Missouri Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate

Description

How to fill out Personal Guaranty - Guarantee Of Contract For The Lease And Purchase Of Real Estate?

If you desire to be thorough, obtain, or create official document templates, utilize US Legal Forms, the largest selection of legal forms accessible online. Take advantage of the site’s straightforward and convenient search to find the documents you need.

Numerous templates for commercial and personal purposes are organized by categories and states, or keywords. Use US Legal Forms to find the Missouri Personal Guaranty - Assurance of Contract for the Lease and Purchase of Real Estate in just a few clicks.

If you are already a US Legal Forms user, Log In to your account and then click the Acquire button to obtain the Missouri Personal Guaranty - Assurance of Contract for the Lease and Purchase of Real Estate. You can also access forms you previously downloaded from the My documents section of your account.

Each legal document format you purchase is yours indefinitely. You have access to every form you downloaded in your account. Go to the My documents section and select a form to print or download again.

Be proactive and obtain, and print the Missouri Personal Guaranty - Assurance of Contract for the Lease and Purchase of Real Estate with US Legal Forms. There are numerous professional and state-specific forms you can utilize for your personal business or personal needs.

- Step 1. Ensure you have chosen the form for your specific area/state.

- Step 2. Use the Review option to examine the form’s content. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other types of the legal form format.

- Step 4. Once you have located the form you want, click the Purchase now button. Select the pricing plan you prefer and provide your information to create an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Choose the format of the legal form and download it to your system.

- Step 7. Fill out, modify, and print or sign the Missouri Personal Guaranty - Assurance of Contract for the Lease and Purchase of Real Estate.

Form popularity

FAQ

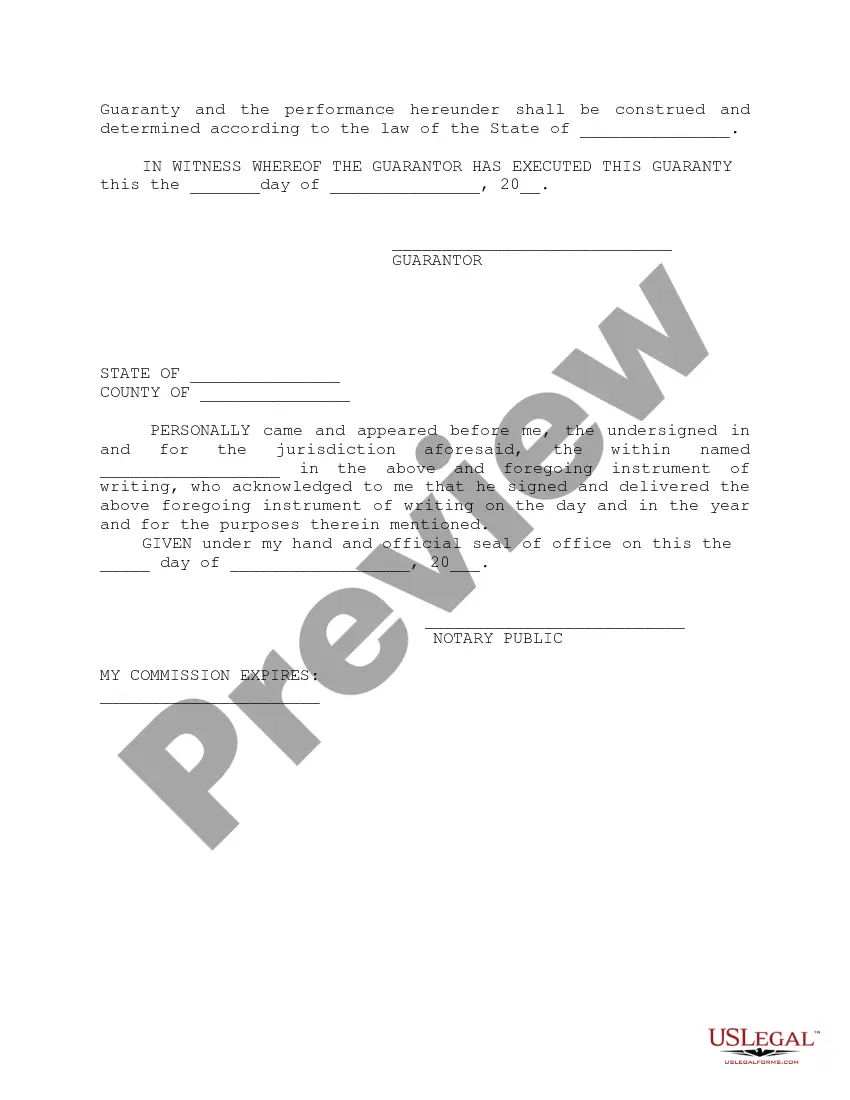

A guarantor is not a lease; instead, a guarantor is someone who agrees to take on the financial responsibilities of the lease if the primary tenant defaults. This role is crucial in balancing the risks in rental agreements. You should consider formalizing this relationship with a Missouri Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate to ensure clarity and legality in your agreement.

A guaranty serves to enhance the reliability of financial agreements by adding a layer of protection against default. It assures all parties that there is a fallback option should the principal borrower fail to fulfill their obligations. In real estate leases, this is particularly vital. A Missouri Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate can safeguard your investment and ensure a smooth transaction.

The purpose of a guarantee agreement is to provide security for a financial obligation, ensuring that a third party will step in if the primary party fails to meet their commitments. This legal instrument is crucial in real estate transactions, as it helps landlords or sellers feel more secure. By having a Missouri Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate, you can protect both your interests and the interests of the other party involved.

A lease to own agreement in Missouri allows you to rent a property with the option to buy it later. This arrangement often benefits individuals looking to purchase real estate but who may not be ready to secure a mortgage immediately. It provides an opportunity to build equity while living in the home. Consider using a Missouri Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate to ensure your investment is protected.

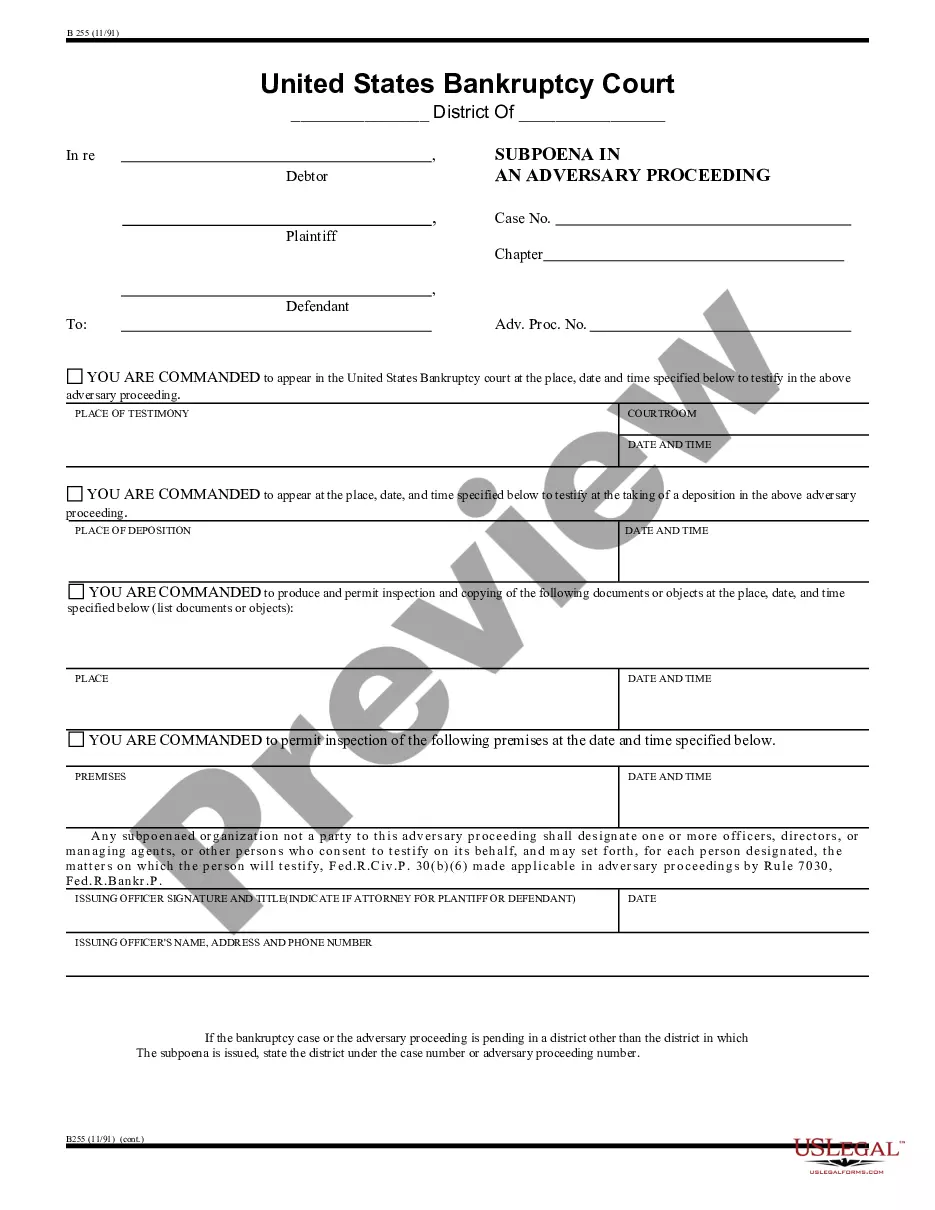

A personal guarantee is an individual's legal promise to repay credit issued to a business for which they serve as an executive or partner. Personal guarantees help businesses get credit when they aren't as established or have an inadequate credit history to qualify on their own.

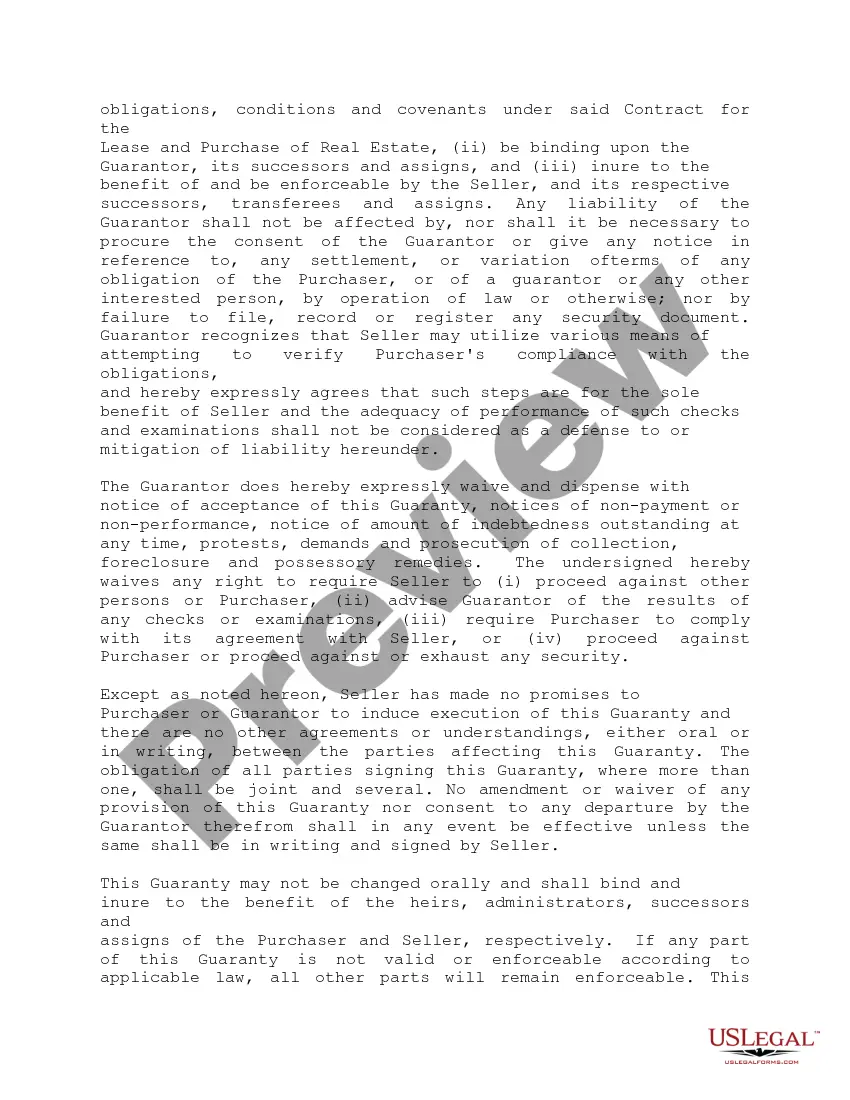

In writing The guarantee must be evidenced in writing to be enforceable. Signed The document must be signed by the guarantor or their authorised agent. Their name can be written or printed. Secondary liability The document must establish that the guarantor has secondary liability for the debt.

If you sign a personal guarantee, you are personally liable for the loan balance or a portion thereof. If your business later defaults on the loan, anyone who signed the personal guarantee can be held responsible for the remaining balance, even after the lender forecloses on the loan collateral.

The guaranty shall continue in full force and effect and may only be terminated in a writing delivered to Y thirty days before termination of the guaranty and such termination shall not eliminate the guaranty as to sums already advanced.

A personal guaranty is not enforceable without consideration A contract is an enforceable promise. The enforceability of a contract comes from one party's giving of consideration to the other party. Here, the bank gives a loan (the consideration) in exchange for the guarantor's promise to repay it.

An otherwise valid and enforceable personal guarantee can be revoked later in several different ways. A guaranty, much like any other contract, can be revoked later if both the guarantor and the lender agree in writing. Some debts owed by personal guarantors can also be discharged in bankruptcy.