Mississippi Annuity as Consideration for Transfer of Securities

Description

How to fill out Annuity As Consideration For Transfer Of Securities?

Are you presently in a situation where you require documents for either business or personal purposes almost every day.

There are many legal document templates available online, but finding reliable ones is not easy.

US Legal Forms offers thousands of form templates, including the Mississippi Annuity as Consideration for Transfer of Securities, designed to comply with state and federal regulations.

Once you locate the correct form, click Get now.

Choose the payment plan you prefer, complete the required information to create your account, and pay for the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Next, you can download the Mississippi Annuity as Consideration for Transfer of Securities template.

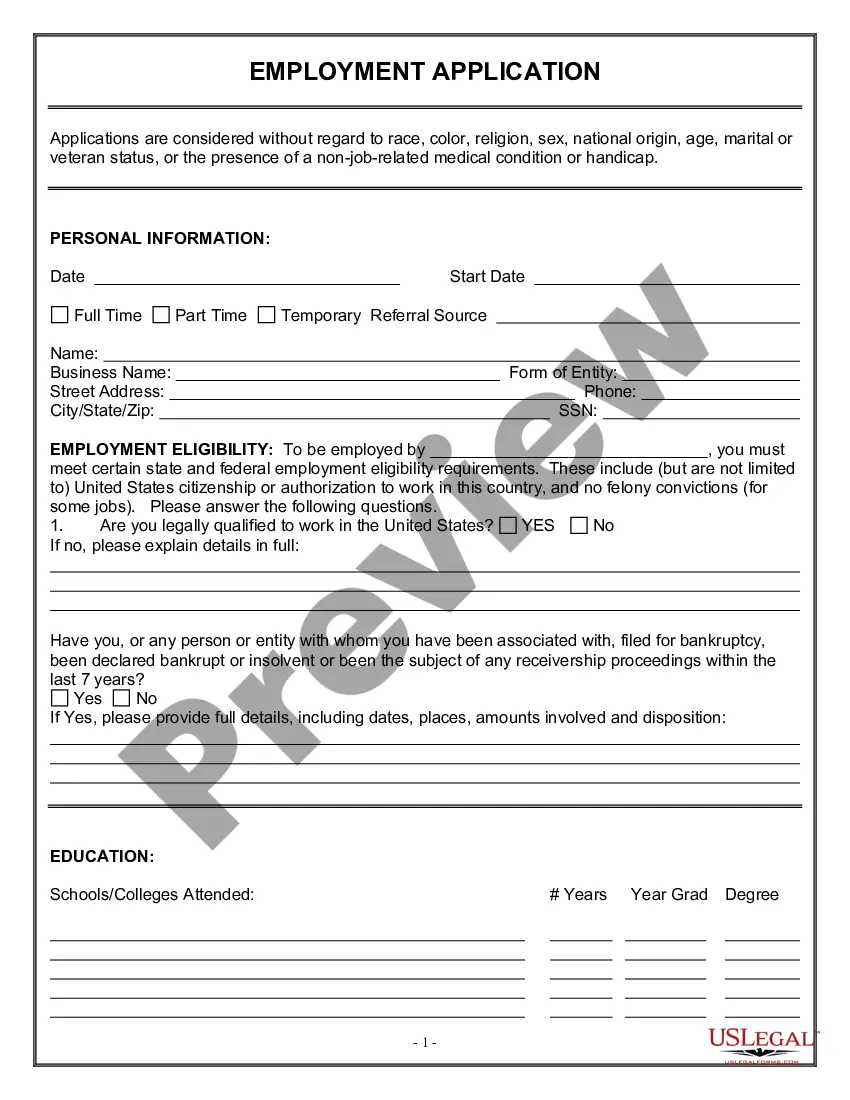

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/county.

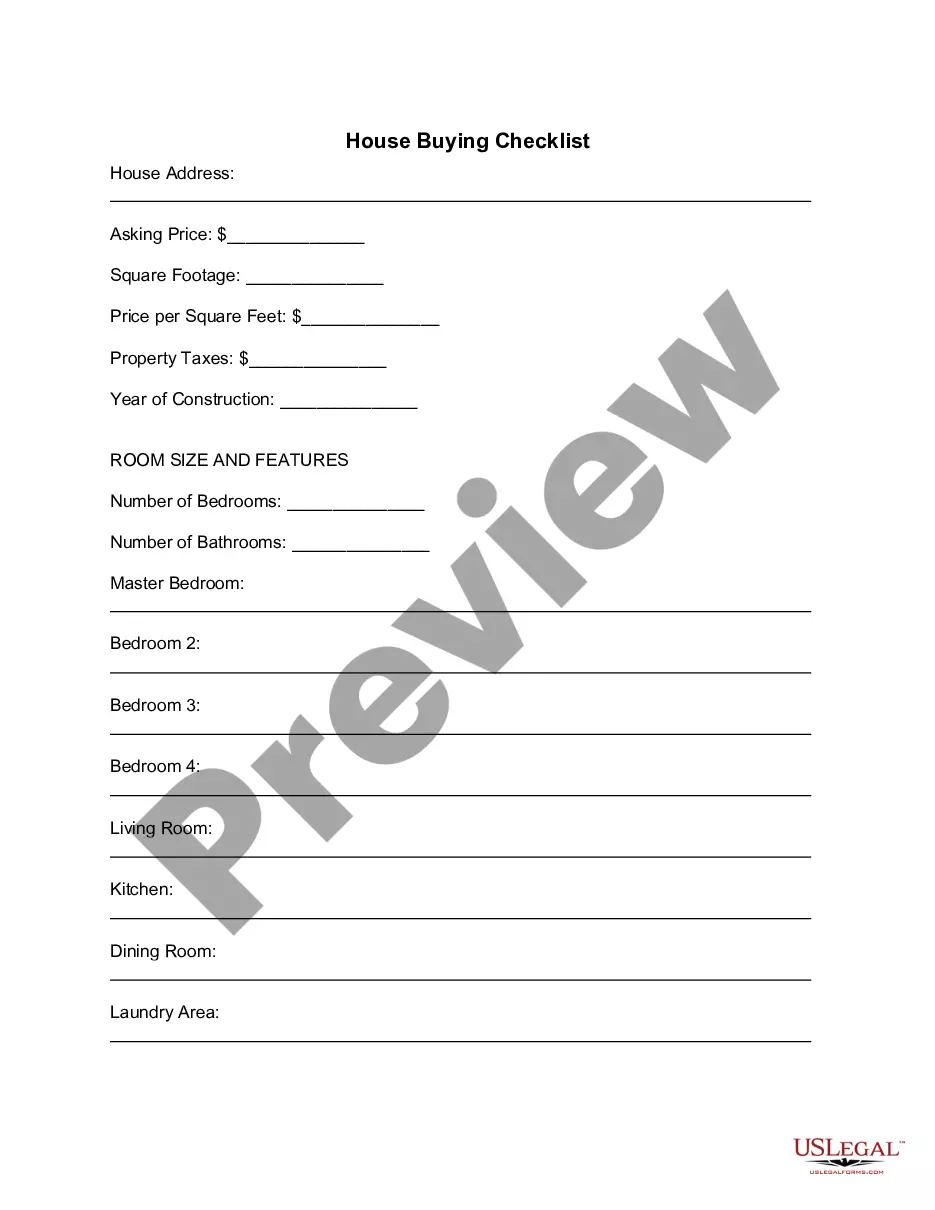

- Use the Review button to check the form.

- Read the description to confirm you have selected the right form.

- If the form isn't what you're looking for, use the Search field to find the form that meets your needs and specifications.

Form popularity

FAQ

What is the stamp duty land tax liability on a transfer of equity? Stamp duty land tax is payable when transferring equity. If the transaction provides an individual an interest in land, stamp duty land tax (SDLT) or land transaction tax (LTT) will be payable by reference to any chargeable consideration given for it.

If you transfer shares into certain 'clearance services' or 'depositary receipt schemes' operated by a third party, such as a bank, you may have to pay Stamp Duty or SDRT at 1.5%.

The chargeable consideration of a land transaction for the purposes of LBTT comprises anything given in money or money's worth for the subject-matter of the transaction, directly or indirectly by the buyer or a connected party.

The definition of chargeable interest refers to 'an estate, interest, right or power in or over land'. Land for these purposes is defined as including buildings and structures. Any fixtures to the land in question are therefore considered to be part of the land for SDLT purposes.

Do You Pay Stamp Duty When You Sell Shares? There's no stamp duty to pay when you sell shares although you may be liable for capital gains tax.

Does the total consideration for the transaction include VAT? For wholly residential transactions, the buyer should not be charged VAT. The buyer may be charged VAT on non-residential transactions. If you are unsure about whether VAT is being charged or not, you should consult the seller or your agent.

For the purposes of stamp duty land tax (SDLT), any consideration in money or money's worth given for the subject matter of the land transaction, directly or indirectly, by the purchaser or a person connected with him (Schedule 4, Finance Act 2003).

In a nutshell, the chargeable consideration is the price paid for the property. The term is defined in the legislation as being any consideration 'in money or money's worth' given for the subject matter of the land transaction in question.

When you buy shares, you usually pay a tax or duty of 0.5% on the transaction. If you buy: shares electronically, you'll pay Stamp Duty Reserve Tax ( SDRT ) shares using a stock transfer form, you'll pay Stamp Duty if the transaction is over £1,000.

LBTT guidance on items which are not included in the chargeable consideration in a land transaction. The purchase price may include a payment for items that are not part of the chargeable consideration.