Mississippi Employment Application for Labourer

Description

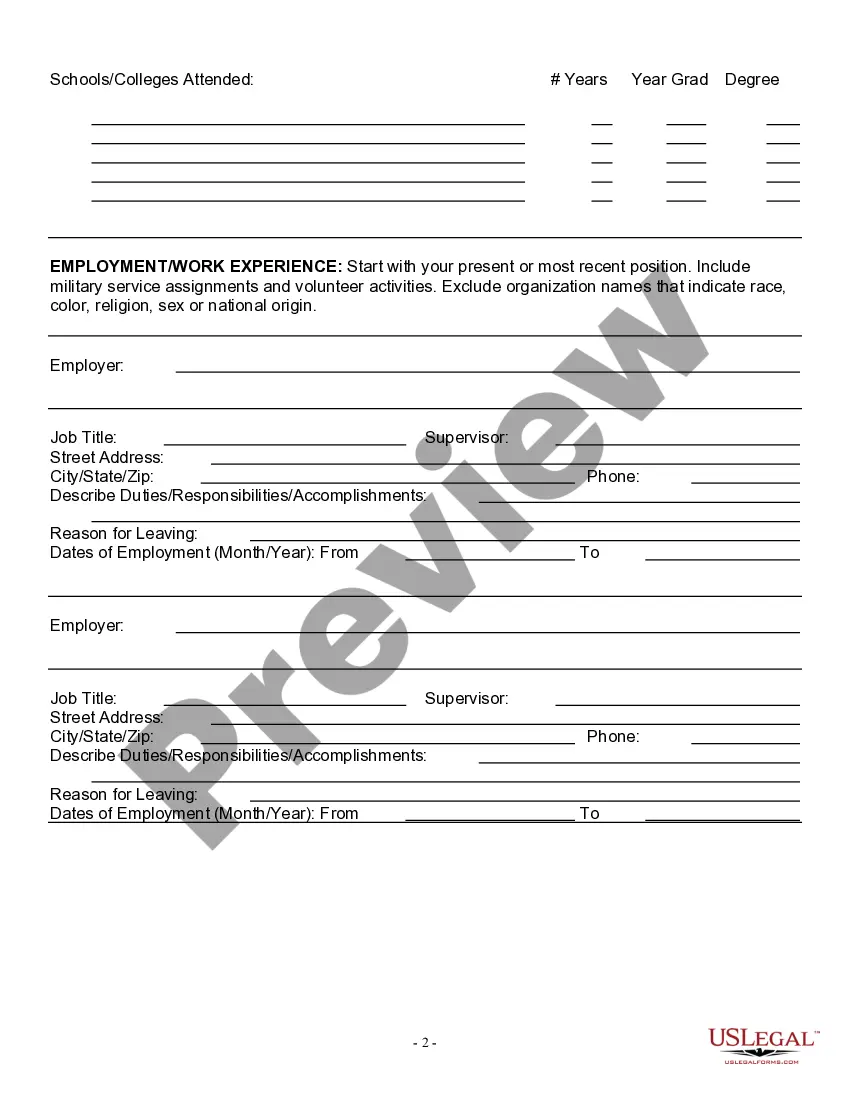

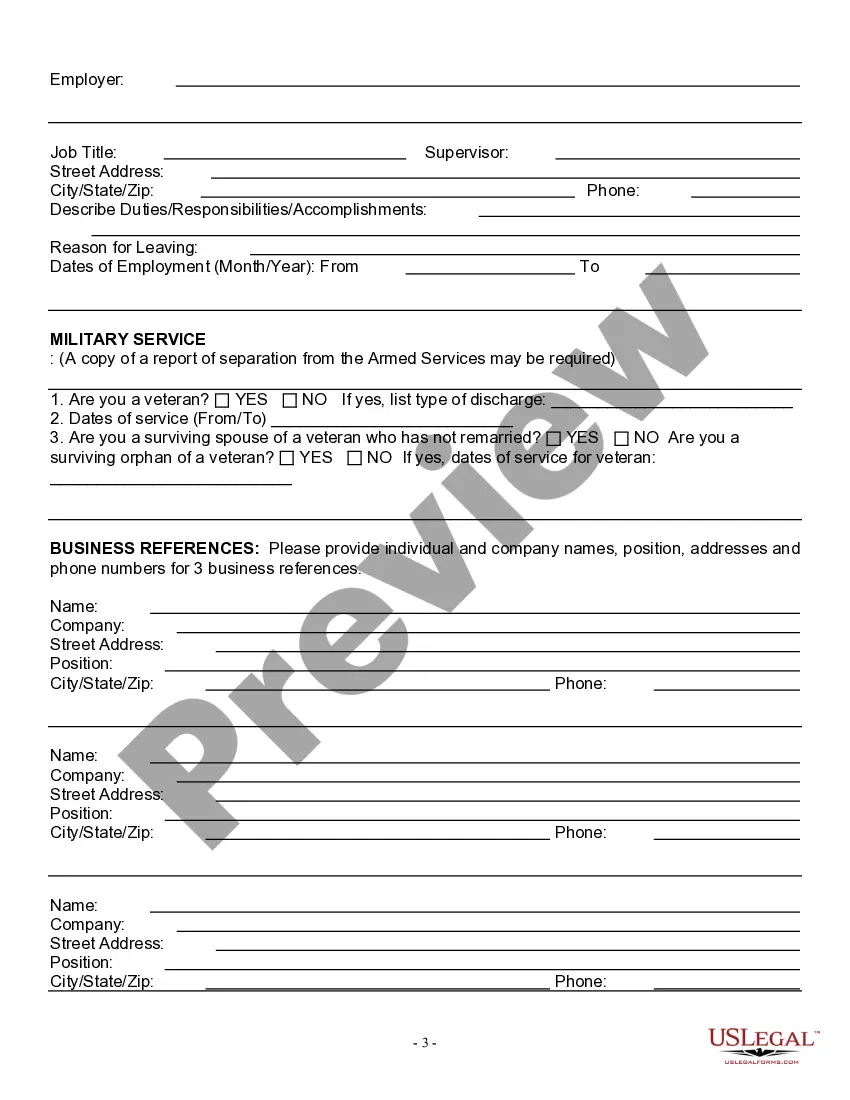

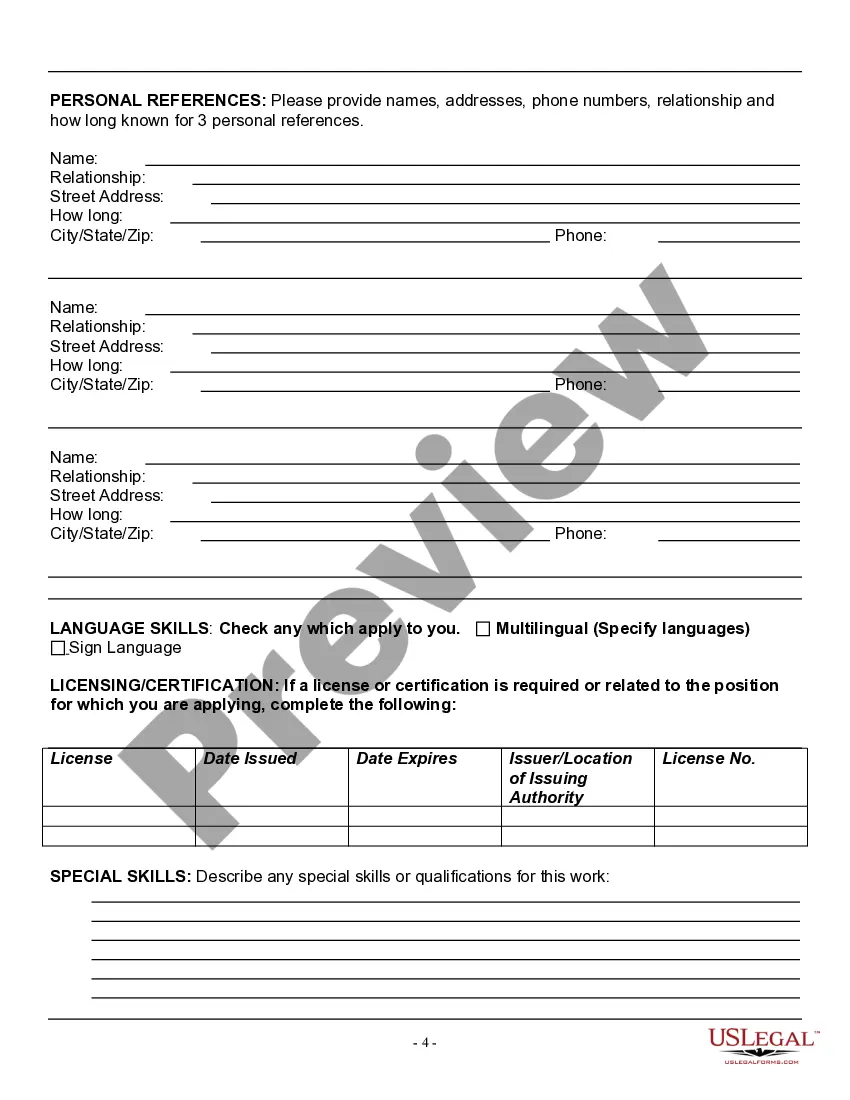

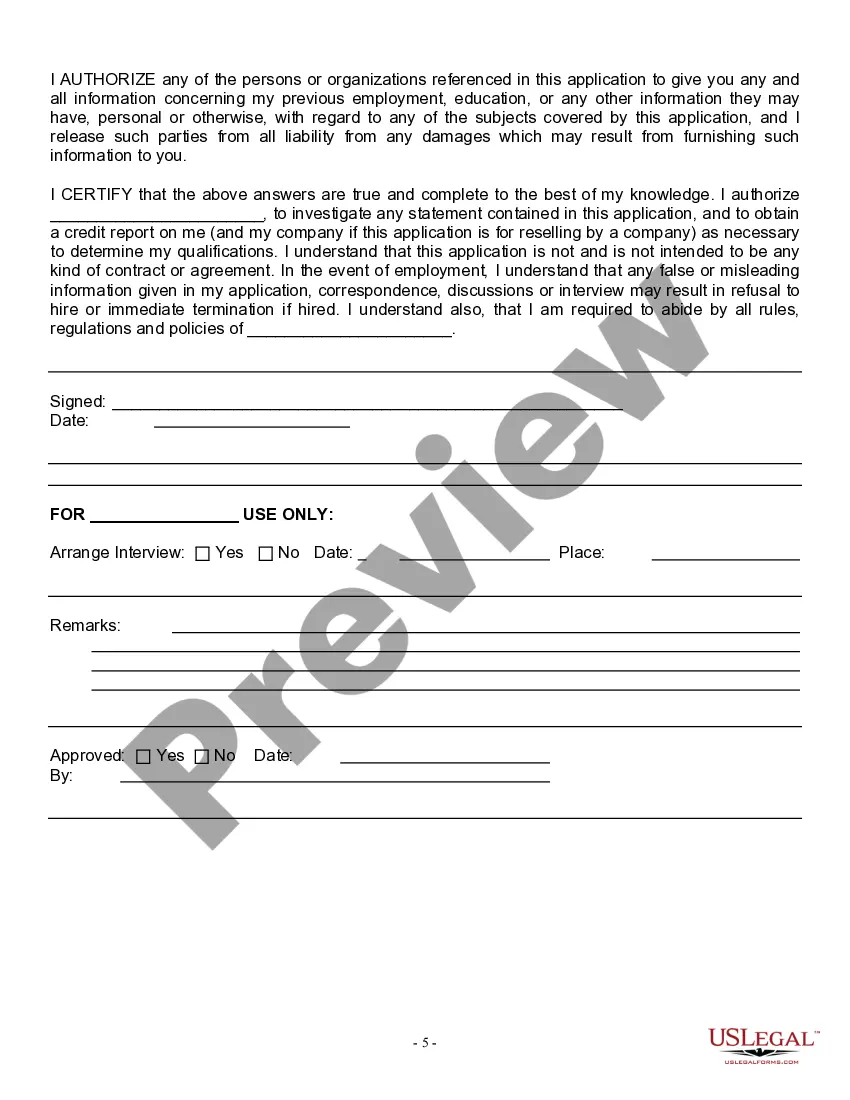

How to fill out Employment Application For Labourer?

If you require to accumulate, download, or print official document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Employ the site’s straightforward and user-friendly search feature to locate the documents you need.

Various templates for professional and personal purposes are categorized by types and states, or keywords.

Step 4. Once you have found the form you need, click the Purchase Now button. Choose your preferred pricing plan and enter your details to create an account.

Step 5. Complete the purchase. You may use your Visa or Mastercard or PayPal account to finalize the transaction.

- Utilize US Legal Forms to find the Mississippi Employment Application for Laborer in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to acquire the Mississippi Employment Application for Laborer.

- You can also access forms you have previously downloaded from the My documents tab in your profile.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have selected the form for your correct city/state.

- Step 2. Use the Preview option to review the content of the form. Be sure to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the page to find other versions of the legal form template.

Form popularity

FAQ

The minimum legal age to work in Mississippi is 14 years old. Children who are 14 to 15 years old are only permitted to work between the hours of am and pm. They can only legally work three hours in a single day. Each week, children of this age range may only work up to 18 hours during the public school year.

In Mississippi, minors can obtain an Employment Certificate through their school, generally by contacting a guidance counselor or school administrator. An Employment Certificate will be issued if the minor meets all of the state's criteria for employment.

The state of Mississippi does not require work permits. The only time a work permit or employment certificate is required in Mississippi is if a minor under the age of 16 is looking to work in a mill, cannery, workshop or factory. In this case, they should seek help in obtaining a permit from the school system.

However, in this unprecedented crisis the State of Minnesota is offering unemployment compensation for the self employed and 1099 workers. This includes those with only part-time employment. Independent contractors and gig workers should qualify.

PUA is intended to provide assistance to persons unemployed or working reduced hours due to COVID-19 and are not eligible for regular unemployment benefits. If you have filed and been denied for regular unemployment since off work due to COVID-19, you do not have to file a new claim.

Federal Department of Labor Offices in MississippiThere is one branch office of the Federal Department of Labor located in Mississippi.

Do independent contractors qualify for unemployment insurance? Yes, with the passing of the CARES Act, independent contractors, gig workers, and self-employed individuals are eligible for unemployment insurance if they are unable to work due to COVID-19.

Key takeaway: Independent contractors are not employed by the company they contract with; they are independent as long as they provide the service or product agreed to. Employees are longer-term, on the company's payroll, and generally not hired for one specific project.

However, unlike an employee of a company, someone who gets a Form 1099 typically needs to purchase their own health insurance policy. While a 1099 worker usually doesn't qualify for employer-sponsored health coverage in California, they can still qualify for a private individual or family insurance policy.

You must also have been unemployed, partially unemployed, or unable or unavailable to work due to at least one of the following reasons to be eligible for PUA: My place of employment was closed as a direct result of the COVID-19 public health emergency.