The decree of the bankruptcy court which terminates the bankruptcy proceedings is generally a discharge that releases the debtor from most debts. A bankruptcy court may refuse to grant a discharge under certain conditions.

Mississippi Complaint Objecting to Discharge of Debtor in Bankruptcy Proceeding Due to Destruction of Books From Which Financial Condition Might Have Been

Description

How to fill out Complaint Objecting To Discharge Of Debtor In Bankruptcy Proceeding Due To Destruction Of Books From Which Financial Condition Might Have Been?

Discovering the right lawful file template can be quite a struggle. Needless to say, there are tons of layouts available on the net, but how would you find the lawful form you require? Take advantage of the US Legal Forms site. The services provides 1000s of layouts, including the Mississippi Complaint Objecting to Discharge of Debtor in Bankruptcy Proceeding Due to Destruction of Books From Which Financial, which you can use for company and private requirements. All the types are inspected by experts and fulfill state and federal demands.

When you are currently registered, log in to the account and click the Obtain switch to obtain the Mississippi Complaint Objecting to Discharge of Debtor in Bankruptcy Proceeding Due to Destruction of Books From Which Financial. Make use of account to check with the lawful types you may have bought formerly. Visit the My Forms tab of your own account and get another backup in the file you require.

When you are a new user of US Legal Forms, here are straightforward directions for you to adhere to:

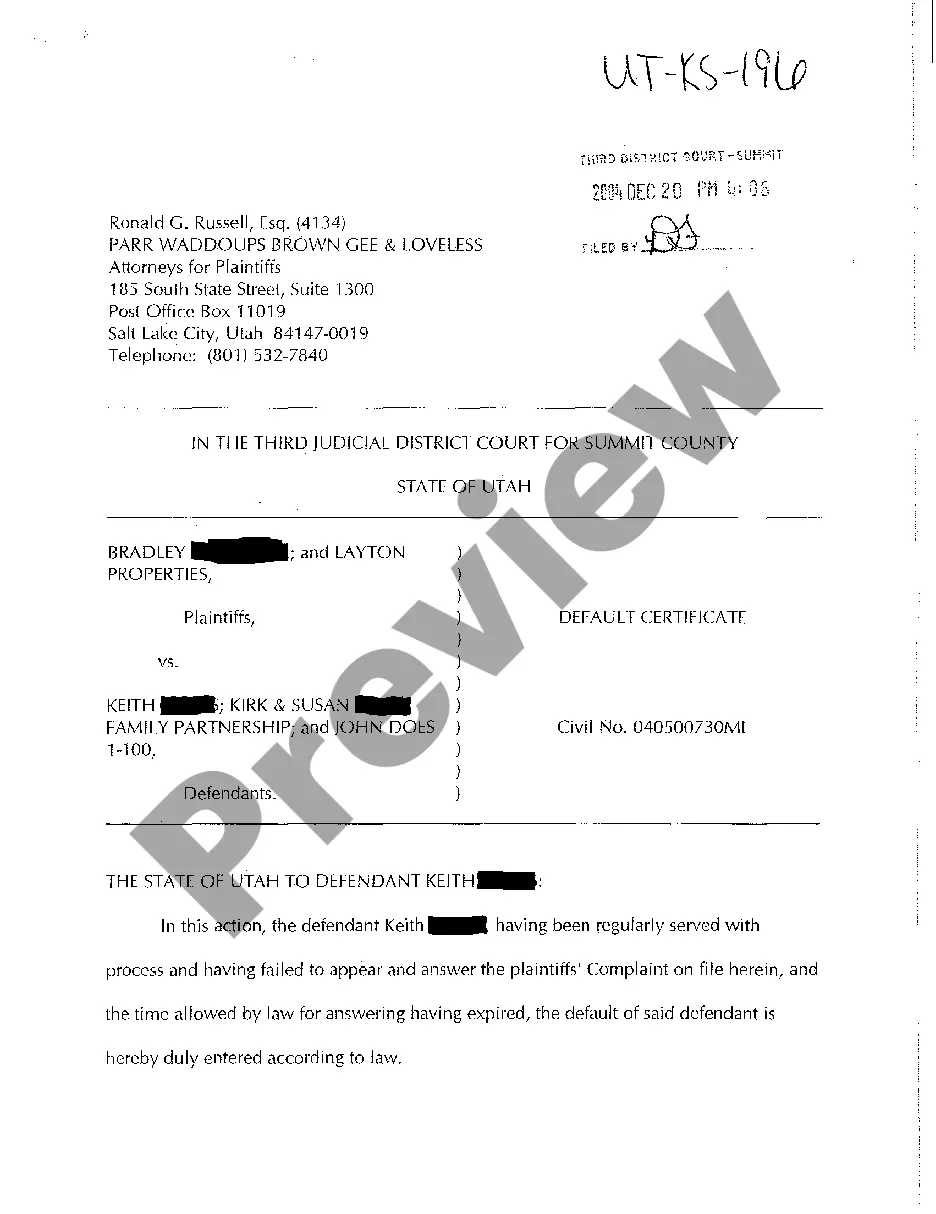

- First, ensure you have selected the correct form for your metropolis/area. You can examine the shape while using Review switch and read the shape information to make certain this is the right one for you.

- If the form fails to fulfill your expectations, use the Seach industry to discover the proper form.

- Once you are certain that the shape would work, click on the Get now switch to obtain the form.

- Opt for the prices strategy you desire and type in the necessary info. Make your account and pay for your order utilizing your PayPal account or bank card.

- Choose the submit format and obtain the lawful file template to the system.

- Full, modify and produce and signal the obtained Mississippi Complaint Objecting to Discharge of Debtor in Bankruptcy Proceeding Due to Destruction of Books From Which Financial.

US Legal Forms is definitely the biggest local library of lawful types in which you can see various file layouts. Take advantage of the service to obtain expertly-manufactured files that adhere to express demands.

Form popularity

FAQ

First, while most forms of consumer debt ? credit card debt, personal loans, medical debt, mortgages and auto loans ? are generally fair game for either eliminating or negotiating a lower payback amount in bankruptcy, that's not true for student loan debt.

Debts Never Discharged in Bankruptcy Alimony and child support. Certain unpaid taxes, such as tax liens. However, some federal, state, and local taxes may be eligible for discharge if they date back several years. Debts for willful and malicious injury to another person or property.

Debts not discharged include debts for alimony and child support, certain taxes, debts for certain educational benefit overpayments or loans made or guaranteed by a governmental unit, debts for willful and malicious injury by the debtor to another entity or to the property of another entity, debts for death or personal ...

Filing for Chapter 7 bankruptcy eliminates credit card debt, medical bills and unsecured loans; however, there are some debts that cannot be discharged. Those debts include child support, spousal support obligations, student loans, judgments for damages resulting from drunk driving accidents, and most unpaid taxes.

An objection to discharge is a notice lodged with the Official Receiver by a trustee to induce a bankrupt to comply with their obligations. An objection will extend the period of bankruptcy so automatic discharge will not occur three years and one day after the bankrupt filed a statement of affairs.

No one can prevent a person from filing bankruptcy but a bankrupt's discharge can be opposed by the Office of the Superintendent of bankruptcy, a creditor or the trustee.

A debtor may apply to the Court to challenge (oppose) a bankruptcy notice before the time for compliance with the notice has finished. The debtor can apply to challenge a bankruptcy notice if: there is a defect in the bankruptcy notice. the debt on which the bankruptcy notice is based does not exist.

The most common types of nondischargeable debts are certain types of tax claims, debts not set forth by the debtor on the lists and schedules the debtor must file with the court, debts for spousal or child support or alimony, debts for willful and malicious injuries to person or property, debts to governmental units ...