Mississippi Incentive Stock Option Plan of the Bankers Note, Inc.

Description

How to fill out Incentive Stock Option Plan Of The Bankers Note, Inc.?

Discovering the right legal document web template might be a have a problem. Of course, there are a variety of templates available on the Internet, but how would you get the legal form you will need? Utilize the US Legal Forms site. The services offers 1000s of templates, such as the Mississippi Incentive Stock Option Plan of the Bankers Note, Inc., that you can use for enterprise and private requirements. All of the varieties are examined by pros and meet federal and state requirements.

If you are previously registered, log in to the accounts and click the Down load option to get the Mississippi Incentive Stock Option Plan of the Bankers Note, Inc.. Utilize your accounts to search with the legal varieties you might have ordered in the past. Check out the My Forms tab of your respective accounts and acquire another version of the document you will need.

If you are a new consumer of US Legal Forms, listed here are basic directions so that you can stick to:

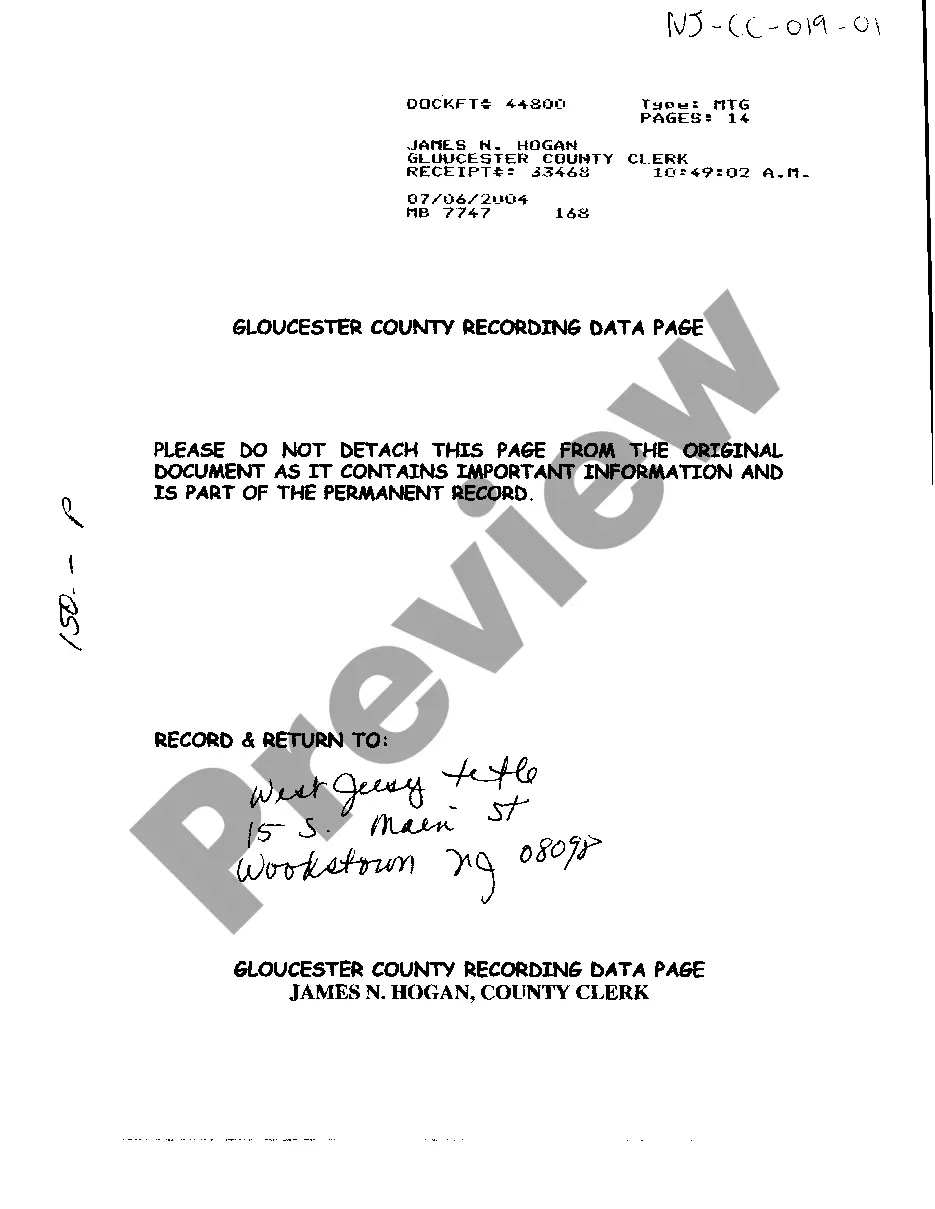

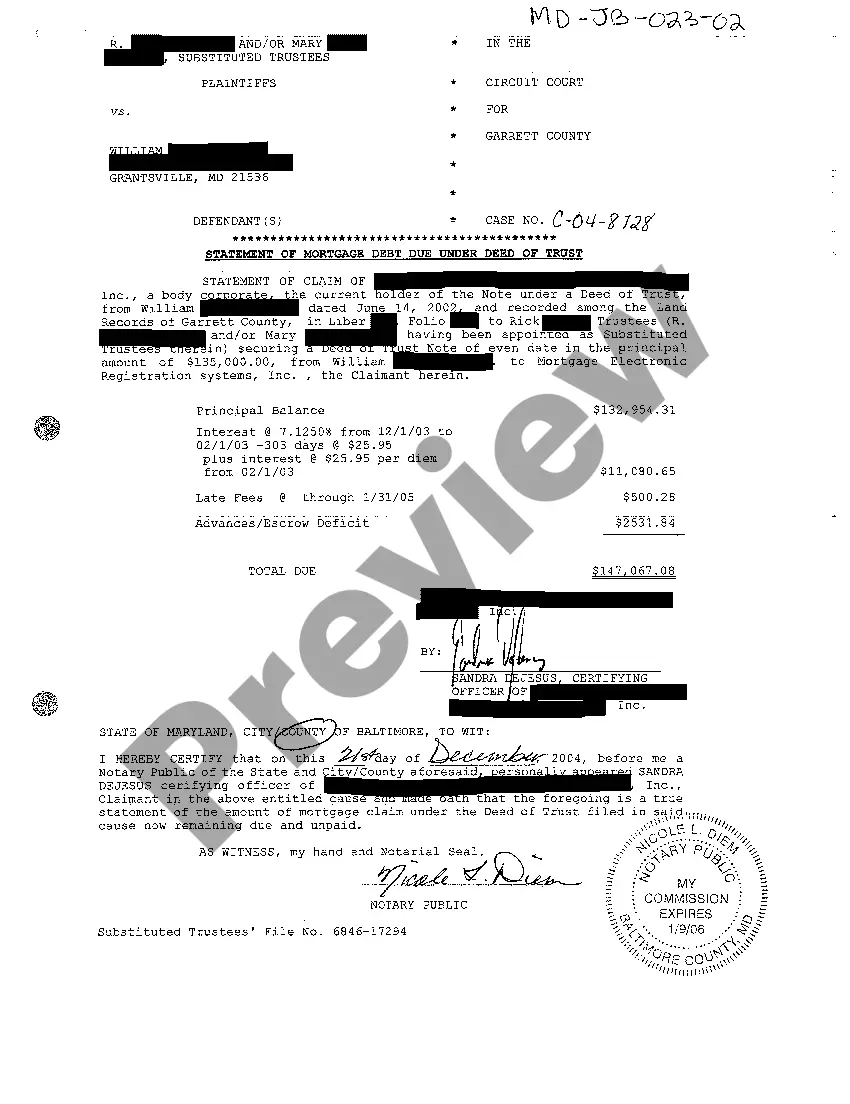

- Initial, ensure you have selected the right form for your town/state. It is possible to examine the form while using Review option and look at the form information to make sure it is the right one for you.

- In case the form fails to meet your expectations, take advantage of the Seach industry to find the appropriate form.

- When you are certain that the form would work, go through the Buy now option to get the form.

- Opt for the rates strategy you desire and enter in the required information and facts. Create your accounts and pay for the transaction utilizing your PayPal accounts or bank card.

- Pick the data file format and acquire the legal document web template to the product.

- Complete, edit and produce and indicator the received Mississippi Incentive Stock Option Plan of the Bankers Note, Inc..

US Legal Forms is the biggest library of legal varieties where you can discover different document templates. Utilize the service to acquire skillfully-made documents that stick to condition requirements.

Form popularity

FAQ

An incentive stock option (ISO) is a corporate benefit that gives an employee the right to buy shares of company stock at a discounted price with the added benefit of possible tax breaks on the profit.

When you're granted stock options, you have the option to purchase company stock at a specific price before a certain date. Whether you actually purchase the stock is entirely up to you. RSUs, on the other hand, grant you the stock itself once the vesting period is complete. You don't have to purchase it.

Your ESPP will have set offering and purchase periods, while a stock option grant has a set term in which you can exercise the options after they vest. The purchase price of stock under a tax-qualified Section 423 ESPP is typically discounted in some way from the market price at purchase.

Incentive stock options (ISOs) are a form of equity compensation that allows you to buy company shares for a specific exercise price. ISOs are a type of stock option?they are not actual shares of stock; you must exercise (buy) your options to become a shareholder.

A stock option plan is a mechanism for affording selected employees and executives or managers of a company the opportunity to acquire stock in their company at a price determined at the time the options are granted and fixed for the term of the options.

There are many requirements on using ISOs. First, the employee must not sell the stock until after two years from the date of receiving the options, and they must hold the stock for at least a year after exercising the option like other capital gains. Secondly, the stock option must last ten years.

Taxes and Incentive Stock Options Although no tax is withheld when you exercise an ISO, tax may be due later when you sell the stock, as illustrated by the examples in this article. Be sure to plan for the tax consequences when you consider the consequences of selling the stock.

Summary of ISO vs. NSO Differences Incentive Stock Options (ISOs)Non-Qualified Stock Options (NSOs)Eligible RecipientsEmployees onlyAny service provider (e.g. employees, advisors, consultants, directors)Tax at GrantNo tax eventNo tax event10 more rows