Mississippi Security Agreement Regarding Aircraft and Equipment

Description

Until a conveyance, lease, or instrument executed for security purposes which may be recorded under ??? 44107(a)(1) or (2) has been filed with the FAA, it is valid only against the parties to the instrument and individuals and entities who have actual knowledge of the instrument. Therefore, the interests of the parties to a transaction, including purchasers, lessor, lessees and secured parties, are not perfected until the instruments creating those interests have been filed with the FAA.

How to fill out Security Agreement Regarding Aircraft And Equipment?

It is feasible to dedicate time on the internet trying to locate the authentic document template that satisfies the federal and state requirements you need.

US Legal Forms offers thousands of official forms that are reviewed by professionals.

You can easily download or print the Mississippi Security Agreement Regarding Aircraft and Equipment from our service.

If available, utilize the Preview button to examine the document template as well. If you wish to find another version of the form, use the Search box to discover the template that meets your needs and requirements.

- If you already possess a US Legal Forms account, you can sign in and then click the Download button.

- After that, you can fill out, modify, print, or sign the Mississippi Security Agreement Regarding Aircraft and Equipment.

- Every official document template you receive is your property indefinitely.

- To obtain an additional copy of the purchased form, navigate to the My documents tab and click the appropriate button.

- If you are utilizing the US Legal Forms site for the first time, follow the straightforward instructions below.

- First, ensure you have selected the correct document template for the state/region you choose.

- Review the form description to confirm you have selected the appropriate document.

Form popularity

FAQ

To perfect a security agreement, you typically need to file it with the appropriate state agency. For a Mississippi Security Agreement Regarding Aircraft and Equipment, this often involves filing a UCC-1 financing statement. This process establishes your legal claim to the assets mentioned in the agreement, ensuring that you have priority over other creditors.

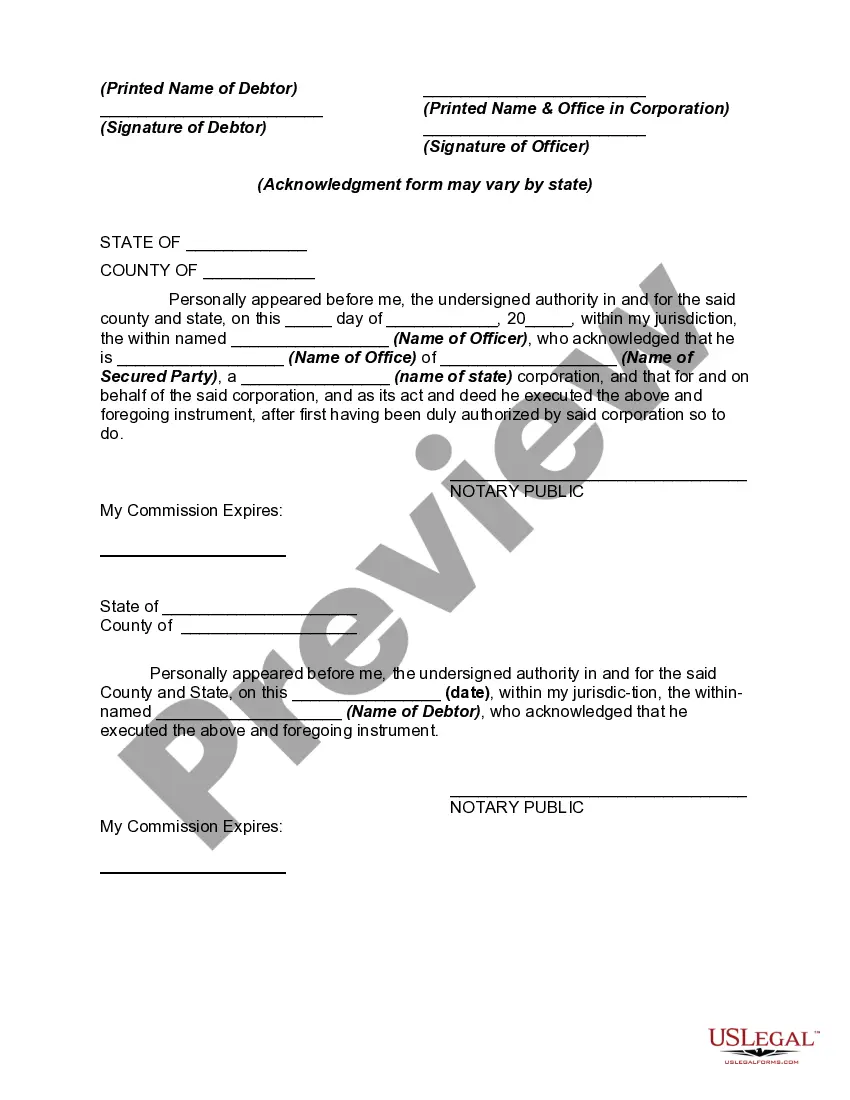

To ensure validity, a Mississippi Security Agreement Regarding Aircraft and Equipment must include clear terms, signatures from both parties, and a description of the collateral. Additionally, it should comply with state laws regarding security interests. Utilizing a trusted platform like uslegalforms can help you meet these requirements efficiently and effectively.

Yes, a valid Mississippi Security Agreement Regarding Aircraft and Equipment requires signatures from both the debtor and the secured party. This mutual agreement confirms that both parties acknowledge the terms and conditions stated in the document. It is vital for the agreement to reflect a clear understanding to avoid any potential conflicts.

Creating a Mississippi Security Agreement Regarding Aircraft and Equipment involves several straightforward steps. First, outline the terms of the agreement, including the obligations of each party and the security interest being granted. You can utilize platforms like uslegalforms to simplify the drafting process and ensure compliance with legal standards.

Typically, a notary public or an authorized agent must authenticate a Mississippi Security Agreement Regarding Aircraft and Equipment. The authentication process adds an additional layer of validation, confirming the identities of the signers. This step is particularly important for preventing disputes over the agreement's validity in the future.

Both the debtor and the secured party must sign the Mississippi Security Agreement Regarding Aircraft and Equipment. Signing this document solidifies the terms of the agreement and provides legal protection for both parties. Remember, clear communication between the parties helps ensure that everyone understands their obligations.

To transfer ownership of an aircraft, you must complete a Bill of Sale and file it with the Federal Aviation Administration (FAA). Additionally, any existing Mississippi Security Agreement Regarding Aircraft and Equipment must be reviewed to ensure that the security interests are appropriately documented. Proper documentation helps protect both the buyer and seller during the ownership transfer process.

Yes, a Mississippi Security Agreement Regarding Aircraft and Equipment must be signed by the secured party. This signature represents their acceptance of the responsibilities and rights outlined in the agreement. Without the secured party's signature, the security agreement may lack enforceability.

Enterprise security works by implementing a layered approach to protect an organization's data and assets from various threats. It involves identifying risks, establishing controls, and continuously monitoring for vulnerabilities. The drafting and execution of a Mississippi Security Agreement Regarding Aircraft and Equipment is a key component of this process, helping organizations manage and mitigate risk effectively. Ultimately, effective enterprise security safeguards sensitive information and supports operational resilience.

Enterprise grade security refers to a level of security designed to protect large organizations from serious threats. This level of security incorporates advanced technologies, protocols, and practices that meet strict compliance standards. Utilizing solutions such as a Mississippi Security Agreement Regarding Aircraft and Equipment can help organizations achieve enterprise grade security effectively. Implementing such measures not only protects critical assets but also builds trust with clients and partners.