If you have to total, acquire, or produce legitimate file web templates, use US Legal Forms, the biggest variety of legitimate types, that can be found on the Internet. Use the site`s simple and easy practical search to get the documents you require. Different web templates for business and person reasons are sorted by classes and suggests, or keywords. Use US Legal Forms to get the Mississippi Notice of Sale to Satisfy Lien of Self-Service Storage Facility within a number of mouse clicks.

When you are currently a US Legal Forms buyer, log in to your account and then click the Obtain key to have the Mississippi Notice of Sale to Satisfy Lien of Self-Service Storage Facility. You can also gain access to types you formerly acquired within the My Forms tab of the account.

If you use US Legal Forms the first time, refer to the instructions under:

- Step 1. Be sure you have chosen the form for that correct area/country.

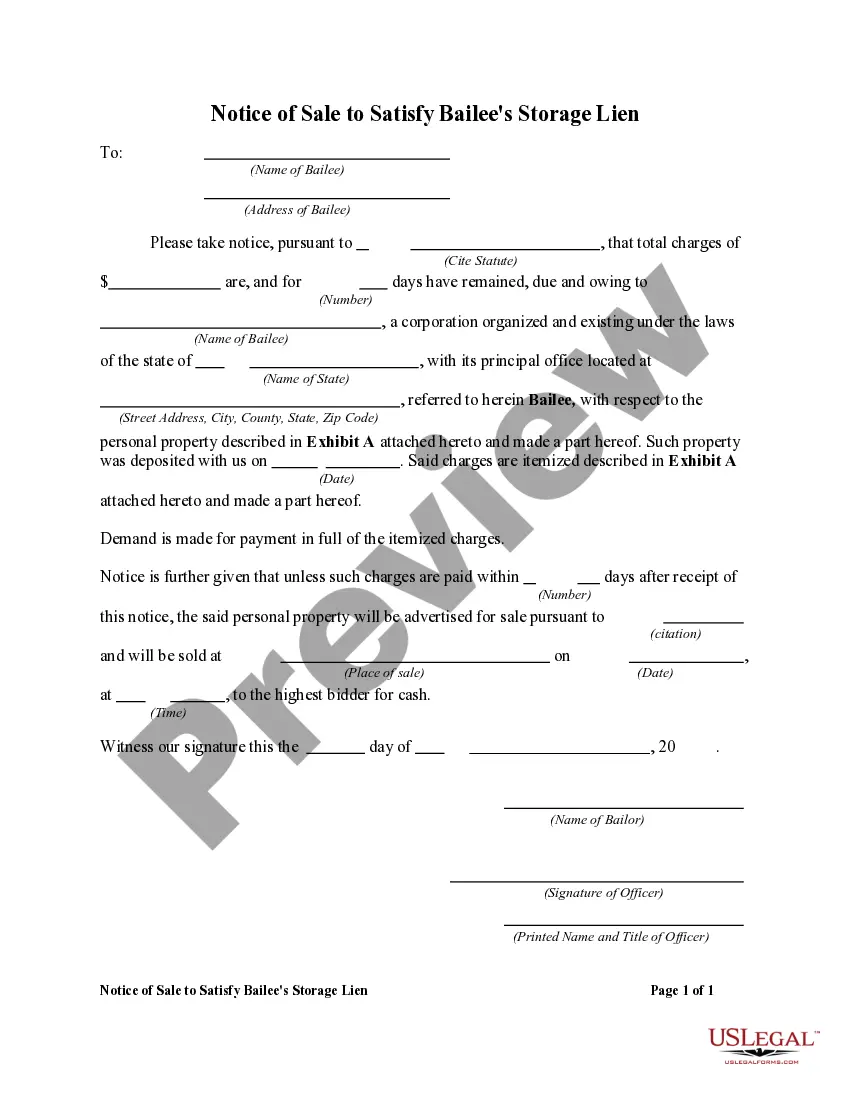

- Step 2. Use the Preview solution to check out the form`s content material. Do not overlook to read through the explanation.

- Step 3. When you are not satisfied together with the type, take advantage of the Search field near the top of the display screen to get other versions from the legitimate type format.

- Step 4. Once you have located the form you require, click on the Get now key. Choose the prices strategy you prefer and put your references to sign up for the account.

- Step 5. Process the deal. You should use your credit card or PayPal account to complete the deal.

- Step 6. Choose the formatting from the legitimate type and acquire it in your device.

- Step 7. Total, edit and produce or indicator the Mississippi Notice of Sale to Satisfy Lien of Self-Service Storage Facility.

Every single legitimate file format you purchase is the one you have permanently. You may have acces to every type you acquired with your acccount. Select the My Forms area and pick a type to produce or acquire once more.

Contend and acquire, and produce the Mississippi Notice of Sale to Satisfy Lien of Self-Service Storage Facility with US Legal Forms. There are many specialist and status-certain types you may use for your business or person demands.