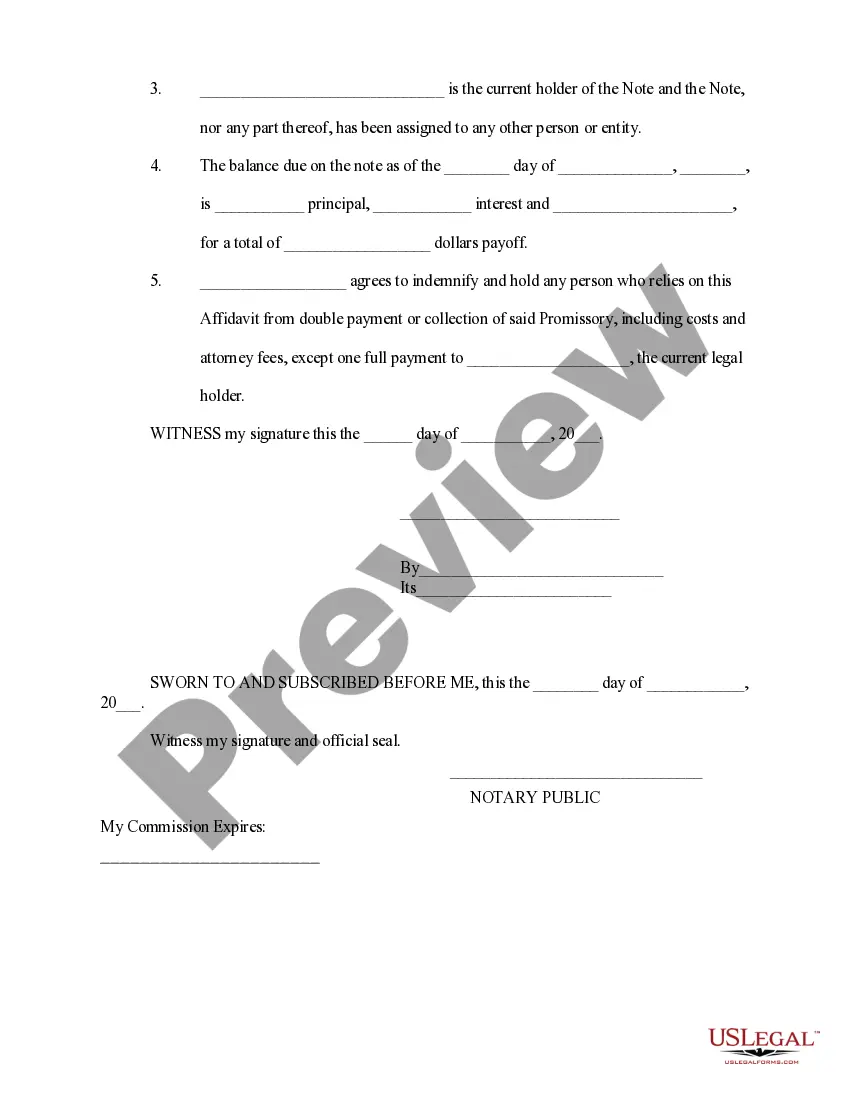

Mississippi Affidavit of Lost Promissory Note

Description

How to fill out Affidavit Of Lost Promissory Note?

If you need extensive, obtain, or print out authentic document templates, utilize US Legal Forms, the largest collection of authentic forms available online. Take advantage of the site’s straightforward and user-friendly search to find the documents you need.

Various templates for business and personal purposes are categorized by regions and states, or keywords. Use US Legal Forms to acquire the Mississippi Affidavit of Lost Promissory Note with just a few clicks.

If you are already a US Legal Forms user, sign in to your account and then click the Acquire button to obtain the Mississippi Affidavit of Lost Promissory Note. You can also access forms you previously saved in the My documents section of your account.

Every authentic document template you obtain is yours indefinitely. You have access to every document you saved within your account. Navigate to the My documents section and select a document to print or download again.

Be proactive and download, and print the Mississippi Affidavit of Lost Promissory Note with US Legal Forms. There are numerous professional and state-specific forms you can use for your business or personal needs.

- Step 1. Ensure you have selected the form for the correct area/state.

- Step 2. Use the Review option to inspect the form’s content. Don’t forget to read the details.

- Step 3. If you are unsatisfied with the document, use the Search field at the top of the screen to find other variations of the authentic document template.

- Step 4. After you’ve found the form you need, click the Purchase now button. Choose the pricing plan you prefer and enter your information to register for an account.

- Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the purchase.

- Step 6. Select the format of the authentic document and download it to your device.

- Step 7. Fill out, edit, and print or sign the Mississippi Affidavit of Lost Promissory Note.

Form popularity

FAQ

After issuance, a Promissory Note must be stamped according to the regulations of the Indian Stamp Act. The common practice is to use a revenue stamp on the note which is then signed by the promissory and/or cross signed by the borrower.

Circumstances for Release of a Promissory NoteThe debt owed on a promissory note either can be paid off, or the noteholder can forgive the debt even if it has not been fully paid. In either case, a release of promissory note needs to be signed by the noteholder.

Even if a promissory note is lost, the legal obligation to repay the loan remains. The lender has a right to re-establish the note legally as long as it has not sold or transferred the note to another party.

Even if a promissory note is lost, the legal obligation to repay the loan remains. The lender has a right to re-establish the note legally as long as it has not sold or transferred the note to another party.

Generally, as long as the promissory note contains legally acceptable interest rates, the signatures of the two contracted parties, and are within the applicable Statute of Limitations, they can be upheld in a court of law.

Even if a promissory note is lost, the legal obligation to repay the loan remains. The lender has a right to re-establish the note legally as long as it has not sold or transferred the note to another party.

Losing the original note or a copyThe original copy of a valid promissory note is usually held by the lender, but the borrower should also keep a copy of the signed document. If the borrower does not repay the loan, the lender can pursue appropriate legal action.

1. Request loan paperwork from your lender. The lender can provide copies of the documents signed at closing. If the loan has changed hands, contact the most current servicer for a copy of your mortgage or deed of trust documents.

The lender holds the promissory note while the loan is outstanding. When the loan is paid off, the note is marked as "paid in full" and returned to the borrower.

You can get a copy of your Master Promissory Notes by going to studentloans.gov and entering your FSA ID. Click on Completed Master Promissory Notes under the menu bar heading that says My Loan Documents. The completed Master Promissory Notes will appear, and you can download them directly.