A debt collector may not use unfair or unconscionable means to collect a debt. This includes causing a person to incur charges for communications by concealing the true propose of the communication.

Missouri Notice to Debt Collector - Causing a Consumer to Incur Charges for Communications by Concealing the Purpose of the Communication

Description

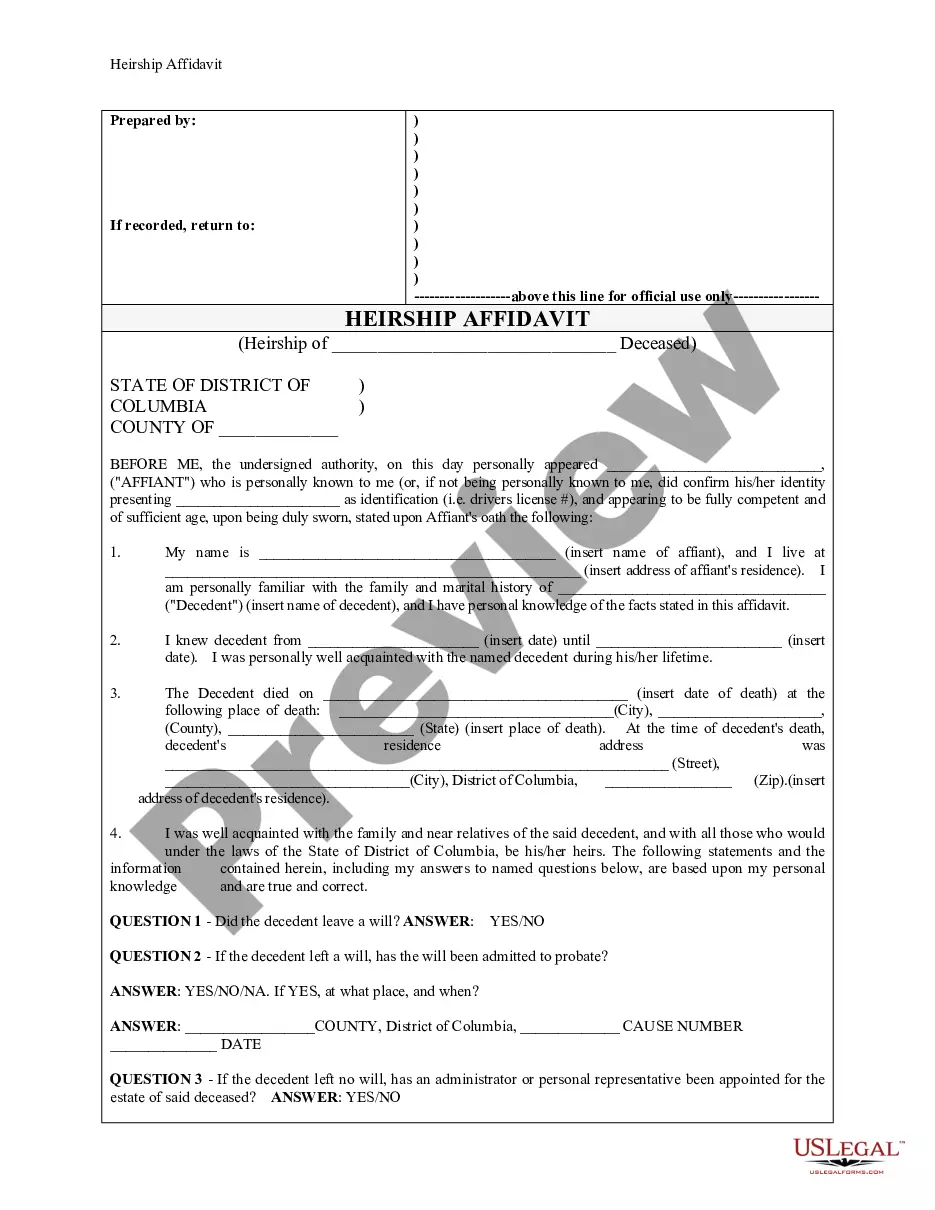

How to fill out Notice To Debt Collector - Causing A Consumer To Incur Charges For Communications By Concealing The Purpose Of The Communication?

Are you currently in a location where you need documents for either professional or personal reasons on a daily basis.

There are numerous legal form templates accessible online, but finding reliable versions can be challenging.

US Legal Forms offers thousands of document templates, such as the Missouri Notice to Debt Collector - Causing a Consumer to Incur Charges for Communications by Concealing the Purpose of the Communication, which are designed to comply with state and federal regulations.

Once you find the appropriate form, click on Purchase now.

Select the pricing plan you prefer, provide the necessary information to set up your account, and pay for your order using PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Missouri Notice to Debt Collector - Causing a Consumer to Incur Charges for Communications by Concealing the Purpose of the Communication template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it corresponds to the correct city/region.

- Utilize the Preview button to examine the form.

- Review the description to make certain you have selected the correct form.

- If the form is not what you are looking for, use the Search field to find the form that fits your needs and requirements.

Form popularity

FAQ

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.16-Sept-2020

The Fair Credit Reporting Act is a federal law that regulates the collection and reporting of credit information from consumers. The law governs how a consumer's credit information is collected and shared with others.

Among the insider tips, Ulzheimer shared with the audience was this: if you are being pursued by debt collectors, you can stop them from calling you ever again by telling them '11-word phrase'. This simple idea was later advertised as an '11-word phrase to stop debt collectors'.

The Fair Debt Collection Practices Act makes it illegal for debt collectors to harass or threaten you when trying to collect on a debt. In addition, on November 30, 2021, the CFPB's new Debt Collection Rule became effective.

A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of any debt.

The Fair Debt Collection Practices Act (FDCPA) (15 USC 1692 et seq.), which became effective in March 1978, was designed to eliminate abusive, deceptive, and unfair debt collection practices.

The Fair Debt Collection Practices Act (FDCPA) is the main federal law that governs debt collection practices. The FDCPA prohibits debt collection companies from using abusive, unfair or deceptive practices to collect debts from you.

Debt collectors must be truthful The Fair Debt Collection Practices Act states that debt collectors cannot use any false, deceptive or misleading representation to collect the debt. Along with other restrictions, debt collectors cannot misrepresent: The amount of the debt. Whether it's past the statute of limitations.

Your credit card debt, auto loans, medical bills, student loans, mortgage, and other household debts are covered under the FDCPA.

Fortunately, there are legal actions you can take to stop this harassment:Write a Letter Requesting To Cease Communications.Document All Contact and Harassment.File a Complaint With the FTC.File a Complaint With Your State's Agency.Consider Suing the Debt Collection Agency for Harassment.