Mississippi Notice of Meeting of LLC Members To Consider Annual Disbursements to Members of the Company

Description

How to fill out Notice Of Meeting Of LLC Members To Consider Annual Disbursements To Members Of The Company?

It is feasible to spend time online trying to locate the valid document format that meets the federal and state requirements you need.

US Legal Forms provides a vast array of valid forms that can be assessed by professionals.

You can effortlessly download or print the Mississippi Notice of Meeting of LLC Members to Discuss Annual Disbursements to Members of the Company from our service.

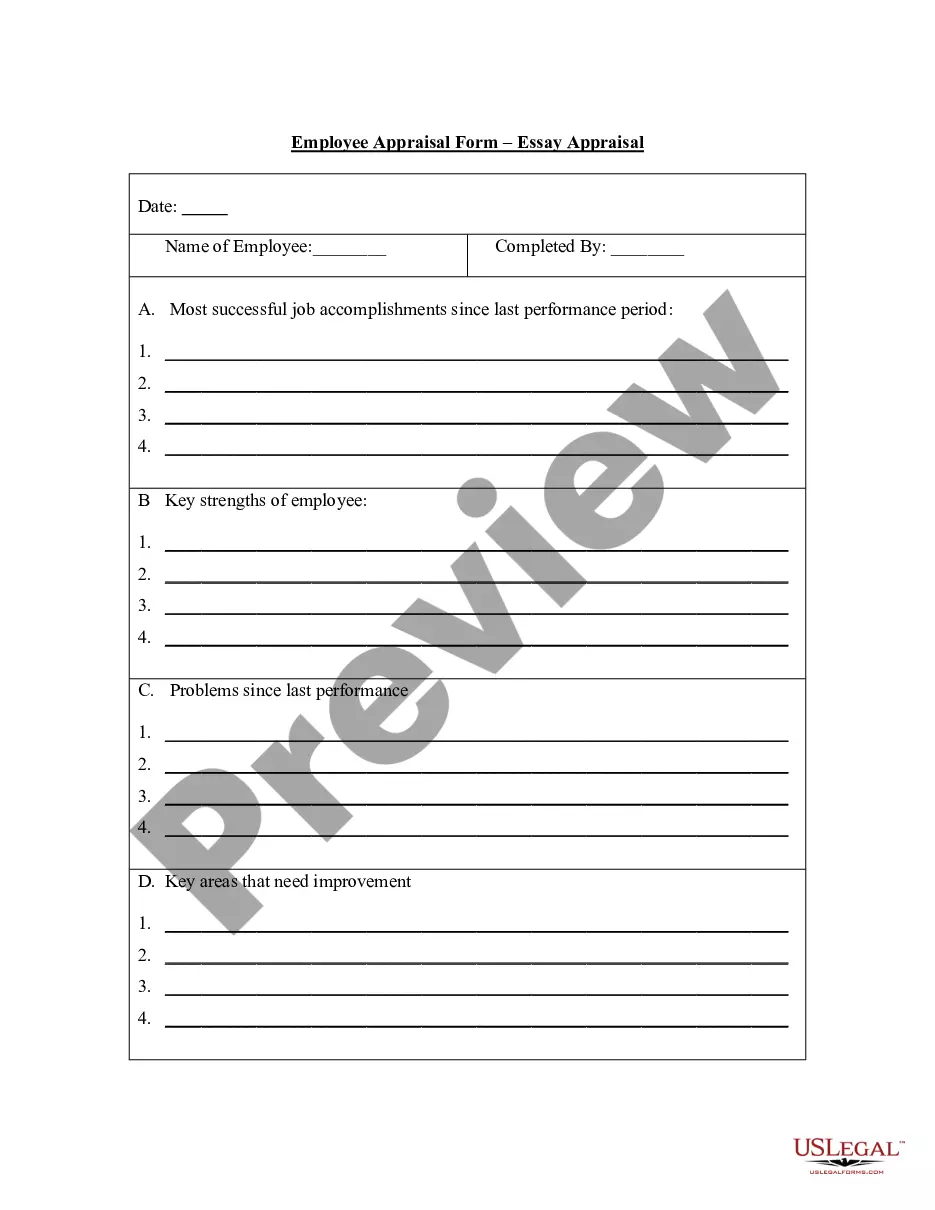

If available, use the Preview option to review the document format as well.

- If you possess a US Legal Forms account, you can sign in and then click the Acquire button.

- Afterward, you can fill out, modify, print, or sign the Mississippi Notice of Meeting of LLC Members to Discuss Annual Disbursements to Members of the Company.

- Each valid document format you purchase is yours permanently.

- To obtain another copy of any acquired form, navigate to the My documents section and click the corresponding option.

- If this is your first time using the US Legal Forms website, follow the simple instructions below.

- First, ensure that you have selected the correct document format for your area/city of choice.

- Check the form description to ensure you have chosen the appropriate document.

Form popularity

FAQ

Mississippi Operating Agreement FAQsNo, an Operating Agreement is not legally required in the state of Mississippi. But you are strongly encouraged to draft one to help ensure you have a clearly defined ownership structure and outline for the operating procedures of your business.

Personal guaranties. This happens when the shareholders/members undertake to personally guarantee the corporation's obligations to the extent specified in a guarantee. It is common for small business owners to sign limited or unlimited personal guarantees for their business to borrow money.

A corporation is an incorporated entity designed to limit the liability of its owners (called shareholders). Generally, shareholders are not personally liable for the debts of the corporation. Creditors can only collect on their debts by going after the assets of the corporation.

Your LLC's Liability for Members' Personal Debtsgetting a court to order that the LLC pay to the creditor all the money due to the LLC owner/debtor from the LLC (this is called a "charging order") foreclosing on the owner/debtor's LLC ownership interest, or. getting a court to order the LLC to be dissolved.

A Statement of Organizer is a document that states the initial members or managers of an LLC. The authorized person/organizer at IncNow prepares this document. While the Operating Agreement should be sufficient proof of ownership, some banks require further assurance.

A member of the LLC should have an ethical responsibility to meet the obligations of the firm. They should have duty of care.

Find InformationChecking a company's letterhead.Visiting a secretary of state website to find out where an LLC conducts business.Searching articles of organization records.

Those LLC members who operate the business owe the fiduciary duties of loyalty and reasonable care to the non-managing LLC owners. Depending upon your state, LLC members may be able to revise, broaden, or eliminate these fiduciary duties by contract or under the conditions of their LLC operating agreement.

Your EIN confirmation letter does show LLC ownership. This is a document sent directly from the IRS (Internal Revenue Service). It will show your EIN, LLC name and the member of the LLC who is the authorized responsible member!