Mississippi Deed of Trust - Multistate

Description

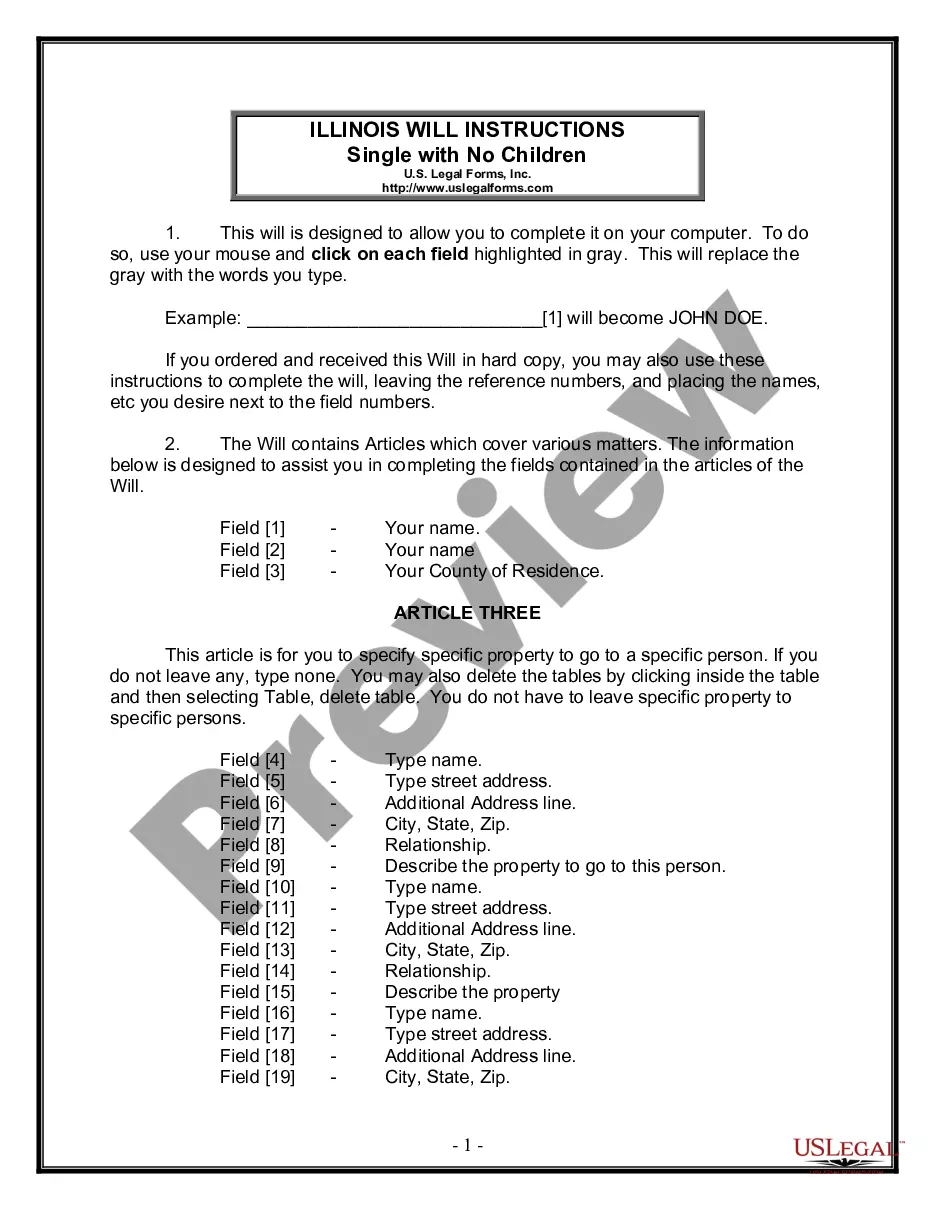

How to fill out Deed Of Trust - Multistate?

If you have to total, download, or print authorized papers web templates, use US Legal Forms, the most important collection of authorized kinds, which can be found online. Make use of the site`s basic and practical search to discover the papers you want. Various web templates for enterprise and specific reasons are sorted by classes and says, or keywords and phrases. Use US Legal Forms to discover the Mississippi Deed of Trust - Multistate within a handful of click throughs.

Should you be currently a US Legal Forms consumer, log in in your account and click the Download key to find the Mississippi Deed of Trust - Multistate. You can also entry kinds you earlier downloaded from the My Forms tab of your account.

Should you use US Legal Forms the very first time, follow the instructions listed below:

- Step 1. Be sure you have chosen the form for the proper area/land.

- Step 2. Make use of the Review method to examine the form`s content. Never neglect to see the outline.

- Step 3. Should you be unsatisfied with the develop, take advantage of the Search area at the top of the display to get other versions from the authorized develop design.

- Step 4. When you have found the form you want, click on the Get now key. Pick the pricing prepare you prefer and add your credentials to register for an account.

- Step 5. Process the financial transaction. You should use your Мisa or Ьastercard or PayPal account to finish the financial transaction.

- Step 6. Choose the format from the authorized develop and download it in your system.

- Step 7. Complete, revise and print or indicator the Mississippi Deed of Trust - Multistate.

Each and every authorized papers design you buy is your own property forever. You might have acces to every develop you downloaded in your acccount. Select the My Forms portion and decide on a develop to print or download once more.

Be competitive and download, and print the Mississippi Deed of Trust - Multistate with US Legal Forms. There are many expert and condition-distinct kinds you can use for your personal enterprise or specific needs.

Form popularity

FAQ

A warranty deed or quit claim deed TRANSFERS TITLE or OWNERSHIP of real property. When you purchase property, you usually receive a warranty deed from the seller to you to show that you now own the property.

Both a warranty deed and deed of trust are used to transfer the title of a property from one person to another. However, the difference between these two contracts is who is protected. As you now know, a deed of trust protects the beneficiary (lender). A warranty deed, on the other hand, protects the property owner.

A deed of trust (also known as a trust deed) is a document sometimes used in financed real estate transactions, generally instead of a mortgage.

Deeds of trust are the most common instrument used in the financing of real estate purchases in Alaska, Arizona, California, Colorado, the District of Columbia, Idaho, Maryland, Mississippi, Missouri, Montana, Nebraska, Nevada, North Carolina, Oregon, Tennessee, Texas, Utah, Virginia, Washington, and West Virginia, ...

Trust deeds are an alternative to mortgages in certain states. Instead of an agreement directly between a lender and a borrower, a trust deed places the title of a property in the hands of a third party, or trustee.

A warranty deed ensures a buyer that the property is owned by the seller and is able to be sold without any encumbrances. A deed of trust is used in certain states, and represents a buyer's guarantee with their lender to repay the property loan as scheduled.

A deed of trust is a legal agreement that's similar to a mortgage, which is used in real estate transactions. Whereas a mortgage only involves the lender and a borrower, a deed of trust adds a neutral third party that holds rights to the real estate until the loan is paid or the borrower defaults.

A deed of trust is an agreement between a home buyer and a lender at the closing of a property. The agreement states that the home buyer will repay the home loan and the mortgage lender will hold the property's legal title until the loan is paid in full.