legal or financial advisor can help you navigate these regulations effectively. For a clearer understanding, exploring a Mississippi Data Entry Employment Contract - Self-Employed Independent Contractor might also be beneficial.

To provide proof of employment as an independent contractor, you should gather items like signed contracts, detailed invoices, and your 1099 forms at tax time. Additionally, including references from clients or documenting your work experience can strengthen your case. When utilizing your Mississippi Data Entry Employment Contract - Self-Employed Independent Contractor, you not only validate your work but also create a professional profile that establishes your credibility.

To show proof that you are self-employed, start by compiling evidence such as your business license, contracts with clients, and tax returns that detail your income. Keeping your Mississippi Data Entry Employment Contract - Self-Employed Independent Contractor on hand can help you demonstrate your self-employment status. This documentation will serve you well whether you need to apply for loans or verify your income.

An independent contractor can show proof of employment through various documents such as contracts, invoices, and 1099 forms. Providing clients or banks with a copy of your Mississippi Data Entry Employment Contract - Self-Employed Independent Contractor can further substantiate your working status. It's crucial to maintain accurate records of your work history to reinforce your employment claims effectively.

Yes, you can absolutely be self-employed and have a contract. In fact, contracts often help you clarify the terms of your work and the expectations of both parties involved. A properly drafted Mississippi Data Entry Employment Contract - Self-Employed Independent Contractor can protect your rights and outline your responsibilities clearly, enabling a smoother working relationship with your clients.

In Mississippi, independent contractor laws define the relationship between the contractor and the client, focusing on control and independence. Generally, if you control how your work is done and provide your tools, you are likely classified as an independent contractor. Understanding these legal frameworks helps you establish your Mississippi Data Entry Employment Contract - Self-Employed Independent Contractor correctly to ensure compliance and protection.

Yes, independent contractors file as self-employed individuals when it comes to tax obligations. This means you will report your income and expenses on Schedule C of your tax return. It is essential to understand how to track your finances properly to comply with tax requirements. Your Mississippi Data Entry Employment Contract - Self-Employed Independent Contractor will guide you in managing these aspects effectively.