Missouri Employee Evaluation Form for Nonprofit

Description

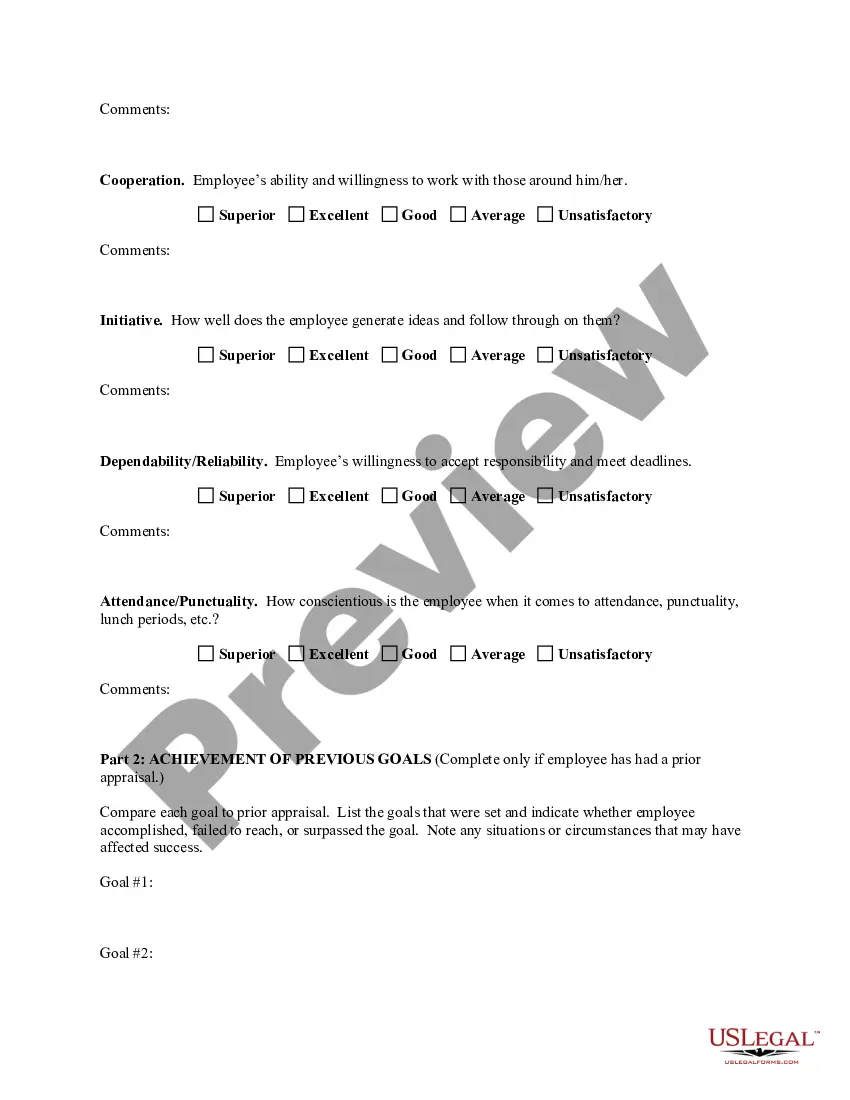

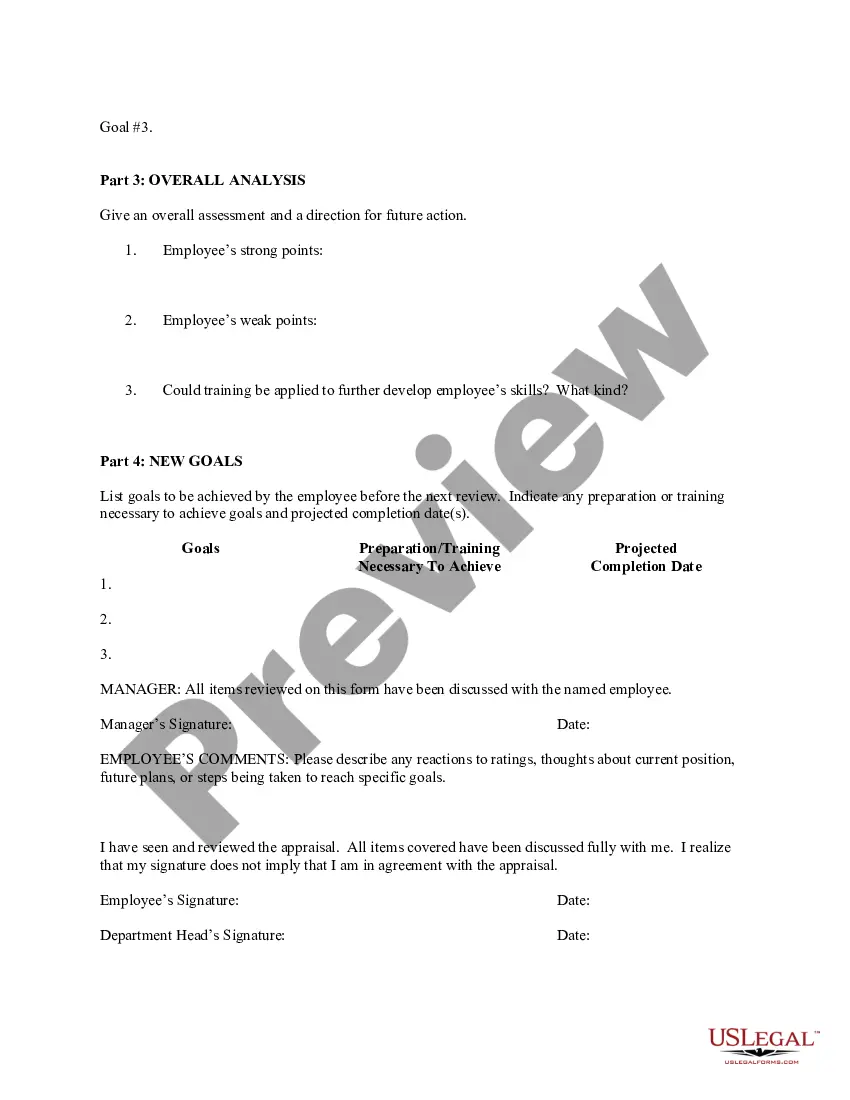

How to fill out Employee Evaluation Form For Nonprofit?

US Legal Forms - one of the largest collections of legal documents in the country - offers a vast array of legal file templates that you can download or print.

Through the website, you can access thousands of templates for business and personal needs, organized by categories, claims, or keywords. You will find the latest versions of forms such as the Missouri Employee Assessment Form for Nonprofit within minutes.

If you have a subscription, Log In and download the Missouri Employee Assessment Form for Nonprofit from the US Legal Forms library. The Download option will be visible on every form you view. You have access to all previously downloaded forms from the My documents tab of your account.

Select the format and download the document onto your device.

Make modifications. Complete, edit, print, and sign the downloaded Missouri Employee Assessment Form for Nonprofit. Each template you add to your account has no expiration date and is yours permanently. Therefore, if you wish to download or print another copy, just visit the My documents section and click on the form you need.

Access the Missouri Employee Assessment Form for Nonprofit with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of expert and state-specific templates that fulfill your business or personal requirements and needs.

- Confirm you have selected the right form for your locality. Click on the Preview button to view the contents of the form.

- Review the form details to ensure you have chosen the correct document.

- If the form does not meet your needs, utilize the Search section at the top of the screen to find the one that does.

- If you are satisfied with the document, confirm your choice by clicking the Get now button.

- Then, select the payment plan you prefer and provide your information to create an account.

- Process the order. Use your credit card or PayPal account to complete the transaction.

Form popularity

FAQ

The Individual Income Tax Return (Form MO-1040) is Missouri's long form. It is a universal form that can be used by any taxpayer. If you do not have any of the special filing situations described below and you choose to file a paper tax return, try filing a short form.

Form MO-1040A Missouri Individual Income Tax Short Form.

Form MO-1040A Missouri Individual Income Tax Short Form.

1. The Missouri adjusted gross income of a resident individual shall be the taxpayer's federal adjusted gross income subject to the modifications in this section.

Form MO-A, Part 1, computes Missouri modifications to federal adjusted gross income. Modifications on Lines 1, 2, 3, 4 and 5 include income that is exempt from federal tax, but taxable for state tax purposes.

A is longer and a bit more complex, and Form is the most detailed and challenging of the lot. While anyone can file Form , you must meet certain requirements to use the shorter EZ or A forms. Here's a quick rundown to help you choose the correct form for your situation.

How Income Taxes Are CalculatedFirst, we calculate your adjusted gross income (AGI) by taking your total household income and reducing it by certain items such as contributions to your 401(k).Next, from AGI we subtract exemptions and deductions (either itemized or standard) to get your taxable income.More items...?

Louis Refund? It is a Form used when part of the previous year's state refund is in your federal income. So if you entered a 1099-G in your federal 1040 for a state refund you received last year, this forms subtracts it out for the state return.

Form MO-1040A Missouri Individual Income Tax Short Form.

If you earn more than $1,200 you must file Form MO-1040. If your home of record is Missouri and you are stationed in Missouri due to military orders, all of your income, including your military pay, is taxable to Missouri.