Missouri Golf Pro Services Contract - Self-Employed

Description

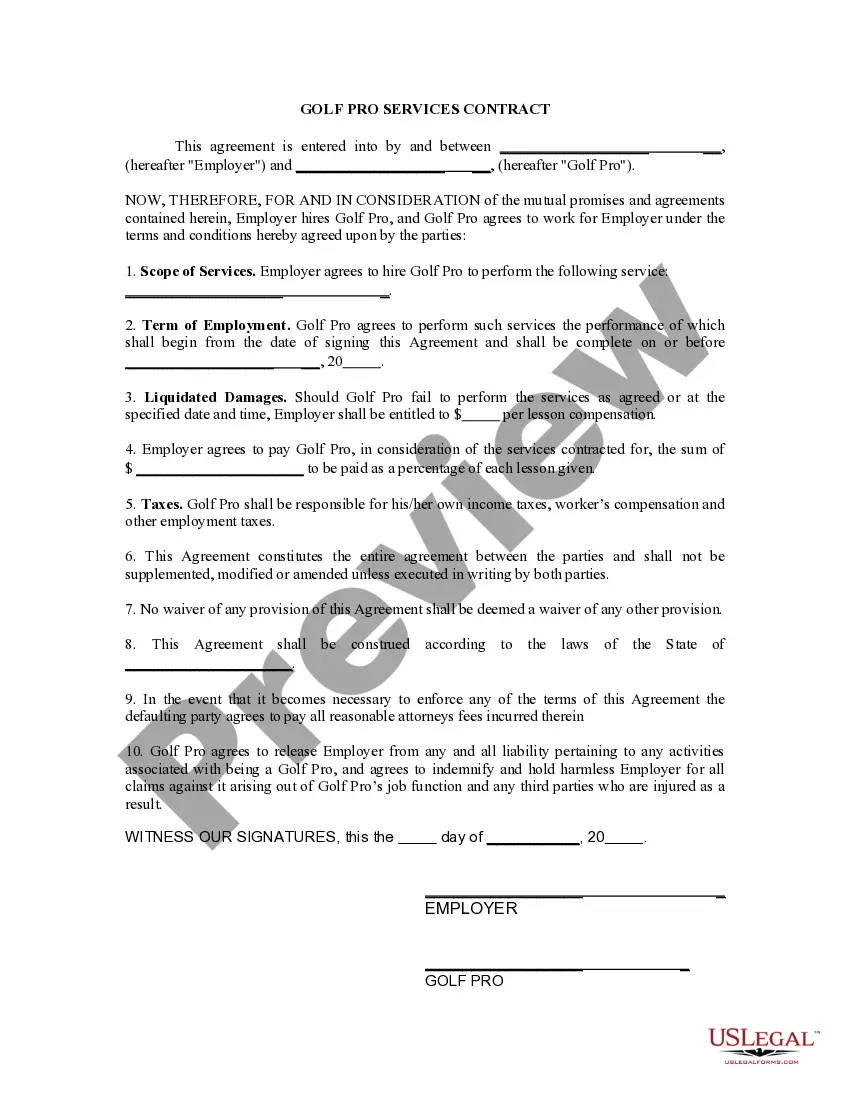

How to fill out Golf Pro Services Contract - Self-Employed?

Are you presently in the situation where you need documents for occasional organization or particular purposes almost every workday.

There are numerous legitimate document templates accessible online, but finding ones you can rely on isn’t easy.

US Legal Forms provides a vast array of form templates, such as the Missouri Golf Pro Services Contract - Self-Employed, which can be printed to meet state and federal requirements.

Utilize US Legal Forms, one of the most extensive collections of legal forms, to save time and avoid mistakes.

The service offers professionally crafted legal document templates that you can use for a variety of purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Missouri Golf Pro Services Contract - Self-Employed template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/region.

- Utilize the Review button to examine the document.

- Check the summary to ensure you have selected the correct form.

- If the form isn’t what you’re looking for, use the Search area to find the form that matches your requirements and specifications.

- Once you find the correct form, click Get now.

- Select the pricing plan you prefer, fill out the necessary information to create your account, and pay for the order using your PayPal or credit card.

- Select a suitable document format and download your version.

- Access all the document templates you have obtained in the My documents section. You can retrieve another copy of the Missouri Golf Pro Services Contract - Self-Employed at any time if needed. Just click on the desired form to download or print the document template.

Form popularity

FAQ

In Missouri, an independent contractor works for themselves and has control over their work, while an employee works under the direction of an employer. The Missouri Golf Pro Services Contract - Self-Employed is designed to outline the terms for golf professionals operating as independent contractors. This distinction affects liability, tax obligations, and benefits, making it essential to understand for both parties. By properly defining your status with a clear contract, you can protect your interests and ensure compliance with local laws.

A Missouri employment contract is a legal agreement that outlines the terms of employment between an employer and an employee. In the context of golf, a Missouri Golf Pro Services Contract - Self-Employed serves a similar purpose for professional golfers, establishing expectations regarding payment, duties, and other arrangements. Utilizing a platform like US Legal Forms can help you create a tailored contract that meets your specific needs.

Most PGA players operate as independent contractors rather than traditional employees, receiving 1099 forms instead of W-2 forms. This classification allows them flexibility in managing their business affairs, including sponsorships and endorsements. If you’re a golfer seeking similar arrangements, consider drafting a Missouri Golf Pro Services Contract - Self-Employed to protect your interests and clarify your working relationships.

To declare yourself a professional golfer, you generally need to meet specific criteria, including a commitment to golf as a career. You should establish eligibility by participating in recognized tournaments and often obtain membership in a professional organization. Additionally, creating a Missouri Golf Pro Services Contract - Self-Employed can formalize your status and outline your professional commitments, responsibilities, and earnings.

Many golfers work as independent contractors, especially when providing instruction or personal coaching. As independent contractors, they must manage their own taxes and business expenses, differentiating them from traditional employees. A Missouri Golf Pro Services Contract - Self-Employed facilitates this relationship by outlining terms of engagement. Therefore, utilizing such a contract can enhance their business operations and protect their interests.

Indeed, professional golfers operate as self-employed individuals. They earn income through tournaments, sponsorships, and personal instruction, which allows them to control their business activities. A Missouri Golf Pro Services Contract - Self-Employed helps define the scope of their work and responsibilities, ensuring clarity and legal protection. Hence, having the right documentation is crucial for their professional journey.

Yes, pro golfers are generally considered self-employed. They often operate as independent businesses, managing their own earnings from competitions, endorsements, and coaching. To formalize this status, many choose to use a Missouri Golf Pro Services Contract - Self-Employed, which outlines the terms of their services. Therefore, using a well-structured contract is vital for their financial protection and professional clarity.

To be an independent contractor, you typically need to register as a business, keep accurate financial records, and understand relevant tax laws. A clear contract, like a Missouri Golf Pro Services Contract - Self-Employed, is essential to define the terms of your service relationships and protect your rights.

Becoming an independent contractor in Missouri starts with identifying your skills and target market. Building a network and marketing your services are crucial steps. Additionally, consider using a Missouri Golf Pro Services Contract - Self-Employed to formalize agreements with your clients and enhance your professional image.

Legal requirements for independent contractors include obtaining necessary permits and tax identification numbers. You should also be familiar with tax obligations and how to track income and expenses. Utilizing a Missouri Golf Pro Services Contract - Self-Employed can help you adhere to these legal standards.