Mississippi Officers Bonus in form of Stock Issuance - Resolution Form

Description

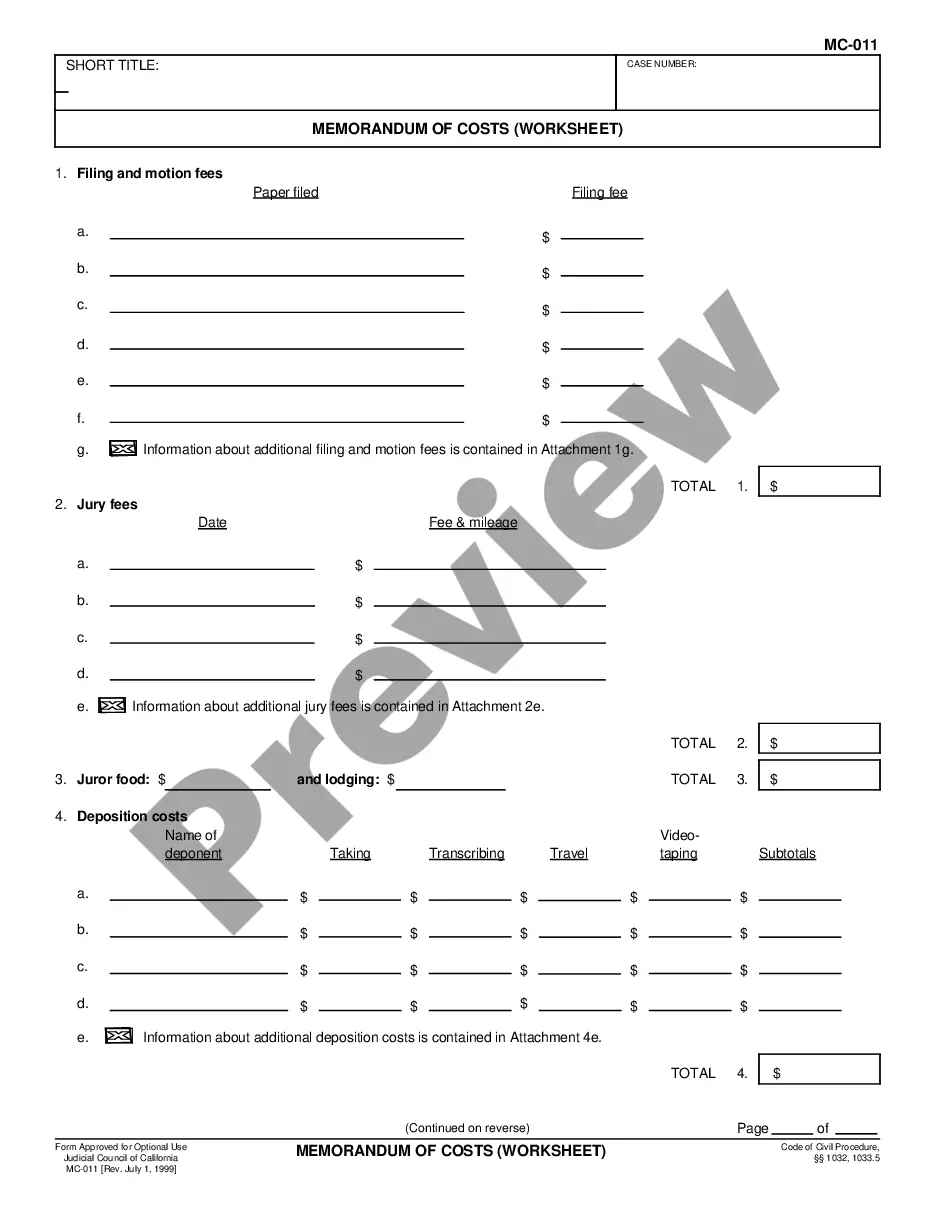

How to fill out Officers Bonus In Form Of Stock Issuance - Resolution Form?

US Legal Forms - one of the most prominent collections of legal forms in the United States - offers a range of legal document templates you can purchase or print.

By using the website, you can obtain thousands of forms for business and personal purposes, organized by categories, regions, or keywords. You can find the latest versions of forms like the Mississippi Officers Bonus in the format of Stock Issuance - Resolution Form in just a few minutes.

If you have a monthly membership, Log In and obtain the Mississippi Officers Bonus in the format of Stock Issuance - Resolution Form from the US Legal Forms library. The Download button will be visible on each form you view. You can access all previously obtained forms in the My documents section of your account.

Process the payment. Use your Visa or Mastercard or PayPal account to complete the transaction.

Select the format and download the form to your device. Make edits. Fill out, modify, print, and sign the downloaded Mississippi Officers Bonus in the format of Stock Issuance - Resolution Form. Each template you added to your account has no expiry date and is yours permanently. So, if you wish to download or print another copy, just visit the My documents section and click on the form you desire.

- To utilize US Legal Forms for the first time, here are simple instructions to help you get started.

- Ensure you have selected the correct form for your city/county.

- Click on the Review button to examine the details of the form.

- Check the form summary to ensure you have chosen the accurate form.

- If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

- Once you are satisfied with the form, confirm your choice by clicking on the Get now button.

- Then, select the payment plan you prefer and provide your details to register for the account.

Form popularity

FAQ

To issue shares, a normal board resolution is sufficient unless otherwise specified in the company’s articles of association. This resolution confirms the decision and outlines how many shares will be issued, along with their type, as captured in the Mississippi Officers Bonus in form of Stock Issuance - Resolution Form. Adhering to these requirements helps maintain order in corporate governance.

Under the Companies Act 2013, a board resolution is a formal document capturing a decision made by the board of directors. It reflects the approval of specific actions, such as issuing shares, and ensures that the process is documented for record-keeping. To align with this act, companies can utilize the Mississippi Officers Bonus in form of Stock Issuance - Resolution Form.

Bonus shares follow specific regulatory guidelines, primarily aimed at benefiting existing shareholders. They can be issued by capitalizing reserve profits, and must ensure equitable distribution without altering ownership proportions. Understanding these rules is important, and using the Mississippi Officers Bonus in form of Stock Issuance - Resolution Form can simplify the process.

The board resolution for issuing shares establishes the authority to create and distribute additional shares to shareholders. It encompasses the details of the share issuance, including the total number of bonus shares and their distribution method. Accurately completing the Mississippi Officers Bonus in form of Stock Issuance - Resolution Form is essential for legal compliance.

For a bonus issue, a normal board resolution is generally sufficient. This resolution should outline the intention to issue shares as a bonus, which can be documented using the Mississippi Officers Bonus in form of Stock Issuance - Resolution Form. Proper approval ensures your company follows legal protocols and upholds shareholder trust.

A special resolution is not typically required for a bonus issue, but it can depend on the company's articles of association. Generally, a normal resolution suffices, which is confirmed in the Mississippi Officers Bonus in form of Stock Issuance - Resolution Form. Reviewing your company's governance documents will clarify specific requirements.

Yes, filing MGT-14 is required for issuing a Mississippi Officers Bonus in form of Stock Issuance - Resolution Form. This form documents a board resolution, ensuring compliance with corporate governance standards. By submitting MGT-14, companies provide transparency and proper records of their financial decisions to regulatory authorities.

A bonus issue by a listed entity involves the distribution of additional shares to current investors, enhancing their ownership without requiring further financial commitment. This move usually stems from retained earnings or surplus profits and can be seen as a strategy to bolster investor relations and enhance stock liquidity. Utilizing the Mississippi Officers Bonus in the form of Stock Issuance - Resolution Form can streamline this process, ensuring accurate and compliant issuance.

To issue bonus shares, a company typically needs to pass a resolution at a board meeting, detailing the number and ratio of shares to be distributed to existing shareholders. Following this, the company should prepare and file necessary documentation, including the Mississippi Officers Bonus in the form of Stock Issuance - Resolution Form, to ensure compliance with regulations. Clear communication with shareholders is also essential during this process to maximize positive reception.

A company typically makes a bonus issue when it wants to capitalize its reserves or undistributed profits to enhance liquidity in the stock market. This move can attract new investors while rewarding existing shareholders, ultimately aiming to create a favorable market environment. For those considering this option, understanding the Mississippi Officers Bonus in the form of Stock Issuance - Resolution Form can be crucial for ensuring compliance and clarity during the process.