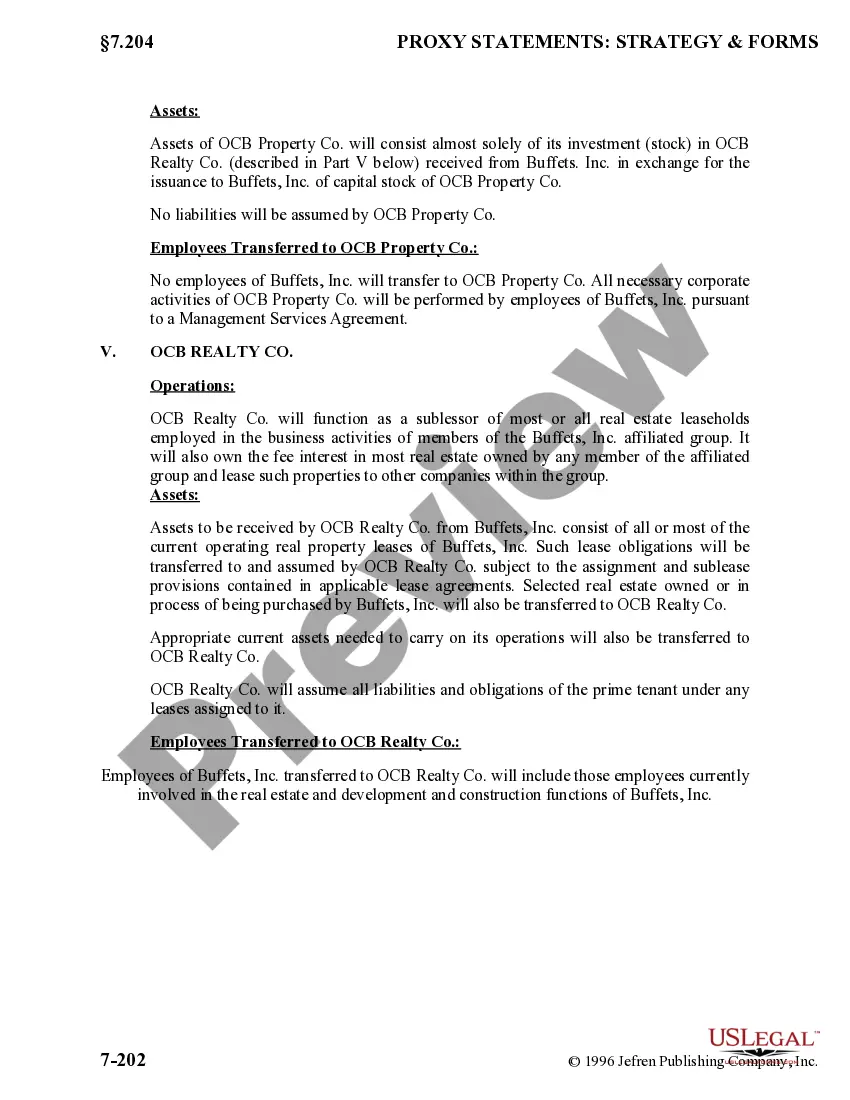

Missouri Plan of Internal Restructuring

Description

How to fill out Plan Of Internal Restructuring?

Have you been inside a position in which you require documents for possibly business or personal functions nearly every day? There are a lot of legitimate record layouts available on the Internet, but finding ones you can depend on isn`t effortless. US Legal Forms delivers 1000s of kind layouts, such as the Missouri Plan of Internal Restructuring, which are composed to fulfill state and federal requirements.

In case you are previously acquainted with US Legal Forms internet site and possess a merchant account, just log in. Following that, it is possible to download the Missouri Plan of Internal Restructuring format.

If you do not provide an profile and wish to begin using US Legal Forms, abide by these steps:

- Get the kind you want and ensure it is to the correct city/region.

- Take advantage of the Review key to analyze the form.

- See the information to actually have selected the proper kind.

- If the kind isn`t what you are trying to find, utilize the Search industry to discover the kind that meets your needs and requirements.

- Whenever you find the correct kind, click on Get now.

- Pick the prices strategy you need, submit the required information and facts to create your bank account, and pay for the order with your PayPal or Visa or Mastercard.

- Choose a hassle-free file file format and download your duplicate.

Discover each of the record layouts you may have purchased in the My Forms menu. You can aquire a additional duplicate of Missouri Plan of Internal Restructuring any time, if needed. Just click the required kind to download or print the record format.

Use US Legal Forms, one of the most comprehensive variety of legitimate varieties, to conserve some time and avoid errors. The service delivers appropriately produced legitimate record layouts which you can use for a range of functions. Create a merchant account on US Legal Forms and initiate creating your life a little easier.

Form popularity

FAQ

For federal and Missouri purposes, a corporation can use the federal NOL incurred in one tax year to reduce the taxable income in another tax year. The NOL deduction cannot exceed the corporation's taxable income (after special deductions).

Based in Washington, D.C., the agency's mission is to enforce tax laws and collect federal taxes from all taxpayers in the United States, including individuals and corporations. This is done by collecting and processing annual tax returns from tax filers.

The Act mandated the replacement of geographic regional divisions of the IRS with units designed to serve particular categories of taxpayers. The Act also provided a five-year term of office for the Commissioner of Internal Revenue.

No, the ERC isn't taxable income in Missouri. The credit isn't classed as business income but is a tax relief, so doesn't fall under the realms of being taxable. However, it will affect payroll deductions, so taxable profits will be affected in that sense.

Section 1203 of the Internal Revenue Service Restructuring and Reform Act of 1998 (the ?RRA?) provides generally that IRS employees must be terminated from Federal employment if they violate certain rules in connection with the performance of their official duties.

The IRS Mission Provide America's taxpayers top quality service by helping them understand and meet their tax responsibilities and enforce the law with integrity and fairness to all. This mission statement describes our role and the public's expectation about how we should perform that role.

The IRS Reform and Reconstruction Act of 1998 seeks to reform the IRS where the Taxpayer Bill of Rights legislation, the TSM pro- gram, and other reformation attempts have failed. Members of Con- gress assert that the Reform Act is the most comprehensive reform of the IRS in over four decades.