This form is a deed of trust modification. It is to be entered into by a borrower, co-grantor, and the lender. The agreement modifies the mortgage or deed of trust to secure a debt described within the agreement. Other provisions include: renewal and extension of the lien, co-grantor liability, and note payment terms.

Mississippi Change or Modification Agreement of Deed of Trust

Description

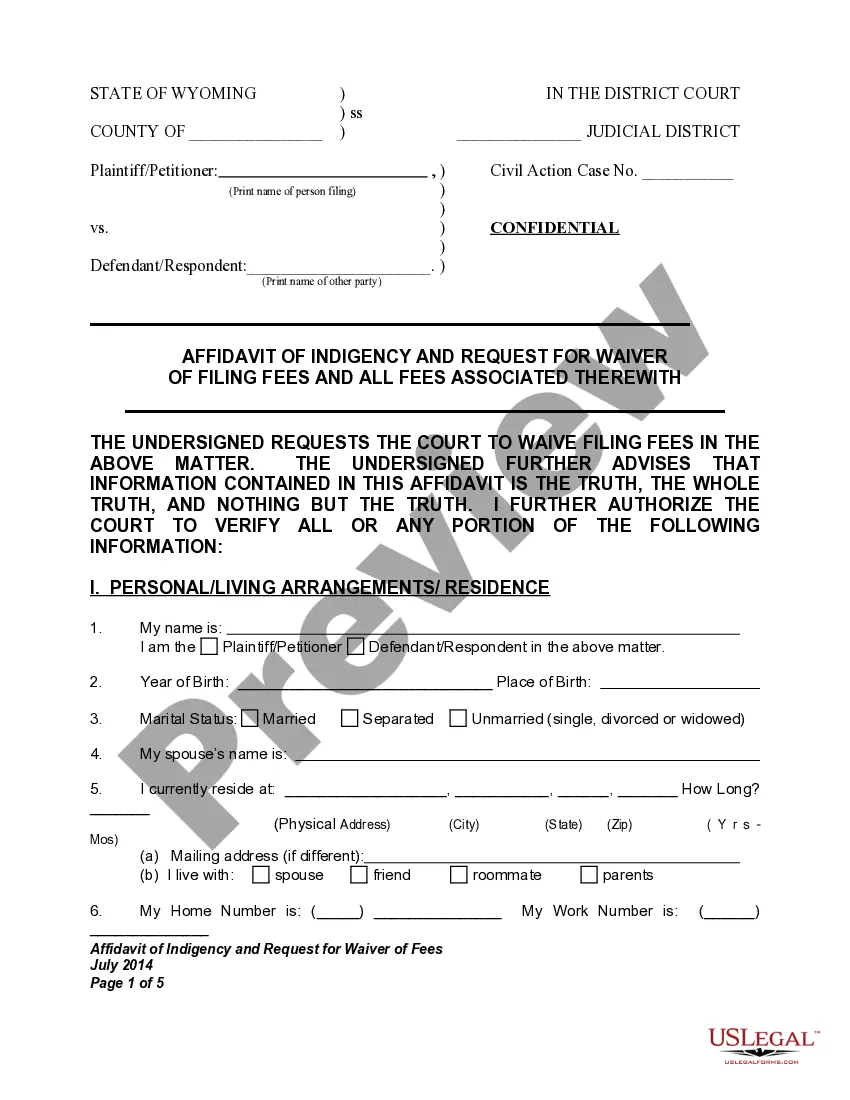

How to fill out Change Or Modification Agreement Of Deed Of Trust?

Selecting the appropriate legal document template can be a challenge. Clearly, there are numerous templates accessible online, but how can you find the legal form you require? Utilize the US Legal Forms website. The service offers a vast array of templates, including the Mississippi Change or Modification Agreement of Deed of Trust, that can be utilized for both business and personal purposes. All forms are reviewed by experts and comply with state and federal regulations.

If you are already registered, Log In to your account and click the Download button to obtain the Mississippi Change or Modification Agreement of Deed of Trust. Use your account to browse through the legal forms you have previously acquired. Visit the My documents section of your account and retrieve another copy of the document you need.

If you are a new user of US Legal Forms, here are simple steps for you to follow: First, ensure you have selected the correct form for your city/region. You can review the form using the Preview option and read the form description to confirm it is suitable for you. If the form does not meet your requirements, utilize the Search field to find the appropriate form. Once you are certain that the form is suitable, select the Get now button to acquire the form. Choose the pricing plan you prefer and fill in the necessary information. Create your account and pay for an order using your PayPal account or credit card. Select the format and download the legal document template onto your device. Complete, modify, print, and sign the obtained Mississippi Change or Modification Agreement of Deed of Trust.

Utilize US Legal Forms for a hassle-free solution to your legal document needs.

- US Legal Forms is the largest repository of legal forms where you can find various document templates.

- Take advantage of the service to download professionally crafted documents that meet state requirements.

- Ensure compliance with legal standards when creating documents.

- Access a wide range of templates for different legal needs.

- Simplify the process of obtaining legal documents online.

- Benefit from expert-reviewed forms to ensure accuracy and legality.

Form popularity

FAQ

A modification of a deed of trust is a legal adjustment made to the existing deed that alters its terms. This can involve changes to payment schedules, interest rates, or other significant aspects of the agreement. A Mississippi Change or Modification Agreement of Deed of Trust is essential to document these alterations properly. Utilizing services like USLegalForms can facilitate this process with professionally crafted documents.

In Mississippi, the requirements for adverse possession include actual possession of the property, open and notorious use, exclusive control, continuous possession for at least 10 years, and possession under a claim of right. Understanding these criteria is essential for anyone considering a claim. A Mississippi Change or Modification Agreement of Deed of Trust may also play a role if the land in question involves a deed of trust. For assistance with legal documentation, consider using USLegalForms.

A modification of a deed of trust refers to changes made to the existing terms of the deed without creating a new document. This can include altering payment terms, interest rates, or other provisions. A Mississippi Change or Modification Agreement of Deed of Trust formalizes these adjustments. It's important to consult legal resources to ensure compliance with state laws.

To amend a trust deed, you'll need to draft a Mississippi Change or Modification Agreement of Deed of Trust that outlines the specific changes. Both the borrower and lender must agree to these amendments. After drafting, the agreement must be signed and notarized to be enforceable. USLegalForms offers resources that help you create this document correctly.

Yes, you can amend a trust deed through a Mississippi Change or Modification Agreement of Deed of Trust. This process allows you to update the terms or conditions of the original deed. It requires the agreement of all parties involved and must be properly documented to ensure legality. Using a platform like USLegalForms can simplify this process by providing the necessary templates and guidance.

How do I transfer a deed in Mississippi? A processed, signed, and notarized deed must be presented to the Recorder of the Deeds in the same county of the property. Once the deed is accepted and signed, the transfer is complete.

A deed of trust is an agreement between a home buyer and a lender at the closing of a property. The agreement states that the home buyer will repay the home loan and the mortgage lender will hold the property's legal title until the loan is paid in full.

The parties would need to apply to the court for an order to rectify the trust deed and satisfy the court that there was a genuine mistake. This is easier in relation to lifetime trusts where the parties agree to the rectification but can be much harder in cases where the Settlor has died.

Modifications of a note secured by a trust deed usually arise out of a financial necessity experienced by the owner of the secured property. However, for an oral modification to be enforceable, both the lender and the borrower must put the oral modification into effect by taking action on it, called execution.