Mississippi Sample Letter for Claim Settlement Against Decedent's Estate

Description

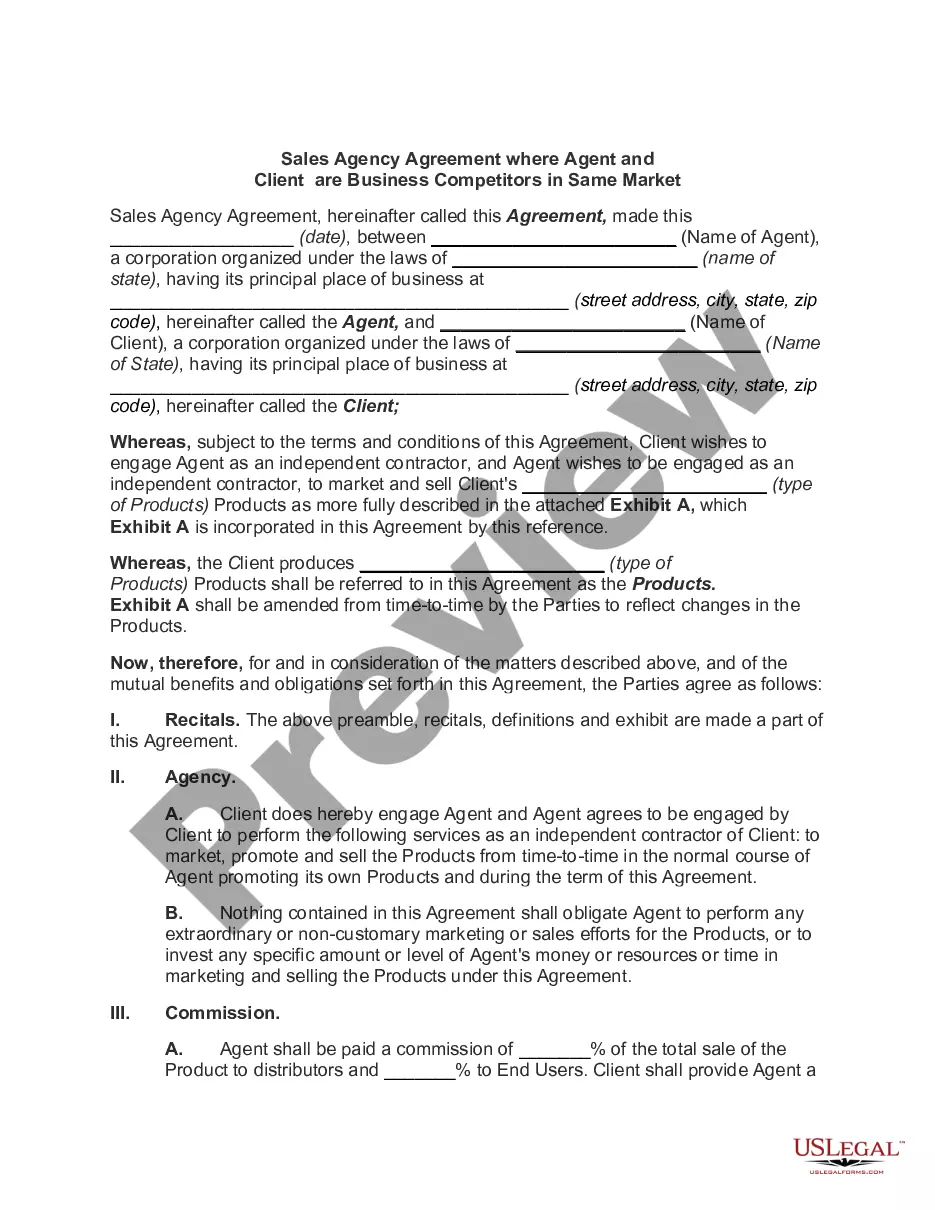

How to fill out Sample Letter For Claim Settlement Against Decedent's Estate?

If you require extensive, retrieve, or print legal document website templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Employ the site's straightforward and efficient search to locate the documents you need.

Various templates for business and personal purposes are categorized by types and states, or keywords.

Step 4. Once you have found the form you need, click the Buy now button. Choose the payment plan you prefer and enter your credentials to register for the account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.Step 6. Choose the format of the legal form and download it to your device.Step 7. Fill out, edit, and print or sign the Mississippi Sample Letter for Claim Settlement Against Decedent's Estate.

- Use US Legal Forms to obtain the Mississippi Sample Letter for Claim Settlement Against Decedent's Estate with just a few clicks.

- If you are currently a US Legal Forms user, Log In to your account and click the Obtain button to find the Mississippi Sample Letter for Claim Settlement Against Decedent's Estate.

- You can also access forms you previously saved in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct area/region.

- Step 2. Utilize the Preview feature to review the form's content. Don’t forget to read the details.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

Id. Rule 81 requires use of a special summons which commands that the defendant appear and defend at a specific time and place set by order of the court and informs him or her that no answer is necessary.

California law does allow creditors to pursue a decedent's potentially inheritable assets.

Under Mississippi's Affidavit of Successor (Small Estate Affidavit) procedure, personal property owed to a deceased person with a value of up to $50,000 may be delivered to his or her heirs or successors by affidavit. The affidavit can be made at any time after 30 days have passed since the person's death.

Payment of Debts and Taxes: The personal representative uses the estate's funds to pay off any outstanding debts and taxes. In Mississippi, creditors have 90 days from the notification to file claims against the estate.

In Mississippi, the executor typically has 90 days from the date of their appointment to submit this inventory to the court. Communicating with Creditors: Once the estate has been inventoried, the executor must then notify all known creditors of the deceased's passing.

Payment of Debts and Taxes: The personal representative uses the estate's funds to pay off any outstanding debts and taxes. In Mississippi, creditors have 90 days from the notification to file claims against the estate.

MS Specifics Within this limit, Mississippi maintains a 3-year statute of limitations on general debts, from original due date or most recent payment, whichever is later (see MS Code § 15-1-29 and MS Code § 15-1-49).

A Mississippi small estate affidavit presents a claim on an estate by an heir or beneficiary. This process helps claimants avoid probate court in the state of Mississippi, but can only be utilized if the estate is worth no more than $75,000.