Mississippi Ratification and approval of directors and officers insurance indemnity fund with copy of agreement

Description

How to fill out Ratification And Approval Of Directors And Officers Insurance Indemnity Fund With Copy Of Agreement?

Have you been in a position in which you will need papers for either company or specific purposes just about every time? There are a variety of lawful file themes available online, but getting types you can trust is not simple. US Legal Forms provides thousands of form themes, much like the Mississippi Ratification and approval of directors and officers insurance indemnity fund with copy of agreement, that are written in order to meet state and federal needs.

In case you are previously informed about US Legal Forms internet site and possess an account, basically log in. After that, you can down load the Mississippi Ratification and approval of directors and officers insurance indemnity fund with copy of agreement template.

Unless you provide an accounts and need to start using US Legal Forms, follow these steps:

- Obtain the form you need and make sure it is for your right metropolis/county.

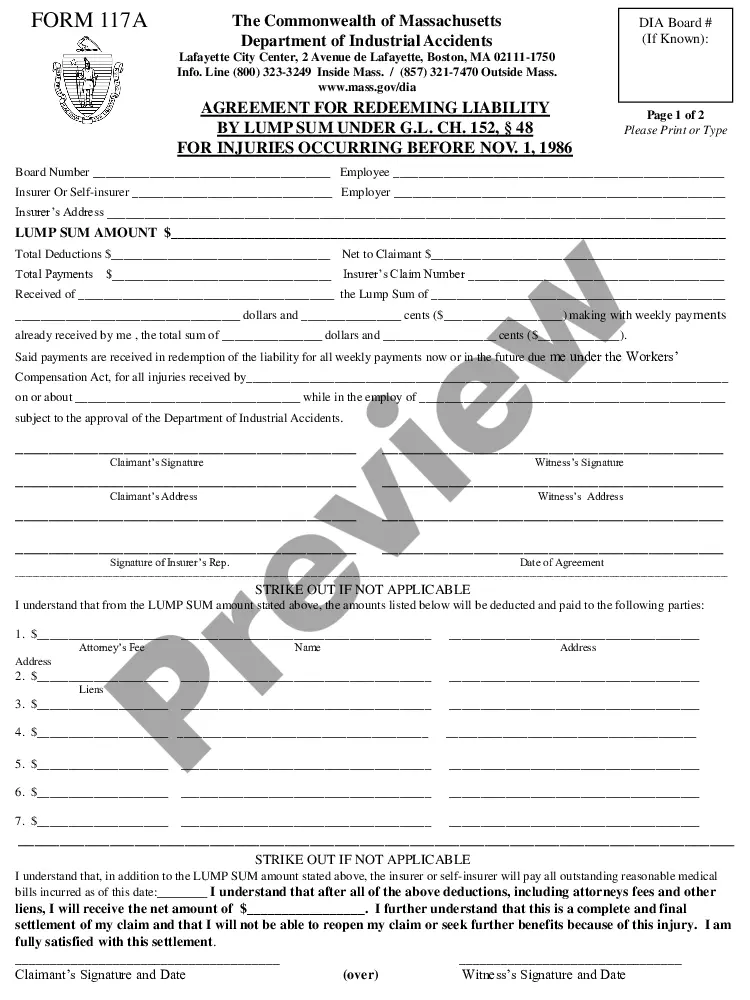

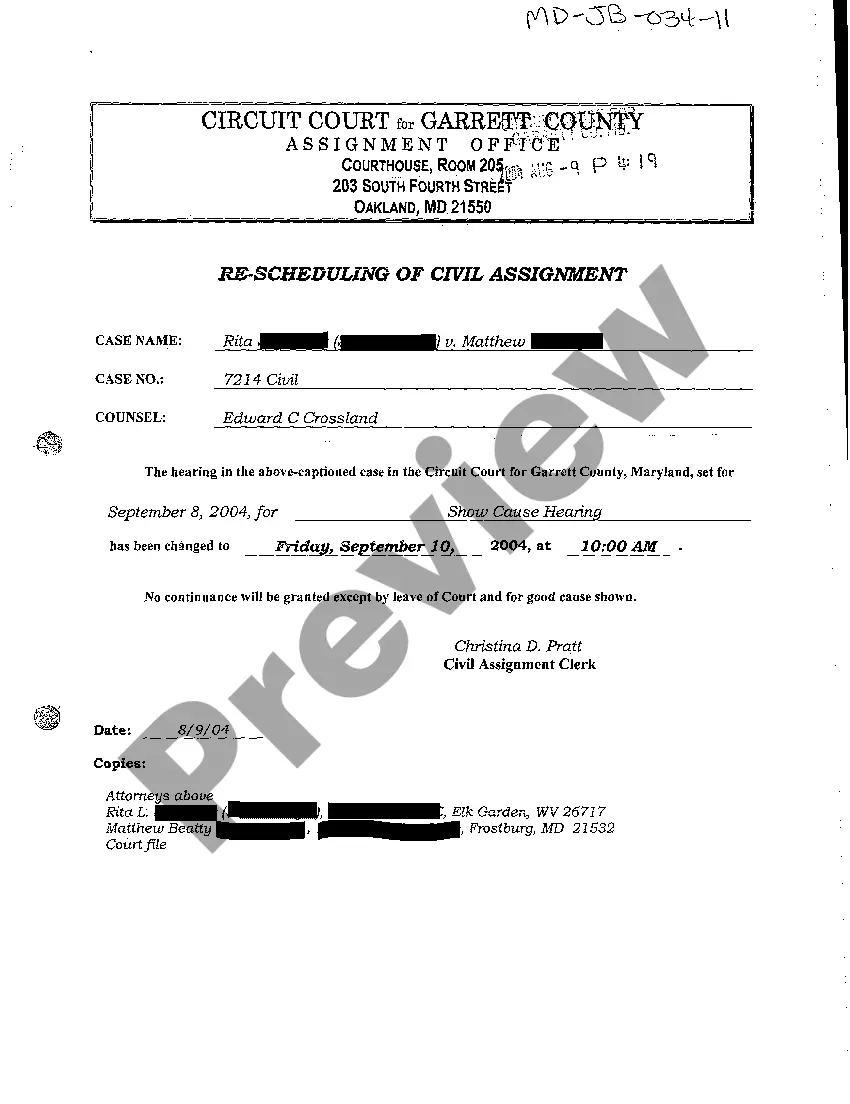

- Utilize the Review button to analyze the form.

- Look at the information to ensure that you have chosen the appropriate form.

- If the form is not what you`re trying to find, utilize the Look for industry to find the form that fits your needs and needs.

- Once you get the right form, click on Purchase now.

- Choose the prices plan you need, fill out the necessary information to create your money, and pay money for an order using your PayPal or Visa or Mastercard.

- Choose a hassle-free paper format and down load your copy.

Find each of the file themes you might have purchased in the My Forms menus. You can get a more copy of Mississippi Ratification and approval of directors and officers insurance indemnity fund with copy of agreement at any time, if needed. Just click on the essential form to down load or print out the file template.

Use US Legal Forms, the most comprehensive assortment of lawful types, in order to save time as well as prevent blunders. The support provides professionally produced lawful file themes that you can use for a variety of purposes. Generate an account on US Legal Forms and start making your way of life a little easier.

Form popularity

FAQ

Under a typical indemnification provision, the employer agrees to indemnify the executive against lawsuits, claims, or demands against the employee resulting from the employee's good faith performance of his or her duties and obligations.

Indemnification is often very broad, often extending ?to the maximum extent permitted by law?, whereas D&O insurance polices contain numerous exclusions and conditions. In addition, D&O insurance must be renewed each year, with possible changes in terms and conditions.

How to Write an Indemnity Agreement Consider the Indemnity Laws in Your Area. ... Draft the Indemnification Clause. ... Outline the Indemnification Period and Scope of Coverage. ... State the Indemnification Exceptions. ... Specify How the Indemnitee Notifies the Indemnitor About Claims. ... Write the Settlement and Consent Clause.

Indemnification is, generally speaking, a reimbursement by a company of its Ds&Os for expenses or losses they have incurred in connection with litigation or other proceedings relating to their service to the company.

A letter of indemnity (LOI) is a legal agreement that renders one or both parties to a contract harmless by some third party in the event of a delinquency or breach by the contracted parties. In other words, the party or parties are indemnified against a possible loss by some third party, such as an insurance company.

A D&O policy protects a director or officer's assets and reimburses them for settlements and legal expenses resulting from such litigation and cases. The purpose of professional indemnity insurance is to protect professionals against claims resulting from mistakes or omissions they have made.

Indemnification, also referred to as indemnity, is an undertaking by one party (the indemnifying party) to compensate the other party (the indemnified party) for certain costs and expenses, typically stemming from third-party claims.

A company may, however, lend money to a director to fund the director's defence costs. Frequently, an indemnity will include a provision under which the company agrees to lend the director the amounts necessary to fund the director's defence costs.