Missouri Termination Review Form

Description

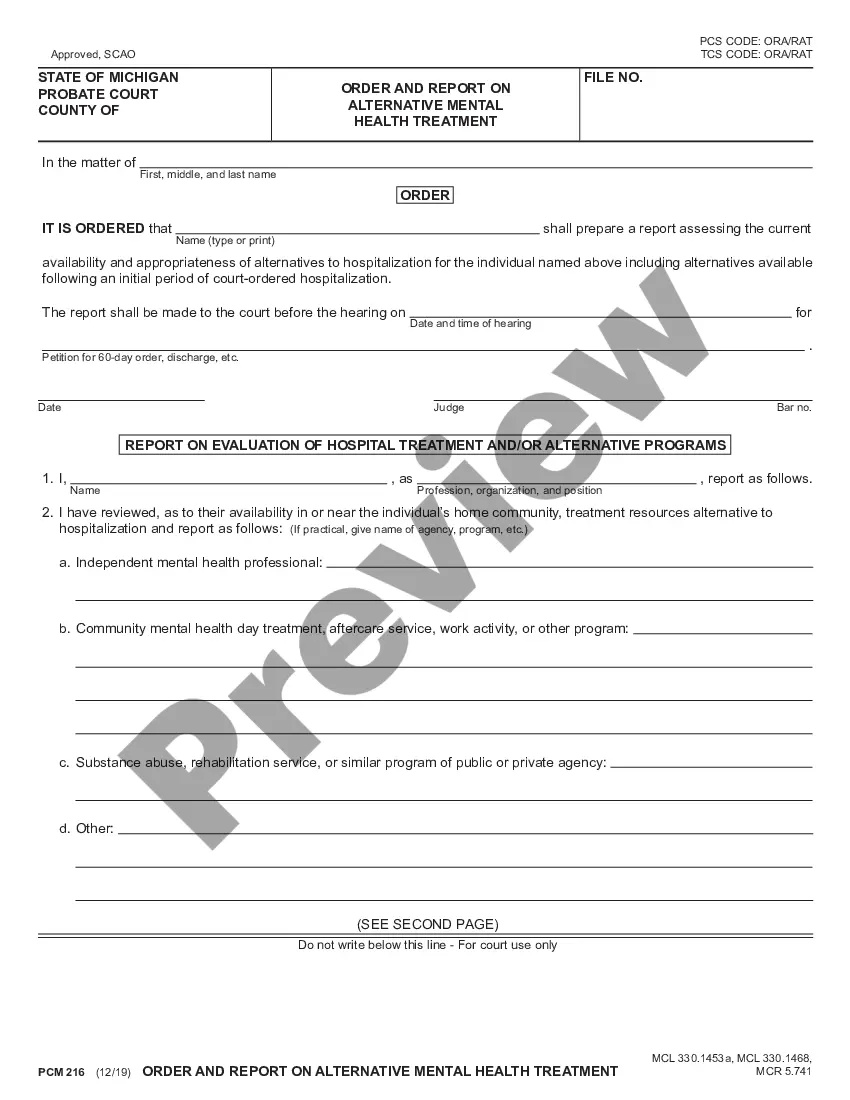

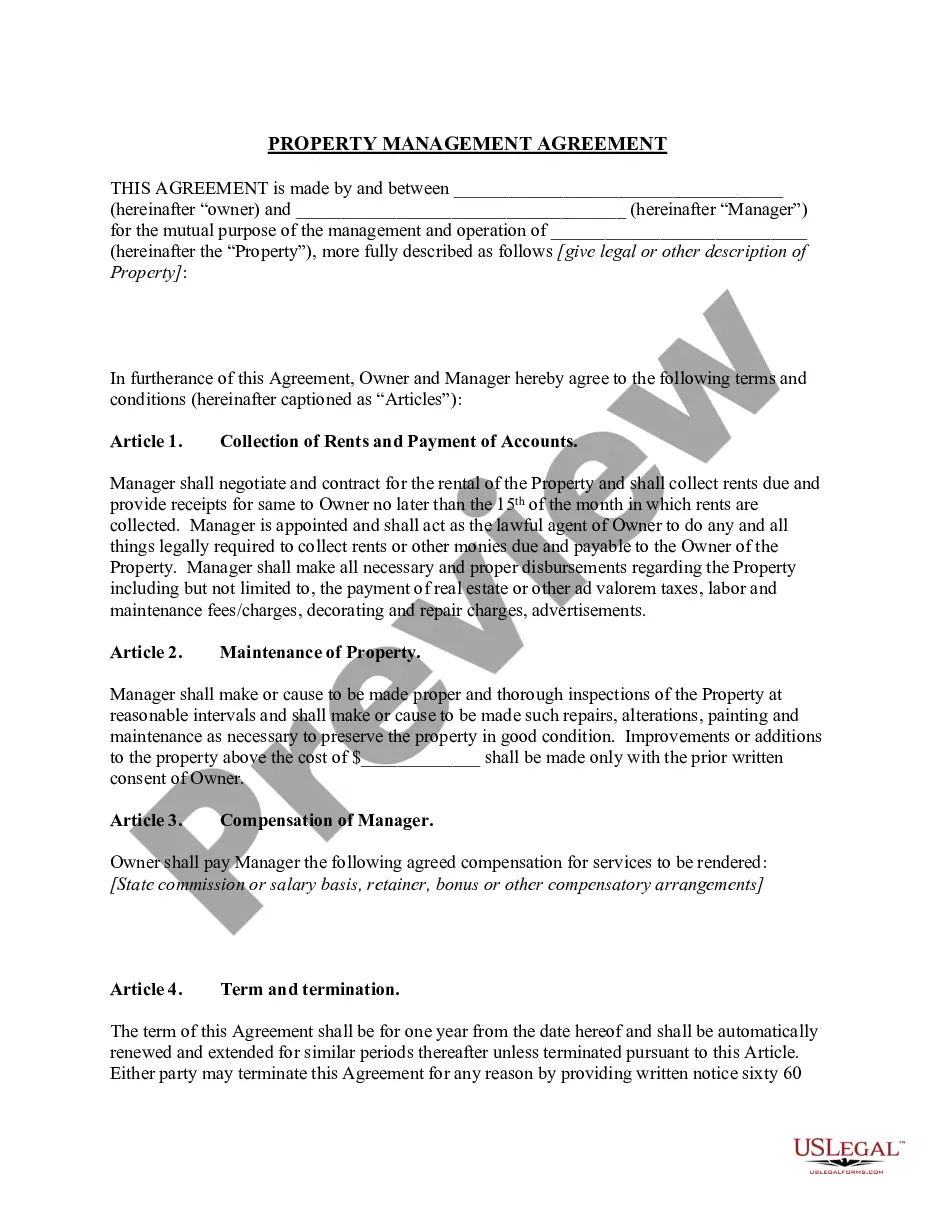

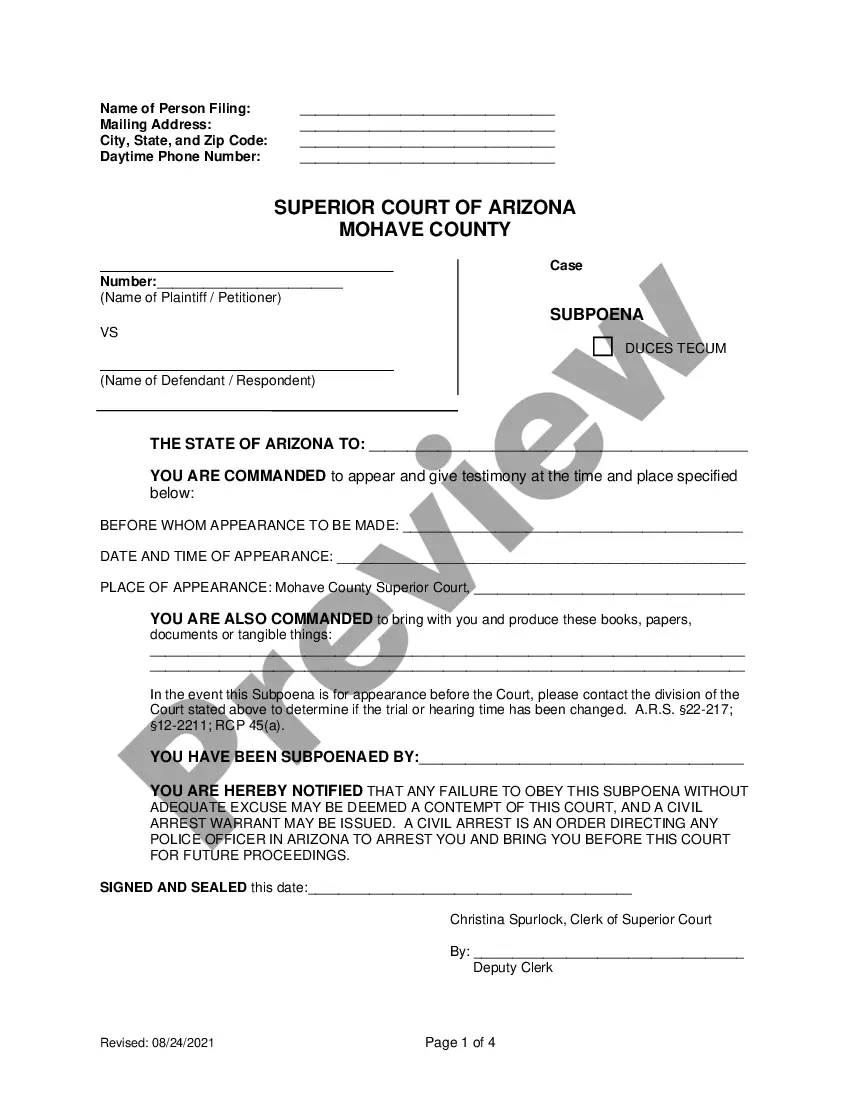

How to fill out Termination Review Form?

You might spend hours online attempting to locate the correct legal document template that satisfies the state and federal standards you need.

US Legal Forms provides thousands of legal forms that can be reviewed by professionals.

You can download or print the Missouri Termination Review Form from my service.

If available, use the Review button to look through the document template as well.

- If you already have a US Legal Forms account, you can Log In and click the Acquire button.

- Then, you can fill out, edit, print, or sign the Missouri Termination Review Form.

- Every legal document template you obtain is yours to keep indefinitely.

- To get another copy of the form you downloaded, go to the My documents tab and click the appropriate button.

- If you're using the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, ensure you have selected the appropriate document template for your region/town of preference.

- Check the form description to confirm you’ve chosen the correct template.

Form popularity

FAQ

In Missouri, certain employees have a right to request that their employer provide them a signed letter stating what they did for the employer and why they were discharged or voluntarily quit their employment.

To dissolve an LLC in Missouri, LLCs have to file an Article of Dissolution. The filing fee is $25.

According to Missouri law, the constitution of wrongful termination occurs when you report issues and any violations concerning workplace safety. If you report or reject to commit any illegal activity or take action against public policies, or any of these specific reasons, you have a valid wrongful termination claim.

How to Dissolve an LLCVote to Dissolve the LLC. Members who decide to dissolve the company are taking part in something called a voluntary dissolution.File Your Final Tax Return.File an Article of Dissolution.Settle Outstanding Debts.Distribute Assets.Conduct Other Wind Down Processes.

For Missouri residents, forms to complete the dissolution of a company can be found on the Missouri Secretary of State's website(opens in new window). For-profit corporations need to complete Articles of Dissolution by Voluntary Action, Request for Termination and Resolution to Dissolve.

To dissolve your LLC in Missouri, you must first complete (and provide by mail, fax or in person) either a Notice of Abandonment of Merger or Consolidation of Limited Liability Company (Form LLC-2) or a Notice of Winding Up (LLC-13) form, disclosing that a dissolution is in process.

The employer has seven days to respond to the written request. If the employer does not pay the wages due within the seven days, it will be liable for additional wages to the employee until he or she is finally paid for up to sixty days. The employee may bring a private legal action to collect the wages due.

There are no circumstances under which an employer can totally withhold a final paycheck under Missouri law; employers are typically required to issue a final paycheck containing compensation for all earned, unpaid wages.

To dissolve an LLC in Missouri, simply follow these three steps: Follow the Operating Agreement. Close Your Business Tax Accounts....Step 1: Follow Your Missouri LLC Operating Agreement.Step 2: Close Your Business Tax Accounts.Step 3: File Articles of Dissolution.

Missouri law requires that final wages be paid to an employee upon the end or termination of employment. An employer who fails to pay final wages is in violation of Missouri Statute 290.110 RSMo. Section 290.110 requires that that all final wages be paid without any deductions.